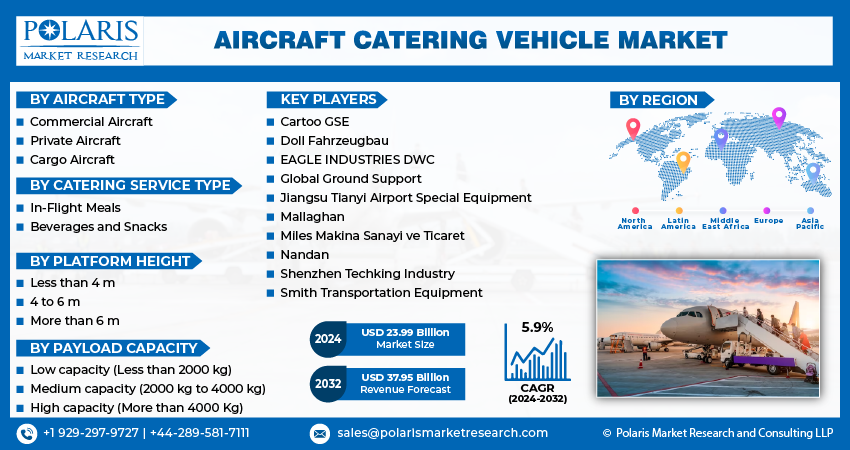

Aircraft Catering Vehicle Market Share, Size, Trends, Industry Analysis Report, By Aircraft Type (Commercial, Private, Cargo); By Catering Service Type; By Platform Height; By Payload Capacity; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4163

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

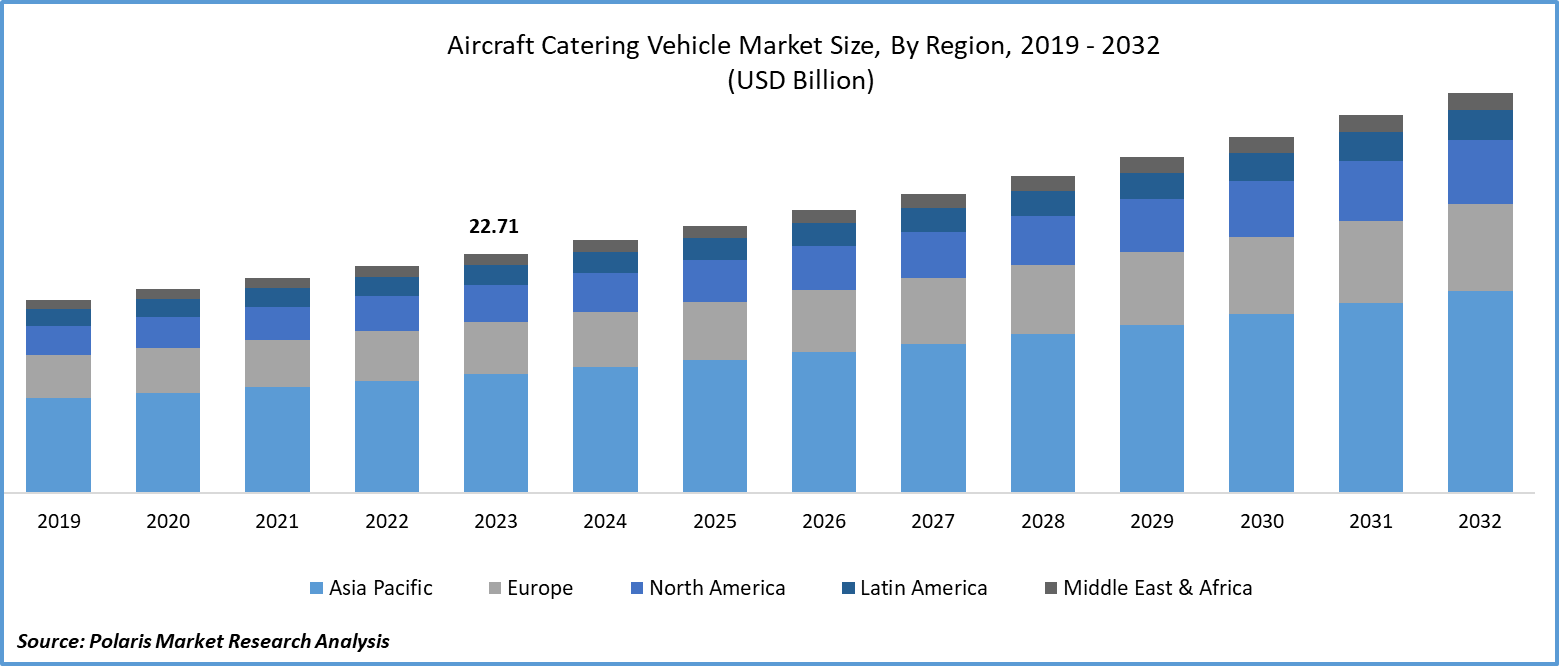

The global aircraft catering vehicle market was valued at USD 22.71 billion in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period.

The increasing global air travel is propelling the need for aircraft catering vehicles as they enable travelers to arrange meals and beverages with better storage along with food safety and quality measures. Perishable food items necessitate the need for refrigerators and other requirements, which will facilitate the demand for aircraft catering vehicles as they are built with the capacity to store a wide range of food products. The increasing research studies on finding the interests of air passengers are likely to assist companies in strategic planning.

To Understand More About this Research: Request a Free Sample Report

- For instance, in May 2023, a study published in MDPI focused on finding the willingness of air travelers to reserve online in-flight meals and their preference to pay for meal updates among US students. The study findings demonstrated students’ willingness to prefer online reservations and the potential benefits of it in reducing cabin food waste.

Moreover, the growing demand for quality and premium meals by air travelers is forcing management to adopt advanced vehicles to meet ongoing consumer expectations, which will have a significant impact on aircraft catering vehicles. However, the unforeseen pandemic like COVID-19 is limiting air travel, as it created worldwide travel restrictions, which will likely hinder the demand for air travel along with the market.

Growth Drivers

- Rising global air travel is likely to positively impact aircraft catering vehicle demand

Global air travel is expected to witness a rapid surge-driven removal of global trade and travel restrictions pertaining to the COVID-19 pandemic. The rising global trade activities are widening the expansion and demand for aircraft and, in turn, aircraft catering vehicles, as they are crucial for managing meal catering services for travelers, which are essential for people with longer journey hours. According to the International Air Travel Association, the total air traffic in August 2023 witnessed a rise of 28.4% compared to August 2022, while domestic traffic increased by 25.4% and 9.2% compared to 2022 and 2019 in August. As this trend is expected to continue, there will be a significant need for airport catering vehicles in the coming years.

Report Segmentation

The market is primarily segmented based on aircraft type, catering service type, platform height, payload capacity and region.

|

By Aircraft Type |

By Catering Service Type |

By Platform Height |

By Payload Capacity |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Aircraft Type Analysis

- Commercial segment is expected to witness the highest growth during the forecast period

The commercial segment will grow rapidly due to the presence of a larger volume of passengers in this aircraft. The more travelers on a plane, the higher the demand for in-flight catering services, which will further create demand for aircraft catering vehicles in the coming years. Furthermore, commercial aircraft are highly focused on revenue generation and higher capacity with predefined routes, driving demand for catering services and, in turn, vehicles driven by longer hours of journey.

The cargo segment garnered a substantial share, largely attributable to the transportation of perishable goods, including pharmaceuticals, which require significant storage and transportation systems to manage the quality and safety of goods, which will fuel the adoption of catering vehicles in the long run.

By Catering Service Type Analysis

- In-flight meals segment accounted for the largest market share in 2023

The in-flight meals segment accounted for the largest share. Airlines are adopting better catering service agents to meet consumer expectations of quality meals, which will enhance the demand for catering vehicles with advanced technologies.

The beverages & snacks segment is expected to grow at the fastest rate over the next few years, driven by rising demand for convenience foods during travel. Most of the global population is acquainted with snacks and drinks in their free time; this is likely to take place during travel as passengers sit for longer periods. The ongoing snacking culture is stimulating the demand for aircraft catering vehicles to meet consumer needs.

By Platform Height Analysis

- More than 6m segment held the significant market revenue share in 2023

The more than 6m segment garnered the largest share, which is highly accelerated due to the increasing use of larger aircraft like the Airbus A380, Antonov An-225 Mriya, Boeing 747-8, Hughes H-4 Hercules, and Strato-launch. These aircraft are used for international travel, which requires more than 6 meters to reach the cargo door. This will force companies to innovate vehicles with the capacity to reach higher heights, contributing to the growth of the market.

By Payload Capacity Analysis

- High-capacity segment held the significant growth in 2023

The high-capacity segment held significant growth in 2023, which is highly accelerated due to its ability to carry a higher payload, which is essential for commercial aircraft meal transportation. This segment can store more than 4000kg. The aircraft with the higher number of travelers will likely adopt this truck rather than others, which will reduce the additional transportation of meals through other vehicles.

Regional Insights

- Asia Pacific region registered the largest share of the global market in 2023

The Asia-Pacific region held the global market with the largest market share in 2023 and is expected to continue its dominance over the study period. The growing air travel in this region is expanding the growth of aircraft catering vehicles in the region. Based on the IATA report published in August 2023, Asia-Pacific airlines registered a 98.5% increase in air traffic in 2023 compared to August 2022. Capacity increased by 96.2%, and the load factor climbed 3.9% to 84.5%. This trend demonstrates that there will be a huge demand for catering vehicles in the coming years.

Furthermore, the increasing number of flight kitchen establishments in the region is showing an upward trajectory for in-flight catering services. For instance, TajSATS introduced a flight kitchen in Goa's Manohar International Airport in 2023, which has the capacity to serve 20,000 meals per day. This will likely create demand for aircraft catering vehicles in the coming years.

The Europe region is expected to grow at a rapid pace, owing to the growing air travel in this region. According to the IATA, European carriers saw a 22% increase in air traffic in April compared to the same period in the previous year. Capacity increased by 145.3%, while the load factor increased by 13.2% to 81.6. This trend will strengthen the demand for catering vehicles during the study period in the region.

Key Market Players & Competitive Insights

The aircraft catering vehicle market was witnessing rising innovations in the marketplace, driven by growing food safety concerns among aircraft management. The presence of larger players in the market is likely to stimulate research activities, contributing to the development of efficient vehicles for airport catering services. The rising demand for in-flight catering is helping the companies expand their product line and global coverage through acquisitions and partnerships.

Some of the major players operating in the global market include:

- Cartoo GSE

- Doll Fahrzeugbau

- EAGLE INDUSTRIES DWC

- Global Ground Support

- Jiangsu Tianyi Airport Special Equipment

- Mallaghan

- Miles Makina Sanayi ve Ticaret

- Nandan

- Shenzhen Techking Industry

- Smith Transportation Equipment

Recent Developments

- In June 2023, LSG Group, an airline catering and retail company, and LSG Group, an onboard solutions provider, entered into a strategic partnership to expand their product portfolio and enhance their offering of innovative, high-quality in-flight products with the aim of improving passenger experience.

Aircraft Catering Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 23.99 billion |

|

Revenue forecast in 2032 |

USD 37.95 billion |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Aircraft Type, By Catering Service Type, By Platform Height, By Payload Capacity, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in aircraft catering vehicle market are Doll Fahrzeugbau, EAGLE INDUSTRIES DWC, Global Ground Support

The global aircraft catering vehicle market is expected to grow at a CAGR of 5.9% during the forecast period.

The aircraft catering vehicle market report covering key segments are aircraft type, catering service type, platform height, payload capacity and region.

key driving factors in aircraft catering vehicle market rising global air travel is likely to positively impact aircraft catering vehicle demand

The global aircraft catering vehicle market size is expected to reach USD 37.95 billion by 2032