Aircraft Manufacturing Market Size, Share, Trends, & Industry Analysis Report

By Product (Gliders, Helicopters), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 113

- Format: PDF

- Report ID: PM2286

- Base Year: 2024

- Historical Data: 2020 - 2023

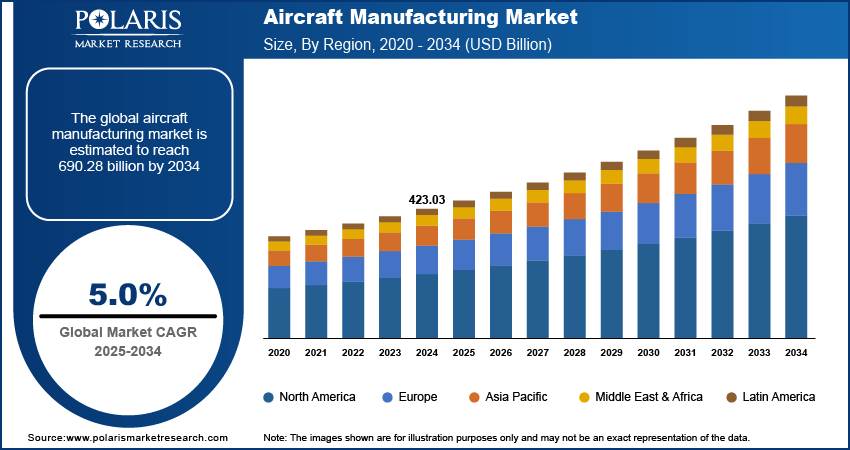

The global aircraft manufacturing market was valued at USD 423.03 billion in 2024 and is expected to grow at a CAGR of 5.0% during the forecast period. The growth is driven by rising demand for air travel and growing demand for the aircrafts from military and commercial sector

Key Insights

- The commercial segment dominated with largest share in 2024 driven by increasing passenger and freight traffic on a globally.

- The helicopters segment is expected to witness significant growth during the forecast period due to rising demand for urban air mobility and VIP transport.

- The North America is accounted for largest share in 2024 due to the increasing demand for new generation airplanes.

- Asia Pacific is expected to witness fastest growth during the forecast period due to rapid economic growth and income growth.

Industry Dynamics

- Rising demand for airplanes and helicopters in military and commercial sector fuels the expansion of the industry.

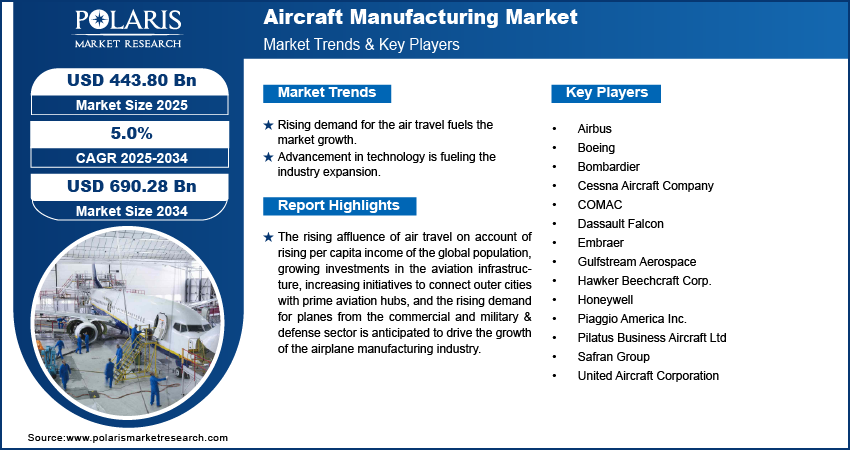

- Rising demand for the air travel fuels the market growth.

- Advancement in technology is fueling the industry expansion.

- High production costs and complex regulatory requirements are limiting the growth.

Market Statistics

- 2024 Market Size: USD 423.03 Billion

- 2034 Projected Market Size: USD 690.28 Billion

- CAGR (2025-2034): 5.0%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Adoption of AI is expected to improved manufacturing efficiency by reducing downtime and improved precision.

- Aircraft designing with AI is expected to create more fuel-efficient aircraft through advanced simulations and generative design.

- Automation of repetitive and skilled tasks may lead to job losses or require workforce reskilling, creating resistance or operational challenges

- Overreliance on AI systems could introduce biases or errors in design or quality processes if not properly managed or understood

The aircraft manufacturing market involves the manufacturing of airplanes and components such as engines, propulsion systems, and much more.

The rising affluence of air travel on account of rising per capita income of the global population, growing investments in the aviation infrastructure, increasing initiatives to connect outer cities with prime aviation hubs, and the rising demand for planes from the commercial and military & defense sector is anticipated to drive the growth of the airplane manufacturing industry. Furthermore, the growing focus on environmental pollution along with the increasing need to improve fuel efficiency is promoting the growth of the industry. The growing technological developments in order to reduce the manufacturing cost and to improve fuel efficiency are anticipated to offer huge industry growth opportunities.

The spread of the COVID-19 reflects the downfall in the aircraft manufacturing market growth because of the significant disruptions in the supply chain and the slowdown in manufacturing activities. The imposed trade barriers and international border closures have disrupted the entire manufacturing process. These disruptions in the supply chain, lockdown measures, and limited consumer and corporate spending are anticipated to hamper demand for airplane manufacturing. Further, the reduction in flight activity is estimated to hinder the growth of the industry. However, the need for an aircraft manufacturing market is projected to bounce back as governments across nations are lifting lockdown restrictions.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The primary factors driving the growth of the industry include the increasing demand for airplanes from commercial and military & defense sectors. For instance, in 2020, Airbus has delivered over 484 narrow-body commercial aircraft while Boeing has delivered over 43. Further, these companies have a large number of existing order backlogs.

By November 2021, Boeing reported a backlog of 4,210 commercial aircraft manufacturing, while Airbus reported a backlog of 7,036. This huge demand for planes from the commercial sector is anticipated to drive the growth of the airplane manufacturing market. Furthermore, the increasing passenger traffic globally is estimated to drive growth. Moreover, the advancement in technology is projected to offer substantial growth opportunities.

For instance, ML (Machine Learning) techniques such as AI (Artificial Intelligence) are being utilized by airplane manufacturers in order to improve safety, quality, and efficiency. The ML algorithms gather the data and analyze it to make better decisions. These technological innovations help in the reduction of manufacturing costs while improving the performance of airplanes. Additionally, the growing use of cargo airplanes by the e-commerce industry is anticipated to drive the growth of the industry.

Report Segmentation

The market is primarily segmented on the basis of product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

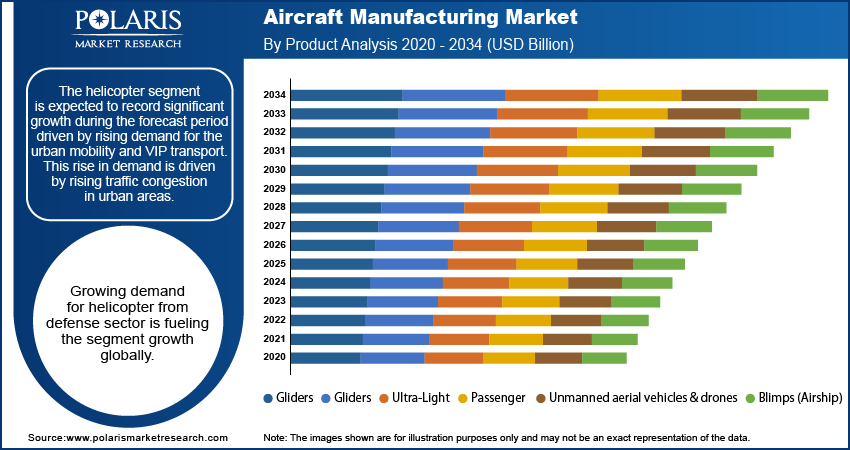

The helicopter segment is expected to record significant growth during the forecast period driven by rising demand for the urban mobility and VIP transport. This rise in demand is driven by rising traffic congestion in urban areas. Growing demand for helicopter from defense sector is fueling the segment growth globally. Many countries are upgrading their old helicopters to advance helicopters for troop transport, surveillance, and combat missions. Moreover, increasing use of helicopter for disaster relief and emergency services is further fueling the demand. These helicopters are used for air ambulance services, search and rescue, and disaster response in areas with poor road infrastructure or during natural disasters, thereby driving the segment growth.

Insight by Application

The commercial segment is recorded to hold the largest revenue share in 2024 and is expected to lead the industry in the forecasting years. This huge share of the segment can be attributed to the increasing passenger and freight traffic on a global scale. Furthermore, the rising demand for cargo services coupled with the increasing trade among nations globally is estimated to drive the growth of the segment. Moreover, the emergence of LCC (low-cost carriers) is anticipated to offer huge growth opportunities to the segment. Following LCCs, various airlines are developing similar business models in order to ensure their future sustenance due to the growing competition in the airplane manufacturing industry.

The military & defense segment is projected to show the fastest growth rate in the forecasting years. The rising demand to replace the aging airplanes in the military & defense sector globally is driving the growth of the segment. Further, the growing investments in defense aircraft by governments across nations in order to enhance their aerial combat abilities are estimated to present huge growth opportunities for the segment. Moreover, the rising political conflicts along with territorial disputes are fueling the demand for advanced military airplanes that have multi-mission capabilities. Additionally, the growing technological advancements in precision & stealth elements support the segment's development.

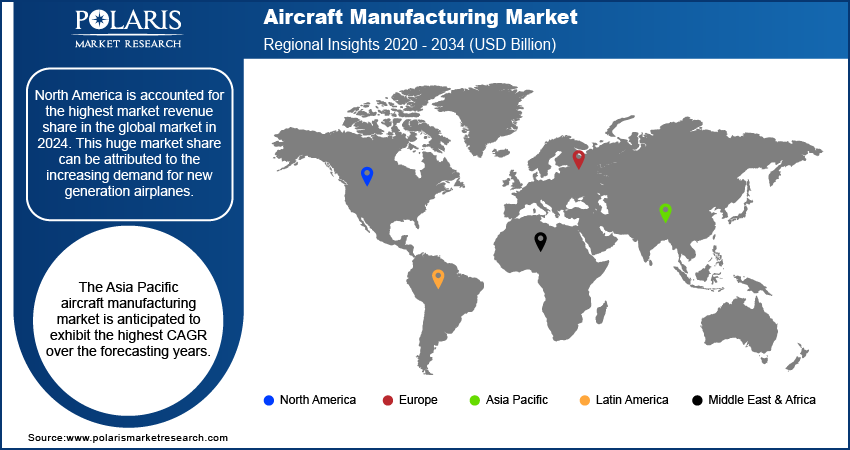

Geographic Overview

North America is accounted for the highest market revenue share in the global market in 2024. This huge market share can be attributed to the increasing demand for new generation airplanes. Further, the presence of a major industry player in the region is anticipated to offer huge market growth opportunities. The involvement of major airplanes & component manufacturers such as Boeing is anticipated to bring in investments. The airplane fleet modernization along with the destination expansion plans of the airlines in the region is anticipated to drive the growth of the airplane manufacturing market. Moreover, the high passenger traffic to & from the US is estimated to boost the market growth. According to the Bureau of Transportation Statistics, the US airlines & foreign airlines in the US carried over 1,052.8 million service passengers in 2019, an increase of 3.9% when compared to 2018. Thereby, these factors are fostering industry growth across North America.

The Asia Pacific aircraft manufacturing market is anticipated to exhibit the highest CAGR over the forecasting years. The overall industry has significantly benefitted from various emerging markets such as India, China, Japan, and others. Rapid economic growth and income growth are acting as a catalyst that is surging air travel across the Asia Pacific. Furthermore, airlines in these emerging nations are rapidly expanding and ordering a huge number of airplanes to meet the growing demand for air travel. Moreover, the increasing demand for military planes in the region as nations are building up their aerial combat abilities is anticipated to drive the demand. For instance, in September 2021, the GOI approved the request for “56 C295 transport aircraft” from Airbus, under this, over 40 military aircraft to be manufactured by the Tata Group. Additionally, the growing manufacturing abilities of the manufacturers are estimated to drive the growth of the market. For instance, in April 2021, Korea announced the first prototype of KF-21 fighter aircraft that was developed in a partnership with Indonesia.

Competitive Insight

Some of the major players operating in the global market include Airbus, Boeing, Bombardier, Cessna Aircraft Company, COMAC, Dassault Falcon, Embraer, Gulfstream Aerospace, Hawker Beechcraft Corp., Honeywell, Piaggio America Inc., Pilatus Business Aircraft Ltd, Safran Group, and United Aircraft Corporation.

Aircraft Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 423.03 billion |

| Market size value in 2025 | USD 443.80 billion |

|

Revenue forecast in 2034 |

USD 690.28 billion |

|

CAGR |

5.0% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Airbus, Boeing, Bombardier, Cessna Aircraft Company, COMAC, Dassault Falcon, Embraer, Gulfstream Aerospace, Hawker Beechcraft Corp., Honeywell, Piaggio America Inc., Pilatus Business Aircraft Ltd, Safran Group, and United Aircraft Corporation. |

FAQ's

• The market size was valued at USD 423.03 billion in 2024 and is projected to grow to USD 690.28 billion by 2034.

• The market is projected to register a CAGR of 5.0% during the forecast period.

• A few of the key players in the market are Airbus, Boeing, Bombardier, Cessna Aircraft Company, COMAC, Dassault Falcon, Embraer, Gulfstream Aerospace, Hawker Beechcraft Corp., Honeywell, Piaggio America Inc., Pilatus Business Aircraft Ltd, Safran Group, and United Aircraft Corporation.

• The commercial segment dominated the market revenue share in 2024.

• The helicopter segment is projected to witness the fastest growth during the forecast period.