Aircraft Cabin Interiors Market Share, Size, Trends, Industry Analysis Report

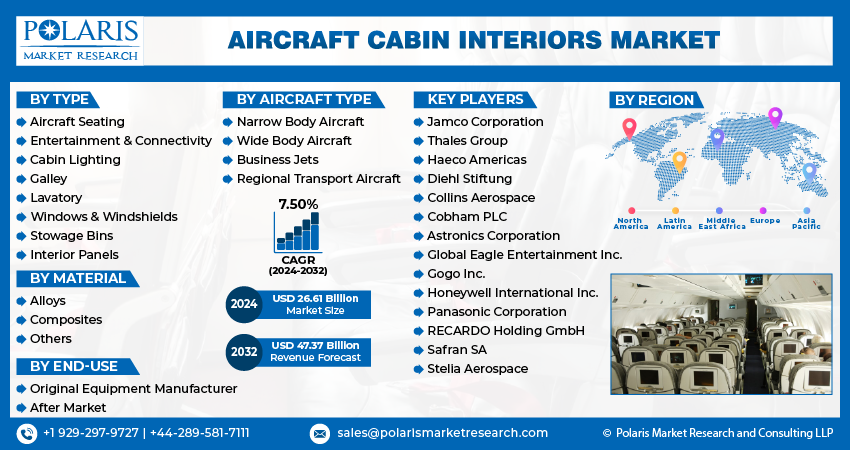

By Type (Aircraft Seating, Entertainment & Connectivity, Cabin Lighting, Galley, Lavatory, Windows & Windshields, Stowage Bins, and Interior Panels); By Material; By Aircraft Type; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: pdf

- Report ID: PM3046

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

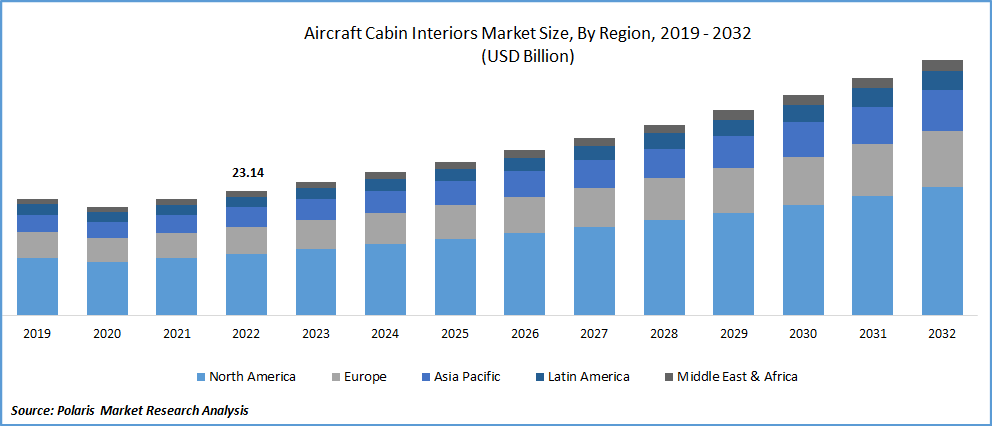

The global aircraft cabin interiors market was valued at USD 24.81 billion in 2023 and is expected to grow at a CAGR of 7.50% during the forecast period. The rise in the need to improve the travel experience by providing them a secure and highly comfortable surrounding at very high altitudes and the extensively growing number of commercial aircraft deliveries across the globe are major factors propelling the global market growth.

Know more about this report: Request for sample pages

In addition, the continuously growing prevalence and penetration of advanced and innovative aircraft systems and components like LED cabin lights, & comfortable sitting structures are also projected to create huge aircraft cabin interiors market growth opportunities in the coming years.

For instance, in June 2022, Collins Aerospace announced the launch of its new lighting system named “Hypergamut” at the “Aircraft Interiors Exposition” in Germany. It is a full cabin innovated lighting system that is mainly attuned to the human circadian rhythm to minimize passenger jetlag and improve the visibility of materials, fixtures, and food items in the cabin.

Furthermore, there has been an emerging trend among airlines worldwide, in order to enhance their passenger experience, are highly implementing new and advanced cabin interior systems such as mood lighting, touchless in-flight solutions, newer generation seats, and in-flight live streaming, which are embedded with innovative smart sensors to control manually seat pressure, temperature, and movement, while using an application on the phone, among others.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the market. During the period of the pandemic, the aircraft industry has faced many challenges to keep up with the demand & supply, and all of these impacted the market negatively. The market declined highly as a result of various government restrictions on travel and even on trade activities by imposing lockdowns and other barriers. However, post-pandemic, the market started recovering slightly along with the passengers flocking to travel by air, and manufacturing units have gained their pace again.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rapidly growing modernization and upgradation of commercial aircraft cabin interior designs along with the surge in demand for aircraft interior refurbishment and space optimization especially from regional airlines and low-cost carriers in countries like India, Africa, China, and Indonesia are key factors driving the aircraft cabin interiors market growth.

The low-cost models have been extremely successful for several short-haul routes and generated huge demand for narrow-body aircraft, which in turn, boosted the demand for interior products at a rapid pace.

Furthermore, the reconfiguration of cabin designs across various airlines and high prevalence among OEMs and cabin designers to develop and innovate new technologies for enhancing passenger comfort regarding not only safety but also green aviation, are likely to be other primary factors augmenting global market growth during the forecast period.

Numerous large market companies are heavily investing in the upgrades of aircraft interiors for the improvement of user experience and application of sustainable materials is also pushing market growth forward.

Report Segmentation

The market is primarily segmented based on type, material, aircraft type, end-user, and region.

|

By Type |

By Material |

By Aircraft Type |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Entertainment & Connectivity Segment Accounted for the Largest Market Share

The rapid change in people’s lifestyles immensely fueled the adoption and way entertainment by consumers and is being taken as a basic utility in various aspects of consumer behavior fueling the segment growth. Growth in the proliferation of entertainment & connectivity to provide improved passenger experiences in their leisure time to cater to the rising consumer demand is further likely to fuel the segment market shortly.

However, the galley segment is projected to expand at fastest growth rate during the anticipated period on account of growing need and demand to provide convenient food & beverage deliveries. In addition, numerous numbers of services launch across the globe for food and drinks for airplane passengers are creating significant growth opportunities for the segment market.

Others Segment is Expected to Hold Significant Market Share

The others segment is expected to account for significant market revenue share over the study period, as aircraft cabin interiors are under a process of continuous evolution in terms of materials used in the manufacturing of interior products. Phenolic resins reinforced with carbon or glass are being highly used for a variety of interior structures like ceilings and sidewalls. Moreover, the growing requirement for lightweight & sustainable materials for the cabin interiors that help to reduce aircraft weight for higher fuel efficiency & low operational costs is expected to create ample growth opportunities in the coming years.

Narrow-Body Aircraft Segment Dominated the Market in 2022

The narrow-body aircraft segment healthy revenue share, in 2022. This is primarily due to an increase in domestic air traffic and several travelers opting for air travel in both developed and developing countries. The growing competition among airline service providers across these countries has encouraged them to improve their services while maintaining prices competitive and affordable, which is projected to boost the segment market exponentially over the projected period.

Aftermarket Segment Held the Largest Market Share in 2022

The aftermarket segment registered highest market share which is mainly accelerated by the growing number of exotic cabin interior design product launches and comparatively massive size of the existing fleet in the current existing commercial planes. The aftermarket segment also includes flight interior upgrades and MRO services by the OEM players.

The OEM segment is anticipated to expand at fastest growth rate during the projected period, due to the exponential rise in the demand for aircraft all over the world and especially in developing nations including China and India. A drastically grown number of air passengers worldwide and airlines’ focus on customer satisfaction resulted in high growth and demand for the segment.

The Demand in Asia Pacific is Expected to Witness Significant Growth

The Asia Pacific region is expected to witness a significant growth rate throughout the forecast period, which is mainly attributable to an extensive rise in aircraft deliveries and a large number of air travelers in countries like China and India.

Additionally, the availability of low-cost carriers (LCC) with low end-to-moderate services compared to the full-service airlines or large airlines, which also tend to buy several narrow-body aircraft covering short distances and which are easy to maintain is expected to propel the growth of the market in the region.

However, North America dominated the market for aircraft cabin interiors in 2022 on account of robust presence of world’s largest airlines, high consumer disposable income, and increased popularity and prevalence of traveling through airplanes instead of other options available in the market. For instance, the smart cabin, introduced by Boeing, transformed the cabin structure with the amalgamation of IoTs mainly for its crew members with a variety of features like voice commands to operate functions like cabin lighting, seating, & lavatories.

Competitive Insight

Some of the major players operating in the global market include Jamco Corporation, Thales Group, Haeco Americas, Diehl Stiftung, Collins Aerospace, Cobham PLC, Astronics Corporation, Global Eagle Entertainment Inc., Gogo Inc., Honeywell International Inc., Panasonic Corporation, RECARDO Holding GmbH, Safran SA, and Stelia Aerospace.

Recent Developments

- In June 2022, Astronics Corp. signed an agreement with Southwest Airlines for providing its EMPOWER Passenger In-Seat Power System for the installation of its 475 Boeing 737 MAX-7 & MAX-8 aircraft. The system will provide 60W type-C & 10.5W type-A USB charging ports & enabled passengers to charge 2 different devices simultaneously.

- In September 2021, Virgin Atlantic launched its new interior and cabin reconfiguration of aircraft A350 that includes extra seats in economy cabins and more social space called ‘The Booth’ for upper-class customers. The Booth will exclusively available to only customers flying with the airline to leisure destinations.

Aircraft Cabin Interiors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.61 billion |

|

Revenue forecast in 2032 |

USD 47.37 billion |

|

CAGR |

7.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Material, By Aircraft Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Jamco Corporation, Thales Group, Haeco Americas, Diehl Stiftung & Co. Kg., Collins Aerospace, Cobham PLC, Astronics Corporation, Global Eagle Entertainment Inc., Gogo Inc., Honeywell International Inc., Panasonic Corporation, RECARDO Holding GmbH, Safran SA, and Stelia Aerospace. |

FAQ's

The aircraft cabin interiors market report covering key segments are type, material, aircraft type, end-user, and region.

Aircraft Cabin Interiors Market Size Worth $47.37 Billion By 2032.

The global aircraft cabin interiors market expected to grow at a CAGR of 7.4% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in aircraft cabin interiors market are growing in-flight entertainment devices and adopting low-cost carriers (LCC) in emerging economies.