Global Air Ambulance Services Market Size, Share, Trends, Industry Analysis Report: By Type (Rotary-wing and Fixed-wing), Service Model, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 114

- Format: PDF

- Report ID: PM1335

- Base Year: 2024

- Historical Data: 2020-2023

Air Ambulance Services Market Overview

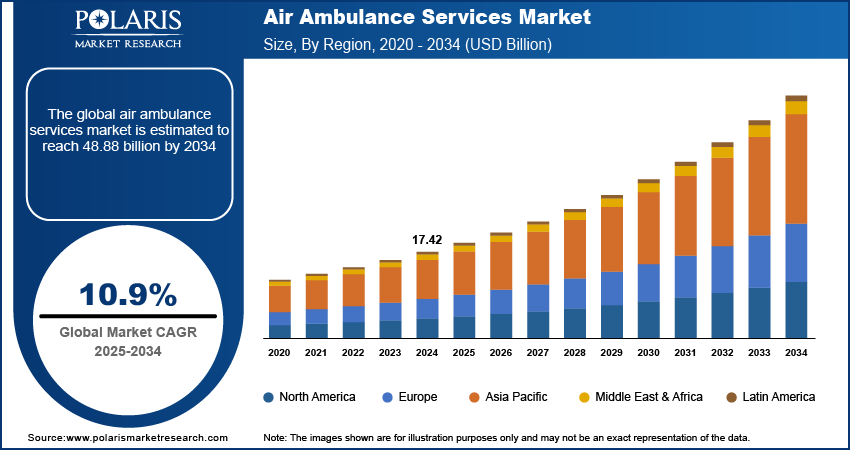

The air ambulance services market size was valued at USD 17.42 billion in 2024. The market is projected to grow from USD 19.25 billion in 2025 to USD 48.88 billion by 2034, exhibiting a CAGR of 10.9% during the forecast period. The air ambulance services market refers to the provision of emergency medical transportation via aircraft, including helicopters and fixed-wing planes, for the rapid transport of patients requiring urgent medical care. This service is particularly crucial in remote areas, during natural disasters, or in cases where time-sensitive medical attention is necessary. Key drivers of the market include the increasing demand for fast and efficient emergency medical services, advancements in aviation technology, and a growing number of healthcare facilities offering critical care capabilities. Additionally, trends such as the integration of telemedicine in air ambulance services and expanding private sector involvement are expected to contribute to the market growth in the coming years. As healthcare access improves globally, the demand for air ambulance services is expected to continue rising.

To Understand More About this Research: Request a Free Sample Report

Air Ambulance Services Market Dynamics

Growing Demand for Faster Emergency Medical Services

One of the major air ambulance services market drivers is the growing demand for rapid emergency medical transportation. As the need for timely medical interventions increases, especially in life-threatening situations, air ambulances play a vital role in providing quick access to healthcare. The ability of air ambulances to reach remote or inaccessible areas has made them indispensable in emergency scenarios, such as accidents, natural disasters, or medical evacuations from remote locations. According to a study published in the Journal of Trauma and Acute Care Surgery in 2022, air ambulances significantly reduce patient mortality rates in rural and underserved areas, demonstrating their critical role in the healthcare system. The increasing focus on reducing response times to improve patient outcomes is driving the growth of this market.

Advancements in Aviation Technology and Medical Equipment

Technological advancements in both aviation and medical equipment are significantly impacting the air ambulance services market. Innovations such as better navigational systems, improved aircraft efficiency, and integration of advanced medical technology on board are enhancing the quality of care provided during transportation. For instance, the introduction of more fuel-efficient and faster aircraft is reducing operational costs while increasing service coverage. Additionally, modern air ambulances are now equipped with advanced life-support systems, telemedicine capabilities, and monitoring tools that allow healthcare professionals to provide continuous care during transit. According to the National Aeronautics and Space Administration (NASA) in 2022, the potential of Advanced Air Mobility (AAM) in healthcare operations was highlighted, emphasizing the use of drones and unmanned aerial vehicles (UAVs) for tasks such as delivering medical supplies and facilitating patient transport.

Increasing Integration of Telemedicine in Air Ambulance Operations

The integration of telemedicine into air ambulance operations is another major trend transforming the market. Telemedicine enables real-time communication between medical teams on the ground and those aboard the air ambulance, ensuring that patients receive continuous care during transport. This trend is particularly relevant in complex medical cases where remote consultations with specialists are necessary. By incorporating telemedicine, air ambulance services are enhancing the quality of care and reducing the risk of complications during transport. A 2021 study in PLOS ONE found that telemedicine-assisted ambulance transports between healthcare facilities were both effective and safe, with only 0.8% of patients requiring telemedicine support during transit. The global rise in telemedicine adoption, fueled by advances in communication technology and regulatory acceptance, further supports the growth of this trend within the air ambulance services market.

Air Ambulance Services Market Segment Insights

Air Ambulance Services Market Assessment by Type

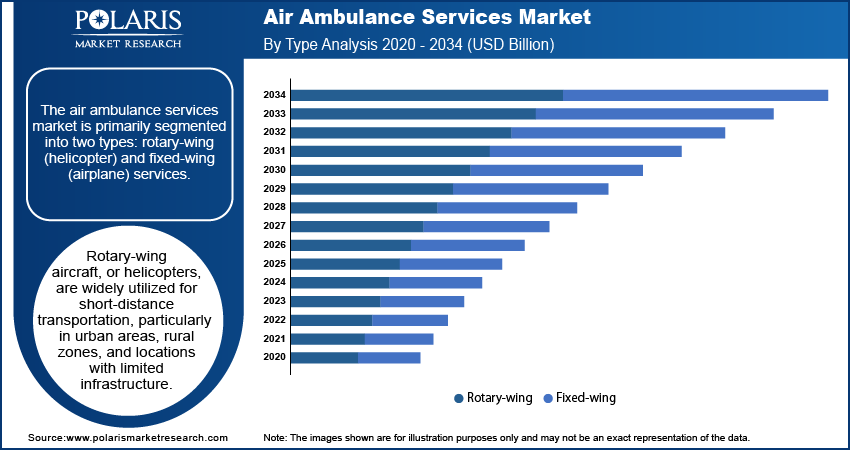

The air ambulance services market is primarily segmented into two types: rotary-wing (helicopter) and fixed-wing (airplane) services. Rotary-wing aircraft, or helicopters, are widely utilized for short-distance transportation, particularly in urban areas, rural zones, and locations with limited infrastructure. They offer superior maneuverability and faster access to hard-to-reach areas, making them highly effective for emergency medical evacuations. However, fixed-wing aircraft are preferred for long-distance transportation, providing better fuel efficiency and the ability to transport patients over vast distances at higher speeds. While both types play crucial roles in the market, the rotary-wing segment holds the largest air ambulance services market share due to its flexibility and the increasing demand for rapid emergency services in densely populated areas. It also continues to register high growth, driven by advancements in helicopter technology and the growing demand for immediate emergency response in critical healthcare situations.

Fixed-wing aircraft, though essential for long-distance patient transportation, have seen a more moderate growth rate compared to rotary-wing services. This is primarily because of the increasing emphasis on shorter, more urgent emergency evacuations, which rotary-wing aircraft can handle more efficiently. Additionally, the rising number of helicopter emergency medical services (HEMS) providers and their ability to operate in various environmental conditions have contributed to the increasing adoption of rotary-wing aircraft in emergency medical services. Despite this, fixed-wing aircraft remain pivotal for medical evacuations over long distances, especially in regions with vast geographical challenges. The continued investment in both aircraft types ensure the overall air ambulance services market expansion, catering to diverse patient transport needs.

Air Ambulance Services Market Assessment by Service Model

The air ambulance services market segmentation, based on service models, includes hospital-based and community-based services. Hospital-based air ambulance services are primarily operated by healthcare facilities, where the transportation is arranged for patients requiring specialized medical attention from the hospital to another healthcare facility or during critical care transport. This model holds a significant share of the market due to the large volume of hospital-based medical emergencies, including trauma cases, organ transplants, and inter-hospital transfers. As hospitals expand their emergency response capabilities and integrate air ambulance services into their operations, this segment continues to see substantial growth, especially in urban areas with advanced healthcare infrastructure.

On the other hand, community-based air ambulance services, often operated by independent organizations or non-profit entities, focus on providing emergency medical transport services directly to individuals in the community, particularly in rural or underserved regions. This segment is seeing a rapid increase in adoption as these services fill critical gaps in emergency medical transportation where traditional infrastructure may be lacking. Community-based services are benefiting from rising awareness about the importance of quick medical intervention in emergencies and the growing reliance on air ambulances in rural settings. While the hospital-based model maintains a larger market share, the community-based service model is registering the fastest growth, driven by the increasing demand for emergency medical evacuation services in remote areas and the expansion of regional air ambulance providers.

Air Ambulance Services Market Regional Insights

The air ambulance services market covers North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Among these regions, North America holds the largest air ambulance services market share, driven by its advanced healthcare infrastructure, high demand for emergency medical transportation, and well-established air ambulance networks. The region benefits from a large number of hospital-based and community-based air ambulance providers, supported by significant investments in aviation technology and medical equipment. Additionally, the presence of a robust healthcare system and high-income populations across the US and Canada contribute to the strong demand for both rotary-wing and fixed-wing air ambulance services. The increasing frequency of medical emergencies, particularly in rural areas, and the integration of advanced telemedicine services are further propelling the market in North America. Other regions, such as Europe and Asia Pacific, are also experiencing growth, but North America's market dominance is expected to continue due to its well-developed air ambulance infrastructure and increasing healthcare expenditure.

Europe holds a significant share of the air ambulance services market, driven by its advanced healthcare systems and the high demand for emergency medical transportation. The market is characterized by a strong presence of both private and public air ambulance providers, particularly in countries such as the UK, Germany, and France. The region’s robust healthcare infrastructure and a large number of well-established hospital-based air ambulance services contribute to this growth. Additionally, the increasing adoption of telemedicine and advancements in aviation technology are further enhancing the efficiency and scope of services. The demand for cross-border air ambulance services in Europe is also rising due to the ease of travel across European Union member states, leading to a more interconnected and rapid emergency medical transportation network.

Asia Pacific is witnessing rapid growth in the air ambulance services market, primarily driven by the expanding healthcare infrastructure, increasing medical tourism, and rising awareness about emergency medical transportation. Countries such as India, China, Japan, and Australia are at the forefront of this growth, with increasing investments in air ambulance services and a surge in demand for both rotary-wing and fixed-wing air ambulances. The rise of medical emergencies in rural and remote areas, coupled with the growing number of air ambulance providers, is propelling market expansion. Furthermore, the region's developing healthcare systems, along with a growing middle-class population seeking better medical care, are boosting the demand for air ambulance services, particularly in countries with vast geographical challenges.

Air Ambulance Services Market – Key Market Players and Competitive Insights

Key players in the air ambulance services market include Air Methods Corporation; REVA, Inc.; International SOS; Air Evac Lifeteam; AMSA (Australian Medical Services Association); Med-Trans Corporation; PHI Air Medical; Lifeguard Ambulance; Angel MedFlight; Scandinavian Air Ambulance; Global Medical Response; Rapid Response; London’s Air Ambulance; Alpin Rescue; and EagleMed. These companies operate across various regions, providing both rotary-wing and fixed-wing air ambulance services to transport patients requiring urgent medical attention. While some are independent entities, others, such as Air Methods Corporation and Global Medical Response, are part of larger healthcare organizations, helping to ensure the continuity of their services.

In terms of competition, companies in the air ambulance services industry focus on improving service efficiency and reducing response times. Key players are constantly innovating to offer faster and more reliable transportation options. Many companies are integrating advanced medical equipment and telemedicine into their services to provide real-time medical care during transportation, which is essential for critical patient transfers. Additionally, competition has increased due to the rising number of independent and community-based air ambulance providers, which are addressing the gaps in medical evacuation services, particularly in rural and underserved regions.

Competitive strategies in the market are largely shaped by technological advancements, fleet expansion, and geographic reach. To maintain an edge, companies are investing in upgrading aircraft, enhancing safety features, and optimizing operational efficiency. Partnerships and collaborations with hospitals and emergency medical service providers are also common to increase service coverage. Companies that can offer specialized services, such as organ transport or long-distance medical evacuations, are differentiating themselves. The market is expected to witness continued competition with the entry of new providers, especially in emerging markets, as demand for air ambulance services grows globally.

Air Methods Corporation is one of the prominent players in the air ambulance services market, providing emergency medical transportation services across the US. The company operates a large fleet of helicopters and fixed-wing aircraft, offering rapid response services for patients requiring immediate medical care. Air Methods focuses on serving both rural and urban areas, delivering essential medical transportation, including critical care, trauma, and emergency evacuations. Global Medical Response is a major player in the air ambulance market, offering a wide range of emergency medical services through its subsidiaries, including air and ground ambulance transportation. GMR operates across North America and internationally, providing critical medical transportation for patients requiring immediate care.

Key Companies in Air Ambulance Services Market

- Air Methods Corporation

- REVA, Inc.

- International SOS

- Air Evac Lifeteam

- AMSA (Australian Medical Services Association)

- Med-Trans Corporation

- PHI Air Medical

- Lifeguard Ambulance

- Angel MedFlight

- Scandinavian Air Ambulance

- Global Medical Response

- Rapid Response

- London’s Air Ambulance

- Alpin Rescue

- EagleMed

Air Ambulance Services Market Developments

- November 2024: Air Methods announced a partnership with a healthcare provider to expand air ambulance coverage in underserved areas. The goal is to enhance access to urgent medical care in remote locations.

- August 2024: GMR launched a new fleet of advanced air ambulances to improve service efficiency and patient care. The company’s expansion into telemedicine and collaboration with hospitals enhances its service offerings, allowing medical professionals to manage patient care effectively during transport.

Air Ambulance Services Market Segmentation

By Type Outlook

- Rotary-wing

- Fixed-wing

By Service Model Outlook

- Hospital-based

- Community-based

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Air Ambulance Services Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.42 billion |

|

Market Size Value in 2025 |

USD 19.25 billion |

|

Revenue Forecast in 2034 |

USD 48.88 billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The air ambulance services market has been segmented into detailed segments of type and service model. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategies in the air ambulance services market are focused on expanding service coverage, enhancing fleet capabilities, and leveraging technological advancements. Companies are investing in new aircraft to improve response times and reduce operational costs. Strategic partnerships with hospitals, healthcare providers, and government agencies are key to expanding market reach and ensuring reliable service. Additionally, companies are integrating telemedicine and advanced medical technologies to improve patient care during transport. Marketing efforts emphasize the reliability, speed, and critical nature of air ambulance services, particularly in underserved or remote regions, to attract both private and institutional clients.

FAQ's

? The air ambulance services market size was valued at USD 17.42 billion in 2024 and is projected to grow to USD 48.88 billion by 2034.

? The market is projected to register a CAGR of 10.9% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? Air ambulance services market key players include Air Methods Corporation, REVA, Inc., International SOS, Air Evac Lifeteam, AMSA (Australian Medical Services Association), Med-Trans Corporation, PHI Air Medical, Lifeguard Ambulance, Angel MedFlight, Scandinavian Air Ambulance, Global Medical Response, Rapid Response, London’s Air Ambulance, Alpin Rescue, and EagleMed.

? The rotary-wing segment accounted for the largest share of the market.

? The hospital-based segment accounted for the largest share of the market.

? Air ambulance services provide emergency medical transportation via aircraft, such as helicopters or fixed-wing planes, to transport patients who require urgent medical care. These services are typically used in situations where ground transportation is impractical or too slow, such as in rural or remote areas, during natural disasters, or for long-distance patient transfers. Air ambulances are equipped with life-support equipment and staffed by medical professionals, including paramedics, nurses, and doctors, to ensure continuous care during transit. These services are crucial for timely medical intervention and improving patient outcomes in critical situations.

? A few key trends in the air ambulance services market are described below: Growing demand for fast emergency medical transport – Increased need for quick response times in medical emergencies, especially in rural or hard-to-reach areas. Technological advancements – Integration of telemedicine, real-time monitoring, and advanced medical equipment onboard for better patient care during transport. Expansion of private sector involvement – Rise in private companies providing air ambulance services, especially in underserved regions. Increased focus on rural and remote areas – Greater emphasis on providing services to areas with limited healthcare access and addressing transportation gaps.

? A new company entering the air ambulance services market could focus on offering specialized services, such as rapid medical evacuation for critical conditions or long-distance patient transfers, which are often underserved. Integrating advanced technologies like telemedicine for real-time patient monitoring and leveraging data analytics to optimize flight routes and reduce response times could provide a competitive edge. Additionally, focusing on underserved rural or remote regions with limited healthcare access can help meet growing demand. Building strong partnerships with hospitals and healthcare providers to enhance service reliability and ensure a high level of customer care would further differentiate the company in the market.

? Companies manufacturing, distributing, or purchasing Air Ambulance Services and related products, and other consulting firms must buy the report