AI Robot Dog Market Size, Share, Trends, Industry Analysis Report: By Type (Research and Development, Service Industries, Educational Purpose, Surveillance and Security, and Companionship), Technology, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 121

- Format: PDF

- Report ID: PM5280

- Base Year: 2024

- Historical Data: 2020-2023

AI Robot Dog Market Overview

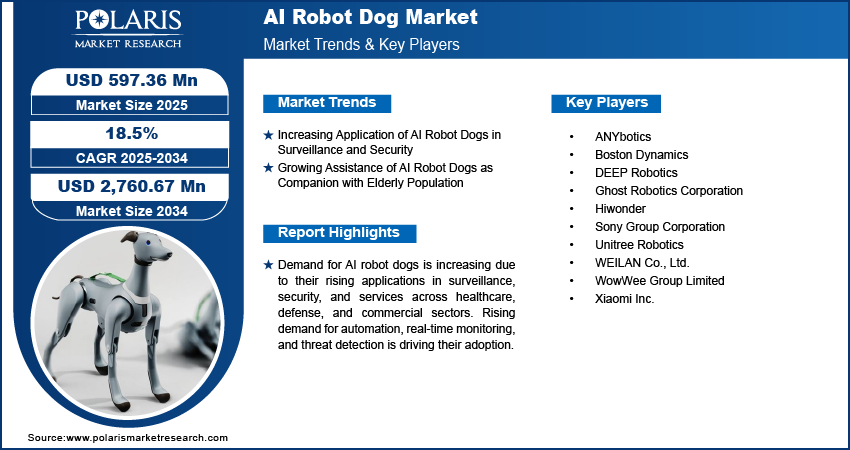

The global AI robot dog market size was valued at USD 505.85 million in 2024 and is expected to reach USD 597.36 million by 2025 and 2,760.67 million by 2034, exhibiting a CAGR of 18.5% during 2025–2034.

AI robot dog has wide applications such as surveillance, security, and services in various sectors, including healthcare, defense and military, and commercial spaces. The increasing need for automated solutions to enhance the efficiency of commercial and industrial spaces drives the AI robot dog market demand. Entities such as organizations, government agencies, and industries are increasingly adopting AI-powered robot dogs for multiple activities, including real-time monitoring, threat detection, and advanced mobility. According to a report by the Centre for International Governance Innovation, in 2022, the US Department of Homeland Security introduced robotic dogs at the Mexico-US border to enhance surveillance and border patrol efficiency in the region. In addition, companies such as Boston Dynamics, Ghost Robotics, and Sony Corporation are continuously investing in the development of intelligent robotic quadrupeds for commercial and defense applications, which is further boosting their market demand among end users.

To Understand More About this Research: Request a Free Sample Report

A few technological trends, including advancements in AI and machine learning and robotics-as-a-service (RaaS), are boosting the AI robot dog market growth. Further, ongoing improvements in AI-based technologies, such as natural language processing (NLP), computer vision, and autonomous navigation systems, are helpful in enhancing the ability of AI robot dogs to interact with humans. Google DeepMind has introduced a project, namely Barkour, which focuses on the research and development of the agility of AI robot dogs by means of improving technology such as machine learning. In the healthcare industry, AI robot dogs are being adopted to provide support and companionship to elderly individuals, which is further fueling the demand for AI robot dogs. Additionally, the growth of elderly populations in regions such as Asia Pacific, North America, and Europe has further increased the adoption of AI-powered robot dogs for companionship.

Sectors, including governments and industries, are investing in AI-driven robotic dogs to enhance their security and operational efficiency. For instance, Rover-X, a four-legged robotic dog, is designed to perform critical missions that are highly risky, such as the leakage of hazardous materials in a chemical plant. This robot dog is developed jointly by HTX (Home Team Science and Technology Agency) in collaboration with Ghost Robotics and A*STAR’s Institute for Infocomm Research (I2R). The market is also witnessing increased adoption in warehousing, logistics, and disaster response applications, which is expected to further fuel the demand for AI robot dogs during the forecast period.

AI Robot Dog Market Dynamics

Increasing Application of AI Robot Dog in Surveillance and Security

The integration of AI robot dogs in surveillance and security applications is helping entities such as organizations, government agencies, and businesses to monitor their surroundings. These robot dogs are equipped with advanced AI, sensors, and autonomous navigation capabilities that are capable of providing continuous and efficient security solutions to the end users. Moreover, compared to traditional surveillance methods that rely on static cameras or human personnel, AI robot dogs offer real-time monitoring, adaptability, and enhanced situational awareness. Thus, the ability of AI robot dogs to patrol large areas, detect threats, and respond autonomously in a critical situation has proven to be an asset for security-sensitive environments, ultimately driving their market demand.

In November 2024, the United States Secret Service implemented robot dogs to enhance security operations at Mar-a-Lago, the private club owned by President Trump in Florida. This advanced robot operating systems are equipped with sensors and surveillance capabilities designed to provide security and provide real-time monitoring of the premises. AI robot dogs have proven to be an asset for facilities requiring continuous surveillance and monitoring in security-focused public and private sectors. Hence, the increasing application of AI robot dogs in surveillance and security is driving the AI robot dog market development.

Growing Assistance of AI Robot Dogs as Companion with Elderly Population

AI robot dogs have emerged as a solution for elderly companionship, addressing the emotional and practical requirements of aging populations. Factors such as the growing rate of the elderly population in countries such as China, Japan, the US, and certain European nations have led to rising cases of mobility limitations and loneliness among such populations. Therefore, AI-powered robot dogs are introduced to provide emotional support to the elderly population. According to the World Health Organization Report 2024, in 2022, the number of elder population aged 60 and above has outnumbered children younger than 5 years. Considering the faster rate of aging among large sections of the population, it is estimated that by 2050, the population aged 60 and above will double from 12% to 22%. Therefore, this section of society will require constant companionship during their aging.

The integration of AI robot dogs with advanced features such as responsive systems, voice recognition, and other sensors helps aging people communicate efficiently with these dogs. Additionally, AI technology, such as natural language processing (NLP), allows these robots to understand and respond to human emotions more effectively. Thus, AI robot dogs are designed to assist the elderly population by providing companionship, which boosts their popularity among them, ultimately leading to their market growth. For instance, Aibo, launched by Sony Corporation, proved to be a better companion for all age groups, including elderly individuals, which helps them to feel companionship, leading to increased demand for such robots, thereby providing growth opportunities for the AI robot dog market.

AI Robot Dog Market Segment Insights

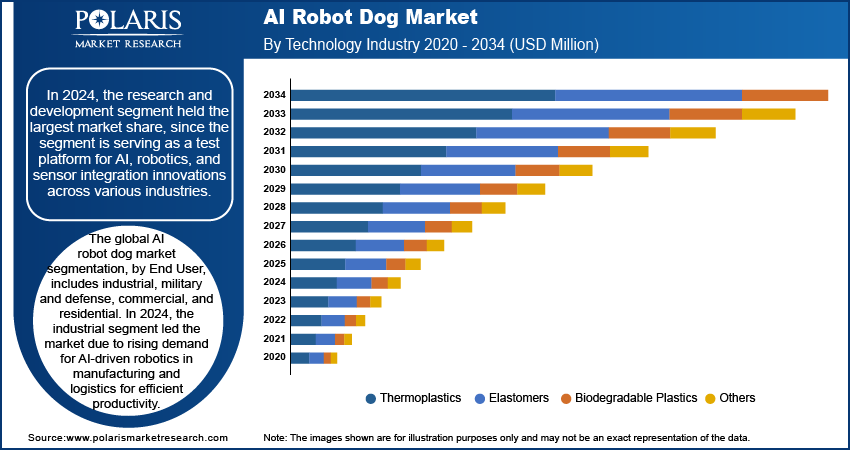

AI Robot Dog Market Assessment by Type Outlook

The global AI robot dog market segmentation, by type, includes research and development, service industries, educational purposes, surveillance and security, and companionship. In 2024, the research and development segment held the largest market share due to its role in serving other industries as test platforms for AI, robotics, and sensor integration innovations. Research institutions and tech companies are using these robotic systems to explore various aspects of artificial intelligence, such as machine learning applications, autonomous navigation, and AI-based behavioral learning models.

Increasing investments in AI research are fueling the growth of this segment. In January 2025, NIO, a Chinese electric vehicle manufacturer, announced the development of a robot dog in the robotics sector. NIO has secured USD 686.7 million in funding to support its advancing autonomous driving and robotics technologies, which includes the development of a robot dog project. Further, a key trend in the use of AI robot dogs in the research and development sector is to understand the behavioral response under conditions such as space exploration simulations and disaster response research. As a resulting factor, these robots provide valuable insights into AI adaptability in complex and dynamic conditions, which helps the researcher understand the scenario, create a responsive action, and make improvements in the related technologies.

Boston Dynamics partnered with NASA’s Jet Propulsion Laboratory to develop a doglike walker called NeBula-SPOT to test AI robot dogs for planetary exploration and understand their behavior in countering subterranean challenges. Thus, this experiment will allow the researchers to develop a better and more advanced AI robot dog that will assist astronauts in performing their tasks.

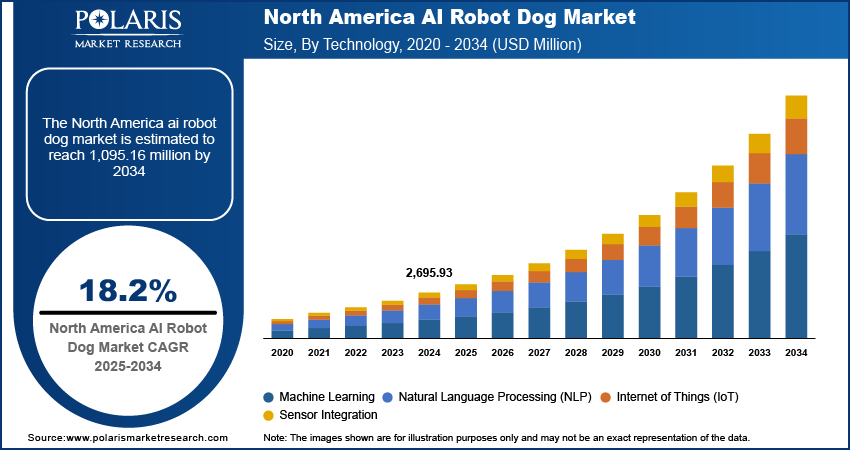

AI Robot Dog Market Evaluation by Technology Outlook

The global AI robot dog market, based on technology, is divided into machine learning, natural language processing (NLP), the Internet of Things (IoT), and sensor integration. In 2024, the machine learning segment held a significant market share due to its capability that allows robotic dogs to simulate real pet behavior, learn from interactions, and enhance their functionality in various applications. The key driving factor attributing to the growth of this segment is the increasing demand for personalized and adaptive robotic companionship. Moreover, consumers are increasingly shifting their preference toward robot dogs that are integrated with AI and have learning behavior. Also, businesses are shifting to develop more advanced features for robot dogs that can self-learn and improve their interaction with humans without requiring constant reprogramming.

A significant trend in the growth of this technology, is the integration of reinforcement learning techniques, which allows AI robot dogs to continuously improve their actions based on feedback provided by its user. Thus, the quick learning behavior of AI robot dogs also enhances their autonomy, which makes them more effective in both residential and commercial applications.

AI Robot Dog Market Evaluation by End User Outlook

The global AI robot dog market, based on end users, is segregated into industrial, military, defense, commercial, and residential. The residential segment is expected to witness the highest growth rate during the forecast period due to its increasing role in assisting the residential sector. The benefits offered by AI robot dogs in providing interaction with family members, including kids, pets, adults, and elderly adults are further fueling their demand within the residential segment. Moreover, AI robot dogs are being viewed as companion providers and home assistants. They are also being employed for emotional support, assist with daily tasks, and integrate with smart home systems for enhanced user convenience.

The key driving factor that will boost the demand of this segment includes an increasing number of single-person households and elderly individuals who constantly seek companionship and assistance. AI robot dogs are helpful in offering emotional engagement and a sense of security to those single people who require attention and support in their daily activities. For instance, the BabyAlpha series offered by WEILAN Co., Ltd. enables users to train their robot pet using voice commands and AI-driven learning patterns and allows companionship to the users lying within the residential sector, which tends to improve the demand for AI robot dogs during the forecast period.

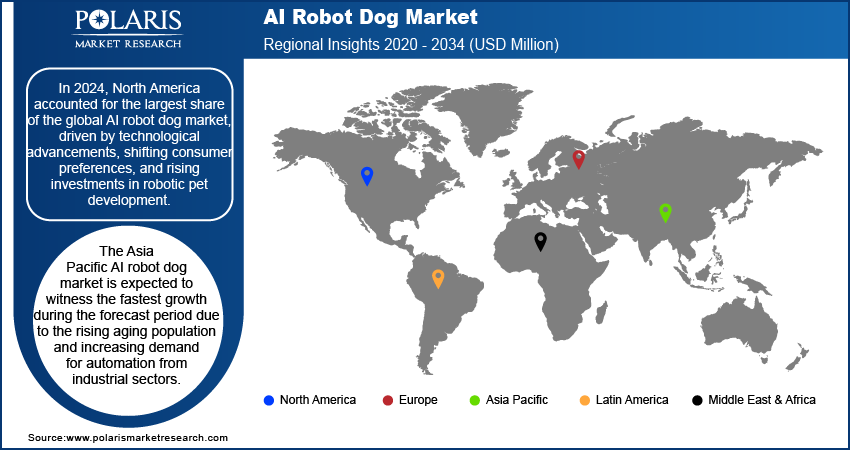

AI Robot Dog Market Regional Analysis

By region, the study provides AI robot dogs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global AI robot dogs market revenue. Factors such as growing combustion from technological advancements and shifting consumer preferences are driving the market growth for AI robot dogs in the region. Key AI robot dogs market trend such as increasing investments in robotic pet development is playing a crucial role in driving demand for AI robot dogs in North America. Key players in the market, recognizing the growing potential, have raised significant funding to expand their research and production capabilities. The US government’s focus on robotics, along with private investments, accelerates the growth of the market. For instance, the allocation of USD 35 billion for the Artemis lunar program highlights the country's commitment to technological progress, which is further boosting the need for technologically advanced companion such as AI robotics. These investments contribute to the development of more sophisticated, affordable, and user-friendly AI robot dogs, further enhancing their appeal among consumers.

The US is progressing at a faster rate in the field of robotics research and is witnessing a rise in the development of AI-powered pets that closely mimic real animal behavior. This progress has been driven by key advancements in technologies such as machine learning, computer vision, and sensors, leading to the growth of robotic pets that are more interactive and responsive. These innovations allow AI robot dogs to recognize voices, adapt to their environment, and offer companionship similar to traditional pets. The US is positioned to remain a key player in advancing these technologies due to ongoing initiatives such as the National Robotics Initiative (NRI-3.0), which received substantial government funding of USD 14 million in 2021.

In Canada, advancements in AI and robotics technology have directly contributed to the growing demand for AI robot dogs. The continuous evolution of artificial intelligence in robotics, including improved motion control, sensory input, and autonomous decision-making, has opened new possibilities for AI robots to integrate into daily life. These advancements align well with the increasing interest in smart home devices, making AI robot dogs an attractive addition to Canadian consumers. As robot density increases in North America, particularly in the US, Canada reaps the benefits of spillover effects from these innovations, which is driving the rising demand for robotic pets.

The demand for AI robot dogs in Asia Pacific has been growing rapidly and is expected to grow during the forecast period due to advancements in artificial intelligence, robotics, and unmanned technologies. Governments and private companies across the region are investing in developing autonomous robotic systems for various applications, including military operations, homeland security, and industrial use. This surge in demand is driven by the increasing need for efficient, versatile, and cost-effective solutions to tackle challenges in sectors such as defense, security, and surveillance. The trend reflects a broader shift toward incorporating AI-powered automation into critical functions, making robot dogs a significant part of future technological developments in the region.

AI Robot Dog Market – Key Players and Competitive Analysis Report

The competitive landscape of the AI robot dog market is characterized by a mix of established players and emerging companies striving to capture market share in a rapidly growing industry. Key players are constantly focusing on product innovation, strategic partnerships, and investments in research and development to expand their offerings and meet diverse consumer demands. However, the AI robot dog market witnesses intense competition as new entrants introduce less expensive products, leveraging breakthroughs in the market. While opportunities are abundant, challenges such as stringent regulatory requirements and competition from alternative products necessitate innovation from AI robot dog market players.

Boston Dynamics is an automation machinery manufacturing company specializing in robotics and simulation. The company's robots, including Spot, Stretch, and Atlas, enhance automation in unstructured environments, improving efficiency and safety across industries. These agile and intelligent robots support tasks such as industrial inspection, warehouse automation, and hazardous environment operations. Spot provides adaptability and data collection capabilities, making it valuable for inspections, safety monitoring, and digital twin applications. Stretch streamlines warehouse logistics with advanced perception and manipulation, automating case handling and unloading tasks.

Unitree Robotics is a robotics company specializing in the development of advanced quadruped and humanoid robots. The company focuses on creating robots for a range of applications, including consumer use, industrial automation, and AI-driven mobility solutions. In the quadruped robotics segment, Unitree has developed several highly capable four-legged robots. The Go2 and Go2-W are designed for consumer and educational purposes, featuring Embodied AI and advanced mobility for all-terrain navigation. The B2 and B2-W models cater to industrial applications, offering enhanced stability, power, and payload capacity for challenging environments. Additionally, the A1 and AlienGo models provide agile and efficient robotic solutions for research, inspection, and security purposes.

List of Key Companies in AI Robot Dog Market

- ANYbotics

- Boston Dynamics

- DEEP Robotics

- Ghost Robotics Corporation

- Hiwonder

- Sony Group Corporation

- Unitree Robotics

- WEILAN Co., Ltd.

- WowWee Group Limited

- Xiaomi Inc

AI Robot Dog Industry Developments

December 2024: ANYbotics raised USD 60 million, totaling over USD 130 million, to accelerate US expansion and global growth, backed by leading investors to enhance industrial inspection robotics and services.

October 2024: WEILAN launched the BabyAlpha A2 series, a smart quadruped petbot for families, offering companionship and emotional connection, alongside the BabyAlpha DevQ for developers.

February 2024: Sony launched the Aibo Espresso Edition robot dog in the US, featuring AI-driven learning, customizable eye colors, and a smart black design. It develops a unique personality through a three-year cloud plan.

AI Robot Dog Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Research and Development

- Service Industries

- Educational Purpose

- Surveillance and Security

- Companionship

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Machine Learning

- Natural Language Processing (NLP)

- Internet of Things (IoT)

- Sensor Integration

By End User Outlook (Revenue, USD Million, 2020–2034)

- Industrial

- Military and Defense

- Commercial

- Residential

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI Robot Dog Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 505.85 million |

|

Market Size Value in 2025 |

USD 597.36 million |

|

Revenue Forecast by 2034 |

USD 2,760.67 million |

|

CAGR |

18.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global AI robot dog market size was valued at USD 505.85 million in 2024 and is projected to grow to USD 2,760.67 million by 2034.

• The global market is projected to register a CAGR of 18.5% during the forecast period.

• In 2024, North America accounted for the largest market share, driven by technological advancements and the introduction of new AI-based technologies.

• A few of the key players in the market are Boston Dynamics; Sony Group Corporation; Unitree Robotics; ANYbotics; Hiwonder; Ghost Robotics Corporation; Xiaomi Inc.; WEILAN Co., Ltd.; DEEP Robotics; and WowWee Group Limited.

• In 2024, the research and development segment held the largest market share due to the growing requirement for more advanced technologies across sectors such as healthcare, industrial manufacturing, and others.

• By 2034, the machine learning segment is expected to witness the highest growth rate due to the surging demand for automation.