Aircraft De-Icing Market Size, Share, Trends, Industry Analysis Report: By System Type, Fluid Type, Application (Commercial Aviation, Military Aviation, and General Aviation), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1584

- Base Year: 2024

- Historical Data: 2020-2023

Aircraft De-Icing Market Overview

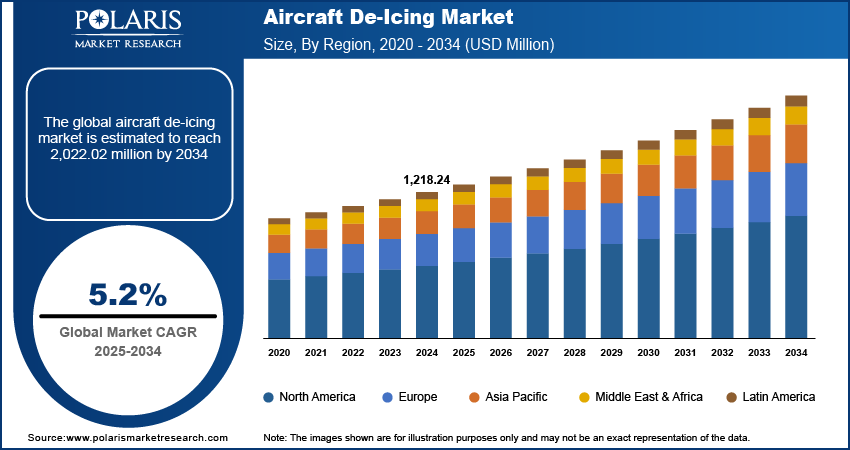

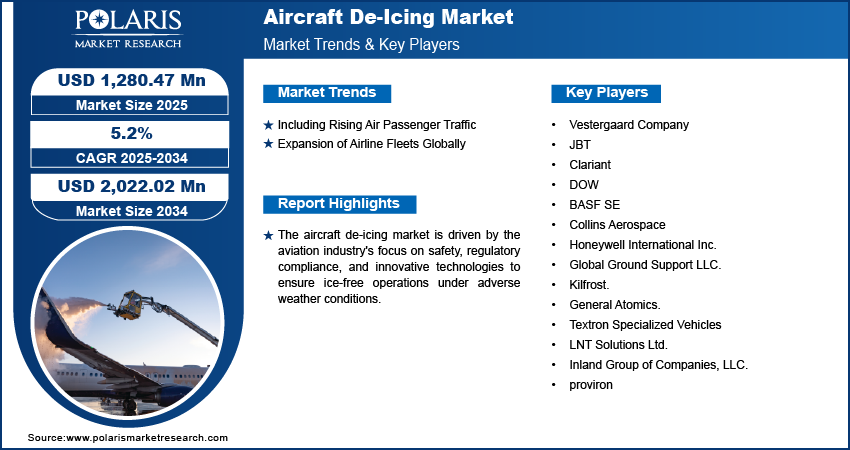

The global aircraft de-icing market size was estimated at USD 1,218.24 million in 2024. The market is projected to grow from USD 1,280.47 million in 2025 to USD 2,022.02 million by 2034, exhibiting a CAGR of 5.2% during 2025–2034.

De-icing an aircraft is the process of removing ice and frost from its surface before takeoff. This procedure is necessary in cold weather conditions and is crucial for safety, as ice and snow can alter the shape of the wings, thereby reducing lift. The global aircraft de-icing market focuses on technologies, systems, and services that ensure aircraft safety during adverse weather conditions by preventing the accumulation of ice on critical surfaces. Aircraft de-icing involves both anti-icing measures to prevent ice formation and de-icing to remove existing ice, which is critical for maintaining aerodynamic efficiency, reducing drag, and ensuring operational safety. The market is driven by the aviation industry’s emphasis on safety, regulatory compliance, and operational efficiency under varying climatic conditions. Key components include de-icing equipment, fluids, and services, catering to both commercial and military aviation sectors.

The market’s evolution is marked by innovations in de-icing fluid formulations, advancements in infrared and electronic thermal management materials, and the integration of environmentally sustainable practices. Emerging trends, such as the adoption of automated de-icing systems and the use of advanced weather monitoring technologies, are also gaining traction. The increasing global fleet of aircraft, coupled with stringent safety regulations and growing air traffic, shows the importance of robust de-icing solutions, making de-icing a critical component of the aviation industry, thereby driving the aircraft de-icing market demand. For instance, an October 2024 EPA report noted that airports with 1,000+ annual jet departures must use non-urea de-icers or meet ammonia limits. New airports with 10,000+ departures in cold climates must collect 60% of deicing fluid and comply with chemical oxygen demand requirements. Existing airports will have discharge requirements set through permits.

To Understand More About this Research: Request a Free Sample Report

Aircraft De-Icing Market Dynamics

Rising Air Traffic and Airport Operations

The increase in global air traffic significantly drives the aircraft de-icing market growth. According to an August 2024 report from Airports Council International, North American airports experienced a substantial rebound in international passenger traffic in 2023, growing by 27.9% compared to 2022. Domestic tourism traffic also showed notable growth, rising by 9.5% from the previous year. The demand for de-icing services rises to ensure safe and efficient operations as air traffic increases, particularly in regions with cold climates, further boosting the market for de-icing products and services.

Government Regulations on Safety Standards

Government regulations and safety standards play a crucial role in driving the demand for aircraft de-icing services. In the US, the Federal Aviation Administration (FAA) mandates that airlines ensure their aircraft are free from ice, snow, or frost before departure to avoid any risks to flight safety. Similarly, the European Union Aviation Safety Agency (EASA) has established clear guidelines for aircraft de-icing. These regulations require airlines and airports to invest in efficient de-icing technologies to comply with safety protocols. These government-mandated safety standards are critical in ensuring that aircraft remain operational during winter months, thus driving market growth for de-icing solutions.

Aircraft De-Icing Market Segment Assessment

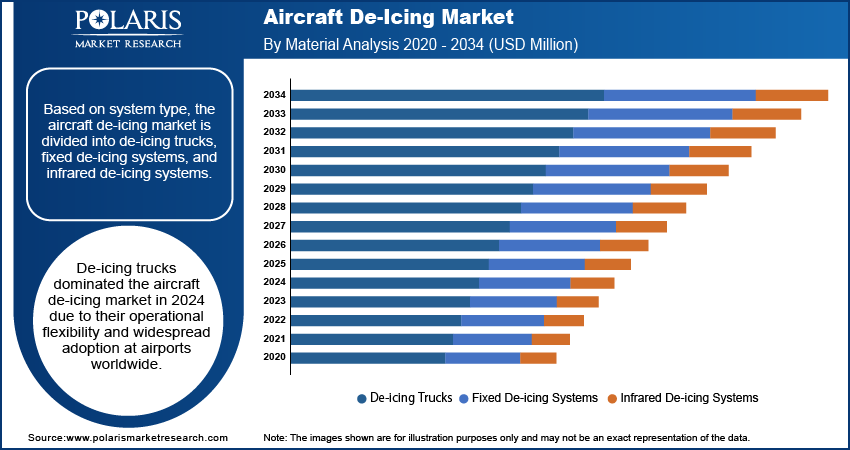

Aircraft De-Icing Market Assessment by System Types

Based on system types, the aircraft de-icing market is categorized into de-icing trucks, fixed de-icing systems, and infrared de-icing systems. De-icing trucks dominated the market demand in 2024 due to their operational flexibility and widespread adoption at airports worldwide. De-icing trucks allow precise application of de-icing fluids, ensuring rapid and effective ice removal even under harsh weather conditions. The ability to operate in remote and varying airport layouts, combined with advancements in autonomous systems, makes them indispensable for aviation safety.

Aircraft De-Icing Market Assessment by Fluid Types

Based on fluid types, the aircraft de-icing market is categorized into type I, type II, type III, and type IV. Type IV fluids dominated the market in 2024 due to their long holdover times, offering extended protection against ice formation. These fluids are designed to prevent ice from forming on aircraft for extended periods, which is crucial during winter weather. Their long holdover time makes them especially useful for large commercial fleets flying in cold, harsh conditions, where frequent de-icing is necessary. Airlines prefer type IV fluids as they reduce the need for repeated applications, ensuring safety and improving operational efficiency, especially during severe winter months.

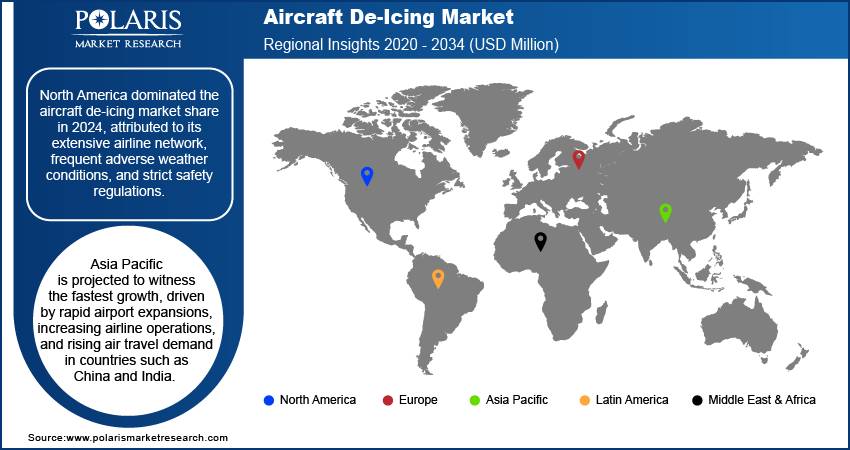

Aircraft De-Icing Market Outlook by Region

By region, the report provides the aircraft de-icing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the aircraft de-icing market share in 2024, attributed to its extensive airline network, frequent adverse weather conditions, and strict safety regulations. The US, in particular, leads due to its large-scale commercial aviation operations and the presence of key market players. The region’s smart airport infrastructure and investments in automated de-icing technologies further consolidate its leadership. For instance, in September 2024, Vestergaard Company launched the OPTIM-ICE semi-automatic de-icing system for narrowbody aircraft. Using LIDAR radars, it scans the aircraft, selects deicing patterns, and assists the operator while preventing contact with the surfaces.

Asia Pacific is projected to witness the fastest growth, driven by rapid airport expansions, increasing airline operations, and rising air travel demand in countries such as China and India. China, as the leading country in this region, is expected to experience growth due to its extensive aviation infrastructure projects and increasing domestic air traffic management. The government’s focus on developing state-of-the-art airports equipped with advanced de-icing technologies positions the region as a key area of growth.

Aircraft De-Icing Key Market Players & Competitive Analysis Report

The aircraft de-icing industry is highly competitive, with global leaders and regional players vying for market share through innovation, strategic partnerships, and regional expansion. Companies such as Vestergaard Company and JBT Corporation dominate due to their comprehensive product portfolios and strong global presence. Innovations such as autonomous de-icing trucks and eco-friendly fluid formulations are key differentiators. Regional players focus on cost-effective solutions tailored to local needs, particularly in emerging markets. Strategic collaborations with airports and airlines, coupled with acquisitions to enhance technological capabilities, are prevalent. For example, Clariant AG and Kilfrost Limited emphasize R&D to develop sustainable de-icing fluids, while Textron GSE expands its geographic reach through strategic partnerships.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions throughout the United States, Canada, Latin America, Europe, Africa, India, the Middle East, Asia Pacific. Dow maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates, and polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers; ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment offer industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions.

Key Companies in Aircraft De-Icing Market

- BASF SE

- Clariant

- Collins Aerospace

- DOW

- General Atomics.

- Global Ground Support LLC.

- Honeywell International Inc.

- Inland Group of Companies, LLC.

- JBT

- Kilfrost.

- LNT Solutions Ltd.

- proviron

- Textron Specialized Vehicles

- Vestergaard Company

Aircraft De-Icing Market Developments

December 2023: Air Canada, a full-service airline that provides scheduled and charter air transportation for passengers and cargo, becomes the first airline to install GaN de-icing technology from De-Ice to reduce departure delays and the carbon footprint associated with chemical de-icing.

February 2021: Aviator Airport Alliance, an aviation services provider, secured a five-year contract from Lufthansa Group for ground handling and de-icing/anti-icing services. Under the agreement, Aviator will provide the services at Stockholm-Arlanda Airport to Deutsche Lufthansa, Swiss International Air Lines, and Austrian Airlines, which are airlines under the Lufthansa Group.

Aircraft De-Icing Market Segmentation

By System Type Outlook (Revenue, USD Million, 2020 - 2034)

- De-icing Trucks

- Fixed De-icing Systems

- Infrared De-icing Systems

By Fluid Type Outlook (Revenue, USD Million, 2020 - 2034)

- Type I

- Type II

- Type III

- Type IV

By Application Outlook (Revenue, USD Million, 2020 - 2034)

- Commercial Aviation

- Military Aviation

- General Aviation

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aircraft De-Icing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,218.24 million |

|

Market Size Value in 2025 |

USD 1,280.47 million |

|

Revenue Forecast in 2034 |

USD 2,022.02 million |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aircraft de-icing market size was valued at USD 1,218.24 million in 2024 and is projected to grow to USD 2,022.02 million by 2034.

The global market is projected to grow at a CAGR of 5.2% during the forecast period.

North America had the largest share of the global market in 2024

Some of the key players in the market are Vestergaard Company, JBT, Clariant, DOW, BASF SE, Collins Aerospace, Honeywell International Inc., Global Ground Support LLC, Kilfrost, and General Atomics.

De-icing trucks dominated the aircraft de-icing market demand in 2024.