Air Fryer Market Size, Share, Trends, Industry Analysis Report

: By Product Type, Application (Residential and Commercial), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1709

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

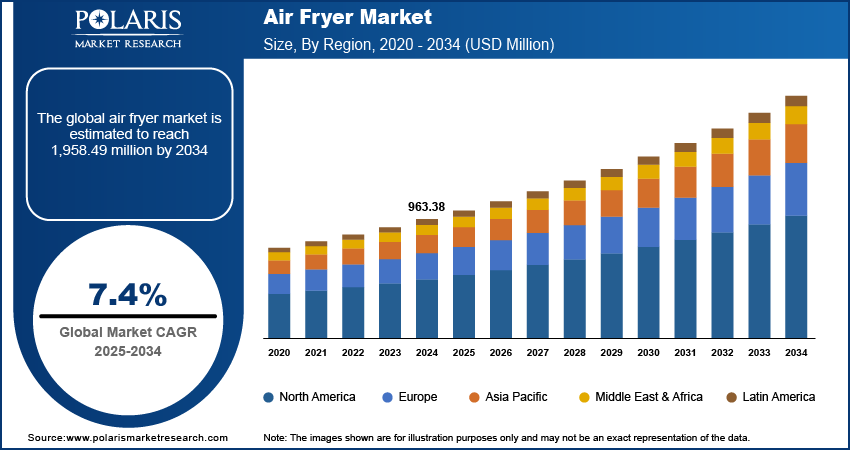

Air fryer market size was valued at USD 963.38 million in 2024, growing at a CAGR of 7.4% during the forecast period 2025-2034. The market is driven by increasing health consciousness, rising lifestyle-related diseases, the growing demand for healthier cooking options, and the adoption of smart kitchen appliances offering convenience and efficiency.

Key Insights

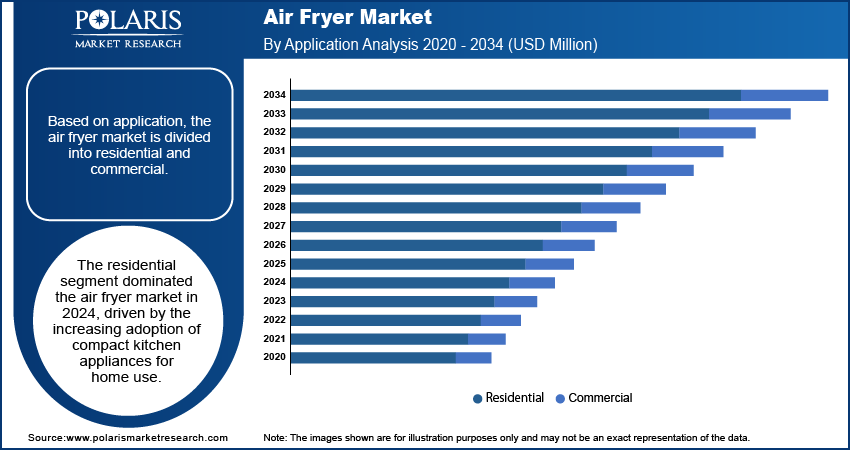

- The residential segment dominated the market in 2024, driven by rising health consciousness and increased demand for compact kitchen appliances.

- The digital air fryer segment is expected to grow fastest, fueled by advancements in smart home automation and IoT devices.

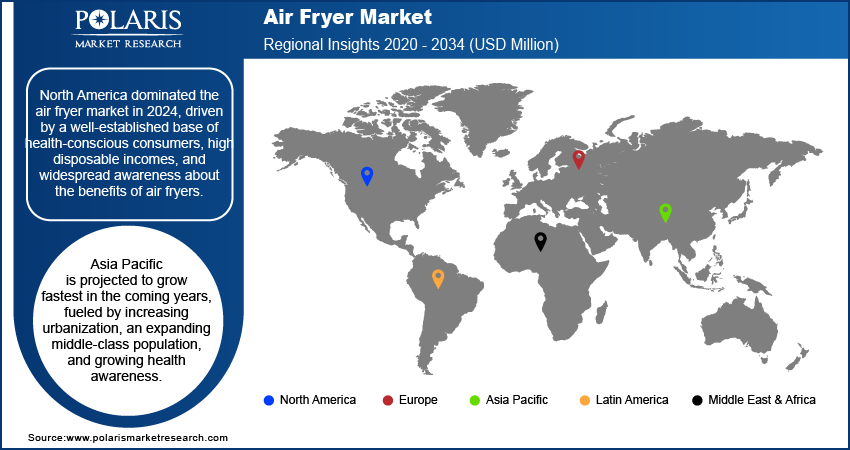

- North America led the market in 2024, supported by health-conscious consumers, high disposable incomes, and advanced kitchen technologies.

- Asia Pacific is projected to grow the fastest, driven by urbanization, rising incomes, health awareness, and government initiatives promoting local manufacturing.

Industry Dynamics

- Rising health consciousness and concerns about lifestyle diseases are driving the demand for air fryers as a healthier cooking alternative.

- The convenience and versatility of air fryers, offering multiple cooking functions, make them a popular choice for modern kitchens.

- Technological advancements in air fryers, such as digital controls and smart connectivity, are increasing their appeal to tech-savvy consumers.

- The growing adoption of smart home technologies presents an opportunity for air fryers to integrate into connected kitchen ecosystems.

Market Statistics

2024 Market Size: USD 963.38 million

2034 Projected Market Size: USD 1,958.49 million

CAGR (2025–2034): 7.4%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

An air fryer is a tabletop convection oven that cook’s food using hot air until it is crispy, similar to deep-frying but with little to no oil. The global air fryer market has experienced growth in recent years, driven by increasing health consciousness among consumers and the rising majority of lifestyle-related diseases such as obesity and diabetes. For instance, in March 2024, WHO published a press release revealing that in 2022, 1 in 8 people worldwide lived with obesity. Adult obesity has doubled since 1990, with 2.5 million adults overweight, including 890 million with obesity. Among children, 37 million under age 5 and 390 million aged 5 to 19 were overweight, with 160 million living with obesity.

Air fryers offer a healthier alternative to traditional deep frying by using minimal oil, thereby reducing calorie and fat intake. This health benefit has been a major factor in their growing popularity. Additionally, the convenience and versatility of air fryers, which can grill, bake, roast, and steam, have appealed to consumers seeking efficient cooking solutions. The market is characterized by a range of products ranging in size, capacity, and functionality, catering to diverse consumer needs. Manufacturers are continually innovating, introducing features such as digital controls, preset cooking programs, and smart connectivity to enhance user experience, further contributing to the air fryer market expansion.

Market Dynamics

Growing Consumer Demand for Healthier Cooking Options

The increasing health consciousness among consumers is a key driver for the growth of the air fryer market. Air fryers are widely popular because they offer a healthier alternative to traditional frying methods. They use little to no oil, resulting in food with fewer calories and less fat. According to the US Centers for Disease Control and Prevention (CDC), over 42% of American adults were considered obese as of 2020, which is contributing to the rising demand for healthier cooking appliances.

Air fryers are becoming a go-to kitchen appliance for many households aiming to reduce fat intake while still enjoying crispy foods with a rising focus on weight management and healthier lifestyles, driving the market revenue.

Increasing Adoption of Smart Kitchen Appliances

The growing adoption of digital kitchen appliances and smart home technologies is significantly contributing to the air fryer market expansion. Modern air fryers now integrate advanced features, such as app control, preset cooking functions, and voice command capabilities, enhancing convenience and precision in meal preparation. For example, in September 2024, Versuni introduced the Philips Airfryer 2000 and 3000 Series, which includes 9 preset cooking functions. These models utilize RapidAir Technology, enabling healthier cooking by reducing fat content by up to 90%. Additionally, they reduce cooking time by 50%, offering both efficiency and nutritional benefits. Such technological innovations make air fryers more appealing as consumers increasingly seek convenience, energy efficiency, and health-conscious options in their kitchen appliances, driving the growing market adoption.

Segment Analysis

Market Assessment by Application

Based on application, the air fryer market is categorized into residential and commercial. The residential segment dominated the market in 2024, driven by the increasing adoption of compact kitchen appliances for home use. Rising health consciousness among households has played a key role in boosting the demand for air fryers, particularly as consumers seek healthier cooking alternatives that reduce fat and calorie intake. Air fryers have become a necessity in modern kitchens due to their versatility, allowing users to fry, roast, bake, and grill with a single device. The pandemic contributed to this trend, with a wave in home cooking and baking activities as people spent more time indoors, further contributing to the air fryer market growth.

Market Assessment by Product Type

Based on product type, the air fryer market is categorized into digital air fryers and manual air fryers. The digital air fryer segment is expected to grow at the fastest rate during the forecast period, driven by advancements in smart home automation, smart kitchen technology, and the increasing penetration of Internet of Things (IoT) devices in households. Digital air fryers offer convenience with features such as touchscreen controls, pre-programmed settings, and smartphone connectivity for remote cooking management. They appeal to tech-savvy younger consumers, such as millennials and Gen Z, who prefer smart and stylish appliances. Additionally, the rise of smart home ecosystems in urban areas will increase air fryer market demand.

Market Outlook by Region

By region, the report provides the air fryer market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024, driven by a well-established base of health-conscious consumers, high disposable incomes, and widespread awareness about the benefits of air fryers. The US leads in this region, accounting for a major share due to its focus on advanced kitchen technologies and innovative products. Moreover, robust e-commerce networks and promotional campaigns by key players have strengthened sales in this region. For instance, Chef AI, a California-based startup, is creating an AI-powered automatic air fryer that predicts cooking times and stops automatically.

Asia Pacific is projected to grow fastest in the coming years, fueled by increasing urbanization, an expanding middle-class population, and growing health awareness. Countries such as India stand out as leading contributors due to rising disposable incomes and a shift toward Western culinary practices. Additionally, government initiatives promoting "Make in India" and local manufacturing also incentivize market players to expand operations in the region.

Key Companies

- Koninklijke Philips N.V.

- Tefal

- Cuisinart

- Instant Brands Inc.

- SharkNinja Operating LLC

- Cosori

- Breville Pty Limited.

- Dash (StoreBound LLC)

- Stanley Black & Decker, Inc.

- GoWISE USA Services

- Chefman

- Hamilton Beach Brands, Inc.

- Bella (Sensio Inc.)

- Kalorik.com.

Air Fryer Key Market Players & Competitive Analysis Report

Major players dominated the global air fryer industry by leveraging innovation, extensive distribution networks, and aggressive marketing strategies. For instance, Philips leads with its advanced technology and robust consumer trust, while Tefal benefits from Groupe SEB’s global presence. Ninja and Cosori target tech-driven consumers through app-controlled models and aesthetically pleasing designs. Meanwhile, Breville and Cuisinart focus on premium segments, offering multi-functional devices.

Companies differentiate through continuous product innovation and localized marketing. For example, Instant Brands affordable pricing strategy makes air fryers accessible to budget-conscious buyers. Collectively, these players invest heavily in R&D, ensuring market leadership by addressing evolving consumer needs.

Market Developments

February 2024: SharkNinja launched the Ninja DoubleStack XL 2-Basket Air Fryer, the first vertical two-basket air fryer offering double the performance with 40% less countertop space.

June 2024: Prestige launched its 4.5-litre Nutrifry air fryer, perfect for baking, grilling, roasting, and reheating. Featuring Smart Airflow technology and 360-degree hot air circulation, it provides crispy results using less oil than traditional frying, making it a healthier choice for your Indian kitchen.

Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020 - 2034)

- Digital Air Fryers

- Manual Air Fryers

By Application Outlook (Revenue, USD Million, 2020 - 2034)

- Residential

- Commercial

By Distribution Channel Outlook (Revenue, USD Million, 2020 - 2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Fryer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 963.38 million |

|

Revenue Forecast in 2035 |

USD 1,032.69 million |

|

Revenue Forecast in 2034 |

USD 1,958.49 million |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global air fryer market size was valued at USD 963.38 million in 2024 and is projected to grow to USD 1,958.49 million by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

North America dominated the air fryer market in 2024.

Some of the key players in the market are Koninklijke Philips N.V.; Tefal; Cuisinart; Instant Brands Inc.; SharkNinja Operating LLC; Cosori; Breville Pty Limited; Dash (StoreBound LLC); Stanley Black & Decker, Inc.; GoWISE USA Services; Chefman.

The residential segment dominated the air fryer market in 2024.