Air Compressor Market Size, Share, Trends, Industry Analysis Report: By Type, Product, Lubrication, Operating Mode, Power Range, Application, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM1079

- Base Year: 2023

- Historical Data: 2019-2022

Air Compressor Market Overview

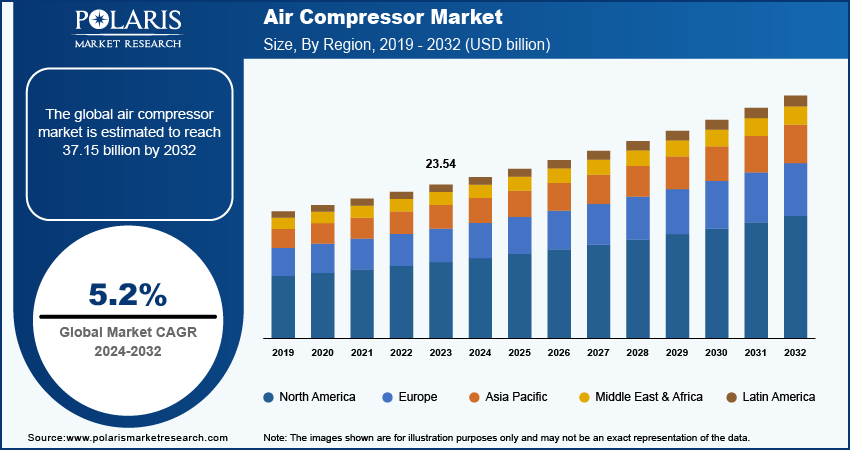

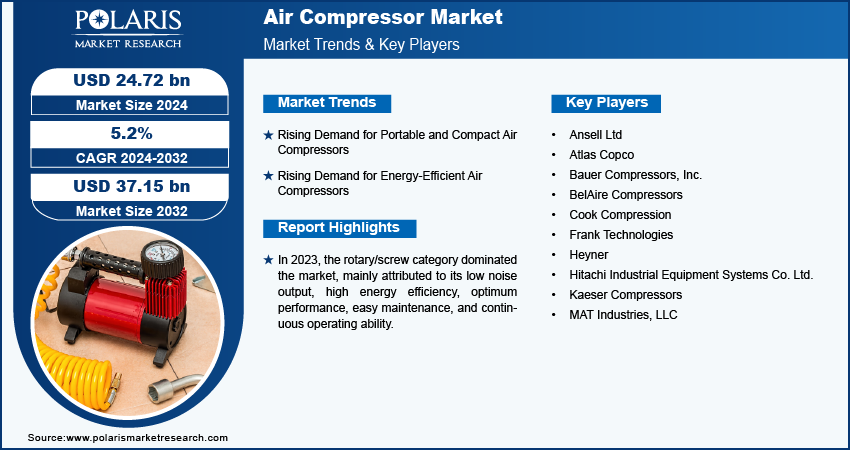

The air compressor market size was valued at USD 23.54 billion in 2023. The market is projected to grow from USD 24.72 billion in 2024 to USD 37.15 billion by 2032, exhibiting a CAGR of 5.2% from 2024 to 2032.

The air compressor market involves the production, distribution, and sale of devices that compress and pressurize air for various uses. These air compressors are utilized in industries like manufacturing, automotive, and healthcare for tasks ranging from powering pneumatic tools to providing clean air in medical equipment.

The market for air compressors is experiencing strong growth due to the increasing demand for high-quality compressed air in sectors such as food & beverage and pharmaceuticals. The quality of compressed air is essential for maintaining product integrity, operational efficiency, and meeting industrial standards. Additionally, the growing adoption of sustainable practices and the shift towards electric and hybrid compressor solutions are further driving the growth of the air compressor market.

To Understand More About this Research: Request a Free Sample Report

Technological improvements resulting from the implementation of the Internet of Things (IoT) to enhance product performance are another major contributor to the expansion of the air compressor market size. Air compressors are incorporated with sensors and data analytics for real-time monitoring of compressor performance and are interconnected through IoT.

For instance, in September 2023, Elgi Equipments launched Air-Alert, an IoT-based air compressor monitoring system designed for the Indian market. This system enables real-time monitoring of essential parameters, providing users with valuable insights and timely alerts.

Air Compressor Market Drivers and Trends

Rising Demand for Portable and Compact Air Compressors

The air compressor market CAGR is driven by the growing demand for portable and compact air compressors. These compressors offer flexibility and mobility, allowing workers to efficiently power pneumatic tools and perform tasks without being tied down by fixed infrastructure. Industries, such as construction and automotive repair, are opting for smaller and lighter compressors because they are easier to handle and operate.

Advancements in air compressor technology have allowed manufacturers to create portable units that deliver optimized performance while being more energy-efficient and environmentally friendly.

For instance, in March 2023, Sullair introduced the E1035H Electric Portable Air Compressor, an eco-friendly product designed for superior efficiency. This air compressor runs on Sullube, an environmentally friendly lubricant formulated by Sullair to improve performance and efficiency. As a result, the market for portable and compact air compressors continues to grow due to their practicality, efficiency, and suitability for a wide range of applications across various industries.

Rising Demand for Energy-Efficient Air Compressors

The air compressor market is growing significantly due to increased demand for energy-efficient air compressors. This is driven by the need to reduce operational costs and comply with environmental regulations. Energy-efficient air compressors use less electricity to produce compressed air, resulting in a reduced carbon footprint. This is appealing to industries such as manufacturing, automotive, pharmaceutical, and construction, where air compressors are essential for operations.

For instance, in April 2024, Atlas Copco enhanced Eakin Healthcare's compressed air supply with a new oil-free compressor and a leak detection audit, identifying 16 leaks. This initiative could reduce energy costs by over £4,000 annually and cut carbon dioxide emissions by nearly 5,000 kg.

Further, features such as variable speed drives (VSD), improved control systems, and better design optimization enable enhanced energy efficiency, sustainability, and operational efficiency, driving the air compressor market revenue.

Air Compressor Market Segment Insights

Air Compressor Market Breakdown by Product Insights

The air compressor market segmentation, based on product, includes centrifugal, reciprocating/piston, and rotary/screw. In 2023, the rotary/screw category dominated the market, mainly attributed to its low noise output, high energy efficiency, optimum performance, easy maintenance, and continuous operating ability.

The aforementioned factors enable the production of high quality air that complies with the regulatory standards, addressing the rising demand from industries such as food & beverage, pharmaceutical, and electronics.

For instance, in October 2023, Kaishan USA launched a range of industrial, oil-free rotary screw air compressors, the KROF series, at Process Expo 2023/ CABP Expo 2023 to cater to the needs of the food & beverage industry.

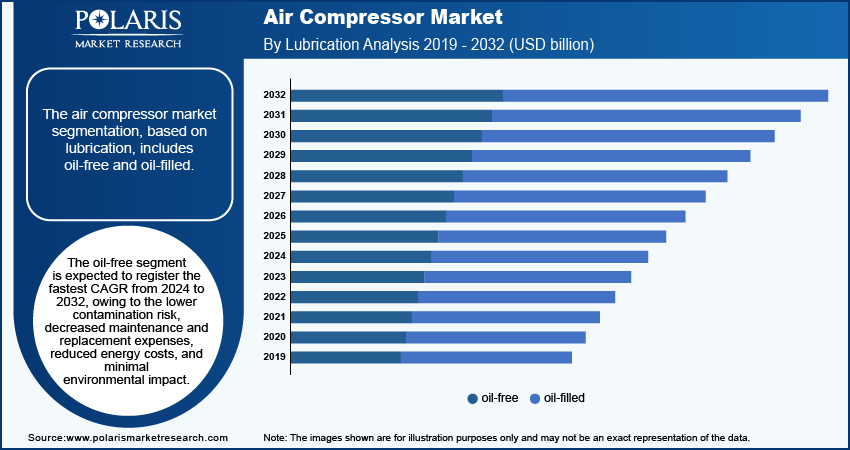

Air Compressor Market Breakdown by Lubrication Insights

The air compressor market segmentation, based on lubrication, includes oil-free and oil-filled. The oil-free segment is expected to register the fastest CAGR from 2024 to 2032, owing to the lower contamination risk, decreased maintenance and replacement expenses, reduced energy costs, and minimal environmental impact.

Further, the key industry players are introducing low-emission and environmentally friendly oil-free air compressors to allow consumers to opt for advanced and energy-efficient air compressors.

For instance, in May 2024, Aggreko launched a low-emission 100% oil-free air compressor designed for industries, including petrochemical plants, manufacturing, oil refineries, food and beverage, healthcare, and pharmaceuticals, in the Middle East region.

Air Compressor Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, the Asia Pacific emerged as a dominant region in the air compressor market, driven by rapid industrialization and urbanization in countries like China and India. The expanding oil and gas industry further fueled demand for air compressors, exemplified by the Indian Oil Corporation Limited's significant expansion of its refining capacity at the Panipat refinery, increasing from 15 MMTPA to 25 MMTPA to meet rising petroleum product needs.

Technological advancements have also played a crucial role, enhancing the efficiency and capabilities of air compressors for various applications, including pneumatic tools, assembly lines, and HVAC systems. Moreover, favorable government policies supporting industrial growth and substantial investments by key market players contribute to this upward trend. For instance, in February 2024, ELGi Equipments Ltd announced plans to invest ₹500 crores to relocate its manufacturing operations outside Coimbatore, aiming to improve operational efficiency. These factors collectively underscore the robust growth trajectory of the air compressor market in the Asia Pacific region.

Europe air compressor market is expected to grow at the fastest CAGR from 2024 to 2032, owing to a strong focus on energy efficiency and sustainability, leading industries to adopt energy-efficient air compressor solutions.

For instance, in March 2024, Aggreko increased its investment in 100% oil-free air compressors in Europe due to the growing demand for environmentally friendly and energy-efficient solutions in energy-intensive sectors.

Industry 4.0 has contributed to industrial growth across different sectors in Europe, spanning from small-scale to large-scale industries. This growth has resulted in new product launches by market players. For instance, in April 2023, ELGi introduced the EQ Series of oil-lubricated direct-drive air compressors in Europe. The EQ Series aims to provide reliability and optimal performance for the 11-22 kW segment in small and medium-sized operations.

Air Compressor Market – Key Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the air compressor market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the air compressor market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the air compressor market to benefit clients and increase the market sector. In recent years, the market has witnessed some technological advancements. Major players in the air compressor market include Ansell Ltd; Atlas Copco; Bauer Compressors, Inc.; BelAire Compressors; Cook Compression; Frank Technologies; Heyner; Hitachi Industrial Equipment Systems Co. Ltd.; Kaeser Compressors; and MAT Industries, LLC.

Atlas Copco is a global industrial company that provides innovative technology, products, services, and solutions. The company has four business areas: compressor technique, industrial technique, vacuum technique, and power technique. The company offers a wide range of products, including air compressors, vacuum and dewatering pumps, industrial tools, and assembly solutions. Atlas Copco has production facilities in 20 countries. In June 2023, Atlas Copco's compressor technique division expanded its research and development capabilities and manufacturing facilities in China in order to boost automation.

Bauer Compressors, Inc. is a manufacturer of high-pressure compressors and purification systems, specializing in applications for breathing air, biogas, and natural gas. Bauer Compressors offers a wide product range that includes stationary and mobile breathing air compressors, air treatment systems, gas filling stations, and industrial compressors. Bauer provides services to industries, including defense, oil and gas, and emergency services. The company is part of Bauer Kompressoren, Germany. In April 2023, Bauer launched three air compressor lines: the K22, BK 23, and BM series. These series feature directly coupled units, providing a combination of compact design and effective performance.

List of Key Companies in Air Compressor Market

- Ansell Ltd

- Atlas Copco

- Bauer Compressors, Inc.

- BelAire Compressors

- Cook Compression

- Frank Technologies

- Heyner

- Hitachi Industrial Equipment Systems Co. Ltd.

- Kaeser Compressors

- MAT Industries, LLC

Air Compressor Industry Developments

August 2023: FS Elliot Co., LLC launched the P400HPR Centrifugal Air Compressor, which guarantees energy efficiency and reliability for high-pressure applications through enhanced features.

April 2023: Atlas Copco acquired Asven S.R.L.'s compressed air business division to strengthen its market position and expand its product portfolio in Argentina’s market.

April 2023: ZF's commercial vehicle solutions division launched an air compressor for high-speed electric vehicles in collaboration with the Liebherr Group's Aerospace & Transportation. They will further work on innovation in fuel cell air compressor systems tailored for commercial vehicles.

Air Compressor Market Segmentation

By Type Outlook

- Stationary

- Portable

By Product Outlook

- Centrifugal

- Reciprocating/Piston

- Rotary/Screw

By Lubrication Outlook

- Oil-Free

- Oil-Filled

By Operating Mode Outlook

- Internal Combustion Engine

- Electric

By Power Range Outlook

- Up to 20 kW

- 21-50 kW

- 51-250 kW

- 251-500 kW

- Over 500 kW

By Application Outlook

- Semiconductor & Electronics

- Food & Beverage

- Healthcare & Medical

- Household Appliances

- Energy

- Oil & Gas

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Compressor Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 23.54 billion |

|

Market Size Value in 2024 |

USD 24.72 billion |

|

Revenue Forecast in 2032 |

USD 37.15 billion |

|

CAGR |

5.2% from 2024–2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The air compressor market size was valued at USD 23.54 billion in 2023 and is projected to be valued at USD 37.15 billion in 2032.

The market is projected to grow at a CAGR of 5.2% from 2024 to 2032

Asia Pacific held the largest share of the market in 2023.

The key players in the market are Ansell Ltd; Atlas Copco; Bauer Compressors, Inc.; BelAire Compressors; Cook Compression; Frank Technologies; Heyner; Hitachi Industrial Equipment Systems Co. Ltd.; Kaeser Compressors; and MAT Industries, LLC.

The rotary/screw category dominated the market in 2023.

The oil-free segment is expected to grow at the fastest CAGR over the forecast period.