Air Traffic Management Market Size, Share, Trends, Industry Analysis Report

: By Technology (Communication, Navigation, Surveillance, and Automation), By Airspace, By Airport Size, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2781

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

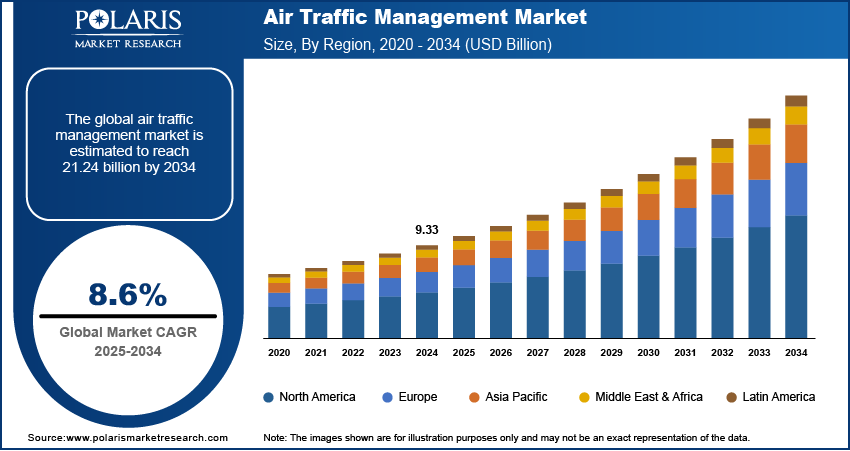

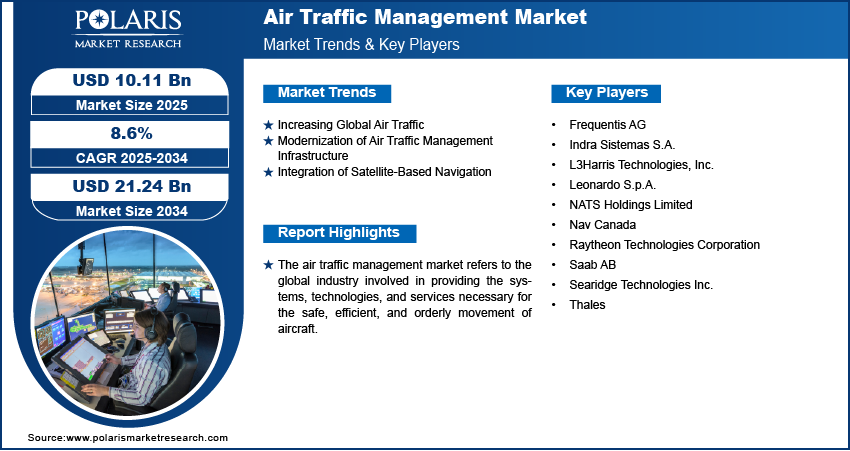

The air traffic management market size was valued at USD 9.33 billion in 2024, growing at a CAGR of 8.6% during 2025–2034. The market is driven by the growing global air traffic, ongoing modernization of infrastructure, and the integration of satellite-based navigation systems, all aimed at enhancing safety, efficiency, and capacity in air travel.

Key Insights

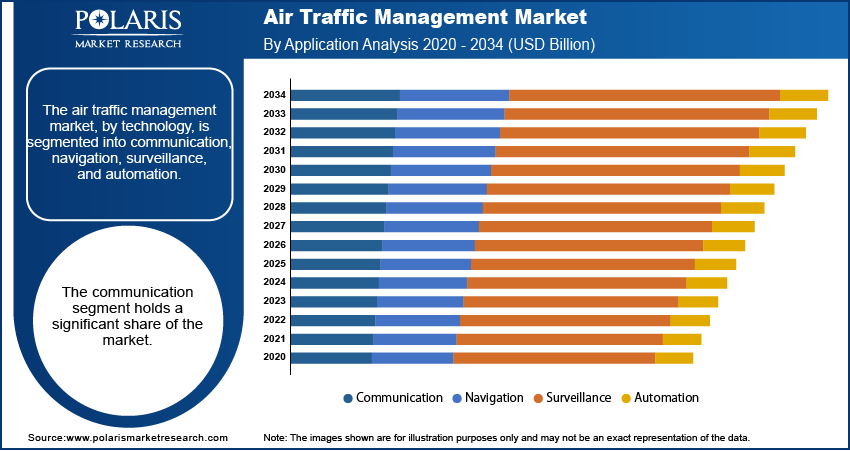

- The communication segment holds a major share due to its essential role in enabling safe, real-time information exchange between controllers and aircraft.

- The air traffic services sector dominates due to its essential role in flight safety, including control, flight information, and alerting services worldwide.

- The communication systems segment leads the market as reliable voice and data exchange is critical for global air traffic operations.

- The large airport segment holds the largest share due to high traffic volume and the need for advanced management systems for complex operations.

- The commercial segment will also grow the fastest as expanding passenger traffic and airline networks drive demand for advanced ATM technologies.

- North America holds the largest revenue share due to a mature aviation sector, high traffic volume, and ongoing infrastructure upgrades.

- Asia Pacific is set to grow the fastest driven by rising air travel in China and India and heavy investment in new airport infrastructure.

Industry Dynamics

- Rising global air travel driven by economic growth and disposable income increases the demand for advanced traffic management systems globally.

- Modernization efforts with new technologies such as ADS-B and IP-based communication systems are boosting air traffic management system adoption.

- Satellite navigation including GNSS and GBAS enables accurate flight path planning and safer operations, supporting better traffic flow management.

- Increasing demand for efficient routes and safety in congested airspace creates scope for digital and satellite-based navigation adoption globally.

- High implementation costs and complex infrastructure upgrades can limit adoption, especially in developing regions with limited financial and technical resources.

Market Statistics

2024 Market Size: USD 9.33 billion

2034 Projected Market Size: USD 21.24 billion

CAGR (2025–2034): 8.6%

North America: Largest market in 2024

AI Impact on Air Traffic Management Market

- AI enhances air traffic flow by predicting congestion and optimizing routes in real time to reduce delays and improve efficiency.

- It assists air traffic controllers by automating routine tasks, lowering workload, and minimizing the risk of human error.

- AI improves safety by analyzing data from multiple sources to detect potential conflicts or anomalies before they become critical.

- It supports predictive maintenance of air traffic systems and equipment, reducing downtime and ensuring system reliability.

- AI enables better coordination between airports, airlines, and control centers through intelligent data sharing and decision-making tools.

To Understand More About this Research: Request a Free Sample Report

The air traffic management market encompasses the systems and air services utilized to ensure the safe, orderly, and efficient movement of aircraft across the globe. This includes a range of functions from air traffic control, which guides aircraft during all phases of flight, to airspace management, which strategically organizes and allocates airspace. Furthermore, air traffic flow management aims to optimize the flow of air traffic, preventing congestion and delays. Air traffic management is a critical component of the aviation industry, directly impacting the safety, capacity, and operational efficiency of air travel.

A primary market driver is the consistent increase in global air traffic, fueled by economic growth and rising disposable incomes, particularly in developing nations. This surge in air travel necessitates more sophisticated air traffic management solutions to manage the growing volume of aircraft safely and efficiently. Additionally, the ongoing modernization of air traffic management infrastructure, involving the integration of advanced technologies such as satellite-based navigation (such as GPS), Automatic Dependent Surveillance-Broadcast (ADS-B), and digital communication systems, is a significant driver. These technological advancements enhance the accuracy of aircraft tracking, enable more direct flight paths, and improve overall airspace capacity. The heightened focus on improving air safety and reducing operational inefficiencies further propels the demand for advanced air traffic management systems and services.

Market Dynamics

Increasing Global Air Traffic

As economies expand and international travel becomes more accessible, the number of flights and air passengers is steadily increasing. This surge in air traffic necessitates advanced air traffic management systems to maintain safety and efficiency within increasingly crowded airspace. According to the "Joint ACI World-ICAO Passenger Traffic Report, Trends, and Outlook," published in January 2025, global passenger traffic in 2024 is expected to surpass pre-pandemic levels, reaching 9.5 billion passengers, which is 104% of the 2019 levels. Furthermore, the report forecasts that by 2030, global passenger traffic will exceed 12 billion, driven particularly by growth in international markets within Asia Pacific and the Middle East. Therefore, the continuous growth in global air traffic propels the air traffic management market growth.

Modernization of Air Traffic Management Infrastructure

Governments and aviation authorities worldwide are investing in upgrading their air traffic management systems to incorporate advanced technologies that enhance safety, efficiency, and capacity. A Rajya Sabha Unstarred Question No. 644 answered by the Indian Ministry of Civil Aviation on February 10, 2025, highlights the steps being taken to modernize air navigation services and upgrade air traffic management systems in India. These initiatives include the deployment of new IP-based Voice Communication Control Systems, the installation of a pan-India Aeronautical Message Handling System, and the commissioning of Automatic Dependent Surveillance-Broadcast (ADS-B) ground stations. The implementation of Performance-Based Navigation (PBN) procedures and a Central Air Traffic Flow Management (C-ATFM) system further demonstrates the commitment to leveraging technological advancements for better airspace management. Hence, the ongoing modernization of air traffic management infrastructure boosts the air traffic management market expansion.

Integration of Satellite-Based Navigation

The integration of satellite-based navigation systems, such as the Global Navigation Satellite System (GNSS), offers precise positioning, timing, and navigation data, which are essential for enhancing the safety and efficiency of air travel. A publication by Canal Geomatics in October 2024 emphasizes that GNSS has become a cornerstone of modern aviation, providing continuous and reliable data for flight management systems. This allows for more accurate flight path planning, real-time adjustments, and improved safety measures, especially during critical phases such as approach and landing. The Federal Aviation Administration (FAA) also highlights the benefits of Ground Based Augmentation System (GBAS), which enhances the capabilities of satellite navigation by increasing capacity, efficiency, and providing user and community benefits through more precise and flexible flight paths. Thus, the increasing integration of satellite-based navigation systems would contribute to the growth opportunities during the forecast period.

Segment Insights

Market Assessment – By Technology

The air traffic management market, by technology, is segmented into communication, navigation, surveillance, and automation. The communication segment holds a significant revenue share. Effective communication systems are foundational to safe and efficient air traffic operations, facilitating seamless information exchange between air traffic controllers and aircraft. This includes voice communication systems, data link services for transmitting flight plans and clearances, and other essential communication infrastructure. The continuous need for reliable and secure communication networks due to the increasing volume of air traffic ensures the sustained prominence of this segment.

The automation segment is anticipated to exhibit the highest growth rate during the forecast period. This growth is driven by the increasing adoption of advanced automation technologies aimed at enhancing efficiency, reducing controller workload, and optimizing airspace utilization. These technologies include automated air traffic control systems, flow management tools, and decision support systems that assist controllers in making informed and timely decisions. As the complexity of air traffic management grows and the demand for greater efficiency intensifies, the integration of sophisticated automation solutions is expected to accelerate.

Market Evaluation– By Airspace

The air traffic management market, by airspace, is segmented into air traffic services, air traffic flow management, airspace management, and aeronautical information management. The air traffic services subsegment accounts for the largest share. Air traffic services, encompassing air traffic control, flight information service, and alerting service, are fundamental to ensuring the safety and efficiency of aircraft operations in all phases of flight. The extensive infrastructure and the availability of personnel required to provide these core services across the globe contribute to the dominance of this segment.

The air traffic flow management segment is projected to experience the highest growth rate during the forecast period. This growth is being propelled by the increasing need to optimize the use of airspace and mitigate congestion, particularly in high-density air traffic regions. Air traffic flow management solutions employ advanced tools and procedures to proactively manage the flow of aircraft, balancing capacity and demand to minimize delays and improve overall efficiency. As air traffic volumes continue to rise and the complexity of airspace management intensifies, the adoption of sophisticated air traffic flow management systems is expected to increase substantially during the forecast period.

Market Assessment – By Technology

By technology, the air traffic management market is segmented into communication systems, navigation, surveillance, and others. The communication systems segment holds the largest share. Robust and reliable communication technologies form the backbone of air traffic control, enabling essential voice and data exchange between controllers and pilots. The critical nature of these systems for ensuring safe and efficient aircraft operations, coupled with the extensive infrastructure already in place globally, contributes to the growth of the communication systems segment.

The surveillance segment is anticipated to demonstrate the highest growth rate during 2025–2034. This growth is being driven by the increasing adoption of advanced surveillance technologies that provide enhanced situational awareness and improved safety. These technologies include advanced radar systems, Automatic Dependent Surveillance-Broadcast (ADS-B), and multilateration systems, which offer more accurate and comprehensive tracking of aircraft. As the volume of air traffic rises and the demand for enhanced safety measures intensifies, the deployment of sophisticated surveillance technologies is expected to accelerate in the coming years.

Market Assessment – By Airport Size

The air traffic management market, by airport size, is segmented into small airport, medium airport, and large airport. The large airport segment accounts for the largest share. Large airports handle the highest volume of air traffic and aircraft movements, necessitating the deployment of comprehensive and sophisticated air traffic management systems to manage their complex operations efficiently and safely. The extensive infrastructure and advanced technologies required by these major aviation and aviation analytics hubs contribute to the expansion of the large airport segment.

The large airport segment is also anticipated to exhibit the highest growth rate during the forecast period. This growth is driven by the continuous expansion of air travel and the increasing number of passengers handled by major airports globally. The need for enhanced efficiency, safety, and capacity at these large airports necessitates ongoing investments in advanced air traffic management technologies and infrastructure upgrades. Consequently, the demand for innovative air traffic management solutions is expected to rise significantly in the large airport segment in the coming years.

Market Assessment – By End Use

The air traffic management market, by end use, is bifurcated into commercial and military. The commercial segment holds a larger share. This is attributable to the significantly higher volume of air traffic and the extensive network of commercial and smart airports and airlines operating globally. The need for sophisticated air traffic management systems to manage the vast number of commercial flights, ensure passenger safety, and optimize operational efficiency contributes to the dominant position of the commercial segment.

The commercial segment is also anticipated to exhibit a higher growth rate during the forecast period. The continuous increase in air passenger traffic, coupled with the ongoing expansion of airline fleets and airport infrastructure worldwide, necessitates further investments in advanced air traffic management technologies. The demand for enhanced safety, efficiency, and capacity to accommodate the growing commercial air travel sector will continue to drive significant growth in the adoption and advancement of air traffic management solutions within this end use segment.

Regional Analysis

The air traffic management market exhibits a diverse regional landscape, with varying levels of market penetration and growth trajectories across different geographies. North America and Europe have historically been significant markets for air traffic management solutions, characterized by well-established aviation infrastructure and stringent safety regulations. Asia Pacific is emerging as a dynamic and rapidly expanding market, driven by increasing air travel demand and significant investments in airport infrastructure. Latin America and the Middle East & Africa also present considerable growth opportunities, fueled by expanding aviation sectors and the modernization of air traffic management systems. Each region's market dynamics are influenced by factors such as air traffic volume, regulatory frameworks, technological adoption rates, and economic development.

North America accounts for the largest revenue share. The region benefits from a mature aviation industry, high air traffic density, and the presence of leading air traffic management technology providers. Stringent safety standards and continuous investments in upgrading air traffic control infrastructure contribute to the significant market size in North America. The focus on enhancing efficiency and integrating advanced technologies across its extensive airspace system solidifies North America's leading position.

The Asia Pacific market is projected to experience the highest growth rate during the forecast period. This rapid expansion is primarily driven by the burgeoning air travel demand in countries such as China and India, coupled with substantial investments in new airport developments and the modernization of existing air traffic management systems. The increasing number of air passengers and the expansion of airline fleets across the region necessitate the adoption of advanced air traffic management solutions to ensure safety and efficiency. The strong economic growth and the focus on improving air connectivity are key factors propelling the adoption of air traffic management technologies and services across Asia Pacific.

Key Players and Competitive Insights

A few major players actively contributing to the air traffic management industry include Thales; Indra Sistemas S.A.; Leonardo S.p.A.; Frequentis AG; Saab AB; Raytheon Technologies Corporation; L3Harris Technologies, Inc.; Nav Canada (a key service provider with in-house technology development); NATS Holdings Limited (also primarily a service provider with technology innovation); and Searidge Technologies Inc. These entities are involved in developing and deploying a range of air traffic management solutions, including communication, navigation, surveillance, and automation systems, catering to the evolving needs of the global aviation industry.

The competitive landscape of the air traffic management market is characterized by a mix of well-established global players and niche technology providers. Competition is driven by factors such as technological innovation, product reliability, system integration capabilities, and the ability to offer customized solutions to meet specific regional and airport requirements. Key competitive insights reveal a growing emphasis on developing next-generation air traffic management systems that incorporate artificial intelligence, machine learning, and cloud-based technologies to enhance efficiency, safety, and sustainability. Strategic collaborations, partnerships, and research and development initiatives are crucial for companies to maintain a competitive edge in this technologically intensive market.

Thales, headquartered in Courbevoie, France, offers a comprehensive suite of air traffic management solutions. Their offerings include air traffic control automation systems, communication and surveillance infrastructure, navigation aids, and digital solutions for airspace management. Thales plays a significant role in modernizing air traffic management systems globally, providing technologies that enhance air safety, increase airspace capacity, and improve operational efficiency for both civil and military aviation.

Indra Sistemas S.A., located in Alcobendas, Spain, is another prominent player in the air traffic management ecosystem. The company provides a wide array of air traffic management products and services, encompassing air traffic control systems, radar and surveillance technologies, communication platforms, and air navigation services. Indra's solutions are designed to optimize air traffic flow, improve safety, and reduce environmental impact, making them a relevant provider for air navigation service providers and airport authorities worldwide.

List of Key Companies

- Frequentis AG

- Indra Sistemas S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- NATS Holdings Limited

- Nav Canada

- Raytheon Technologies Corporation

- Saab AB

- Searidge Technologies Inc.

- Thales

Air Traffic Management Industry Developments

- March 2024: Leidos announced the opening of an Air Traffic Management Research and Collaboration Center in Singapore. The company stated that the center will focus on providing safe and efficient solutions for air navigation service providers across the Indo-Pacific region.

- January 2024: EasyJet announced its partnership as the first airline to join the Iris program—an initiative spearheaded by the European Space Agency (ESA) in collaboration with global communications provider Viasat. This program leverages next-generation satellite technologies to support the modernization of air traffic management.

- October 2023: Officials at Biju Patnaik International Airport in Bhubaneswar, Odisha, revealed the installation of a new air traffic management automation system at the airport's newly established air traffic control center. This upgrade aims to enhance the efficiency and effectiveness of flight operations.

Air Traffic Management Market Segmentation

By Airspace Outlook (Revenue – USD Billion, 2020–2034)

- Air Traffic Services

- Air Traffic Flow Management

- Airspace Management

- Aeronautical Information Management

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Communication Systems

- Navigation

- Surveillance

- Others

By Airport Size Outlook (Revenue – USD Billion, 2020–2034)

- Small Airport

- Medium Airport

- Large Airport

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Military

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Traffic Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.33 billion |

|

Market Size Value in 2025 |

USD 10.11 billion |

|

Revenue Forecast by 2034 |

USD 21.24 billion |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The air traffic management market has been segmented into detailed segments of airspace, technology, airport size, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy in the air traffic management market centers on continuous technological innovation, particularly in areas such as automation, digitalization, and integration of AI/ML for enhanced efficiency and safety. Market penetration can be improved by tailoring solutions to the specific needs of different airport sizes and regional air traffic complexities. Strategic collaborations between technology providers and air navigation service providers (ANSPs) are crucial for the successful deployment and adoption of new systems. Furthermore, emphasizing the benefits of air traffic management solutions in terms of cost savings through optimized operations and reduced delays can drive demand for air traffic management. Expanding into emerging aviation markets with significant growth potential, especially in Asia Pacific and Latin America, also represents a vital marketing strategy.

FAQ's

The market size was valued at USD 9.33 billion in 2024 and is projected to grow to USD 21.24 billion by 2034.

The market is projected to register a CAGR of 8.6% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Thales; Indra Sistemas S.A.; Leonardo S.p.A.; Frequentis AG; Saab AB; Raytheon Technologies Corporation; L3Harris Technologies, Inc.; Nav Canada (a key service provider with in-house technology development); NATS Holdings Limited (also primarily a service provider with technology innovation); and Searidge Technologies Inc.

The communication segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Increasing Automation for air traffic control: Rising adoption of automated systems for air traffic control, flow management, and decision support to enhance efficiency and reduce controller workload. ? Digitalization and Data Integration: Shift toward digital platforms and the integration of various data sources to provide a more comprehensive and real-time view of airspace operations. ? Integration of Artificial Intelligence (AI) and Machine Learning (ML): Growing use of AI and ML algorithms for predictive analysis, optimizing flight paths, and improving airspace management.

Air traffic management is the system used to ensure the safe, orderly, and efficient movement of aircraft during all phases of flight, from takeoff to landing and including on-ground operations at airports. It is like the "rules of the road" for the sky, but significantly more complex due to the three-dimensional nature of airspace and the high speeds involved.