Air Separation Plant Market Share, Size, Trends, Industry Analysis Report, By Gas; By Process (Cryogenic Distillation, Non-Cryogenic Distillation); By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM1198

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The air separation plant market size was valued at USD 4,956.1 Million in 2023. The market is anticipated to grow from USD 5,201.0 Million in 2024 to USD 7,715.9 Million by 2032, exhibiting a CAGR of 5.0% % during the forecast period.

Industry Trend

Air separation plants are used to extract high purity gases such as nitrogen, oxygen, and argon from the atmosphere. The separation process includes a mix of adsorption purification, cryogenic distillation, and internal compression at high pressure

To Understand More About this Research:Request a Free Sample Report

The market is divided into oxygen, nitrogen, argon, and other gases based on gas. During the projection period, an increase in nitrogen demand is anticipated. The market sectors for chemicals and food & beverages have seen a growth in its application. High purity nitrogen is produced at the separation plants for use in laser cutting, electronics soldering, and pharmaceutical applications. It is added to steel during the manufacturing process for casting, melting, and ladle operations. Through stripping and sparring, it can be used to remove pollutants from process streams.

The market is divided into cryogenic distillation and non-cryogenic distillation based on the process. In medium- to large-scale plants, cryogenic separation techniques are typically used to produce gases like nitrogen, oxygen, and argon. Extremely high-quality oxygen and nitrogen are produced by this technique. Because of its high efficiency and cost-effectiveness, it is utilized by factories with high production rates. Compared to plants that produce liquids, gas production facilities require less energy.

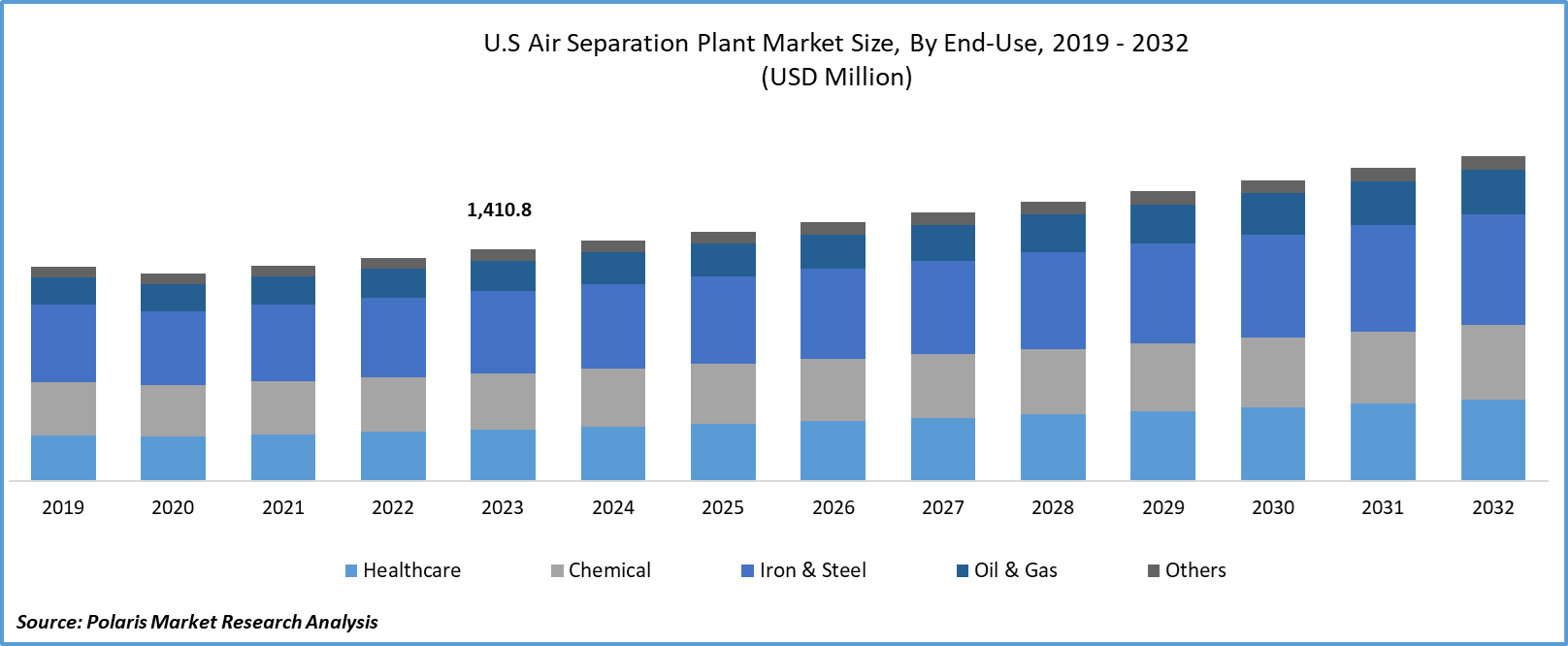

The separation market is divided into healthcare, chemical, iron and steel, oil and gas, and others based on the end-use. The expansion of this market is fueled by the expansion of the world's iron and steel sector as well as the expanding use of iron and steel in a variety of sectors, including the aerospace, building, and automotive industries. The development of this market segment is further accelerated by investments in R&D and technical breakthroughs.

The landscape of acquisitions within the air separation plant market, trends indicate a consolidation phase driven by several factors. Increased demand for industrial gases, especially in sectors like healthcare and electronics, has fueled the expansion strategies of major players. Companies are seeking to enhance their market presence, technological capabilities, and geographic reach through strategic acquisitions.

- For instance, in February 2023, CRYOTEC Anlagenbau GmbH has acquired by Nikkiso Clean Energy and Industrial Gases Group. The acquisition will strengthen the Cryotec business on international level.

Key Takeaway

- North America dominated the largest market and contributed to more than 36% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By process category, the non-cryogenic distillation segment accounted for the largest market share in 2023.

- By end-use category, the healthcare segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the air separation plant market?

Growing demand for industrial gases from dynamic manufacturing sectors.

As the global economy continues to grow, the demand for manufactured goods is also increasing, which is driving the demand for industrial gases. Industrial gases such as nitrogen, oxygen, and argon are critical for various manufacturing processes, including metal fabrication, chemical production, and electronics manufacturing. The growing demand for these products is driving the demand for industrial gases and, in turn, driving the growth of the air separation plant market. The increasing adoption of automation and robotics in manufacturing is also driving the demand for industrial gases. These technologies require a steady supply of high-purity gases to operate, and air separation plants are used to produce these gases. Moreover, the rising demand for cleaner and more sustainable manufacturing processes is also driving the growth of the air separation plant market. Air separation plants can produce gases such as hydrogen and carbon dioxide, which can be used as alternative fuels and feedstocks for chemical production, reducing greenhouse gas emissions and supporting a more sustainable manufacturing industry. Overall, the growing demand for industrial gases from dynamic manufacturing sectors is expected to continue to drive the growth of the air separation plant market in the coming years.

Which factor is restraining the demand for air separation plant?

High costs associated with fabrication, component assembly, and operations.

Air separation plants require specialized equipment, including large compressors, heat exchangers, and distillation columns, which can be expensive to manufacture and install. In addition, the complexity of air separation plant operations requires highly skilled personnel, which can add to the operating costs. Maintenance and repair costs can also be high due to the specialized nature of the equipment used in air separation plants. Energy costs can also be a significant factor in the operating costs of air separation plants. Air separation plants require large amounts of energy to compress and cool air, and to separate it into its constituent gases. The cost of energy can vary depending on the location of the plant and the cost of electricity and natural gas in the region. However, advances in technology and improved manufacturing processes have led to some cost reductions in air separation plant fabrication and operations.

Report Segmentation

The market is primarily segmented based on gas, process, end-use, and region.

|

By Gas |

By Process |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Process Insights

Based on process analysis, the market is segmented on the cryogenic distillation, non-cryogenic distillation. Non-cryogenic Distillation held the largest market share in 2023. Non-cryogenic distillation methods, such as pressure swing adsorption (PSA) and membrane separation, offer cost-effective solutions for producing industrial gases like nitrogen and oxygen. These methods typically require lower capital investment and operational costs compared to cryogenic distillation, making them attractive to a wide range of industries.

Moreover, non-cryogenic distillation technologies are known for their flexibility and scalability, allowing for efficient production in both large-scale and small-scale applications. This versatility makes them suitable for various industries, including healthcare, food and beverage, and electronics, where demand for industrial gases fluctuates based on production needs. Additionally, advancements in non-cryogenic distillation technologies have improved their efficiency and reliability, further enhancing their attractiveness in the market. For example, advancements in membrane materials and PSA processes have led to higher gas purity levels and increased productivity, meeting the stringent requirements of diverse end-user industries.

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of healthcare, chemical, iron & steel, oil & gas, others. The healthcare segment expected to be the fastest growing CAGR during the forecast period. Air separation plants are used to produce medical gases such as oxygen, nitrogen, and argon, which are critical for various medical applications. Medical oxygen is one of the most widely used medical gases and is used for treating patients with respiratory conditions such as COPD, asthma, and pneumonia. It is also used during surgical procedures and in intensive care units. It is also used in various medical equipment, such as surgical instruments and laser systems. Argon is used for cryosurgery, which is a surgical technique that involves freezing and destroying abnormal tissues. It is also used in various medical equipment, such as MRI machines and radiation therapy equipment. Air separation plants used in healthcare applications must meet strict regulatory requirements to ensure the purity and quality of the medical gases produced. This includes compliance with standards such as the US Pharmacopeia (USP) and the European Pharmacopoeia (EP).

Regional Insights

North America

North America region accounted to be the largest market share in 2023. Due to the presence of several major end-use industries, such as chemicals, healthcare, and oil and gas. The United States is the largest market for air separation plants in North America, accounting for a significant share of the regional market. The United States is also one of the largest producers of shale gas in the world, which is driving the demand for air separation plants for natural gas processing and liquefaction. Canada is another important market for air separation plants in North America, driven by the presence of the oil and gas industry, as well as the healthcare industry. The demand for industrial gases in Canada is also driven by the presence of several other end-use industries, such as food and beverage, metals and mining, and chemicals.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. Increasing industrialization coupled with growing metal production in the region has fueled the adoption of air separation plants. The demand for air separation plants has increased from industries such as iron & steel, chemical, and oil & gas in the region. Air separation plants have been utilized in the healthcare sector during the COVID-19 outbreak to care for critically ill patients. The market growth in manufacturing activities, increasing demand for photovoltaic cells, and application of specialty gases in the industrial sector are factors expected to provide growth opportunities in the region during the forecast period.

Competitive Landscape

In the competitive landscape of the air separation plant market, several key players dominate, leveraging a combination of technological innovation, extensive distribution networks, and strategic partnerships. These industry giants focus on expanding their market share through mergers and acquisitions, as well as investments in research and development to enhance efficiency and sustainability. Additionally, emerging players, particularly from regions with growing industrial sectors like Asia-Pacific, are gaining traction by offering cost-effective solutions and niche technologies tailored to specific market segments.

Some of the major players operating in the global market include:

- Air Liquide Engineering & Construction

- Air Products and Chemicals, Inc.

- Air Water Inc.

- AMCS Corporation

- CRYOTEC Anlagenbau GmbH

- DIG AIRGAS CO., LTD.

- ENERFLEX LTD.

- GAS Engineering, LLC.

- Gulf Process Gases, LLC

- HangZhou Oxygen Plant Group

- KaiFeng Air Separation Group Co., Ltd.

- Linde Plc.

- Novair

- Phoenix Equipment Corporation

- TAIYO NIPPON SANSO CORPORATION

- Technex

- Yingde Gases Group Co., Ltd.

Recent Developments

· In March 2023, Taiyo Nippon Sanso Corporation launched Carbon dioxide (CO2) recovery equipment using Pressure Swing Adsorption (PSA) technology capacity 10 Tons per day. This equipment can recover CO2 with a concentration of 98% or higher from concentrated CO2 emission sources, such as lime production furnaces.

· In October 2023, Air Water Inc. has constructed new liquefied gas plant i.e. liquefied oxygen, liquefied nitrogen and liquefied argon, in Chennai, Tamil Nadu, a state situated in southern India.

· In February 2022, Air Water Inc. and Mitsui & Co., Ltd. ("Mitsui") has an strategic alliance for global cooperation focusing on the industrial gas business.

· In December 2022, Air Products and Chemicals, Inc. and AES has invested approximately USD 4 Million to Build First Mega-Scale Green Hydrogen Production Facility in Texas.

· In November 2022, Novair has expanded its capacity to meet the global demand for medical oxygen-generating systems by inaugurating a new international logistics platform in Compans, near Paris Charles de Gaulle airport.

· In January 2022, Novair has acquired AMERICA ENERGY, an air compressor manufacturer, and continues to expand in North America.

Report Coverage

The air separation plant market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, gas, process, end-use, and their futuristic growth opportunities.

Air Separation Plant Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5,201.0 Million |

|

Revenue forecast in 2032 |

USD 7,715.9 Million |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Segments covered |

By Gas, By Process, By End-Use And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Air Separation Plant Market are Air Liquide Engineering & Construction, Air Products and Chemicals, Inc., Air Water Inc.

The air separation plant market exhibiting a CAGR of 5.0% % during the forecast period.

Air Separation Plant Market report covering key segments are gas, process, end-use, and region.

The key driving factors in Air Separation Plant Market are Growing demand for industrial gases from dynamic manufacturing sectors.

Air Separation Plant Market Size Worth $7,715.9 Million by 2032