Aircraft Fuel Systems Market Size, Share, Trends, Industry Analysis Report: By Application (Commercial, UAV, and Military), Engine, Type, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1663

- Base Year: 2024

- Historical Data: 2020-2023

Aircraft Fuel Systems Market Overview

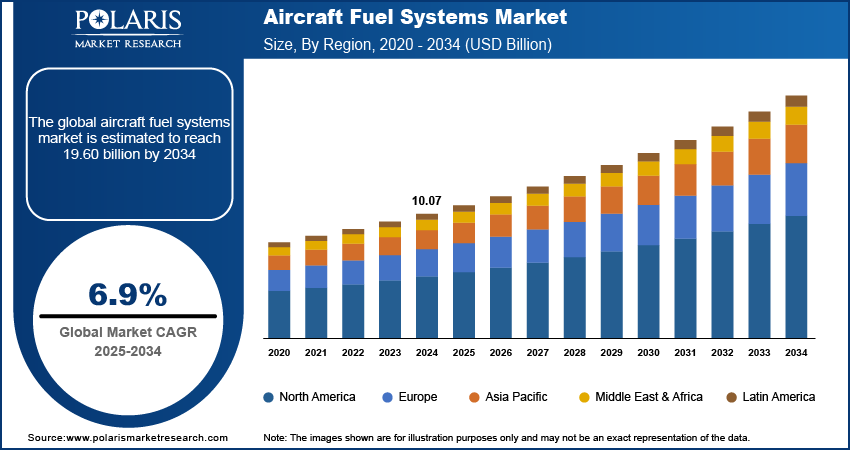

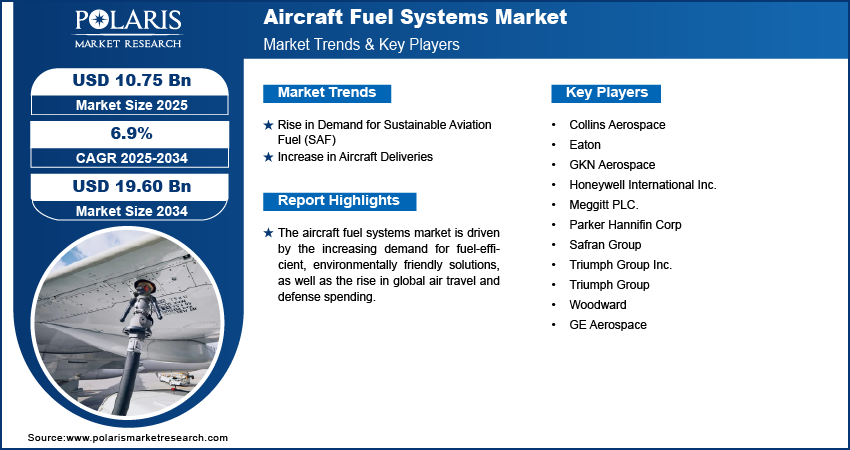

The aircraft fuel systems market size was valued at USD 10.07 billion in 2024. The market is projected to grow from USD 10.75 billion in 2025 to USD 19.60 billion by 2034, exhibiting a CAGR of 6.9% during the forecast period.

Aircraft fuel systems are complex assemblies that efficiently and reliably store, manage, and deliver fuel to an aircraft's engines. These systems ensure proper fuel distribution under unstable conditions, supporting optimal engine performance and flight safety.

The aircraft fuel systems market is a critical segment of the aviation industry, encompassing systems that manage fuel storage, transfer, and delivery for various aircraft types. Growth in the market is driven by increasing air travel, demand for fuel-efficient technologies, and advancements in electric and hybrid propulsion systems. For instance, in December 2023, EcoPulse, a hybrid-electric aircraft demonstrator by Daher, Safran, and Airbus, completed its first hybrid-electric flight. The aircraft’s propellers, powered by a battery and turbo-generator, operated successfully, marking a step toward more sustainable aviation. Modern fuel systems emphasize safety, weight reduction, and adaptability to alternative fuels such as hydrogen. The military aviation sector, along with the rising adoption of unmanned aerial vehicles (UAVs), is contributing significantly to aircraft fuel systems market expansion. Additionally, emerging technologies, such as advanced fuel management systems and zero-emission solutions, are shaping the future of market growth.

To Understand More About this Research: Request a Free Sample Report

Aircraft Fuel Systems Market Dynamics

Rise in Demand for Sustainable Aviation Fuel (SAF)

The rise in demand for sustainable aviation fuel (SAF) is driving the market, as SAF offers a promising solution to reduce aviation's carbon footprint. SAF’s role in achieving this target has gained increased attention, with global aviation aiming for net-zero emissions by 2050. Advanced aircraft fuel systems are required to integrate these bio-based fuels efficiently as airlines and manufacturers adopt SAF to meet regulatory requirements and consumer demand for greener travel. The shift towards SAF is producing innovations in aircraft fuel systems, particularly in areas such as fuel compatibility, delivery mechanisms, and storage solutions, which are crucial for optimizing SAF use.

For instance, in February 2024, Airbus and TotalEnergies announced a partnership to advance aviation de-carbonization through the use of sustainable aviation fuel (SAF). The collaboration aims to supply Airbus with SAF for over half of its European needs, while also researching to develop 100% sustainable fuels for future aircraft. This partnership aligns with the industry's goal of achieving carbon neutrality by 2050, with TotalEnergies targeting 1.5 million tons of annual SAF production by 2030. Additionally, as SAF production scales up, fuel systems need to adapt to different types and blends of SAF, further driving aircraft fuel systems market growth.

Increase in Aircraft Deliveries

The increase in aircraft deliveries directly drives the demand for aircraft fuel systems as new aircraft require advanced fuel management solutions. The need for efficient, reliable, and optimized fuel systems becomes crucial as airlines and manufacturers expand their fleets to meet growing passenger and cargo demand. The introduction of next-generation aircraft with more fuel-efficient designs further drives innovation in fuel system technologies, which are essential for ensuring optimal performance and compliance with environmental regulations.

For instance, in April 2023, JetZero launched its ultra-efficient blended wing body (BWB) aircraft for the airline middle market, promising a 50% reduction in fuel consumption. Designed to seat over 200 passengers, it aims to replace older models with a lighter, more efficient design. Supported by NASA and Northrop Grumman the aircraft features modern high-bypass engines and is adaptable for future zero-emission fuels, including liquid hydrogen. Additionally, the rise in global air travel, particularly in emerging markets, fuels the demand for both commercial and military aircraft, further increasing the need for advanced aircraft fuel systems.

Aircraft Fuel Systems Market Segment Analysis

Aircraft Fuel Systems Market Assessment by Application Outlook

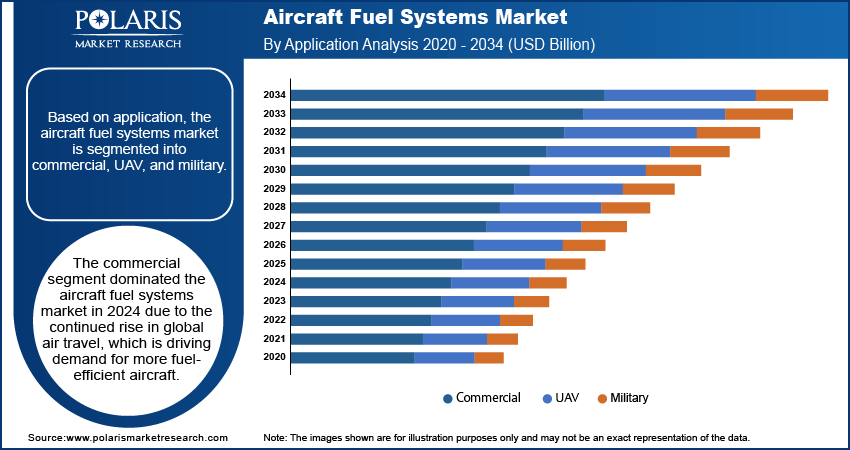

The global aircraft fuel systems market segmentation, based on application, includes commercial, UAV, and military. The commercial segment dominated the market in 2024 due to the continued rise in global air travel, which is driving demand for more fuel-efficient aircraft. Commercial aviation, representing a major portion of the aviation industry, is prioritizing the development and integration of advanced fuel systems to meet environmental regulations and improve operational efficiency. Additionally, large-scale aircraft deliveries from major manufacturers such as Boeing and Airbus are contributing to the growth of fuel systems in commercial aircraft, supporting the sector’s dominance. The adoption of sustainable aviation fuel (SAF) and hybrid-electric technologies in commercial aviation also highlights the sector's focus on reducing carbon emissions, further boosting the advanced fuel systems market demand.

Aircraft Fuel Systems Market Evaluation by Component Outlook

The global aircraft fuel systems market segmentation, based on component, includes valves, gauges, piping, pumps, inerting systems, and filters. Piping systems are expected to witness the fastest growth in the market due to their critical role in the efficient transfer and distribution of fuel across the aircraft. Increasing advancements in fuel-efficient aircraft designs, such as those incorporating hybrid-electric propulsion systems, demand improved and lightweight piping systems to ensure performance optimization. Additionally, the adoption of advanced materials in piping systems improves durability and reduces weight, aligning with the industry's focus on fuel efficiency and emissions reduction. The growing production of next-generation aircraft further supports this trend, as modern designs require innovative piping systems to meet evolving safety and performance standards.

Aircraft Fuel Systems Market Regional Insights

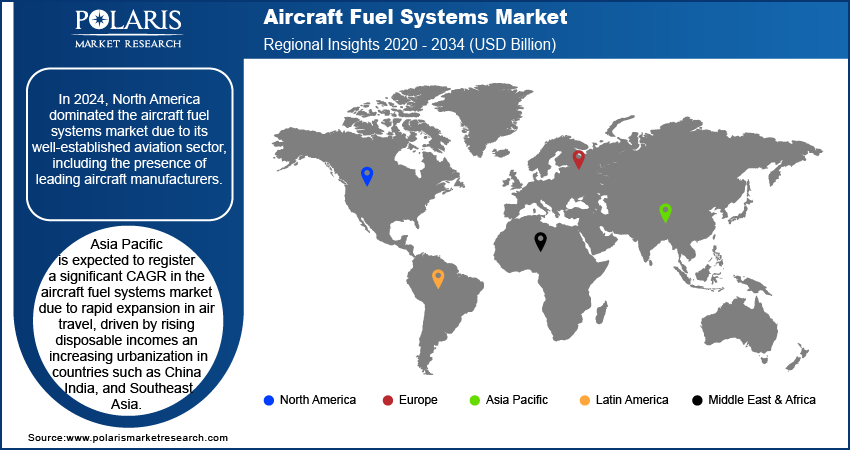

By region, the study provides aircraft fuel systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its well-established aviation sector, including the presence of leading aircraft manufacturers such as Boeing and Lockheed Martin. The region's high demand for both commercial and military aircraft, driven by increasing air travel and defense budgets, significantly supports the market. For instance, The Biden administration's Sustainable Aviation Fuel Grand Challenge, launched in 2021, aims to produce 3 billion gallons of SAF annually by 2030 and 35 billion gallons by 2050 to meet 100% of domestic airline fuel needs. This initiative is expected to drive advancements in fuel system technologies to support SAF compatibility. Additionally, substantial investments in technological advancements and a strong focus on sustainability, such as incorporating fuel-efficient systems and sustainable aviation fuels, further enhance market growth. The extensive network of aerospace suppliers and the rapid adoption of innovative fuel system technologies also contribute to North America's leadership in this sector.

Asia Pacific is expected to register a significant aircraft fuel systems market CAGR due to rapid expansion in air travel, driven by rising disposable incomes and increasing urbanization in countries such as China, India, and Southeast Asia. For instance, a report published by the Association of Asia Pacific Airlines in January 2024 highlights that Asia Pacific Airlines carried a total of 25.1 million international passengers in November 2023, marking a substantial 76.9% increase compared to November 2022. The region's investments in developing aviation infrastructure, coupled with government initiatives to support local aircraft manufacturing, further boost the market growth. Additionally, a surge in defense spending by countries such as India and China to modernize their military fleets is contributing to higher demand for advanced fuel systems. The focus on low-emission aviation technologies in response to environmental regulations also supports market expansion in the region.

Aircraft Fuel Systems Market – Key Players and Competitive Analysis Report

The competitive landscape of the aircraft fuel systems industry includes global leaders and regional players aiming to secure market share through technological advancements, partnerships, and regional expansion. Key players such as Honeywell International Inc., Parker Hannifin Corp, Eaton, and Safran Group leverage their expertise in research and development, along with expansive distribution networks, to deliver state-of-the-art fuel management systems, fuel pumps, and other advanced components. The market is driven by increasing demand for fuel-efficient systems and sustainable solutions such as hydrogen and biofuel-compatible fuel systems, reflecting a broader industry shift toward decarbonization. Regional players address localized needs with cost-effective and customized solutions, fostering competition. Strategies such as mergers and acquisitions, collaborations with aerospace manufacturers, and investments in advanced technologies, including electric propulsion-compatible fuel systems, underline the market's dynamic growth trajectory. These developments highlight the role of innovation, regional strategies, and sustainable practices in shaping the aircraft fuel systems industry's evolution. A few key major players are Collins Aerospace, Eaton, GKN Aerospace, Honeywell International Inc., Meggitt PLC., Parker Hannifin Corp, Safran Group, Triumph Group Inc., Triumph Group, Woodward, and GE Aerospace

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. The home and building technologies segment offer products, solutions, software, and technologies that allow homeowners to maintain control and connectivity to their comfort, energy, and security. The performance materials and technologies segment manufacture and develops process technologies, materials, and automation solutions. Moreover, the safety and productivity solutions segment provide software, products, and connected solutions, including footwear and personal protection equipment designed for play, work, and outdoor activities.

Eaton is an intelligent power management company that provides power solutions through industry-leading aerospace, electrical, vehicle, and hydraulic products and services. The energy-efficient products and services enable customers to manage hydraulic, electrical, and mechanical power effectively. The company’s products and services are categorized under various business segments, including electrical Americas and global, aerospace, vehicle, mobility, and hydraulics. The company offers multiple products, including actuators and motion control, clutches and brakes, cylinders, electric circuit protection, energy storage systems, hydraulic motors & generators, lighting and controls, plastics, pumps, utility & grid solutions, valves, and others. In addition, the company provides various services for electrical and power management, including consulting services, engineering studies, design and analysis, grid modernization, power systems automation and control, preventive maintenance, and other turnkey electrical services.

Key Companies in Aircraft Fuel Systems Market

- Collins Aerospace

- Eaton

- GKN Aerospace

- Honeywell International Inc.

- Meggitt PLC.

- Parker Hannifin Corp

- Safran Group

- Triumph Group Inc.

- Triumph Group

- Woodward

- GE Aerospace

Aircraft Fuel Systems Market Developments

July 2024: Intelligent Energy launched the IE-FLIGHT F300 hydrogen fuel cell system at the Farnborough International Airshow. Designed for sub-regional and regional aircraft, it offers high power density, zero emissions, and enhanced thermal efficiency through patented high-temperature operation. This innovation supports aviation's transition to sustainable and emission-free technologies.

April 2024: Parker Aerospace partnered with the HyFIVE consortium to develop liquid hydrogen fuel systems for zero-emission aviation by the 2030s. Supported by a combined $ 46.99 billion in funding from industry and the UK government, the project collaborates with Marshall, GKN Aerospace, and leading universities under the ATI Programme.

December 2023: GE Aerospace and its partners reached a milestone, having tested 10 different aircraft engine models with 100% Sustainable Aviation Fuel (SAF) since 2016. These tests, conducted across component, engine, and aircraft-level systems, align with the aviation industry's goal of achieving net zero CO2 emissions by 2050.

Aircraft Fuel Systems Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- UAV

- Military

By Engine Outlook (Revenue, USD Billion, 2020–2034)

- Turboprop Engine

- Jet Aircraft Engine

- UAV Engine

- Helicopter Engine

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Fuel Injection System

- Pump Feed System

- Gravity Feed Fuel System

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Valve

- Gauges

- Piping

- Pump

- Inerting Systems

- Filters

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aircraft Fuel Systems Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.07 billion |

|

Market Size Value in 2025 |

USD 10.75 billion |

|

Revenue Forecast by 2034 |

USD 19.60 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aircraft fuel systems market size was valued at USD 10.07 billion in 2024 and is projected to grow to USD 19.60 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period

In 2024, North America dominated the aircraft fuel systems market.

A few key players in the market are Collins Aerospace, Eaton, GKN Aerospace, Honeywell International Inc., Meggitt PLC., Parker Hannifin Corp, Safran Group, Triumph Group Inc., Triumph Group, Woodward, and GE Aerospace.

The commercial segment dominated the aircraft fuel systems market in 2024.

Piping systems are expected to witness the fastest growth in the aircraft fuel systems market.