Air Insulated Switchgear Market Size, Share, Trends, Industry Analysis Report, By Installation (Indoor, Outdoor), Voltage, Application, and Region; Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5138

- Base Year: 2023

- Historical Data: 2019-2022

Air Insulated Switchgear Market Outlook

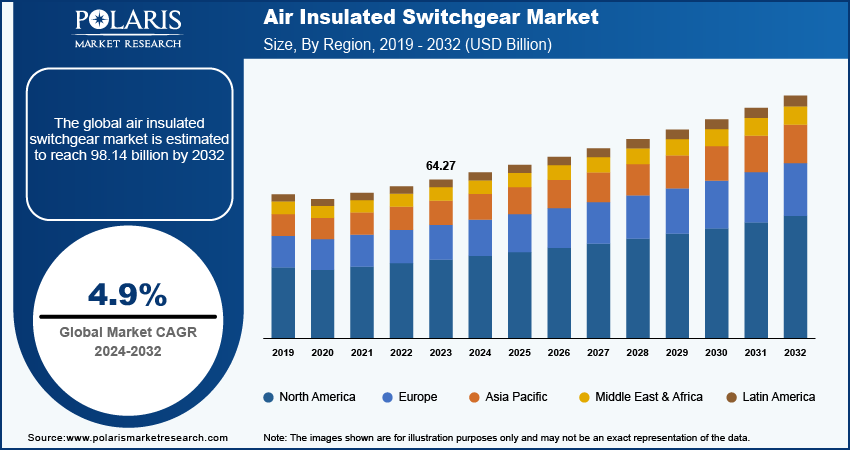

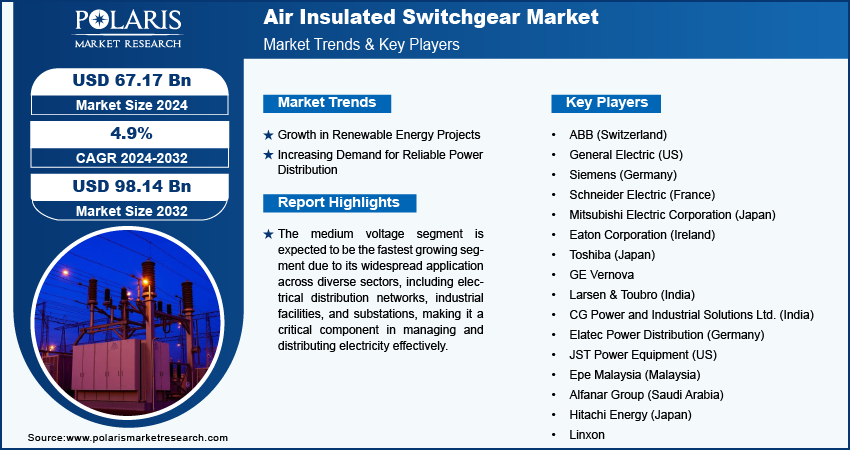

The Air Insulated Switchgear Market size was valued at USD 64.27 billion in 2023. The market is anticipated to grow from USD 67.17 billion in 2024 to USD 98.14 billion by 2032, exhibiting a CAGR of 4.9% during 2024–2032.

Air Insulated Switchgear Market Overview

Air-insulated switchgear (AIS) refers to electrical devices housed in air-insulated enclosures, designed for high-voltage applications. They facilitate safe and efficient distribution of electrical power, providing protection and control in substations and industrial installations, while minimizing space and maintenance requirements. The Air Insulated Switchgear Market is primarily driven by the increasing need for efficient power distribution systems, especially in developing countries, due to rapid urbanization and industrial expansion. Furthermore, the aging electrical infrastructure led to investments in upgrading the infrastructure to enhance the efficiency and stability of electrical infrastructure, which drives the market growth.

To Understand More About this Research: Request a Free Sample Report

In October 2023, the US administration declared that the federal government would provide USD 1.3 billion to construct three new interstate power transmission lines and upgrade the aging electric grid in England and between the US and Canada. This will increase grid capacity by an additional 3.5 gigawatts, sufficient for powering 3 million households.

Growing investments in projects related to renewable energy sources such as solar and wind power propel the requirement for advanced switchgear to manage types of power output and enhance the stability of grid integration, which would create opportunities for the Air Insulated Switchgear Market. In May 2024, five overseas financial institutions approved a USD 400 million green loan for Adani Green Energy Limited (AGEL) 750MW solar projects that are taking place in Rajasthan and Gujarat, India.

Companies are increasing their acquisitions and collaborations to expand their market share. In July 2024, Mitsubishi Electric received an order for 84kV dry Air Insulated Switchgear from Kansai Transmission and Distribution in Japan. This new environmentally friendly product is designed for use in gas-insulated switchgear (GIS) and will be installed in substations. It ensures high safety, helps to reduce environmental impact, and improves the efficiency of operation and maintenance.

Air Insulated Switchgear Market Drivers

Growth in Renewable Energy Projects

The growth in renewable energy projects is a major driver for the adoption of air-insulated switchgear (AIS) as the global energy sector shifts toward cleaner sources such as solar, wind, and hydroelectric power. This transition creates a growing need for efficient, reliable, and flexible power distribution systems. AIS is particularly well-suited for large-scale installations due to its scalability and modularity, and its durability enables it to perform reliably in harsh environments, such as deserts and offshore wind farms. Additionally, AIS is compatible with distributed energy resources, avoids the use of SF6 gas, and is cost-effective while adapting well to smart grids. Overall, AIS supports the transition to greener, more efficient energy systems and addresses the increasing demand for reliable and eco-friendly power distribution infrastructure.

For instance, Godrej Electricals & Electronics, a key division of Godrej & Boyce, disclosed significant strides in its power infrastructure sector, securing orders exceeding Rs. 1000 Crores in the fiscal year 2024. These acquisitions predominantly revolve around Air Insulated Switchgear (AIS) and Gas Insulated Switchgear (GIS) substations throughout India, with projects extending up to 765kV capacity. Noteworthy, each project ranges from 100 Crores to 400 Crores, underscoring the substantial investment in advancing the nation’s power infrastructure.

Increasing Demand for Reliable Power Distribution

The increasing demand for reliable power distribution is a critical driver for the adoption of air-insulated switchgear, especially in developing regions undergoing rapid urbanization and industrial growth. As populations and industries expand, the need for robust and efficient power distribution systems becomes essential to support economic activities and infrastructure development. This demand highlights the importance of investing in reliable solutions that can meet the challenges of a growing energy landscape. For instance, ABB’s launched UniGear ZS1 switchgear in 2023, the latest in air-insulated medium-voltage switchgear technology. It provides an attractive solution for space-constrained environments, enabling efficient and environmentally responsible energy distribution and management. The switchgear incorporates advanced thermoplastic components instead of traditional, non-recyclable composite insulation materials. This strategic choice not only reduces the product's environmental footprint but also aligns seamlessly with ABB's overarching mission to minimize the environmental impact of its offerings.

Air Insulated Switchgear Market- Segment Insights

The Air Insulated Switchgear Market is primarily segmented on the basis of installation, voltage, application, and region.

|

By Installation |

By Voltage |

By Application |

By Region |

|

|

|

|

Air Insulated Switchgear Market, By Installation

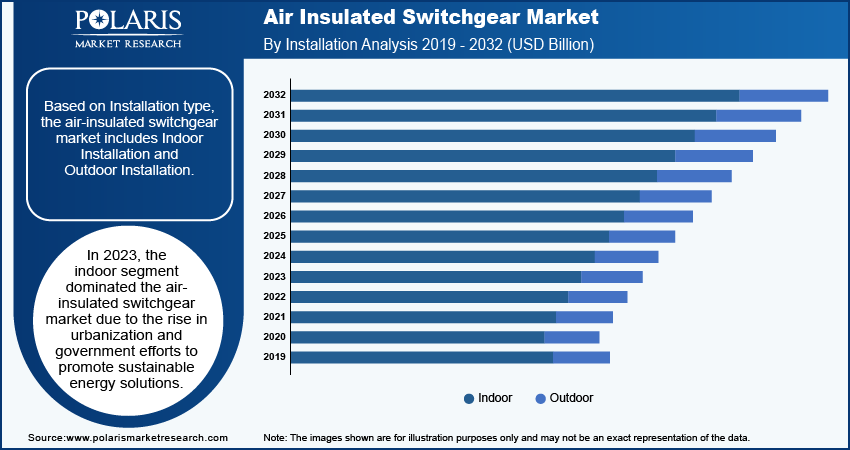

The global air insulated switchgear market segmentation, based on installation type, includes indoor installation and outdoor installation. The indoor segment accounted for the largest share of revenue in 2023, mainly due to the rise in urbanization and government efforts to promote sustainable energy solutions. In urban areas, there is a greater need for air-insulated switchgear to make the most of limited space by installing these devices indoors whenever possible. Renewable energy generation has become more prevalent in smaller areas, and there is an increasing need for switchgear to ensure proper electricity distribution, further boosting the growth of this segment.

The outdoor segment is also expected to experience rapid growth during the forecast period. This growth is driven by the expanding rural electrification projects, long-distance power transmission, increasing industrial projects, and investments in solar power grid integration.

Air Insulated Switchgear Market, By Voltage

The global air insulated switchgear market segmentation based on voltage includes low, medium, and high voltage. The medium voltage segment is expected to be the fastest growing segment due to its widespread application across diverse sectors, including electrical distribution networks, industrial facilities, and substations, making it a critical component in managing and distributing electricity effectively. Additionally, as urban and industrial infrastructure expands, there is a growing demand for medium voltage air insulated switchgear (MV AIS) to meet increasing electrical loads and ensure a reliable power supply. This makes it a cost-effective solution compared to high-voltage switchgear while providing robust performance. Continuous advancements in technology, such as improved insulation and monitoring systems, further strengthen its dominance in the market.

For instance, in a steel production facility, MV AIS manages the power supply to heavy machinery and production lines, handling substantial electrical loads required for equipment such as electric arc furnaces and rolling mills. Its robustness, reliability, cost-effectiveness, and adaptability make it the preferred choice for high-load applications in demanding industrial environments.

Air Insulated Switchgear Market, By Application

The global air insulated switchgear market segmentation, based on application, includes transmission & distribution facilities, industrial applications, commercial & residential applications, transportation, and others. The transmission & distribution facilities are expected to be the fastest growing segment due to their use within electrical substations, transmission lines, and distribution networks. It has a critical role in the grid infrastructure, managing and controlling the flow of electricity from generation sources to end-users. Additionally, in this segment, the AIS is designed for scalability to meet varying load requirements and future expansions. It includes advanced safety features, streamlined maintenance with remote diagnostics and modular components, and offers lower long-term costs, contributing to efficient grid operations while adhering to environmental regulations. Thus, the transmission & distribution utilities segment of the air-insulated switchgear (AIS) market is vital for ensuring reliable and efficient electricity management.

The industrial sector, encompassing factories and manufacturing plants, is poised for significant growth due to the increased adoption of automation and the necessity for a dependable power supply to maintain uninterrupted operations.

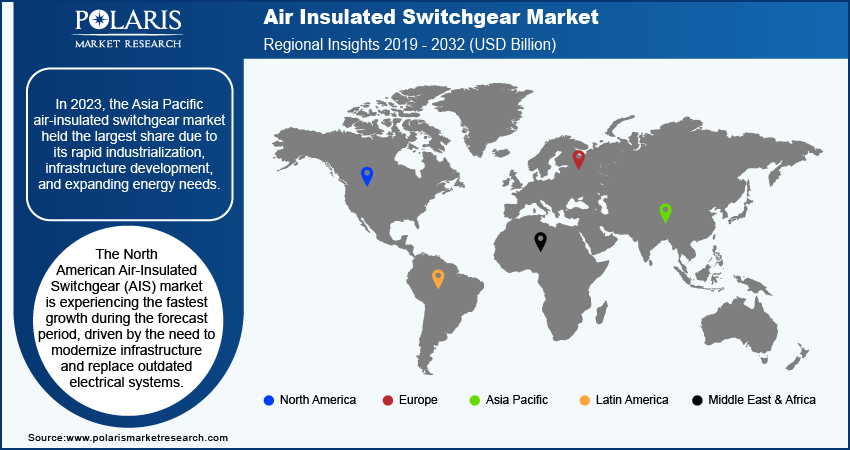

Air Insulated Switchgear Market, By Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific air insulated switchgear market held the largest share due to its rapid industrialization, infrastructure development, and expanding energy needs. Countries including China, India, and Japan are at the forefront of this growth, driven by expanding energy demands and government initiatives to modernize the power grid. Air-insulated switchgear (AIS) is closely related to power grids as a key component in ensuring efficient and reliable electricity distribution, particularly in medium- to high-voltage substations, which are essential for connecting various elements of the power grid. Additionally, the expansion of electrical infrastructure, driven by rapid industrialization and significant investments in solar power grids, continues to fuel the demand for air-insulated switchgear in the region. This surge is largely due to the need for reliable power distribution systems capable of supporting both industrial growth and renewable energy projects.

For instance, Japan is planning to boost its electricity grid by investing $50 billion by 2050. The goal is for renewable energy to make up half of the country's energy mix by 2050. A new transmission network will connect Tokyo with the main solar and wind energy regions.

North American air-insulated switchgear (AIS) market is experiencing steady growth, driven by the need to modernize infrastructure and replace outdated electrical systems. In both the US and Canada, there is a significant demand for reliable power distribution, particularly from utilities and industrial sectors. This demand is propelled by ongoing grid modernization initiatives, the rise of renewable energy projects, and the expansion of industrial infrastructure. For instance, New York’s Con Edison invests $2.3bn into grid resilience. On Staten Island, new switchgear and substation transformers, along with the reconfiguration of overhead circuits in Dongan Hills, new transformer vaults, and the replacement of dozens of poles and spans of wire in the New Dorp Beach area, where the demand for power is growing; new cable, poles, and manholes to serve West Brighton, Travis, Port Richmond, and South Beach.

Air Insulated Switchgear Key Market Players & Competitive Insights

The competitive landscape of the Air Insulated Switchgear Market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as Siemens, ABB, and Eaton leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced air-insulated switchgear products.

The increase in government infrastructure spending and collaboration and partnership initiatives by key players has a positive impact on market growth. Major players include ABB; General Electric; Siemens; Schneider Electric; Toshiba; Alfanar Group; Hitachi Energy; Eaton Corporation; Mitsubishi Electric Corporation; Hubbell; Larsen & Toubro Limited; ELATEC POWER DISTRIBUTION GmbH.

Linxon is a parent company of AtkinsRéalis Group Inc. based in Sweden. Linxon combines AtkinsRéalis’ project management expertise and Hitachi Energy’s industry-leading technological knowledge in a partnership forming a leading engineering company. Linxon is building the infrastructure to power the world with carbon-free technology by offering turnkey solutions in the areas of substations for power transmission, renewable energy, and transportation. In December 2023, Svenska Kraftnät (SvK) selected Linxon to deliver a new 10-bay 400 kV Air Insulated Switchgear (AIS) substation. The order forms part of a wider project in association with the Swedish energy company, Vattenfall, which includes an additional 130 kV substation.

GE Vernova, formerly GE Power and GE Renewable Energy, is an energy equipment manufacturing and services company headquartered in Cambridge, Massachusetts. GE Vernova was formed from the merger and subsequent spin-off of General Electric's energy businesses in 2024. In August 2023, Grid Solutions, an integral part of the GE Vernova portfolio of energy businesses, signed a contract with Casa dos Ventos, a Brazilian renewable energy company in the country’s energy transition, to construct two 500 kV air-insulated substations (AIS) for the Serra do Tigre Wind Complex in the municipalities of Currais Novos and Sao Tome in the state of Rio Grande do Norte. The contract also includes the construction of a connection bay that will be installed in Santa Luzia, Paraiba.

Major Players in Air Insulated Switchgear Market

- ABB (Switzerland)

- General Electric (US)

- Siemens (Germany)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- Eaton Corporation (Ireland)

- Toshiba (Japan)

- GE Vernova

- Larsen & Toubro (India)

- CG Power and Industrial Solutions Ltd. (India)

- Elatec Power Distribution (Germany)

- JST Power Equipment (US)

- Epe Malaysia (Malaysia)

- Alfanar Group (Saudi Arabia)

- Hitachi Energy (Japan)

- Linxon

Recent Developments in Industry

April 2022: Schneider Electric launched “EasySet MV air-insulated,” an indoor type switchgear. It is a compact solution for medium voltage primary distribution. This switchgear offers unparalleled ease of operation, monitoring, and maintenance for meeting electrical distribution needs & it is a compact and modular switchgear for MV primary distribution that leverages vacuum circuit breaker technology.

January 2023: PFIFFNER Group, a Switzerland-based transmission and distribution component specialist, announced a new, high voltage air-insulated switchgear (AIS) circuit breaker for substations that uses an SF6-free and F-gas free as its insulation media, helping to set a new standard for the safe and sustainable operation of electrical grids.

April 2023: Eaton announced it had completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a manufacturer of power distribution and sub-transmission transformers in China.

Report Coverage

The Air Insulated Switchgear Market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, installation, voltage, application, and futuristic growth opportunities.

Air Insulated Switchgear Market Report Scope

|

Report Attributes |

Details |

|

Market Size value in 2024 |

USD 67.17 billion |

|

Revenue Forecast in 2032 |

USD 98.14 billion |

|

CAGR |

4.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global air insulated switchgear market size was valued at USD 64.27 billion in 2023 and is projected to grow to USD 98.14 billion by 2032.

The global market is projected to register a CAGR of 4.9% during the forecast period.

Asia Pacific had the largest share of the global market due to the region's well-established rapid industrialization, infrastructure development, and expanding energy needs.

The key players in the market ABB; General Electric; Siemens; Schneider Electric; Toshiba; Alfanar Group; Hitachi Energy; Eaton Corporation; Mitsubishi Electric Corporation; Hubbell; Larsen & Toubro Limited; ELATEC POWER DISTRIBUTION GmbH.

The indoor segment dominated the market in 2023 due to the high and consistent demand for disposable medical supplies within the hospital sector.

The transmission & distribution facility category had the highest share due to the use within electrical substations, transmission lines, and distribution networks.