Air Purifier Market Size, Share, Trends, Industry Analysis Report: By Technology, Application, Distribution Channel (Online and Offline), Coverage Range, Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1746

- Base Year: 2024

- Historical Data: 2020-2023

Air Purifier Market Overview

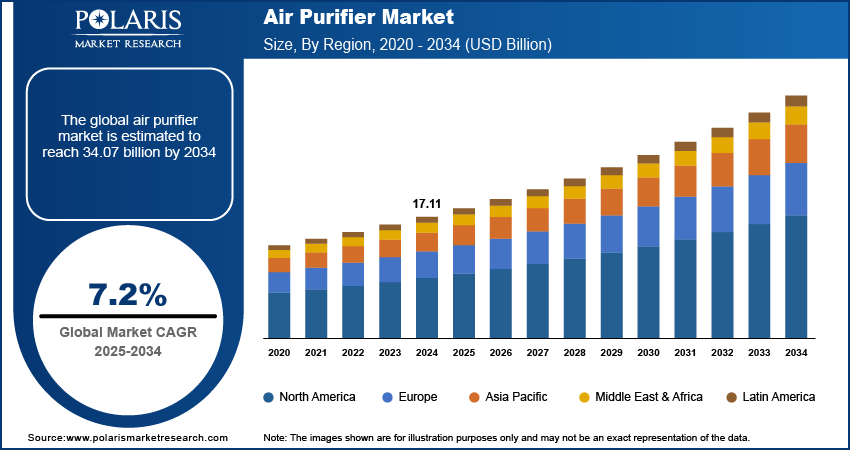

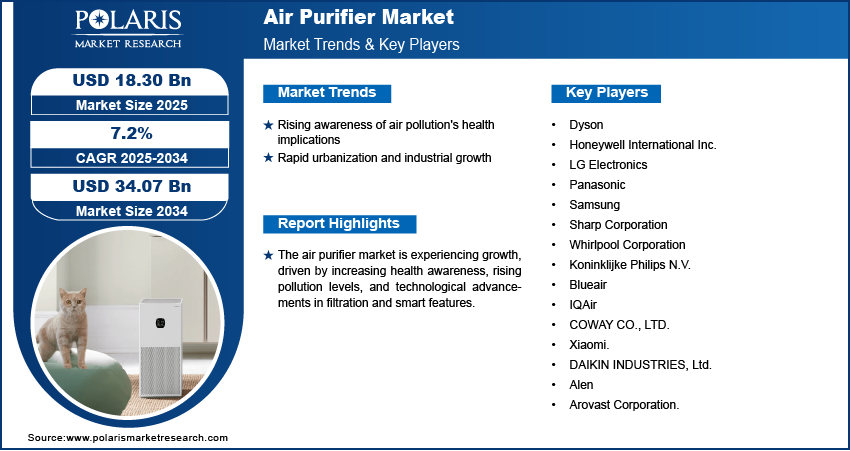

Air Purifier market was valued at USD 17.11 billion in 2024. It is expected to grow from USD 18.30 billion in 2025 to USD 34.07 billion by 2034, at a CAGR of 7.2% during the forecast period.

An air purifier is a device designed to remove impurities such as dust, allergens, pollutants, and harmful particles from indoor air to improve air quality and health.

The global air purifier market has emerged as a key segment within the environmental technology landscape, addressing increasing concerns over air quality and pollution. For instance, a report from the EPA published in August 2024 showed that around 66 million tons of pollution were released into the air in the US in 2023. This pollution mainly leads to the creation of ozone and particulate matter, causes acid rain, and reduces visibility. The majority of airborne pollutants, such as particulate matter (PM2.5, PM10), volatile organic compounds (VOCs), and allergens has surged, impacting public health with escalating urbanization and industrialization. Air purifiers are designed to improve indoor air quality by removing contaminants using advanced filtration technologies such as HEPA (High-Efficiency Particulate Air), activated carbon, and UV-C light. The market encompasses residential, commercial, and industrial applications, catering to diverse needs ranging from mitigating allergies in homes to controlling harmful emissions in industrial spaces.

Governments worldwide are introducing stringent air quality regulations, further driving the adoption of air purifiers. The growing awareness regarding the health risks of polluted air, coupled with technological advancements and the integration of IoT-enabled purifiers, underscores the air purifier market growth.

To Understand More About this Research: Request a Free Sample Report

Air Purifier Market Dynamics

Rising Awareness of Air Pollution's Health Implications

Rising awareness of air pollution's health implications is a key driver for the air purifier market expansion. Increasing levels of air pollution, especially in urban areas, have heightened concerns about respiratory and cardiovascular diseases, allergies, and other health issues. This growing understanding has directed consumers to adopt preventive measures, such as air quality control system, to improve indoor air quality. Governments and healthcare organizations are also actively promoting awareness about the adverse health effects of polluted air, further encouraging the adoption of air purification technologies.

For instance, in August 2022, Congress passed the Inflation Reduction Act, providing the EPA with USD 41.5 billion to address the climate crisis. Over USD 11 billion of this will help ensure clean air and a safe climate for Americans. Additionally, the rise in air purifier market demand is fueled by the growing prevalence of respiratory disorders such as asthma and bronchitis, particularly among children and the elderly, who are more vulnerable to air pollution's effects.

Rapid Urbanization and Industrial Growth

Rapid urbanization and industrial growth are driving the air purifier market demand as they contribute to increasing air pollution levels in urban areas. Expanding cities often witness a surge in vehicle emissions, construction dust, and industrial discharge, leading to declining air quality. The dense population in these areas further intensifies the problem by increasing energy consumption and indoor air pollutants. Consequently, the rising health concerns related to respiratory diseases, allergies, and other pollution-related ailments are prompting individuals and institutions to invest in air purification solutions.

For instance, in 2021, respiratory diseases caused 324,300 deaths in the EU, 6.1% of total deaths. Malta and Denmark had higher rates at 10.8% and 10.5%, while the Baltic countries, Slovenia, and Finland had rates below 3.5%. Governments and organizations are also implementing stricter air quality regulations, boosting the adoption of air purifiers in residential, commercial, and industrial settings. This trend highlights the crucial role of air purifiers in mitigating the adverse effects of urbanization and industrialization.

Air Purifier Market Segment Assessment

Air Purifier Market Assessment by Technology Outlook

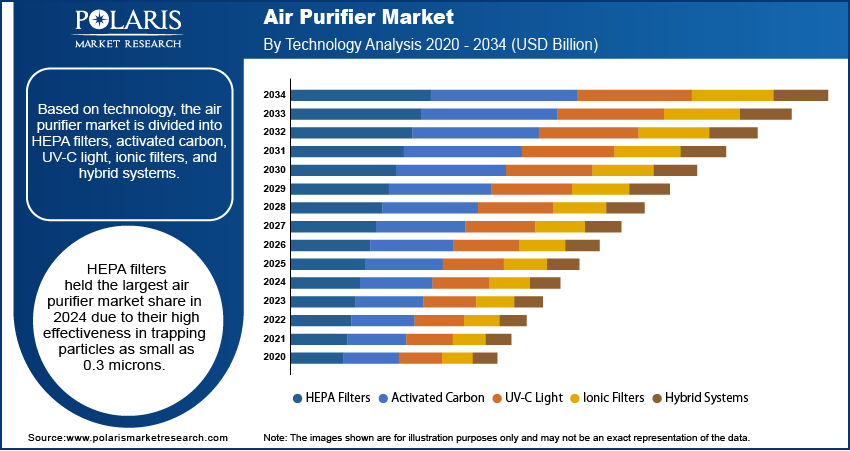

The global air purifier market segmentation, based on technology, includes HEPA filters, activated carbon, UV-C light, ionic filters, and hybrid systems. HEPA filters held the largest air purifier market share in 2024 due to its superior filtration efficiency and widespread adoption across residential, commercial, and industrial applications. HEPA (High-Efficiency Particulate Air) filters are highly effective in capturing airborne particles, such as dust, pollen, pet dander, and allergens, making them a preferred choice for improving indoor air quality. Additionally, the increasing awareness of respiratory health, rising concerns over air pollution, and strict indoor air quality regulations have further driven the HEPA-based air purifiers market demand. Their compatibility with advanced filtration systems and integration into hybrid air purification technologies have also strengthened their dominance in the market.

Air Purifier Market Evaluation by Distribution Channel Outlook

The global air purifier market evaluation, based on distribution channel, includes online and offline. The online sales segment is expected to witness rapid air purifier market growth due to their convenience, wider product selection, and competitive pricing. E-commerce platforms allow consumers to easily compare features, prices, and reviews, enabling informed purchase decisions without geographical constraints. The rising penetration of smartphones and internet connectivity, especially in emerging markets, has further fueled online shopping trends. Additionally, manufacturers and retailers are leveraging digital marketing and offering discounts, free delivery, and flexible payment options to attract customers.

Air Purifier Market Outlook by Region

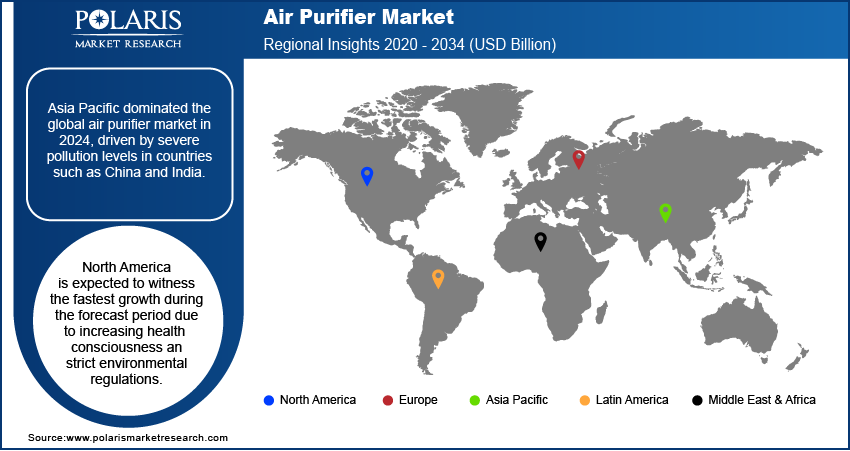

By region, the report provides the air purifier market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024, driven by severe pollution levels in countries such as China and India. India's government-led initiatives to combat air pollution, such as subsidies for air purifier adoption and awareness campaigns, have boosted the air purifier market growth. For instance, according to a December 2023 report by the Ministry of Environment, Forest, and Climate Change, the government has allocated USD 1.158 billion to 131 cities under the National Clean Air Programme (NCAP) to address air pollution from FY 2019-20 to FY 2023-24. Additionally, rising disposable incomes and urbanization boost the air purifier market demand.

North America is expected to witness the fastest growth during the forecast period due to increasing health consciousness and strict environmental regulations. The US, in particular, leads the region with technological advancements and higher adoption rates of smart air purifiers. The robust presence of key players and active R&D investments further cement its position as a leader.

Key Companies in Air Purifier Market

- Dyson

- Honeywell International Inc.

- LG Electronics

- Panasonic

- Samsung

- Sharp Corporation

- Whirlpool Corporation

- Koninklijke Philips N.V.

- Blueair

- IQAir

- COWAY CO., LTD.

- Xiaomi.

- DAIKIN INDUSTRIES, Ltd.

- Alen

- Arovast Corporation.

Air Purifier Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the air purifier industry grow even more. The top 15 companies collectively dominated the market by leveraging technological innovation, extensive distribution networks, and strategic partnerships. Dyson and Honeywell, for instance, focus on R&D to introduce advanced, IoT-enabled models, enhancing user experience. Meanwhile, regional players such as Xiaomi cater to price-sensitive markets with affordable, high-performance purifiers. The competition is intense, with key players aiming for air purifier market share through mergers, acquisitions, and product diversification, ensuring a dynamic and competitive market landscape.

Air Purifier Market Development

June 2024: Coway launched the Airmega 100 air purifier in Europe, featuring 360° air intake, a 3-stage HEPA filtration system, and real-time air quality indicators. Designed for smaller spaces, it addresses hay fever and allergy concerns with energy-saving technology and quiet operation, ensuring healthier indoor air.

February 2023: Carrier launched the Carbon Air Purifier with UV in North America, targeting odor, VOC, and gas reduction. It also helps curb microorganism growth on evaporator coils.

Air Purifier Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- HEPA Filters

- Activated Carbon

- UV-C Light

- Ionic Filters

- Hybrid Systems

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Residential

- Commercial (Offices, Hospitals, and Schools)

- Industrial

By Distribution Channel Outlook (Revenue, USD Billion, 2020 - 2034)

- Online

- Offline

By Coverage Range Outlook (Revenue, USD Billion, 2020 - 2034)

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Standalone/Portable

- In-duct/Fixed

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Purifier Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.11 billion |

|

Market Size Value in 2025 |

USD 18.30 billion |

|

Revenue Forecast in 2034 |

USD 34.07 billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global air purifier market size was valued at USD 17.11 billion in 2024 and is projected to grow to USD 34.07 billion by 2034.

• The global market is projected to grow at a CAGR of 7.2% during the forecast period.

• Asia Pacific dominated the global air purifier market in 2024.

• Some of the key players in the market are Dyson; Honeywell International Inc.; LG Electronics; Panasonic; Samsung; Sharp Corporation; Whirlpool Corporation; Koninklijke Philips N.V.; Blueair; IQAir; and COWAY CO., LTD.

• HEPA filters held the largest air purifier market share in 2024.