Aircraft Electrical System Market Share, Size, Trends, Industry Analysis Report

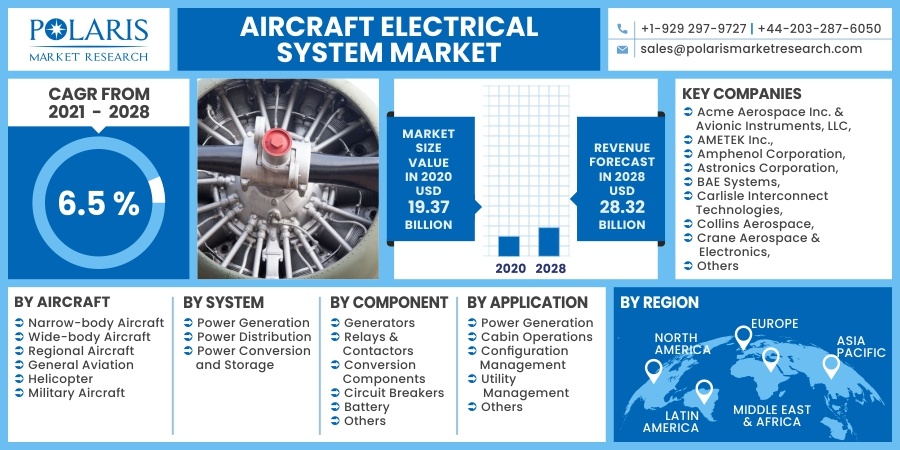

By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft); By System; By Component; By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2084

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

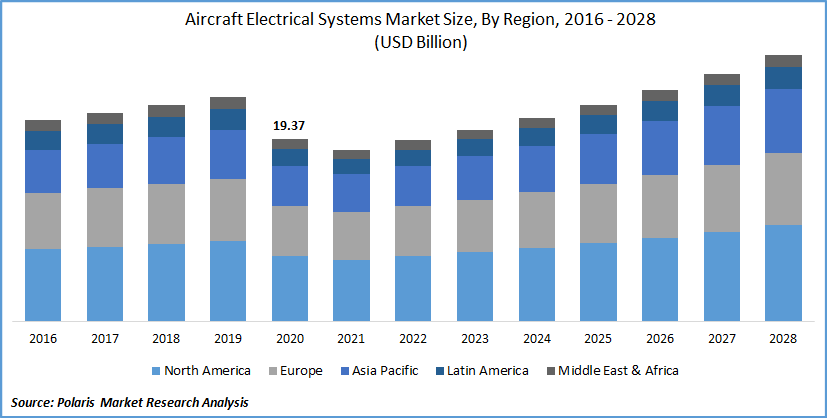

The global aircraft electrical system market was valued at USD 19.37 billion in 2020 and is expected to grow at a CAGR of 6.5% during forecast period. The trend of more electric aircraft with increasing usage of electrical machines and power electronics is one of the prime drivers for aircraft electrical systems. The aircraft industry is increasingly adopting advanced electronics to meet power demands with increased electrical loads. Furthermore, there is also a growing need for reducing carbon emissions and improving fuel economy, which can be achieved to a great extent by deploying more and more electronics in an aircraft.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 pandemic has devasted the ever-growing aircraft industry. The industry's overall demand for electrical systems is in high synergy with the growth/decline of aircraft deliveries. In 2020, the industry recorded USD 371 billion of passenger operating revenues, with an overall reduction of about 2,699 million passengers from 2019 levels.

However, as the impact of the pandemic and economic downturn continues to be acute with the high commercial roll-out of vaccination programs globally, there is a surge in air travel across the globe, with domestic air traffic bouncing back at an excellent rate.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing demand for more electric aircraft, growing need for more power with modern integrated electronics, shift from conventional 120 VAC systems to 270 VDC, and 540 VDC systems demand electrical systems with high voltage switching, and organic growth in aircraft deliveries are key factors fueling the market for electrical systems in the aircraft industry.

Additionally, the growing need for reducing carbon footprints in the aircraft industry demands weight reduction, leading to shrinking electronic systems. The trend of meeting SWaP goals drives the demand for lowering power consumption and advancement throughout power generation and distribution systems.

Report Segmentation

The market is segmented in the most comprehensive way based on aircraft, system, component, application, and region.

|

By Aircraft |

By System |

By Component |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft

Commercial aircraft (including both narrow-body and wide-body aircraft) segment holds high dominance and offers excellent growth in the near-term as it is witnessing a gradual shift from traditional pneumatic and hydraulic components to electrical components, which substantiates the power demand and ultimately drives the electrical systems market.

For instance, thrust reverser actuation systems have evolved over the decades, with newer commercial aircraft platforms such as A350XWB and A380 having shifted to an electrically powered actuation system for the thrust reversers from traditional hydraulic systems.

The military aircraft segment is also not untouched by electrification trends in the global market. Shrinking power devices while meeting increasing power capacities and thermal management needs substantiates demand for highly reliable power sources driving the market segment. Besides, the trend of meeting SWaP (Size Weight and Power) goals and high levels of electronic system integration further drives the market demand.

Insight by System

Among system types, the power generation segment is likely to remain dominant in the global market during the forecast period. The development of high-thrust engines with increasing demand for greater efficiency substantiates the power demand, stability of engine control, highly integrated electrical power generation systems.

The power distribution segment is estimated to witness the highest CAGR during the forecast period driven by increasing demand for high power load switching and distribution devices such as relays and contactors. There is the trend of building more and more electronic intelligence with an aim to protect abnormal events and proactively detect system faults. Smart contractors are gaining prevalence to control high power circuits and protect against overcurrent and faults.

Insight by Component

Relays & Contactors are likely to offer the highest CAGR in the global market during the forecast period. Increasing demand for high-voltage AC and DC systems in aircraft drives the demand for high-power electromechanical relays and efficient contactors. Furthermore, the adoption of 270 VDC and 540 VDC among commercial and military aircraft has led to incremental technology updates in relays and contactors.

Generators hold a significant share in the global market driven by the ever-growing need for more and more power electronics in modern aircraft platforms. Growing need for reducing electronic load failures and protection from Undervoltage, which may potentially cause component failures, is driving the segment's demand in the market.

Geographic Overview

North America leads the global market with significant demand from leading OEMs and tier players. Modern aircraft platforms in the region demand more power and advancement in electrical systems. For instance, Boeing's upcoming aircraft program B777x will generate twice the current B777 system's power generation. Its electrical load management system will also monitor 30% more power in the aircraft.

Some of the key aircraft platforms in the region, such as Boeing Apache, Super Hornet, Lockheed Martin C130J, and F35; and Gulfstream 650, have modular electronic solutions with 270VDC architectures and seamless transition of power from generation to distribution which drives advancements in the electrical system.

Asia-Pacific region offers the highest growth CAGR driven by a gradual transition to more electric aircraft applications leading to new requirements for active and passive conversion interconnection within power systems to drive electric loads such as motors and pumps.

Besides, there is also a trend of shifting from hydraulic or pneumatic actuators to electric actuators among commercial aircraft and helicopters. New and upcoming aircraft programs such as COMAC C919 and Mitsubishi MRJ jet to further enhance the region's market growth.

Competitive Insight

Leading aircraft electrical systems and component manufacturers are increasingly focusing on developing efficient electronics across the application areas onboard, such as actuators, thrust reverser components, and auxiliary power units. There is also an increasing level of consolidation in the market, with major players acquiring small players in the market.

Some of the key players competing in the global market are Acme Aerospace Inc. & Avionic Instruments, LLC, AMETEK Inc., Amphenol Corporation, Astronics Corporation, BAE Systems, Carlisle Interconnect Technologies, Collins Aerospace, Crane Aerospace & Electronics, Delorean Aerospace LLC, EaglePicher Technologies, Esterline Technologies, GE Aviation, Hartzell Engine Technologies LLC, Honeywell International, Meggitt plc, PBS AEROSPACE, Pioneer Magnetics, Radiant Power Corp, Safran SA, Thales Group.

Aircraft Electrical System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 19.37 billion |

|

Revenue forecast in 2028 |

USD 28.32 billion |

|

CAGR |

6.5 % from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft, By System, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Acme Aerospace Inc. & Avionic Instruments, LLC, AMETEK Inc., Amphenol Corporation, Astronics Corporation, BAE Systems, Carlisle Interconnect Technologies, Collins Aerospace, Crane Aerospace & Electronics, Delorean Aerospace LLC, EaglePicher Technologies, Esterline Technologies, GE Aviation, Hartzell Engine Technologies LLC, Honeywell International, Meggitt plc, PBS AEROSPACE, Pioneer Magnetics, Radiant Power Corp, Safran SA, Thales Group |