Air Suspension Market Size, Share, Trends, Industry Analysis Report: By Control Type (Electronically Controlled Air Suspension and Non-electronically Controlled Air Suspension), Application Type, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 117

- Format: PDF

- Report ID: PM3400

- Base Year: 2024

- Historical Data: 2020-2023

Air Suspension Market Overview

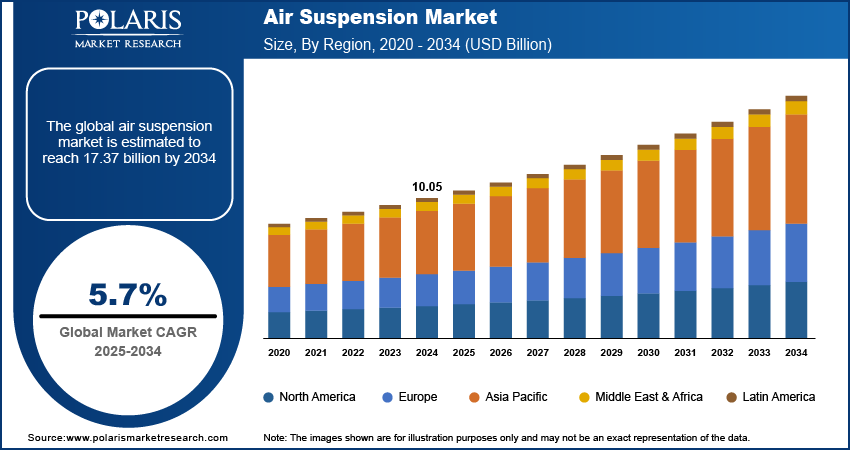

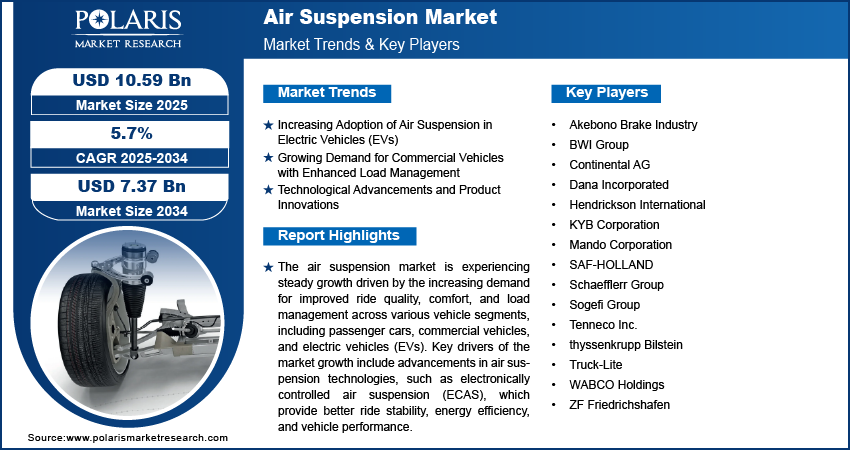

The air suspension market size was valued at USD 10.05 billion in 2024. The market is projected to grow from USD 10.59 billion in 2025 to USD 17.37 billion by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

The air suspension market involves the use of air springs and related systems in vehicles to provide a smoother and more adjustable ride by replacing traditional steel springs. This market has been growing due to the increasing demand for enhanced ride quality, comfort, and vehicle load management, especially in the automotive, commercial vehicle, and luxury car segments. Key drivers of market growth include rising consumer preference for improved driving experiences, advancements in air suspension technologies, and the adoption of air suspension systems in electric vehicles (EVs) for better weight distribution and efficiency. Additionally, the growing demand for commercial vehicles with higher load capacity and the trend toward vehicle customization are fueling the air suspension market expansion.

To Understand More About this Research: Request a Free Sample Report

Air Suspension Market Dynamics

Increasing Adoption of Air Suspension in Electric Vehicles (EVs)

The growing adoption of electric vehicles (EVs) has significantly influenced the air suspension market. As EVs continue to gain popularity, manufacturers are integrating air suspension systems to optimize weight distribution and improve driving comfort. Air suspension provides better load management, which is essential in EVs, where battery weight and distribution impact vehicle performance. Furthermore, air suspension supports the reduction of energy consumption by adjusting the vehicle's height based on load, improving aerodynamics, and contributing to overall energy efficiency. This trend is expected to continue as automakers increasingly focus on enhancing the driving experience and efficiency of their electric vehicle offerings.

Growing Demand for Commercial Vehicles with Enhanced Load Management

In the commercial vehicle sector, there is a rising demand for air suspension systems due to their ability to manage heavier loads and enhance stability, especially in freight and logistics. Air suspension helps provide better weight distribution across the vehicle, reducing wear and tear on roads and tires. It also increases vehicle longevity. The need for efficient, high-performing commercial vehicles is driving the demand for air suspension, particularly in regions with strong logistics and transportation industries.

Technological Advancements and Product Innovations

The air suspension market is seeing significant technological advancements and product innovations. Manufacturers are focusing on developing air suspension systems that are lightweight material, more durable, and capable of providing greater precision in ride control. Smart air suspension systems with sensors that can adjust the ride height and firmness in real-time are becoming more prevalent, offering improved comfort and handling. Innovations such as electronically controlled air suspension (ECAS) are enhancing the adaptability of vehicles to varying road conditions and payloads. As a result, air suspension systems are becoming more accessible across various vehicle segments. These advancements are supported by continuous R&D investments from leading players in the automotive and commercial vehicle industries. Therefore, significant technological advancements and product innovations in air suspension systems are driving the air suspension market growth.

Air Suspension Market Segment Insights

Air Suspension Market Outlook – Control Type-Based Insights

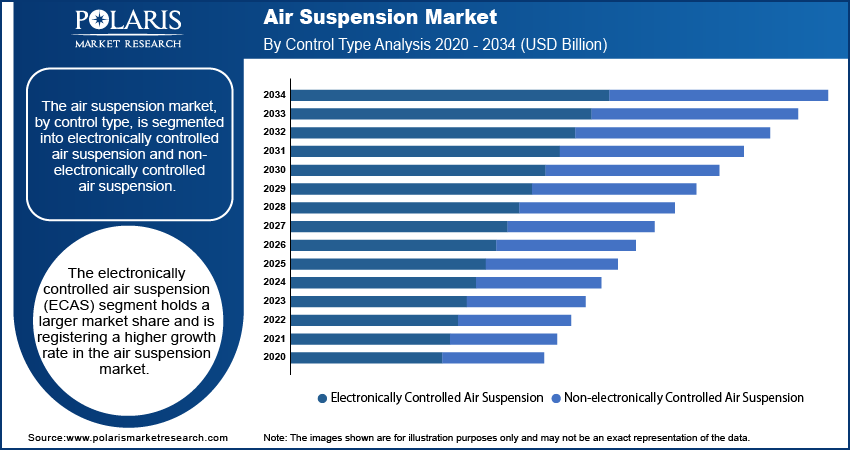

The air suspension market, by control type, is segmented into electronically controlled air suspension and non-electronically controlled air suspension. The electronically controlled air suspension (ECAS) segment holds a larger market share and is registering the highest growth within the air suspension market. This segment benefits from technological advancements that offer improved ride comfort, stability, and vehicle performance. ECAS systems are designed to adjust the suspension automatically based on factors such as load, road conditions, and vehicle speed, providing a dynamic and responsive driving experience. These systems are particularly popular in high-end vehicles, electric vehicles, and commercial trucks, where precision control is crucial. The increasing integration of electronic control systems in modern vehicles, combined with the growing demand for enhanced comfort and performance, has fueled the expansion of this segment.

The non-electronically controlled air suspension segment continues to maintain a strong presence, particularly in budget-conscious markets and older vehicle models. While they do not offer the same level of adaptability as ECAS, they remain popular in applications where basic load leveling and ride comfort are sufficient. These systems typically feature manual or pneumatic controls that adjust the suspension according to pre-set parameters. Although the growth of this segment is slower compared to electronically controlled systems, it still plays an important role in the air suspension market, particularly in more cost-sensitive segments and certain types of commercial vehicles.

Air Suspension Market Assessment – Application Type-Based Insights

The air suspension market, by application type, is segmented into passenger cars and commercial vehicles. The passenger cars segment holds a larger share of the air suspension market revenue, driven by increasing consumer demand for enhanced ride comfort and vehicle performance. With rising disposable incomes and consumer preferences for luxury vehicles, automakers are increasingly adopting air suspension systems in mid-range and high-end models. This segment has witnessed a significant shift, particularly with the growing popularity of electric vehicles (EVs), where air suspension offers benefits such as better load management and improved driving dynamics. The development of more advanced, electronically controlled air suspension systems has driven the adoption in this segment, offering superior handling and comfort, which are highly valued by consumers.

The commercial vehicle segment, while smaller in comparison, is experiencing strong growth due to the increasing demand for vehicles that can handle heavy loads while maintaining ride stability. Air suspension systems are crucial for ensuring better weight distribution, reducing wear and tear on vehicles, and improving safety in commercial trucks, buses, and transport vehicles. The growth in logistics and freight transport, as well as the push for fuel efficiency and sustainability, are key factors driving the adoption of air suspension in this sector. As commercial vehicles continue to evolve, the demand for advanced air suspension systems that offer greater adaptability to varying loads and road conditions is expected to rise, contributing to the segment growth.

Air Suspension Market Evaluation – End User-Based Insights

The air suspension market, by end user, is segmented into OEM and aftermarket. The OEM (original equipment manufacturer) segment holds a larger market share owing to the increasing integration of air suspension systems in new vehicles across various segments, including passenger cars, commercial vehicles, and electric vehicles. The adoption of air suspension in OEM vehicles is primarily fueled by the growing demand for enhanced drive comfort, better load management, and the technological advancements in electronically controlled air suspension systems. As manufacturers aim to meet consumer expectations for improved vehicle performance and comfort, particularly in the luxury and electric vehicle segments, the OEM sector continues to experience strong growth.

The aftermarket segment is registering significant growth, driven by vehicle owners looking to replace or upgrade their existing suspension systems. This trend is especially strong in the commercial vehicle sector, where operators seek to improve vehicle durability and performance. Additionally, the increasing number of older vehicles still on the road with conventional suspension systems is supporting demand for aftermarket air suspension solutions. The growth of the aftermarket segment is also fueled by rising awareness of the benefits of air suspension in terms of vehicle longevity and reduced maintenance costs. The aftermarket expansion is expected to continue as more vehicle owners look for customized solutions to enhance driving comfort and performance.

Air Suspension Market Regional Insights

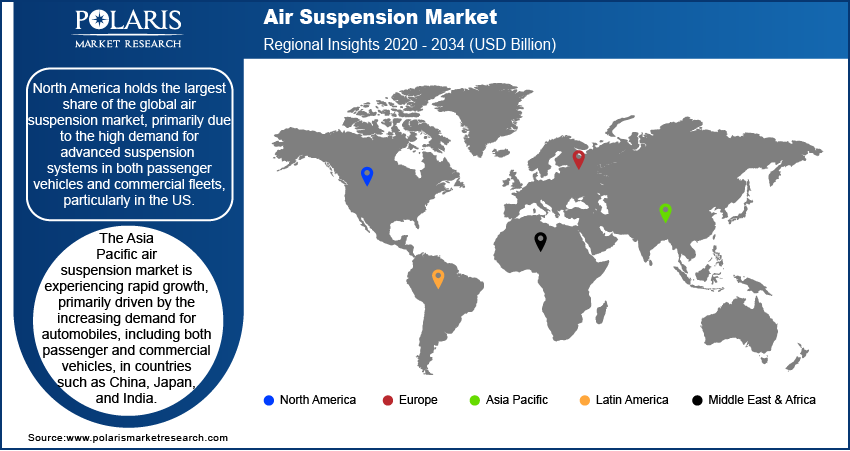

By region, the study provides air suspension market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global market, primarily due to the high demand for advanced suspension systems in both passenger vehicles and commercial fleets, particularly in the US. The region's strong automotive industry, including a significant presence of luxury vehicle manufacturers and the growing adoption of electric vehicles, is a major driver of this demand. Additionally, the commercial vehicle sector in North America is expanding, fueled by the need for improved load management and vehicle stability in logistics and transportation. The presence of key players in the automotive sector and advancements in air suspension technologies further contribute to the dominance of North America in the global market.

Europe holds a significant share of the global air suspension market, driven by the region’s strong automotive industry, which includes major manufacturers of luxury and electric vehicles. Countries such as Germany, France, and the UK are key contributors, with a growing adoption of air suspension in passenger cars and commercial vehicles. The demand is particularly strong for luxury and high-performance vehicles, where air suspension systems enhance ride comfort and vehicle stability. Additionally, the increasing focus on sustainability and fuel efficiency in commercial vehicles has led to the adoption of air suspension systems, as they improve load management and reduce vehicle wear. The presence of key automotive OEMs and the push toward environmentally friendly technologies further contribute to the market growth in Europe.

The Asia Pacific air suspension market is experiencing rapid growth, primarily driven by the increasing demand for automobiles, including both passenger and commercial vehicles, in countries such as China, Japan, and India. The region is seeing a rise in consumer preference for advanced vehicle features, including air suspension systems, especially in premium and electric vehicles. China, being the largest automotive market in the world, is a key contributor to this growth. Additionally, the expanding commercial vehicle sector in countries such as India and Southeast Asia, fueled by rising industrialization and transportation needs, is boosting the demand for air suspension systems. As the region continues to urbanize and as the adoption of electric and hybrid vehicles increases, the air suspension market in Asia Pacific is expected to continue its upward trajectory during the forecast period.

Air Suspension Market – Key Market Players and Competitive Insights

Key players in the air suspension market include manufacturers such as Continental AG, ZF Friedrichshafen, WABCO Holdings, Hendrickson International, BWI Group, and SAF-HOLLAND. These companies are actively involved in the development and supply of air suspension systems for various vehicle segments, including passenger cars, commercial vehicles, and electric vehicles. Other notable players include Dana Incorporated, Akebono Brake Industry, Tenneco Inc., Schaeffler Group, thyssenkrupp Bilstein, KYB Corporation, Mando Corporation, Truck-Lite, and Sogefi Group. Each of these companies provides air suspension solutions tailored to meet the specific needs of different vehicle types, focusing on enhancing ride quality, load management, and vehicle stability. Additionally, firms such as Ride Control LLC and Air Lift Company are key contributors, particularly in the aftermarket segment, offering a range of air suspension products for commercial vehicles and passenger cars.

The competitive environment in the air suspension market is shaped by the presence of several players that focus on technological advancements and product innovation. Companies such as ZF Friedrichshafen and Continental AG are investing heavily in research and development to improve the efficiency and performance of their air suspension systems, with a particular emphasis on the integration of electronically controlled systems. Meanwhile, companies such as Hendrickson International and SAF-HOLLAND are capitalizing on the increasing demand from the commercial vehicle sector by providing robust solutions that enhance vehicle durability and stability. The market is also seeing a strong push toward the development of air suspension systems for electric vehicles, where players such as BWI Group and Tenneco Inc. are focusing on optimizing the technology to suit the unique demands of EVs.

As manufacturers continue to compete, the air suspension market is expected to witness further consolidation through mergers and acquisitions, alongside strategic partnerships aimed at expanding product offerings. Companies with strong OEM relationships, such as ZF Friedrichshafen and Continental AG, are well-positioned to drive growth, especially as the automotive industry shifts toward electric vehicles and autonomous technologies. Additionally, with the increasing demand for air suspension systems in commercial vehicles, companies focusing on providing cost-effective, durable solutions will likely see steady growth. The overall competitive landscape is marked by a mix of established players investing in innovation and new entrants offering customized solutions for niche markets.

Continental AG is a global supplier of automotive components, with a strong focus on air suspension systems. The company is involved in the design, manufacturing, and supply of air suspension technologies for various vehicle types, including passenger cars and commercial vehicles. It has been investing in advancements to improve ride quality and vehicle performance, particularly through the development of electronically controlled air suspension systems. Their solutions are widely used in luxury and electric vehicles, where the demand for enhanced comfort and efficiency is high. Continental has been focusing on expanding its footprint in the electric vehicle segment, where air suspension plays a critical role in improving overall vehicle stability and energy efficiency.

ZF Friedrichshafen is another major player in the air suspension market, providing a wide range of suspension solutions for passenger and commercial vehicles. The company’s focus has been on integrating advanced technologies to enhance vehicle dynamics and improve driving comfort. ZF’s air suspension systems are known for their performance in heavy-duty applications, such as commercial trucks and buses, while also serving the growing demand in electric and autonomous vehicles. ZF has been enhancing its product offerings by developing more adaptive and efficient suspension systems, which include features such as real-time adjustments to ride height and damping.

List of Key Companies in Air Suspension Market

- Akebono Brake Industry

- BWI Group

- Continental AG

- Dana Incorporated

- Hendrickson International

- KYB Corporation

- Mando Corporation

- SAF-HOLLAND

- Schaeffler Group

- Sogefi Group

- Tenneco Inc.

- thyssenkrupp Bilstein

- Truck-Lite

- WABCO Holdings

- ZF Friedrichshafen

Air Suspension Industry Developments

- In November 2024, Continental announced the launch of a new air suspension system for commercial vehicles aimed at improving ride comfort and reducing fuel consumption.

- In October 2024, ZF announced a partnership with an electric vehicle manufacturer to develop a new air suspension system optimized for electric buses, aimed at improving energy efficiency and ride quality for urban transportation.

Air Suspension Market Segmentation

By Control Type Outlook

- Electronically Controlled Air Suspension

- Non-electronically Controlled Air Suspension

By Application Type Outlook

- Passenger Cars

- Commercial vehicles

By End User Outlook

- OEM

- Aftermarket

By Component Outlook

- Air Spring

- Tank

- Solenoid Valve

- Shock Absorber

- Air Compressor

- Electronic Control Unit

- Height & Pressure Sensor

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Suspension Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.05 billion |

|

Market Size Value in 2025 |

USD 10.59 billion |

|

Revenue Forecast by 2034 |

USD 7.37 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The air suspension market has been broadly segmented on the basis of control type, application type, end user, and component. Moreover, the study provides the reader with a detailed understanding of the different segments at global and regional levels.

Growth/Marketing Strategy

The air suspension market growth and marketing strategy focuses on continuous innovation, strategic partnerships, and expanding product portfolios. Companies are investing heavily in research and development to enhance air suspension systems with advanced technologies such as electronically controlled air suspension (ECAS) to meet the rising demand for improved ride comfort, fuel efficiency, and vehicle stability. Additionally, players are expanding their presence in emerging markets such as Asia Pacific, where the automotive and commercial vehicle sectors are rapidly growing. To strengthen their market position, companies are forming alliances with electric vehicle manufacturers and focusing on sustainability to meet regulatory requirements and consumer preferences for eco-friendly solutions. These strategies are expected to drive market expansion and increase competitiveness.

FAQ's

? The market size was valued at USD 10.05 billion in 2024 and is projected to grow to USD 17.37 billion by 2034.

? The market is projected to register a CAGR of 5.7% during 2025–2034.

? North America accounted for the largest share of the market in 2024.

? A few key players in the market include manufacturers such as Continental AG, ZF Friedrichshafen, WABCO Holdings, Hendrickson International, BWI Group, and SAF-HOLLAND.

? The electronically controlled air suspension (ECAS) segment accounted for a larger share of the market in 2024.

? The passenger car segment accounted for a larger market share in 2024.

? Air suspension is a type of vehicle suspension system that uses air springs, rather than traditional steel or coil springs, to absorb shock and maintain the vehicle’s ride height. The system includes air bags or airbags that are inflated or deflated using a compressor to adjust the vehicle's suspension, providing a smoother ride and the ability to adjust the vehicle's height based on load and road conditions. Air suspension is commonly used in both passenger cars and commercial vehicles, offering benefits such as improved ride comfort, better load management, enhanced vehicle stability, and the ability to level the vehicle for varying load weights. It is also becoming increasingly popular in electric vehicles due to its ability to optimize vehicle performance and efficiency.

A few key trends in the air suspension market include: Adoption of Air Suspension in Electric Vehicles (EVs): Increasing integration of air suspension systems in EVs for better weight distribution, improved energy efficiency, and enhanced ride comfort. Technological Advancements: Development of electronically controlled air suspension (ECAS) systems that offer real-time adjustment to ride height and damping, improving vehicle handling and comfort. Growing Demand in Commercial Vehicles: Rising adoption of air suspension systems in commercial vehicles to improve load management, vehicle durability, and fuel efficiency, especially in logistics and freight transport. Focus on Sustainability: Manufacturers are developing more energy-efficient air suspension systems, particularly in response to the growing demand for eco-friendly solutions in automotive and commercial vehicle sectors.

? A new company entering the air suspension market must focus on developing innovative, cost-effective solutions that cater to emerging trends, such as the growing demand for air suspension in electric vehicles (EVs) and commercial fleets. Investing in research and development to enhance the efficiency and adaptability of air suspension systems, especially through electronically controlled systems, will provide a competitive edge. Additionally, offering tailored aftermarket solutions for vehicle customization and focusing on sustainability by creating eco-friendly, energy-efficient systems can attract environmentally conscious consumers. Building strong partnerships with EV manufacturers and expanding into emerging markets, particularly in Asia Pacific, can further drive growth and market presence.

? Companies manufacturing, distributing, or purchasing air suspension and related products, and other consulting firms must buy the report.