AI in Cybersecurity Market Size, Share, Trends, Industry Analysis Report: By Type, Application, Technology, Offering (Hardware, Software, and Services), Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM4386

- Base Year: 2024

- Historical Data: 2020-2023

AI in Cybersecurity Market Overview

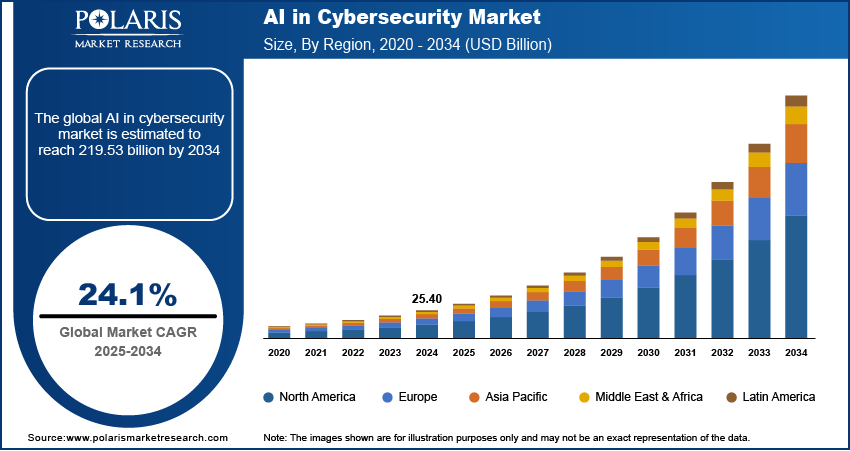

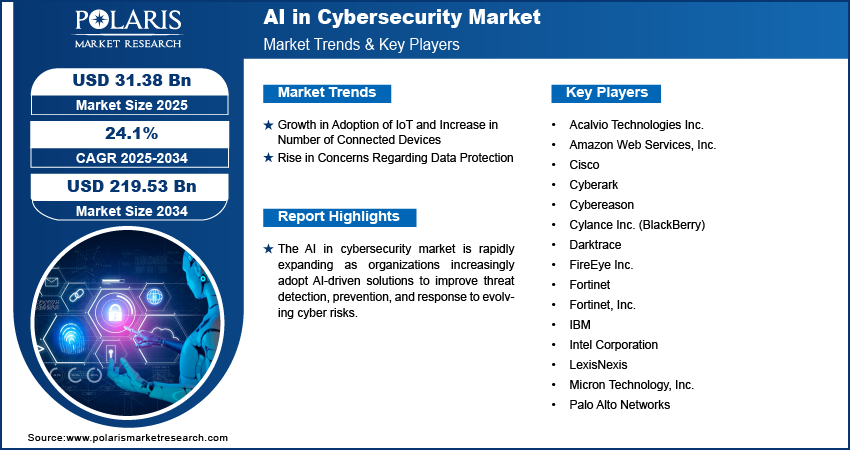

The global AI in cybersecurity market was valued at USD 25.40 billion in 2024. It is expected to grow from USD 31.38 billion in 2025 to USD 219.53 billion by 2034, at a CAGR of 24.1% during the forecast period.

AI in cybersecurity refers to the use of artificial intelligence technologies to improve the detection, prevention, and response to cyber threats. The AI in cybersecurity market revenue is witnessing rapid growth as organizations increasingly adopt AI-code tools to strengthen their defense mechanisms against evolving cyberattacks. One of the key drivers of this market is the rising complexity and frequency of cyber threats, which traditional methods struggle to address. A 2024 report by the International Telecommunication Sector revealed that 8 billion records were breached in 2023, with over 2,800 incidents reported. The average cost of a data breach has increased by 15% in the past three years, totaling approximately USD 3.3 million for small businesses in North America, further boosting the AI in cybersecurity market expansion. Additionally, AI-powered solutions analyze vast volumes of data in real time, identifying irregularities and patterns indicative of potential breaches, thus providing proactive protection.

To Understand More About this Research: Request a Free Sample Report

The growing adoption of cloud computing has increased the attack surface for cybercriminals, further raising the risk of cyber-attacks. AI in cybersecurity addresses this challenge by leveraging machine learning and predictive analytics to secure endpoints and networks, adapting dynamically to new threats. These factors, combined with the growing need for compliance with strict data protection regulations such as European Union's General Data Protection Regulation (GDPR) and others, are positioning AI as a vital component in the evolving cybersecurity landscape.

AI in Cybersecurity Market Driver Analysis

Growth in Adoption of IoT and Increase in Number of Connected Devices

The IoT and the expansion of connected devices generate vast amounts of data and often lack robust security measures, making them vulnerable to exploitation and creating a larger attack surface for cyber threats. A November 2024 CSIS report revealed that the UK’s National Cyber Security Center (NCSC) identified a three-fold increase in cyberattacks compared to 2023. The NCSC supported 430 incidents, with 89 deemed nationally significant, and recognized China, Russia, Iran, and North Korea as key threats. Additionally, AI-powered cybersecurity solutions are crucial in this context as they enable real-time monitoring and threat detection across multiple endpoints. These solutions can identify and mitigate potential risks, ensuring the integrity and security of interconnected systems by leveraging machine learning algorithms. The growing reliance on IoT devices is driving the AI in cybersecurity market demand to safeguard critical infrastructures and sensitive data.

Rise in Concerns Regarding Data Protection

Data breaches and unauthorized access lead to substantial financial and reputational damage, making robust cybersecurity measures essential. Thereby encouraging companies to invest in AI tools for cybersecurity. For instance, in August 2024, IBM launched a generative AI cybersecurity assistant to improve threat detection and response, enabling consultants to advance alert investigations. Additionally, AI enhances data protection by using advanced analytics and predictive capabilities to detect vulnerabilities and prevent unauthorized access, with the increasing volume of sensitive information being exchanged and stored digitally. Its ability to adapt to emerging threats and provide automated responses ensures comprehensive security for sensitive information, addressing the critical need for data protection.

AI in Cybersecurity Market Segment Assessment

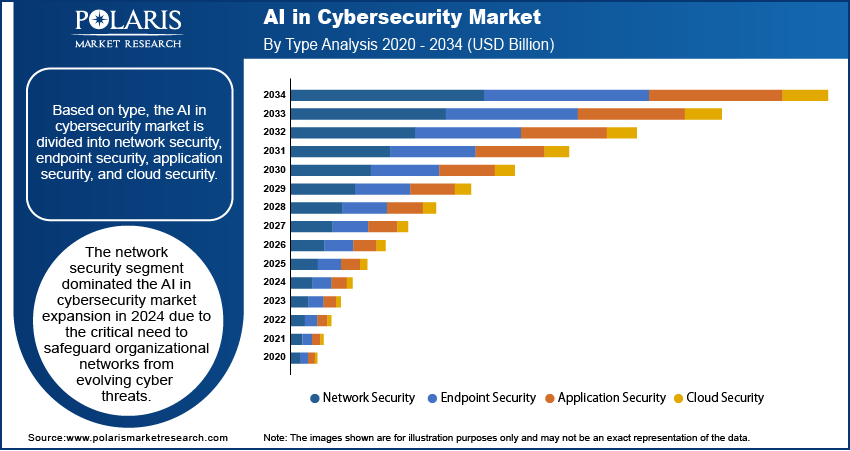

AI in Cybersecurity Market Assessment by Type Outlook

The global AI in cybersecurity market assessment, based on type, includes network security, endpoint security, application security, and cloud security. The network security segment dominated the AI in cybersecurity market expansion in 2024 due to the critical need to safeguard organizational networks from evolving cyber threats. Securing networks against malware, phishing, and ransomware attacks has become a top priority as enterprises increasingly adopt digital transformation initiatives and cloud-based infrastructures. AI-powered network security solutions excel in real-time traffic analysis, abnormality detection, and proactive threat mitigation, ensuring robust protection of sensitive data and operational continuity. This essential role in securing core systems and communications highlights the network security segment's dominance.

AI in Cybersecurity Market Evaluation by Application Outlook

The global AI in cybersecurity market evaluation, based on application, includes identity & access management, risk & compliance management, data loss prevention, unified threat management, fraud detection/ anti-fraud, threat intelligence, others. The data loss prevention segment is expected to witness the fastest AI in cybersecurity market growth during the forecast period due to the rising emphasis on safeguarding sensitive and confidential information. Organizations face heightened risks of accidental leaks or intentional data breaches with increasing volumes of data being generated and exchanged. AI-driven DLP solutions offer advanced capabilities to monitor, identify, and prevent unauthorized data transfers or exposure, ensuring compliance with strict data protection regulations such as Digital Personal Data Protection Act (DPDPA), California Consumer Privacy Act (CCPA), and others. This growing need for robust data security across industries positions the DLP segment for accelerated adoption during the forecast period.

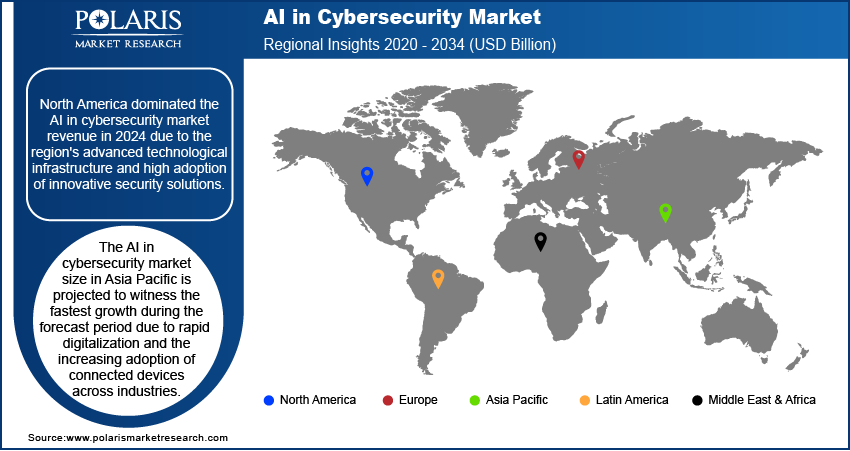

AI in Cybersecurity Market Outlook by Region

By region, the report provides the AI in Cybersecurity market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the AI in cybersecurity market revenue in 2024 due to the region's advanced technological infrastructure and high adoption of innovative security solutions. The presence of major cybersecurity companies such as IBM and AWS and early adopters of AI-driven technologies across industries such as finance, healthcare, and government especially contributed to market dominance. Additionally, the growing prevalence of cyber threats and stringent regulatory frameworks for data protection encouraged organizations to invest heavily in AI-powered cybersecurity solutions. For instance, in November 2024, Accenture expanded its generative AI-powered cybersecurity services, leveraging generative AI, deepfake protection, and quantum-safe data security solutions to enhance client's resilience and ability to reinvent themselves. These factors, combined with robust research and development initiatives, solidified North America's leadership in the market.

The AI in cybersecurity market size in Asia Pacific is projected to witness the fastest growth during the forecast period due to rapid digitalization and the increasing adoption of connected devices across industries. The expanding use of cloud services, IoT technologies, and e-commerce platforms has created a greater need for advanced cybersecurity solutions to protect sensitive data and critical systems. Additionally, rising awareness of cyber threats and government initiatives to enhance cybersecurity infrastructure are driving investments in AI-powered solutions. A July 2024 report by the Minister of State for Electronics and Information Technology highlighted that in 2023, the number of cybersecurity incidents was 23,158, further highlighting the need for robust AI cybersecurity solutions. The region's growing economic activity and technological advancements position it as a key market for accelerated growth during the forecast period.

Key Companies in AI in Cybersecurity Market

- Acalvio Technologies Inc.

- Amazon Web Services, Inc.

- Cisco

- Cyberark

- Cybereason

- Cylance Inc. (BlackBerry)

- Darktrace

- FireEye Inc.

- Fortinet

- Fortinet, Inc.

- IBM

- Intel Corporation

- LexisNexis

- Micron Technology, Inc.

- Palo Alto Networks

AI in Cybersecurity Key Market Players & Competitive Analysis Report

Major market players in the AI in Cybersecurity market are investing heavily in research and development to enhance their offerings, driving AI in cybersecurity market development. The market is highly competitive, with leading players emphasizing innovation, advanced threat detection technologies, and strategic partnerships. Companies such as IBM, Palo Alto Networks, and Cisco Systems are focusing on integrating AI with automation to deliver comprehensive security solutions, while CrowdStrike and Darktrace lead with cutting-edge, AI-driven threat intelligence platforms. These companies hold significant market share through robust R&D initiatives, regional expansions, and solutions tailored to meet the evolving cybersecurity needs of various industries.

Cisco Systems, Inc. is a global technology leader specializing in networking hardware, software, and telecommunications equipment. Founded in 1984 and headquartered in San Jose, California, Cisco is renowned for its innovation in developing solutions that enable connectivity and digital transformation across various industries. The company’s core products and services include networking infrastructure, cybersecurity solutions, collaboration tools, and data center technologies. Cisco’s networking portfolio encompasses routers, switches, and wireless systems that form the backbone of modern internet and enterprise networks. In addition to hardware, Cisco offers a range of software solutions for network management, security, and cloud computing. Their cybersecurity offerings are designed to protect against evolving threats, ensuring the integrity and privacy of data across networks. Cisco is also a key player in the realm of collaboration technology, providing tools such as WebEx for video conferencing and teleconsultation, which are integral to remote work and virtual meetings. The company's focus on innovation, combined with its broad product and service portfolio, positions Cisco as a pivotal player in shaping the future of networking and communications technology.

Intel Corporation, an American multinational technology company, is engaged in the design and manufacturing of computer processors, chipsets, and various semiconductor components. Intel produces various products and services, including microprocessors, system-on-chip (SoC) products, chipsets, and memory and storage solutions. The company's processors are used in multiple devices, from personal computers and laptops to servers and data centers. Intel's chipsets connect processors and other components, while its memory and storage solutions include solid-state drives (SSDs) and other storage devices. In addition to its hardware products, Intel also offers a range of software and services. These include software development tools, operating systems, and security solutions. Intel also provides consulting and support services to help customers optimize their computing systems and applications. The company invests heavily in R&D to develop new technologies and improve its products. The company has also been at the forefront of several key technological advances in the industry, including developing the first microprocessor and introducing the x86 architecture, which has become the standard for most personal computers. It has also significantly contributed to advancing artificial intelligence and machine learning. The company has developed several specialized processors specifically designed for AI applications, such as the Intel Movidius Neural Compute Stick and the Intel Nervana Neural Network Processor. Intel has also invested in AI startups and has collaborated with universities and research institutions to advance the field of AI.

AI in Cybersecurity Market Development

October 2024: SentinelOne and AWS expanded their collaboration to enhance AI-driven cybersecurity, utilizing Amazon Bedrock for SentinelOne's Purple AI analyst and Singularity Platform.

September 2024: TCS collaborated with Google Cloud to introduce AI-powered cybersecurity solutions designed to effectively address advanced threats.

AI in Cybersecurity Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Identity & Access Management

- Risk & Compliance Management

- Data Loss Prevention

- Unified Threat Management

- Fraud Detection/ Anti-fraud

- Threat Intelligence

- Others

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Machine Learning

- Natural Language Processing

- Context-aware computing

By Offering Outlook (Revenue, USD Billion, 2020 - 2034)

- Hardware

- Software

- Services

By Vertical Outlook (Revenue, USD Billion, 2020 - 2034)

- BFSI

- Retail

- Government & Defence

- Manufacturing

- Enterprise

- Healthcare

- Automotive & Transportation

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI in Cybersecurity Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.40 billion |

|

Market Size Value in 2025 |

USD 31.38 billion |

|

Revenue Forecast in 2034 |

USD 219.53 billion |

|

CAGR |

24.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global AI in cybersecurity market size was valued at USD 25.40 billion in 2024 and is projected to grow to USD 219.53 billion by 2034.

• The global market is projected to grow at a CAGR of 24.1% during the forecast period.

• North America dominated the AI in cybersecurity market revenue in 2024.

• Some of the key players in the market are Acalvio Technologies Inc.; Amazon Web Services; Cylance Inc. (BlackBerry); Darktrace; FireEye Inc.; Fortinet; IBM Corporation; Intel Corporation; LexisNexis; Micron Technology Inc.; Palo Alto Networks; Cisco; Cyberark; Cybereason; Sumitomo Chemical Company.

• The network security segment dominated the AI in cybersecurity market expansion in 2024.