AI System Debugging Market Size, Share, Trends, Industry Analysis Report: By Components (Software and Services), Deployment Mode, Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5441

- Base Year: 2024

- Historical Data: 2020-2023

AI System Debugging Market Overview

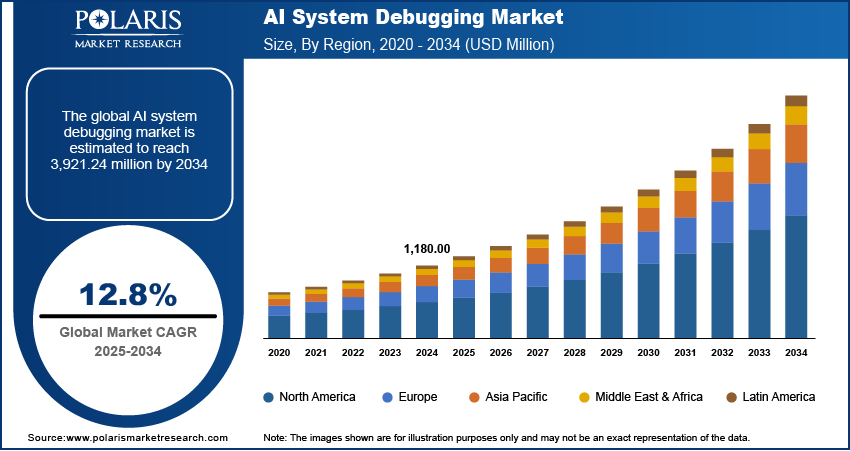

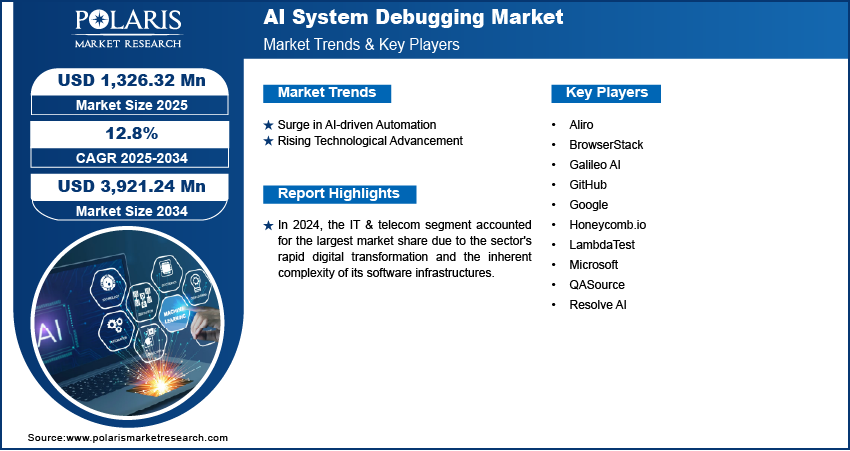

AI system debugging market size was valued at USD 1,180.00 million in 2024 and is expected to reach USD 1,326.32 million by 2025 and USD 3,921.24 million by 2034, exhibiting a CAGR of 12.8% during the forecast period.

The AI system debugging market encompasses tools and services that leverage artificial intelligence to identify, diagnose, and resolve errors or bugs within software systems. These solutions utilize machine learning, natural language processing, and predictive analytics to detect irregularities, suggest fixes, and even self-heal code issues in real-time, thereby enhancing the efficiency and accuracy of the debugging process. The growing need for explainable AI (XAI) is fueling market demand as enterprises seek compliance with ethical AI regulations.

To Understand More About this Research: Request a Free Sample Report

The increasing complexity of neural networks and deep learning models is creating significant AI system debugging market opportunities for technology providers specializing in automated debugging solutions. Additionally, emerging regulations around AI fairness and compliance are also influencing market development as enterprises invest in tools that enhance AI governance.

AI System Debugging Market Dynamics

Surge in AI-Driven Automation

The surge in AI-driven automation across industries such as IT, healthcare, and finance is significantly contributing to AI system debugging market growth. For instance, according to the National University, approximately 77% of organizations are currently implementing or investigating the integration of artificial intelligence within their operational frameworks. Furthermore, a significant 83% of these companies categorize AI as a critical priority in their strategic business initiatives. Enterprises are increasingly incorporating AI models into mission-critical applications to ensure accuracy, reliability, and compliance. While AI-powered automation is transforming business operations, the complexity of these models has introduced new debugging challenges. As a result, continuous model monitoring and debugging have become essential to detect errors, optimize performance, and stay compliant with evolving regulations. This growing reliance on AI automation is fueling market expansion, with organizations investing in advanced debugging solutions to protect AI-driven workflows.

Rising Technological Advancement

Advancements in machine learning model interpretability and bias detection frameworks are reshaping the AI system debugging market dynamics, ensuring that AI models function accurately and fairly. As AI adoption continues to grow, the need for transparency in decision-making processes has become a priority. Enterprises are increasingly utilizing advanced debugging tools to detect and mitigate biases, improve model accuracy, and comply with regulatory standards. The rising demand for explainable AI (XAI) is further accelerating growth, as organizations prioritize responsible AI deployment. These technological advancements are driving demand for solutions that enhance AI accountability, creating significant opportunities for vendors specializing in AI debugging.

AI System Debugging Market Segment Insights

AI System Debugging Market Assessment by Components

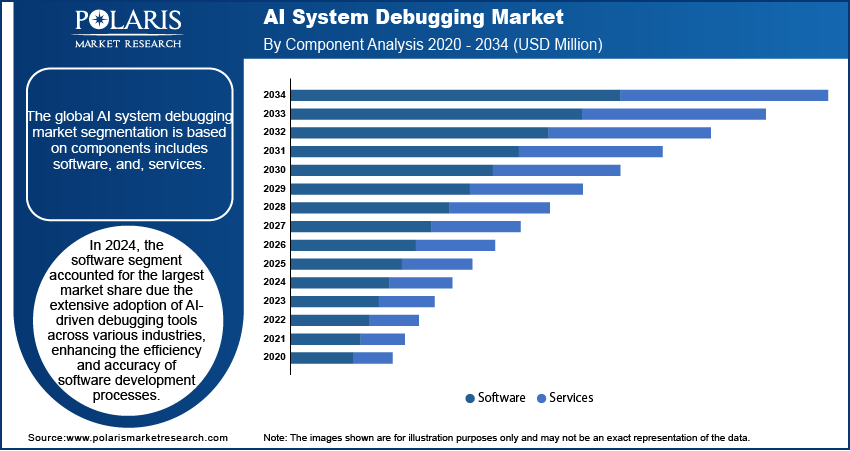

The global AI system debugging market segmentation, based on components, includes software and services. In 2024, the software segment accounted for the largest AI system debugging market share due to the extensive adoption of AI-driven debugging tools across various industries, enhancing the efficiency and accuracy of software development processes. These tools leverage machine learning and pattern recognition to identify and rectify code anomalies, reducing development time and minimizing errors. The increasing complexity of software systems necessitates advanced debugging solutions, further propelling the demand for AI-enabled software tools. Consequently, organizations are investing heavily in these technologies to maintain competitive advantage and ensure high-quality software delivery.

The services segment is also expected to witness the highest CAGR over the forecast period due to the growing need for specialized expertise in implementing and managing AI debugging solutions. As organizations integrate AI into their development workflows, they require tailored services to customize these tools to their unique environments. Additionally, continuous advancements in AI technologies necessitate ongoing support and training, driving the demand for professional services. This trend underscores the critical role of service providers in facilitating the seamless adoption and optimization of AI debugging tools.

AI System Debugging Market Evaluation by End-Use Industry

The global AI system debugging market segmentation, based on end-use industry, includes IT & telecom, BFSI, retail & eCommerce, automotive & manufacturing, government & defense, healthcare, and others. In 2024, the IT & telecom segment accounted for the largest market share due to the sector's rapid digital transformation and the inherent complexity of its software infrastructures. AI system debugging tools are essential in this context, enabling efficient management of intricate networks and applications. Automating error detection and resolution, these tools enhance system reliability and performance, which are crucial in the highly competitive IT & telecom landscape. The sector's commitment to innovation and operational excellence further fuels the adoption of advanced debugging solutions.

The healthcare segment is expected to register the highest CAGR over the forecast period due to the increasing integration of AI in healthcare applications, such as diagnostic systems and patient management platforms. Ensuring the accuracy and reliability of these critical systems is paramount, necessitating robust debugging solutions. AI-enabled debugging tools facilitate the development of secure and efficient healthcare software, supporting improved patient outcomes and operational efficiencies. The sector's focus on precision and safety amplifies the demand for advanced debugging technologies.

AI System Debugging Market Regional Analysis

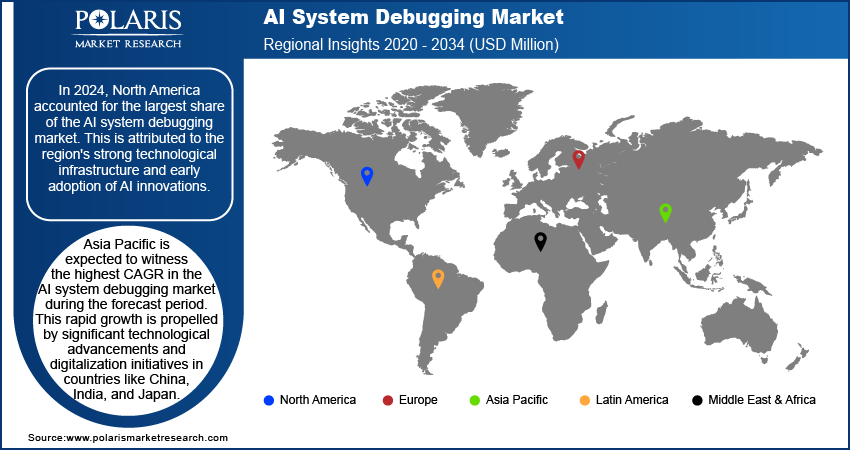

By region, the study provides AI system debugging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share. This is attributed to the region's strong technological infrastructure and early adoption of AI innovations. Major technology companies and startups in North America are at the forefront of AI research and development, driving the implementation of advanced debugging tools. North American technology giants are actively acquiring AI startups to enhance their global reach in the AI system debugging market. For instance, in April 2024, Nvidia acquired Run:ai for USD 700 million, which enhances AI infrastructure optimization. The presence of a skilled workforce and substantial investments in AI further boost the market. Additionally, supportive regulatory frameworks and a culture of innovation contribute to the widespread adoption of AI debugging solutions across various industries.

Asia Pacific is expected to witness the highest AI system debugging market CAGR during the forecast period. This rapid growth is propelled by significant technological advancements and digitalization initiatives in countries such as China, India, and Japan. The expanding IT and telecommunications sectors in these nations are increasingly adopting AI debugging tools to enhance software quality and operational efficiency. Government policies promoting AI integration and substantial investments in technology infrastructure further accelerate this trend. For instance, in October 2024, China's Ministry of Industry and Information Technology launched a pilot program to liberalize value-added telecom services in Beijing, Hainan, Shanghai, and Shenzhen. This initiative permits foreign investors to establish wholly-owned enterprises, including internet data centers, and engage in online data processing and transaction services. It also enhances access to China's cloud computing and computing power markets. The region's dynamic economic landscape and burgeoning tech industry create a fertile ground for the proliferation of AI-enabled debugging solutions.

AI System Debugging Key Market Players & Competitive Analysis Report

The competitive landscape of the AI system debugging market is shaped by intense rivalry, strategic partnerships, and technological advancements. Companies are focusing on partnerships and collaborations to integrate AI-driven debugging tools into broader software development ecosystems. Major players are leveraging mergers and acquisitions to expand their technological capabilities and market presence. Frequent product launches introduce innovative solutions that improve debugging efficiency through machine learning and predictive analytics. Competitive edges are being established through automation, self-healing capabilities, and real-time anomaly detection.

The competition strategy revolves around integrating AI debugging into DevOps pipelines, enhancing cloud-based debugging solutions, and offering scalable tools for enterprises. Competitive analysis indicates that key market players are differentiating themselves through proprietary algorithms, data-driven debugging insights, and seamless cloud integration. Business insights suggest that AI-powered debugging is becoming a critical component in accelerating software deployment cycles. Technology analysis highlights the rise of autonomous debugging and explainable AI to improve debugging transparency. Competitive trends include the adoption of generative AI for debugging automation and the use of reinforcement learning for intelligent error detection. International collaboration and competition drive market expansion, with companies forming global alliances to optimize AI debugging solutions across diverse industries.

Google LLC, a subsidiary of Alphabet Inc., provides search and advertising services on the Internet. The company, Google LLC, operates in two major reportable segments – Google Services and Google Cloud. The "Google Services" segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google Photos, Google Maps, Google Play, YouTube, and Search. The segment's hardware products are also characterized by various products such as Pixel 5a 5G, Pixel 6 phones, Chromecast with Google TV, the Fitbit Charge 5, Google Nest Cams, and Nest Doorbells. The company's cloud segment is further categorized into two: Google Cloud Platforms and Google Workspace. The Google Cloud platform aids developers in building, testing, and deploying applications on its scalable and reliable infrastructure. The Google collaboration tools include applications such as Gmail, Calendar, Docs, Drive, Meet, and more. Also, it provides OCR on the Google Cloud Platform, including image uploading, text extraction, translation, and Cloud Pub/Sub integration.

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. Microsoft has invested heavily in artificial intelligence (AI) and machine learning technologies in recent years. The company has been using AI to improve its products and services and developing new AI-based applications. For instance, Microsoft's Cortana virtual assistant uses machine learning to provide personalized recommendations and insights to users. Microsoft has also developed several AI-based products and services, including the Azure Machine Learning platform, which allows developers to build, deploy, and manage machine learning models at scale. The company has also developed AI tools for healthcare, such as Microsoft Healthcare Bot, which helps patients get answers to their health-related questions.

Key Companies in AI System Debugging Market

- Aliro

- BrowserStack

- Galileo AI

- GitHub

- Honeycomb.io

- LambdaTest

- Microsoft

- QASource

- Resolve AI

AI System Debugging Market Developments

July 2024: Lightrun launched its AI-powered Runtime Autonomous Debugger in private beta, designed to help developers quickly fix production code issues, streamlining the debugging process and improving efficiency.

July 2024: Microsoft launched Visual Studio 2022 v17.13, featuring key enhancements in AI-assisted development, debugging, productivity, and cloud integration. This update optimizes workflows and code management to improve the overall developer experience.

AI System Debugging Market Segmentation

By Components Outlook (Revenue USD Million 2020 - 2034)

- Software

- Services

By Deployment Mode Outlook (Revenue USD Million 2020 - 2034)

- On-Premises

- Cloud-Based

By Application Outlook (Revenue USD Million 2020 - 2034)

- Code Debugging

- Model Debugging

- Auditing

- Performance Optimization

- Security & Compliance

- Others

By End-Use Industry Outlook (Revenue USD Million 2020 - 2034)

- IT & Telecom

- BFSI

- Retail & eCommerce

- Automotive & Manufacturing

- Government & Defense

- Healthcare

- Others

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI System Debugging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,180.00 million |

|

Market Size Value in 2025 |

USD 1,326.32 million |

|

Revenue Forecast in 2034 |

USD 3,921.24 million |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global AI system debugging market size was valued at USD 1,180.00 million in 2024 and is projected to grow to USD 3,921.24 million by 2034.

The global market is projected to register a CAGR of 12.8% during the forecast period.

In 2024, North America accounted for the largest share of the AI system debugging market. This is attributed to the region's strong technological infrastructure and early adoption of AI innovations.

Some of the key players in the market are Aliro; BrowserStack; Galileo AI; GitHub; Google; Honeycomb.io; LambdaTest; Microsoft; QASource; and Resolve AI.

In 2024, the software segment accounted for the largest market share due the extensive adoption of AI-driven debugging tools across various industries, enhancing the efficiency and accuracy of software development processes.

In 2024, the IT & telecom segment accounted for the largest market share due to the sector's rapid digital transformation and the inherent complexity of its software infrastructures.