Air Starter Market Size, Share, Trends, Industry Analysis Report: By Type (Vane Air Starters, Turbine Air Starters, and Electric Air Starters), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5245

- Base Year: 2024

- Historical Data: 2020-2023

Air Starter Market Overview

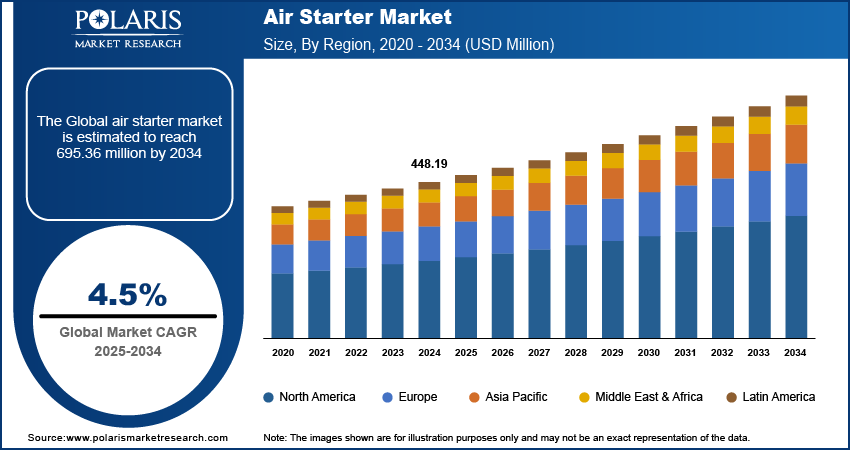

The air starter market size was valued at USD 448.19 million in 2024. The market is projected to grow from USD 467.91 million in 2025 to USD 695.36 million by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

An air starter is a type of mechanical device that uses compressed air to start an engine, typically in large machinery, heavy-duty vehicles, or industrial applications. Air starter is a reliable alternative to traditional electric starters, especially in environments where electric power might be unavailable, hazardous, or impractical. The growing demand for heavy machinery and industrial equipment is significantly driving the air starter market expansion. Furthermore, technological improvements in the efficiency and design of air starters have made them more cost-effective and reliable, which has enhanced air starter adoption in new sectors, thereby fueling the air starter market growth.

The air starter market development is driven by its benefits such as safety and reliability in hazardous environments, such as chemical plants, mines, and refineries, where electric starters are unsafe due to explosive gases or extreme conditions. Moreover, the increasing demand for air travel and expansion of the aerospace industry fuel the need for air starters in commercial and military aircraft., which is further contributing to the air starter market growth.

To Understand More About this Research: Request a Free Sample Report

Air Starter Market Driver Analysis

Growth in Offshore Oil and Gas Exploration

Offshore rigs and remote drilling sites often rely on air starters to start engines where electrical systems are not viable. The increasing global demand for energy, particularly from oil and gas, is further fueling the adoption of air starters in oil and gas industries. According to the U.S. Energy Information Administration, oil production in the US rose from 11,742 barrels per day in May 2022 to 13,201 barrels per day in May 2024, reflecting a significant increase in output. Therefore, the growth in offshore oil and gas exploration is driving the demand for air starters.

Expansion of Construction Projects

The increase in global infrastructure development, urbanization, and large-scale construction projects are propelling the need for heavy construction equipment such as excavators, bulldozers, cranes, and loaders. According to the Homes and Community Renewal, in October 2024, the New York City Department of Housing Preservation and Development received Letters of Intent from 650 property owners for roughly 71,000 new residential units, including 21,000 affordable apartments. Heavy machines, which rely on large engines, often require air starters for reliable operation, particularly in harsh environments or areas where electric starters may fail. Thus, the rising need for dependable engine start-up solutions due to the growing construction projects is fueling the air starter market demand.

Air Starter Market Segment Analysis

Air Starter Market Assessment by Type

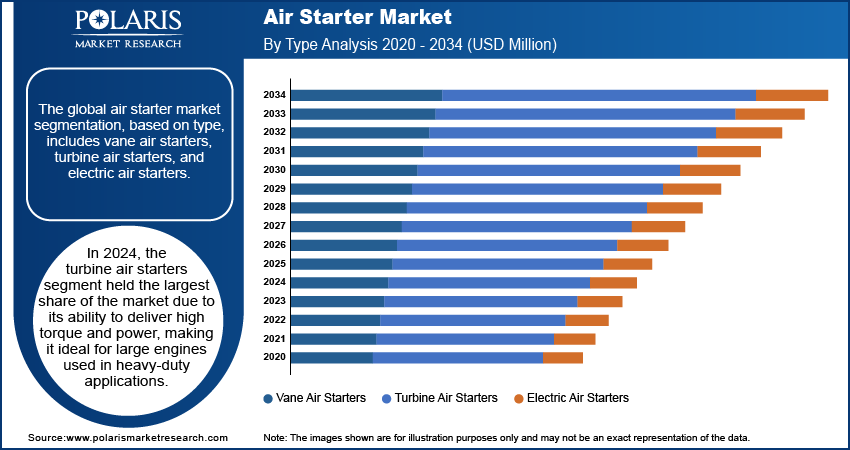

The global air starter market analysis, based on type, is segmented into vane air starters, turbine air starters, and electric air starters. In 2024, the turbine air starters segment held the largest share of the market due to its ability to deliver high torque and power, making it ideal for large engines used in heavy-duty applications. Turbine air starters are particularly favored in industries such as oil & gas, mining, and marine, where reliable and powerful engine start-up solutions are essential, especially in harsh and hazardous environments. Turbine air starters are highly efficient and capable of withstanding extreme conditions such as high temperatures, vibrations, and corrosive elements. Furthermore, these air starters are valued for their longer lifespan, lower maintenance needs, and ability to function in locations where electrical power might be unavailable or unsafe.

Air Starter Market Evaluation by End User

The global air starter market segmentation, based on end user, includes oil & gas, military & aviation, mining, marine, and others. The oil & gas segment is expected to witness the highest CAGR during the forecast period due to the growing demand for energy, particularly in offshore exploration and remote drilling sites where air starters are crucial for starting large engines. The oil & gas industry requires highly reliable and durable equipment to function in harsh and hazardous environments, such as deep-water rigs and remote extraction sites. Additionally, as exploration activities expand into more remote and challenging locations, the reliance on air starters for engine start-up solutions that withstand extreme conditions drives market growth. This increasing focus on offshore oil & gas exploration, along with advancements in extraction technologies, is expected to fuel the demand for air starters in the oil & gas sector.

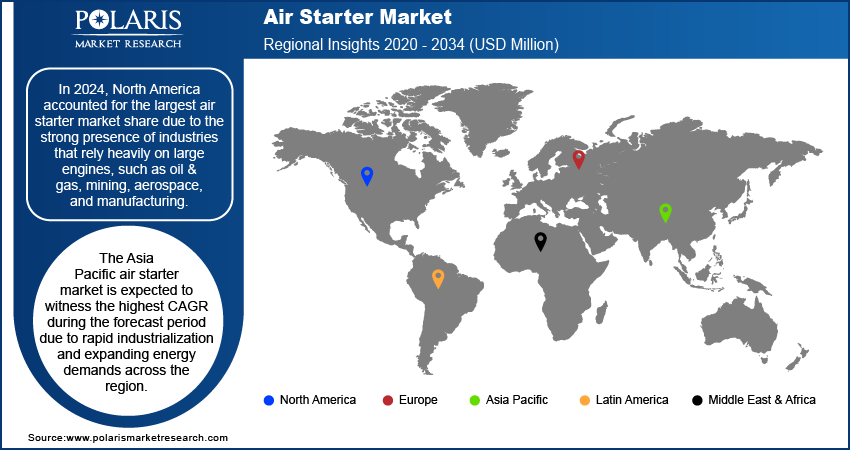

Air Starter Market Breakdown, by Regional Outlook

By region, the study provides air starter market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the strong presence of industries that rely heavily on large engines, such as oil & gas, mining, aerospace, and manufacturing. In October 2023, the Biden administration announced its plan to expand oil and gas drilling areas in the Gulf of Mexico as part of the new five-year leasing strategy starting in 2024. The growing demand for energy, particularly in offshore oil drilling, as well as advancements in manufacturing and industrial equipment, drives the air starters market expansion in North America. Additionally, the region's well-established infrastructure, along with the increasing focus on safety and reliability in hazardous environments, has led to the widespread use of air starters in sectors where electrical systems are not feasible or safe, such as in offshore rigs and remote mining operations.

The US accounted for the largest share of the air starter market due to ongoing investments in energy exploration and infrastructure development. Furthermore, infrastructure and increasing focus on safety and reliability in hazardous environments have led to the widespread use of air starters in sectors such as mining and aerospace.

The Asia Pacific air starter market is expected to witness the highest CAGR during the forecast period due to rapid industrialization and expanding energy demands across the region. Countries such as China, India, and Southeast Asian nations are experiencing significant growth in industries, including oil & gas, mining, construction, and manufacturing, all of which rely on heavy machinery and large engines that require reliable starting solutions. For instance, the Australian mining industry experienced strong growth, with record ore exports in June 2021. Investments in the sector are projected to reach approximately USD 154.89 billion, driven by high demand and improvements in mining infrastructure and technology.

The India air starter market is expected to witness significant growth during the forecast period due to the increasing number of infrastructure projects. According to the Department of Economic Affairs, in 2024, India recorded 9,242 new infrastructure projects, reflecting significant advancements in the development sector.

Air Starter Market – Key Players and Competitive Insights

The competitive landscape of the air starter market outlook is characterized by a mix of established players and emerging companies, each striving to enhance product performance, reliability, and adaptability to meet the needs of various industries. Leading companies are investing in research and development to improve air starter efficiency, reduce maintenance requirements, and enhance durability in harsh environments, such as offshore rigs, mining sites, and chemical plants. Key players are also focused on expanding their product portfolios to offer customized air starter solutions suited to specific industrial applications, which helps them maintain a competitive edge. Partnerships and strategic collaborations with oil & gas, aerospace, and manufacturing companies are becoming increasingly common, enabling air starter providers to secure long-term contracts and boost their market position. Additionally, as demand for environmentally sustainable and fuel-efficient solutions rises, companies are increasingly exploring innovative technologies to reduce emissions and improve energy efficiency. A few key major players are Austart, Ingersoll Rand, Caterpillar, Rheinmetall AG, Honeywell International Inc., TLD, Maradyne, SPICO, JetAll, Guinalt, MASCO, KH Equipment, TDI, Hilliard Corporation, Textron Specialized Vehicles, and YSwinch.com.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Honeywell is the leading producer of air turbine start system (ATSS) technology for gas turbine aircraft engines. The company’s ATSS consists of an air turbine starter and starter air valve.

Caterpillar Inc. is a global manufacturer and distributor of industrial gas turbines, mining and construction equipment, diesel and natural gas engines, and diesel-electric locomotives. Their product portfolio includes compactors, asphalt pavers, road reclaimers, cold planers, material handlers, forestry machines, track-type tractors, telehandlers, motor graders, excavators, and pipelayers, as well as a variety of loaders and related parts and tools. The Energy & Transportation segment provides comprehensive support to customers across various industries, including power generation, oil & gas, rail, marine, and industrial sectors, specifically for Caterpillar machinery.

Key Companies in the Air Starter Market

- Austart

- Ingersoll Rand

- Caterpillar

- Rheinmetall AG

- Honeywell International Inc.

- TLD

- Maradyne

- SPICO

- JetAll

- Guinalt

- MASCO

- KH Equipment

- TDI

- Hilliard Corporation

- Textron Specialized Vehicles

- YSwinch.com

Air Starter Industry Developments

In May 2024, Safran Electrical & Power signed an agreement with Bell Textron Inc. to supply starter-generator systems for the US Army's Future Long Range Assault Aircraft (FLRAA) program, enhancing the aircraft's operational efficiency and reliability.

Air Starter Market Segmentation

By Type Outlook (Revenue, USD Million; 2020–2034)

- Vane Air Starters

- Turbine Air Starters

- Electric Air Starters

By End User Outlook (Revenue, USD Million; 2020–2034)

- Oil & Gas

- Military & Aviation

- Mining

- Marine

- Others

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Starter Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 448.19 million |

|

Market Size Value in 2025 |

USD 467.91 million |

|

Revenue Forecast by 2034 |

USD 695.36 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global air starter market value reached USD 448.19 million in 2024 and is projected to grow to USD 695.36 million by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

In 2024, North America dominated the market due to the strong presence of industries that rely heavily on large engines, such as oil & gas, mining, aerospace, and manufacturing.

A few key players in the market are Austart, Ingersoll Rand, Caterpillar, Rheinmetall AG, Honeywell International Inc., TLD, Maradyne, SPICO, JetAll, Guinalt, MASCO, KH Equipment, TDI, Hilliard Corporation, Textron Specialized Vehicles, and YSwinch.com.

In 2024, the turbine air starters segment held the largest share of the market due to its ability to deliver high torque and power, making it ideal for large engines used in heavy-duty applications.

The oil & gas segment is expected to witness the highest CAGR during the forecast period due to the growing demand for energy, particularly in offshore exploration and remote drilling sites.