AI in Drug Discovery Market Size, Share, Trends, Industry Analysis Report: By Offering (Software and Services), By Technology, By Therapeutic Area, By Application, By End User, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1850

- Base Year: 2024

- Historical Data: 2020-2023

AI in Drug Discovery Market Overview

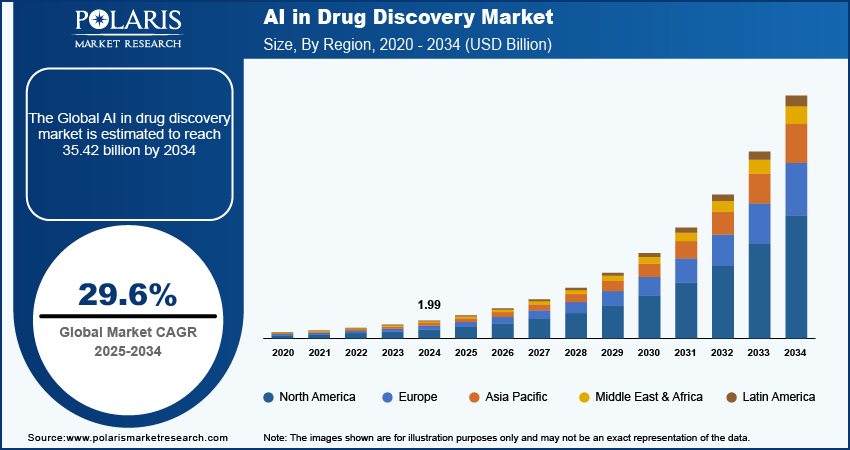

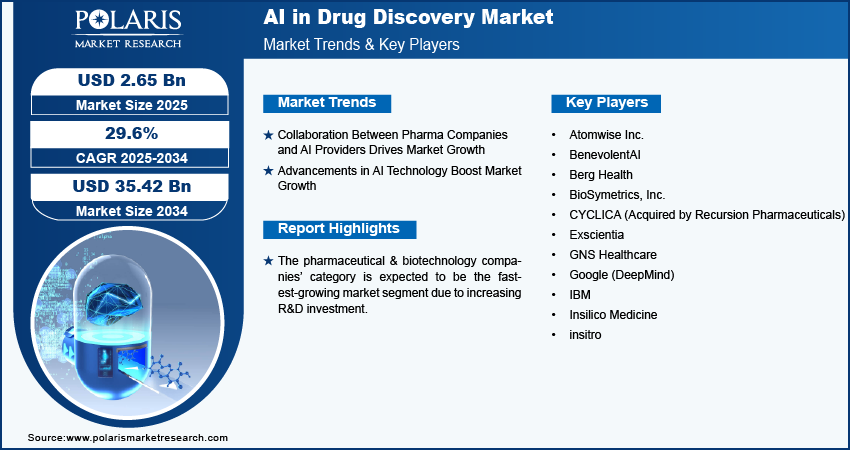

The AI in drug discovery market size was valued at USD 1.99 billion in 2024. The market is projected to grow from USD 2.65 billion in 2025 to USD 35.42 billion by 2034, exhibiting a CAGR of 29.6% during 2025–2034.

The AI in drug discovery market involves the application of artificial intelligence (AI) technologies at different stages of the drug discovery and development process. It encompasses the use of AI-driven tools and platforms to analyze biological data, identify potential drug candidates, predict their efficacy and safety, optimize drug design, and streamline clinical trials. The rising prevalence of chronic diseases like cancer, diabetes, cardiovascular diseases, and neurological disorders drives the market revenue. For instance, according to the American Diabetes Association, in 2021, the prevalence of diabetes in the United States was 11.6%, affecting 38.4 million Americans. This has led to an increasing demand for innovative and more potent drugs, thus driving demand for AI in drug discovery. Furthermore, the growing need for personalized medicine needs tools to analyze vast amounts of genetic and molecular data to develop targeted therapies. Consequently, the escalating demand for more potent drugs within shorter time frames is anticipated to propel the AI in drug discovery market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Governments and private sectors are heavily investing in AI technologies for healthcare, including drug discovery. These investments are driving research and development efforts, fostering innovation, and encouraging the adoption of AI in drug discovery, significantly boosting market growth. Furthermore, the emergence of new diseases and global health crises, such as the COVID-19 pandemic, has highlighted the need for rapid drug discovery and development. The urgency to address these health challenges has led to increased funding and collaboration with the AI in the drug discovery market.

AI in Drug Discovery Market Drivers and Trends

Collaboration Between Pharma Companies and AI Providers Drives Market Growth

Pharmaceutical companies are increasingly partnering with AI technology providers to enhance their drug discovery efforts. These collaborations combine the domain expertise of pharma companies with the computational power of AI, leading to more efficient drug development processes and innovative drug candidates. For instance, in May 2024, Sanofi, Formation Bio, and OpenAI announced collaboration to develop AI-powered software to speed up drug development and deliver new medicines to patients more efficiently. They will leverage data, software, and tuned models to create customized solutions across the drug development lifecycle. As a result, the market share of AI in drug discovery is anticipated to experience substantial growth during the forecast period.

Advancements in AI Technology Boost Market Growth

The continuous advancements in AI, particularly in natural language processing (NLP), predictive analytics, and quantum computing, are significantly expanding the capabilities of AI in drug discovery. These advancements are facilitating more precise predictions, improved drug-target interactions, and the identification of novel drug candidates. Furthermore, the integration of AI with genomics, proteomics, and other omics technologies is driving demand for personalized medicines. AI algorithms are adept at analyzing complex omics data to identify biomarkers and customize drug treatments based on individual genetic profiles. This personalized approach enhances the efficacy of therapies, thereby fueling the demand for AI in drug discovery solutions.

AI in Drug Discovery Market Segment Insights

AI in Drug Discovery Market Breakdown by Therapeutic Area Insights

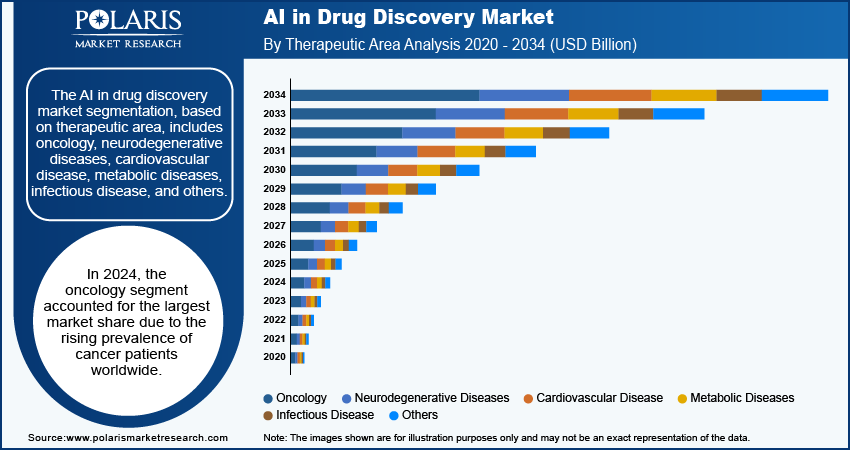

The AI in drug discovery market segmentation, based on therapeutic area, includes oncology, neurodegenerative diseases, cardiovascular disease, metabolic diseases, infectious disease, and others. In 2024, the oncology segment accounted for the largest market share due to the rising prevalence of cancer patients worldwide. For instance, according to the CDC, the United States reported 1.77 million new cancer cases in 2021 and more than six lakh cancer-related deaths in 2022. This rise in cancer cases necessitates a faster drug development process in the oncology segment, resulting in increased adoption of AI in drug discovery and thereby driving the AI in drug discovery market growth.

AI in Drug Discovery Market Breakdown by End User Insights

The AI in drug discovery market segmentation, based on end user, includes, pharmaceutical & biotechnology companies, contract research organizations, research centers, academic & government institutes. The pharmaceutical & biotechnology companies’ category is expected to be the fastest-growing market segment due to increasing R&D investment. Pharmaceutical and biotechnology companies are significantly increasing their investments in research and development (R&D) to maintain a competitive edge and bring new drugs to market. AI technologies are being increasingly leveraged to optimize and accelerate the drug discovery process, enabling more efficient identification of potential drug candidates. For instance, Pfizer, a pharmaceutical company, has embraced Artificial Intelligence to streamline and accelerate clinical drug development. Thus, the growing need for research and development in novel drug discovery is expected to make the pharmaceutical and biotechnology companies segment the fastest-growing segment in the market during the forecast period.

AI in Drug Discovery Market Breakdown by Regional Insights

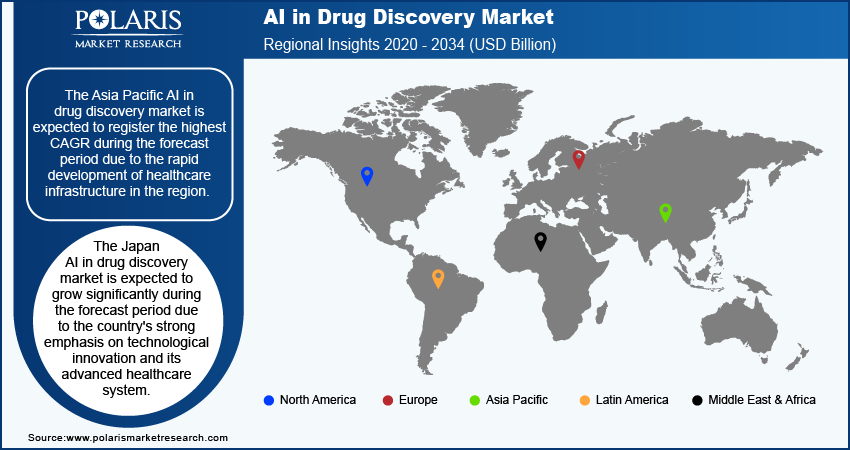

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America AI in drug discovery market accounted for the largest market share in 2024. North America, particularly the US, is home to many of the world's leading pharmaceutical and biotechnology companies. These companies have been early adopters of AI technologies to enhance their drug discovery processes, contributing to the market growth. Furthermore, the increasing prevalence of chronic diseases in North America is driving the demand for more efficient and personalized therapies. For example, the Centers for Disease Control and Prevention reports that nearly 116 million adults in the United States have hypertension. Consequently, the growing burden of chronic diseases necessitates a faster drug development process, which highlights the significant role of AI in drug development, thus contributing to the market growth in North America.

The US AI in drug discovery market had the largest market share in 2023. The US boasts a world-leading research ecosystem, with top-tier universities, research institutions, and biotech startups collaborating on AI in drug discovery. This ecosystem fosters innovation and rapid advancements, thereby contributing to the market growth in US.

The Asia Pacific AI in drug discovery market is expected to register the highest CAGR during the forecast period due to the rapid development of healthcare infrastructure in the region. Also, substantial investments in AI technologies by public and private entities is fueling market growth in the region. Furthermore, the increasing prevalence of chronic illnesses and the demand for personalized medicine are compelling pharmaceutical and biotechnology companies in the region to adopt AI-driven drug discovery processes. The sizable and diverse patient pool in countries such as China and India offers valuable data for AI models, significantly strengthening the region's potential for innovation in drug discovery. Additionally, government support and collaborations with global AI and healthcare companies are playing a crucial role in the rapid expansion of the market in the Asia Pacific region.

The Japan AI in drug discovery market is expected to grow significantly during the forecast period due to the country's strong emphasis on technological innovation and its advanced healthcare system. Japan's aging population and the associated increase in demand for novel therapies are driving demand for the adoption of AI in drug discovery. Additionally, Japan has a robust pharmaceutical industry that is increasingly investing in AI to accelerate drug development and reduce costs. The government's supportive policies, including funding for AI research and collaborations between academia, industry, and government institutions, further boost the growth of the AI in drug discovery market in Japan.

AI in Drug Discovery Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the AI in drug discovery market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, AI in drug discovery industry must offer cost-effective items.

In recent years, the AI in drug discovery industry has offered some technological advancements. Major players in the AI in drug discovery market include Atomwise Inc.; BenevolentAI; Berg Health (in January 2023, Berg Health acquired by BPGbio Inc.); BioSymetrics, Inc.; CYCLICA (Acquired by Recursion Pharmaceuticals); Exscientia; GNS Healthcare (In January 2023, the company Rebranded as Aitia); Google (DeepMind); IBM; Insilico Medicine; and insitro.

Recursion Pharmaceuticals, Inc. is a biotech company that uses advanced technology to decode biology and industrialize drug discovery. The company is developing multiple drugs in clinical trials, including treatments for cerebral cavernous malformation, neurofibromatosis type 2, familial adenomatous polyposis, Clostridioides difficile infection, and AXIN1 or APC mutant cancers. Also, Recursion Pharmaceuticals, Inc. acquired Cyclica. In April 2023, Cyclica collaborated with Canadian platform to enhance the federated AI-driven insights in genomics and precision health.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software which generates 29% of its revenue. Infrastructure services hold 37%, the hardware segment has 8%, and IT services hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. The company is responsible for 50% of all wireless and 90% of all credit card transactions. In November 2023, IBM and Boehringer Ingelheim collaborated to further develop Generative AI and foundational models to enhance the process of therapeutic antibody development.

List of Key Companies in AI in Drug Discovery Market

- Atomwise Inc.

- BenevolentAI

- Berg Health (In January 2023, Berg Health acquired by BPGbio Inc.)

- BioSymetrics, Inc.

- CYCLICA (Acquired by Recursion Pharmaceuticals)

- Exscientia

- GNS Healthcare (In January 2023, the company Rebranded as Aitia)

- Google (DeepMind)

- IBM

- Insilico Medicine

- insitro

AI in Drug Discovery Industry Developments

In July 2024, Exscientia plc collaborated with Amazon Web Services (AWS) to leverage the cloud provider’s artificial intelligence (AI) and machine learning (ML) services to strengthen its platform for comprehensive drug discovery and automation.

In May 2024, Google launched AlphaFold 3, a new AI model developed by Google DeepMind and Isomorphic Labs. The company claims that the model accurately predicts the structure of RNA, DNA, proteins, and ligands and how they interact with the potential to transform the understanding of the biological world and drug discovery.

In December 2023, MilliporeSigma launched AIDDISON, the first software-as-a-service platform bridging virtual molecule design with real-world manufacturability via Synthia retrosynthesis software API integration.

AI in Drug Discovery Market Segmentation

By Offering Outlook

- Software

- Services

By Technology Outlook

- Machine Learning

- Deep Learning

- Supervised Learning

- Reinforcement Learning

- Unsupervised Learning

- Other Machine Learning Technologies

- Other Technologies

By Therapeutic Area Outlook

- Oncology

- Neurodegenerative Diseases

- Cardiovascular Disease

- Metabolic Diseases

- Infectious Disease

- Others

By Application Outlook

- Drug optimization & repurposing

- Preclinical testing

- Others

By End User Outlook

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Research Centers

- Academic & Government Institutes

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI in Drug Discovery Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.99 billion |

|

Market Size Value in 2025 |

USD 2.65 billion |

|

Revenue Forecast in 2034 |

USD 35.42 billion |

|

CAGR |

29.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global AI in drug discovery market size was valued at USD 1.99 billion in 2024 and is projected to grow to USD 35.42 billion by 2034.

The global market is projected to grow at a CAGR of 29.6% during 2025–2034.

North America had the largest share in the global market in 2024 due to presence of leading pharmaceutical and biotechnology companies.

Key players in the market are Atomwise Inc.; BenevolentAI; Berg Health (in January 2023, Berg Health acquired by BPGbio Inc.); BioSymetrics, Inc.; CYCLICA (Acquired by Recursion Pharmaceuticals); Exscientia; GNS Healthcare (In January 2023, the company Rebranded as Aitia); Google (DeepMind); IBM; Insilico Medicine; and insitro.

The oncology segment dominated the market in 2024 due to the rising prevalence of cancer worldwide.

The pharmaceutical & biotechnology companies’ category is expected to be the fastest-growing market segment due to increasing R&D investment