Air Deflector Market Size, Share, Trends, Industry Analysis Report: By Type, Mounting Method, Material, Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Nov-2024

- Pages: 117

- Format: PDF

- Report ID: PM5099

- Base Year: 2024

- Historical Data: 2020-2023

Air Deflector Market Overview

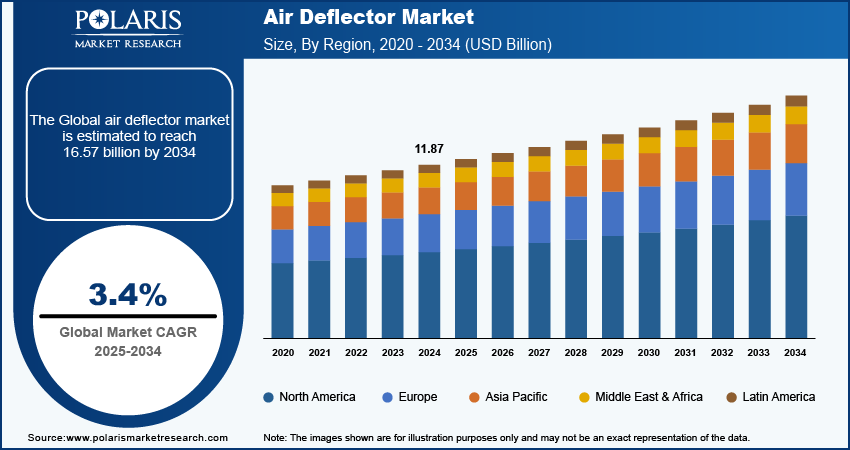

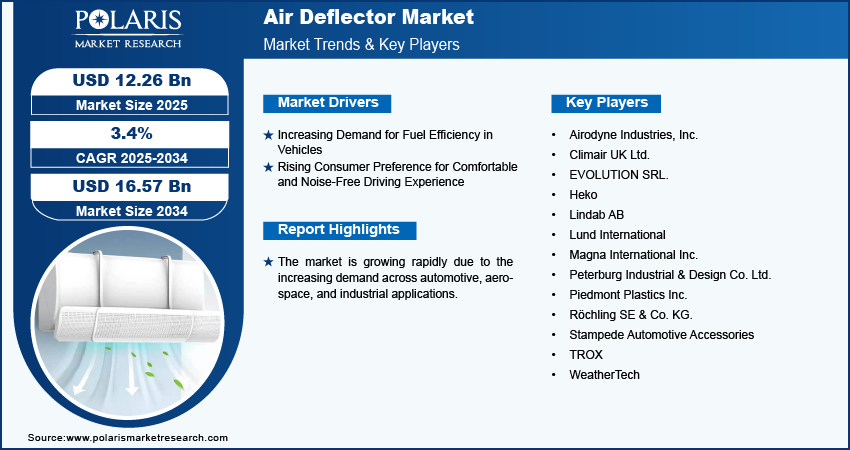

The air deflector market size was valued at USD 11.87 billion in 2024. The market is projected to grow from USD 12.26 billion in 2025 to USD 16.57 billion by 2034, exhibiting a CAGR of 3.4% during 2025–2034.

The air deflector market focuses on products designed to redirect airflow, improving comfort and energy efficiency in various industries. The market has been experiencing rapid growth, driven by increasing demand across automotive, aerospace, and industrial applications. Air deflectors, primarily used to improve aerodynamics, reduce drag, and enhance fuel efficiency, are gaining popularity as industries focus on sustainability and energy efficiency. In the automotive sector, air deflectors are widely used to manage airflow, reduce wind noise, and improve vehicle performance. In the aerospace industry, air deflectors contribute to smoother airflow and increased fuel efficiency, which is essential for reducing operational costs.

Industrial applications utilize air deflectors to regulate air circulation in HVAC systems, improving energy consumption and air quality. Growing environmental regulations, coupled with advancements in material technologies, are encouraging manufacturers to innovate with lightweight, durable, and cost-effective air deflector solutions. The market is expected to grow in the coming years as industries prioritize energy efficiency and sustainability. In March 2023, the EU implemented CO2 emission performance standards for cars and vans, setting strict limits for manufacturers. This move pushed automakers to adopt various aerodynamic enhancements, including air deflectors, to meet these targets. The introduction of EU Regulation 2019/631 mandates lower fleet-wide emissions, encouraging automakers to integrate more advanced air deflectors into vehicle designs to reduce drag and improve fuel efficiency. These regulations reflect the government's role in promoting sustainability and driving innovation in the air deflector market by setting industry-wide standards for environmental performance.

Air Deflector Market Trends

Increasing Demand for Fuel Efficiency in Vehicles

The stringent regulatory standards for fuel efficiency are established worldwide due to growing environmental pollution. In the automotive sector, manufacturers are increasingly adopting air deflectors to improve vehicle aerodynamics and meet government regulations and consumer expectations for eco-friendly vehicles. By reducing drag and streamlining airflow around the vehicle, air deflectors improve fuel efficiency and boost vehicle stability at higher speeds, leading to better overall performance. In the UK, new regulations were introduced in February 2022, allowing HGVs to include aerodynamic features such as long cabs to cut fuel consumption and CO2 emissions. These changes are expected to reduce fuel consumption by 7% to 15% to align with the UK's goal of reducing environmental impact while simultaneously improving driver safety and comfort.

Rising Air Deflector Market in the Automotive Industry

The increasing demand for a comfortable and quiet driving experience fuels the growth of air deflectors in the automotive industry. The air deflector works by redirecting airflow around the vehicle, which helps minimize wind noise and provides a smoother and quieter ride for the user. Aligning with the rising consumer preference for enhanced in-car comfort and noise reduction fuels the growth of the air deflector market.

Additionally, the expanding automotive market in emerging economies offers significant growth opportunities for air deflector manufacturers as vehicle production and sales surge in regions such as Asia Pacific, Latin America, and Africa. The growth in vehicle ownership across regions such as Asia Pacific, Latin America, and Africa, fueled by rising disposable incomes, is driving demand for features that improve driving comfort and fuel efficiency. In April 2024, India alone produced 23,58,041 units of passenger vehicles, three-wheelers, two-wheelers, and quadricycles, highlighting the surge in automotive production. Furthermore, in FY23, India exported a total of 47,61,487 automobiles, showcasing the country's growing presence in the global automotive market. The increasing vehicle production is driving innovations in vehicle design aimed at improving fuel efficiency and comfort for consumers, which drives the demand for air deflectors.

Air Deflector Market Segment Insights

Air Deflector Market Breakdown by Material Outlook

The global air deflector market segmentation, based on material, includes acrylic, ABS, fiberglass, and others. In 2023, the acrylic segment dominated the market due to its optimal combination of durability, UV resistance, and lightweight properties, making it a selected material for improving vehicle aerodynamics and fuel efficiency while maintaining long-term performance under changing environmental conditions. Acrylic's exceptional ability to withstand extreme environmental conditions without yellowing or degrading makes it an ideal choice for automotive and heavy-duty vehicle applications. In addition to its durability, acrylic offers remarkable clarity, enhancing the aesthetic appeal of vehicles and contributing to their overall design integrity. Also, its affordability compared to materials such as fiberglass or ABS contributes to its dominance. These qualities, along with its capacity to reduce drag and improve vehicle fuel efficiency, make acrylic the preferred material for air deflectors.

The ABS segment is projected to register the highest CAGR during the forecast period due to its durability and impact resistance, which makes it a popular material for side window and hood deflectors. ABS plastic is known for its ability to resist road debris and harsh weather, which provides protection while improving the vehicle's appearance. Furthermore, its paintable surface meets the increasing demand for personalized vehicle accessories, combining functionality with aesthetics. As consumers prioritize strength and customization in automotive components, ABS plastic remains an adaptable choice in the air deflector market, catering to these evolving preferences.

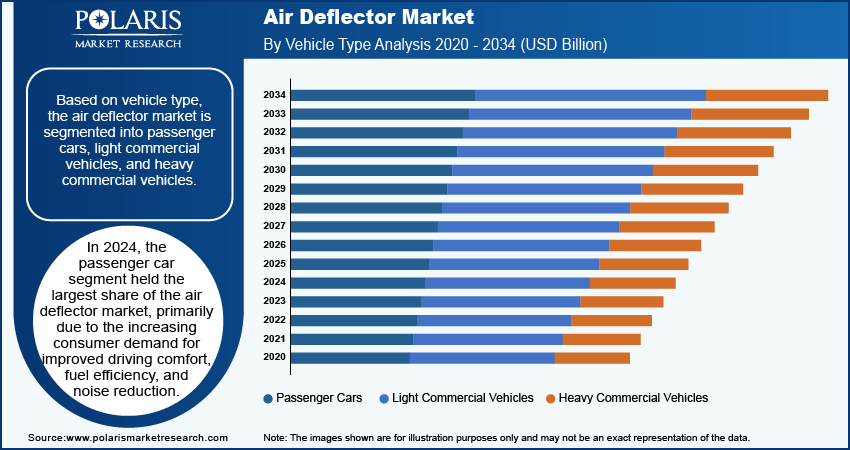

Air Deflector Market Breakdown by Vehicle Type Outlook

The global air deflector market segmentation, based on vehicle type, includes passenger cars, light commercial vehicles, and heavy commercial vehicles. In 2023, the passenger cars segment held the largest share of the market, primarily due to the increasing consumer demand for improved driving comfort, fuel efficiency, and noise reduction. Passenger cars are the most common vehicle type on the road, leading to a higher volume of deflector installations. The growing trend of customization and the need for aerodynamic solutions to improve fuel economy and reduce wind noise further drive the growth of this segment. Additionally, advancements in materials, such as acrylic and ABS, have allowed to design deflectors tailored for passenger vehicles. The demand for air deflectors in passenger cars is expected to remain strong during the forecast period as the automotive sector continues to innovate in aerodynamics.

In the light commercial vehicle (LCV) sector, air deflectors are increasingly adopted for their ability to improve durability and fuel efficiency. The deflectors help protect vehicles and cargo from environmental conditions while reducing drag, which lowers fuel consumption. Additionally, the growing demand for LCV customization and branding propels the requirement for air deflectors due to their functionality and also as a promotional tool.

Air Deflector Market, by Regional Outlook

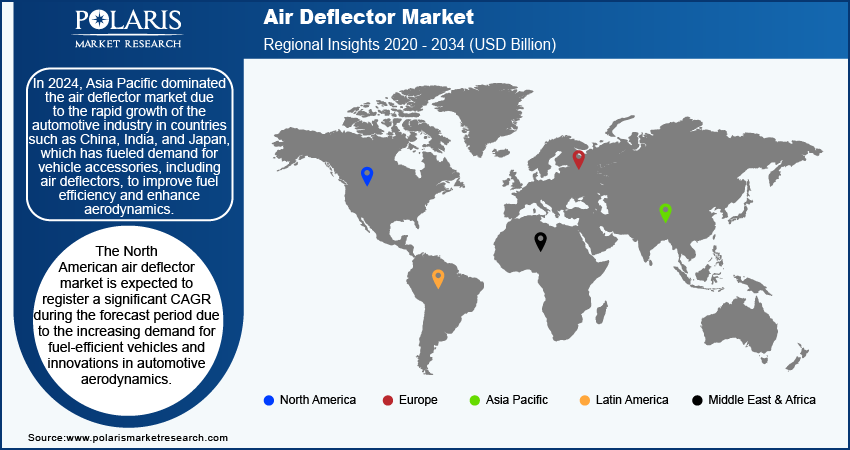

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, Asia Pacific dominated the air deflector market due to the rapid growth of the automotive industry in countries such as China, India, and Japan, which has fueled demand for vehicle accessories, including air deflectors, to improve fuel efficiency and enhance aerodynamics. As the region's automotive production and sales increase, the adoption of air deflectors also propels to meet the rising demand for fuel-efficient and environmentally friendly vehicles. According to a report published in Union Budget 2024, India aims to double its auto industry size to approximately USD 180 billion by 2024. In FY 2023–2024, automobile exports reached 4.5 million units, with two-wheelers accounting for 76.8% of total exports. The government allocated approximately USD 322 million to FAME II and exempted import duties on key battery materials such as lithium, cobalt, and nickel to support EV production. Additionally, the growing trend of vehicle customization and the shift toward more advanced, aerodynamic designs among consumers in these countries, especially in India, contribute to the regional market's dominance. The region's large vehicle fleet, associated with the rise in commercial vehicle operations, further drives the demand for air deflectors. Moreover, governments of Asia Pacific are increasingly focusing on reducing vehicle emissions, which has led to greater investments in aerodynamic technologies such as air deflectors.

The North America air deflector market is expected to register a significant CAGR during the forecast period due to the increasing demand for fuel-efficient vehicles and innovations in automotive aerodynamics. Air deflectors reduce drag and enhance fuel economy; thus, they are gaining traction as more automakers and consumers seek eco-friendly solutions. The region’s shift toward electric and hybrid vehicles, associated with stringent emissions regulations, fuels the market expansion.

Air Deflector Market – Key Players and Competitive Insights

The competitive landscape of the air deflector market is marked by a mix of regional and global players competing through innovation, strategic collaborations, and geographic expansion. Leading companies leverage strong research and development capabilities and comprehensive distribution networks to offer advanced air deflector solutions across the automotive, industrial, and building sectors. Market leaders such as Röchling SE & Co. KG, TROX, Lindab AB, and others focus on product innovation to improve aerodynamic performance, energy efficiency, and sustainability to meet the evolving needs of customers. A few competitive strategies in the air deflector market include mergers and acquisitions, partnerships with OEMs and industrial companies, and targeted investments in emerging markets. Such strategies aim at increasing market presence and expanding product portfolios. Companies continue to innovate by integrating sustainable materials and advanced technologies to address changing regulatory and environmental standards, particularly in the automotive and construction industries. A few major market players are Airodyne Industries, Inc.; Peterburg Industrial & Design Co. Ltd.; EVOLUTION SRL.; Lund International; Climair UK Ltd.; Magna International Inc.; Piedmont Plastics Inc.; Röchling SE & Co. KG.; WeatherTech; Stampede Automotive Accessories; TROX; Lindab AB; and Heko.

Lindab AB, a European company specializing in energy-efficient ventilation solutions for healthier indoor climates, introduced a new air ventilation duct system in 2023. The innovative system is made from 75% recycled steel and is powered entirely by renewable electricity, reducing its climate impact by ∼60%. Lindab has partnered with SSAB to ensure a future supply of fossil-free steel.

The Röchling Group develops and supplies customized plastic products for a wide range of industrial sectors. Their solutions aim to improve the security of packaging and optimize various industrial applications, offering innovative and durable plastic components tailored to meet industry needs. In 2023, the Röchling Group invested over approximately USD 17.5 million in constructing a new plant spanning almost 20,000 square meters, creating over 60 new jobs. This investment further solidifies the company's leading position in the rapidly growing deflector Asian market.

Key Companies in Air Deflector Market

- Airodyne Industries, Inc.

- Climair UK Ltd.

- EVOLUTION SRL.

- Heko

- Lindab AB

- Lund International

- Magna International Inc.

- Peterburg Industrial & Design Co. Ltd.

- Piedmont Plastics Inc.

- Röchling SE & Co. KG.

- Stampede Automotive Accessories

- TROX

- WeatherTech

Air Deflector Industry Developments

In September 2023, TROX introduced the RFD-V diffuser, specifically designed for free-hanging installations. This diffuser is engineered to provide enhanced control over air distribution, improving comfort levels in environments with exposed ceilings by optimizing airflow and addressing ventilation challenges.

In May 2024, Comfort First Products launched the Air Vent Deflector to Optimize Commercial HVAC Efficiency. The device fits over air vents, enabling airflow redirection for commercial HVAC systems.

Air Deflector Market Segmentation

By Type Outlook (Revenue, USD Billion, 2019–2032)

-

- Window Deflector

- Sunroof Deflector

- Bug Deflector

By Mounting Method Outlook (Revenue, USD Billion, 2019–2032)

-

- Tape-on

- Bolt-on

- In-Channel

By Material Outlook (Revenue, USD Billion, 2019–2032)

-

- Acrylic

- ABS

- Fiberglass

- Others

By Vehicle Type Outlook (Revenue, USD Billion, 2019–2032)

-

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Regional Outlook (Revenue, USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Deflector Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.87 billion |

|

Market Size Value in 2025 |

USD 12.26 billion |

|

Revenue Forecast by 2034 |

USD 16.57 billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.87 billion in 2024 and is projected to grow to USD 16.57 billion by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period.

In 2024, Asia Pacific dominated the market due to the rapid growth of the automotive industry in countries such as China, India, and Japan, which has fueled demand for vehicle accessories, including air deflectors, to improve fuel efficiency and enhance aerodynamics.

A few key players in the market are Airodyne Industries, Inc.; Peterburg Industrial & Design Co. Ltd.; EVOLUTION SRL.; Lund International; Climair UK Ltd.; Magna International Inc.; Piedmont Plastics Inc.; Röchling SE & Co. KG.; WeatherTech; Stampede Automotive Accessories; TROX; Lindab AB; and Heko

The passenger car segment held the largest share of the market in 2024, primarily due to the increasing consumer demand for improved driving comfort, fuel efficiency, and noise reduction.

In 2024, the acrylic segment dominated the market due to its durability, UV resistance, and lightweight properties.