AI in Chemicals Market Size, Share, Trends, Industry Analysis Report – By Component; Business Application; End User, and By Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5109

- Base Year: 2023

- Historical Data: 2019-2022

Market Outlook

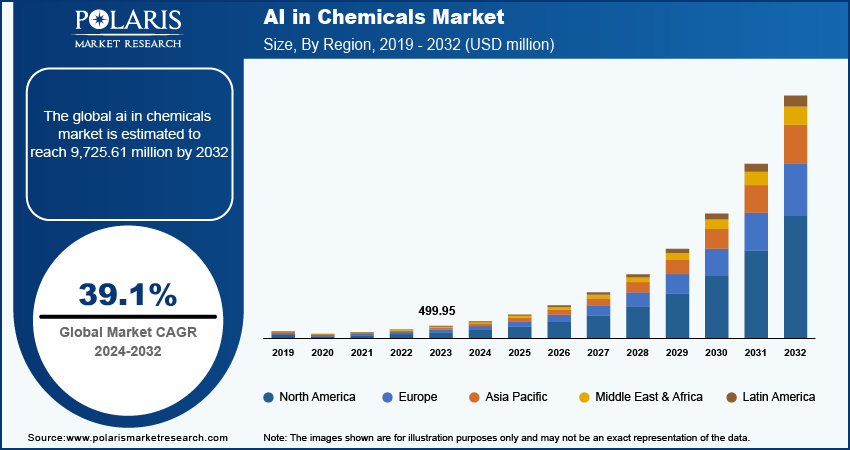

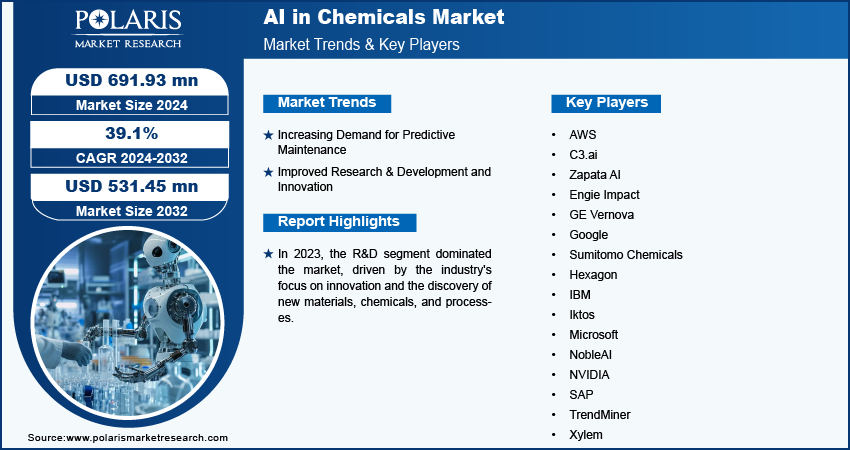

The AI in chemicals market size was valued at USD 499.95 million in 2023. The market is anticipated to grow from USD 691.93 million in 2024 to USD 9,725.61 million by 2032, exhibiting a CAGR of 39.1% during 2024 – 2032

Market Overview

The chemical industry is increasingly adopting advanced digital techniques which is driving the growing need for enhanced batch production scheduling. As the awareness of the benefits of AI solutions expands, more companies are integrating these technologies to optimize manufacturing processes, resulting in greater demand for reliable and efficient production methods. The chemical sector benefits from AI by enhancing product development, improving demand forecasting, and refining quality testing. AI applications like predictive maintenance, process optimization, virtual screening, and molecular modeling revolutionize chemical production, fostering a supportive environment for AI integration in the industry. Furthermore, the adoption of digital technology, such as Artificial Intelligence, in the chemical industry accelerates innovation and efficiency. Companies use AI for real-time monitoring, predictive maintenance, and process optimization, leading to more accurate forecasting and better decision-making. As the industry embraces these technologies, it becomes more agile, responsive, and capable of meeting the evolving demands of the market.

To Understand More About this Research:Request a Free Sample Report

Additionally, increased government spending on research and development in manufacturing process optimization will drive growth in the AI in chemicals market in the coming years as AI helps streamline operations, reduce costs, and enhance safety by providing advanced analytics and automation solutions. For instance, in 2019, NIST used AI for high-throughput data evaluation, which is critical to the chemical manufacturing enterprise. The project was aimed to improve the chemical manufacturing design process by providing optimal property value recommendations while enhancing transparency around data sources and reliability. Traditionally, engineers relied on handbooks and databases, which often lacked clarity on data trustworthiness, leading to costly errors in plant design. For example, a 10% error in vapor pressure calculations could double the size of distillation columns, significantly increasing capital investment.

The project leveraged artificial intelligence, machine learning, and quantum chemical computations to streamline data curation and improve property predictions. By automating labor-intensive tasks like data extraction from scientific literature and developing transfer learning methodologies has significantly boosted the efficiency of subject matter experts and improved the quality of chemical property data. Therefore, this initiative has ultimately reduced the manufacturing costs and environmental impacts.

Growth Drivers

Improved Research & Development and Innovation are Driving Market Growth

AI improve research and development by simulating chemical reactions, predicting outcomes, and analyzing complex datasets, which boosts the discovery of new materials, products, and processes. AI also analyzes vast amounts of experimental data to identify patterns and correlations, guiding the discovery of promising new materials. For instance, in July 2024, Imperial and BASF spinout SOLVE used AI and innovative experimental methods to transform chemical manufacturing digitally. The companies aimed to improve the production of drugs and fertilizers by gathering data on chemical reactions and using machine learning to predict optimal manufacturing methods. This technology is expected to make chemical production more sustainable, reduce waste, lower costs, and enhance supply chain resilience.

Increasing Demand for Predictive Maintenance are Driving Market Growth

The rising demand for AI in chemical industry enhances predictive maintenance by continuously analyzing equipment data to foresee potential failures before they happen. This proactive approach minimizes downtime, extends the lifespan of equipment, and reduces maintenance costs. For instance, Dow Chemical’s began implementing AI-driven predictive maintenance systems in 2020 to monitor their chemical processing equipment. By analyzing real-time data from sensors embedded in their machinery, AI algorithms can identify early signs of wear and performance irregularities. The technology, therefore, allows Dow to schedule maintenance just before equipment failures are likely to occur, moving away from a reactive, time-based maintenance approach. As a result, the company has reduced unexpected breakdowns, improved operational efficiency, and lowered maintenance costs. The introduced technology thus demonstrates the significant advantages of using AI for maintaining the reliability of critical machinery in the chemical industry.

Restraining Factors

High Cost of New Technologies

One of the primary challenges in adopting artificial intelligence (AI) in the chemical industry is the high cost associated with implementing new technologies. Integrating AI-driven systems necessitates substantial investments in advanced hardware, software, and infrastructure, including IoT sensors, data storage, and high-performance computing resources. In addition to the costs of technology, training specialized personnel to manage and interpret AI systems further contributes to the overall expense. For many chemical companies, particularly small to mid-sized enterprises, these initial costs can be prohibitively high.

Moreover, there is often uncertainty regarding the return on investment (ROI) during the early stages of AI implementation. Companies may need time to realize significant cost savings or efficiency improvements, lead to reluctance in replacing existing systems with newer, more expensive technologies. As a result, this financial burden can slow the widespread adoption of AI within the industry.

AI in Chemicals Market - Segment Insights

AI in Chemicals Market, By Component

The global AI in Chemicals market segmentation, based on components, includes hardware, software, and services. In 2023, the software segment dominated the market due to its critical role in enabling AI-driven innovations across various processes in the industry. Software solutions are essential for optimizing chemical reactions, predicting material properties, and improving laboratory management. Furthermore, AI software enables data-driven decision-making, enhancing operational efficiency, and accelerating research and development efforts. The growing adoption of machine learning, deep learning, and advanced analytics is driving demand for such software. Additionally, cloud-based deployment provides scalability, cost efficiency, and easy access to real-time data. Therefore, the transformative capabilities of AI software position it as a leading component in the market.

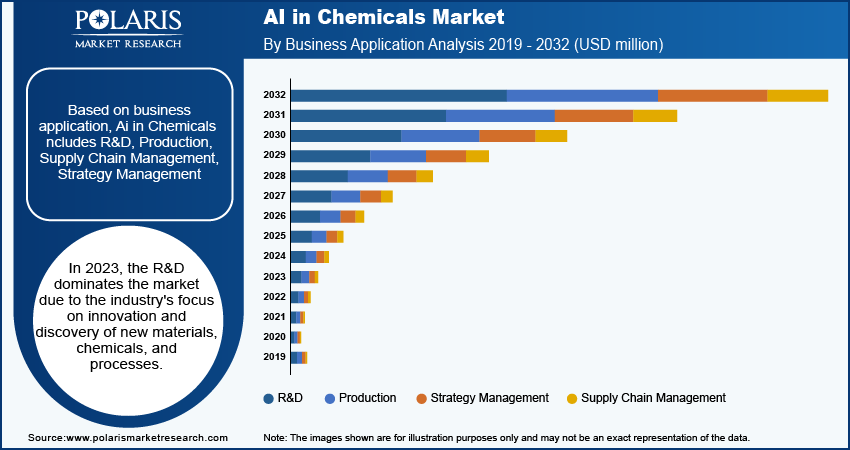

AI in Chemicals Market, By Business Application

The global AI in Chemicals market segmentation, based on business application, includes production, R&D, and supply chain management, strategy management. In 2023, the R&D segment dominated the market, driven by the industry's focus on innovation and the discovery of new materials, chemicals, and processes. AI played a crucial role in accelerating R&D by enabling advanced simulations of chemical reactions, predicting material properties, and analyzing vast datasets. Additionally, AI tools such as machine learning, deep learning, and chemical modeling software helped reduce the time and cost of experimentation, leading to faster product development. Companies are continuously investing in AI-driven R&D to bring new products to market more quickly and improve research capabilities, as a result, R&D became the leading business application for AI in the chemicals market.

AI in Chemicals Market, By End User

The global AI in Chemicals market segmentation, based on end user, includes basic chemicals, active ingredients, green & biochemical, advance materials, paints & coatings, adhesive & sealants, water treatment & services, other end users. In 2023, the basic chemicals segment dominated the market due to growing demand for products such as petrochemicals, fertilizers, and polymers, which form the foundation of numerous industries, making their production highly crucial and large-scale. AI technologies, such as machine learning, predictive analytics, and autonomous systems, are transforming traditional manufacturing processes and operational strategies; by implementing predictive maintenance algorithms, companies have achieved significant benefits. These algorithms continuously analyze real-time data from equipment sensors, including temperature, vibration, and pressure, to detect early signs of potential failures. Moreover, the proactive approach enables refineries to anticipate and address issues before they result in equipment breakdowns or unplanned downtime. Therefore, the end-user segment remained a dominant force in the AI in chemicals market in 2023.

Regional Insights

North America Held Largest Share of Global AI in Chemicals Market in 2023

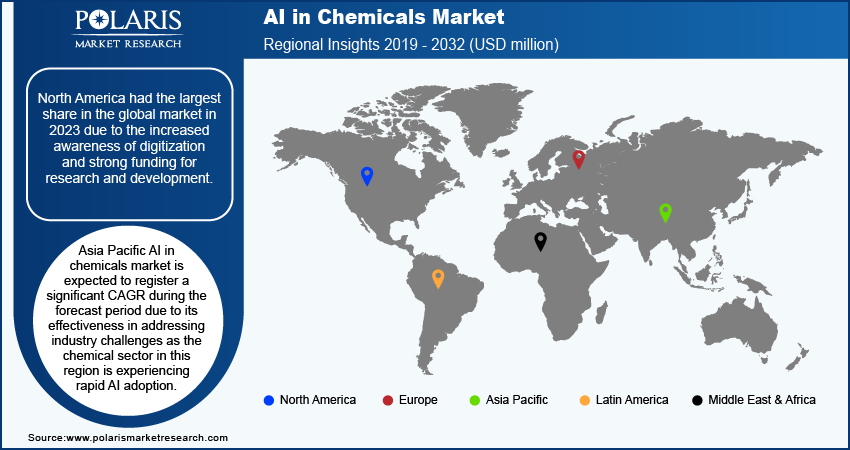

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2023, North America dominated the AI in chemicals market, driven by increased awareness of digitization and strong funding for research and development. Government support has promoted confidence in AI-based processes, contributing to this leadership. Despite recent declines in investment levels, the United States remains the global leader in AI financing, holding the top position in transaction share and overall funding within the industry.

A notable development occurred in March 2024 when Standard Industries, a manufacturer of specialty chemicals, launched a $1 million AI Challenge. The initiative aimed to transform the creation of fine chemicals by streamlining and optimizing the labor-intensive process of chemical retrosynthesis, which currently relies heavily on manual analysis and trial and error. Such efforts reflect the ongoing commitment to leveraging AI technologies to enhance efficiency in the chemical sector.

The Asia Pacific AI in chemicals market is projected to register a significant compound annual growth rate (CAGR) during the forecast period, driven by rapid AI adoption in the chemical sector. The growth is expected largely due to the effectiveness of AI technologies in addressing industry challenges, such as optimizing manufacturing processes, predicting equipment failures, and enhancing product quality. Moreover, the rising demand for chemicals in the region further fuels the need for increased efficiency and innovation, prompting companies to embrace AI-driven approaches to stay competitive.

Key Market Players and Competitive Insights

Strategic Partnerships to Drive Competition

The competitive landscape of the AI in chemical market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as AWS, C3.ai, Engie Impact, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of products. These companies are focusing on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of the industry. These major players utilize AI to enhance operational efficiencies and develop new chemical compounds. Collaborations between chemical companies and AI technology providers drives innovation, accelerating AI adoption specially in chemical industry. Competitive strategies often include mergers and acquisitions, Major players include AWS, C3.ai, Engie Impact, Zapata AI, Sumitomo Chemical Co., GE Vernova, Google, Hexagon, IBM, Iktos, Microsoft, NobleAI, NVIDIA, SAP, Nexocode, Sandbox, Deepmatter, Zapata AI, Chemical.Ai, TrendMiner, Xylem (US). Sumitomo Chemical Co., Ltd. is a major Japanese chemical company, based in Tokyo, Japan has developed an in-house generative AI service called "ChatSCC," available to its 6,500 employees. It aims to boost productivity, enhance competitiveness, and facilitate the effective use of proprietary data. The tool features robust security measures and has shown a 50% improvement in operational efficiency during chemical testing. The company plans to expand its use and link proprietary data to the service in the future to further improve operational efficiency.

Zapata Computing Holdings Inc., also known as Zapata AI, operates as an industrial generative artificial intelligence (AI) software company in the United States. In June 2024, the company joined the KT Consortium to help transform chemical engineering processes using generative AI.

As a member of the consortium, Zapata AI will collaborate directly with leading chemical and biochemical manufacturers. The partnership aims to leverage Zapata AI's expertise in optimization, virtual sensors, predictive modelling, and generative AI capabilities to accelerate the development and manufacturing of chemical compounds at scale.

Major Players Operating in Global AI in Chemicals Market

- AWS

- C3.ai

- Zapata AI

- Engie Impact

- GE Vernova

- Sumitomo Chemicals

- Hexagon

- IBM

- Iktos

- Microsoft

- NobleAI

- NVIDIA

- SAP

- TrendMiner

- Xylem

Recent Developments in Industry

In September 2024, Entalpic raised €8.5 million to pioneer AI solutions for decarbonizing industrial chemistry, to generate and evaluate new materials and molecules that could replace outdated industrial chemical processes.

In May 2023, Mitsui Chemicals, Inc. and IBM started verifying to assess agility and accuracy in discovering new applications of Mitsui Chemicals products by combining Generative Pre-trained Transformer (GPT) (*1), a generative AI, with IBM Watson (*2) Discovery. This initiative aims to expand top line (sales) and revenue share of Mitsui Chemicals products by advancing digital transformation in the business domain.

In September 2023, NobleAI launched AI-powered chemical and materials informatics solutions on Microsoft's Azure Marketplace. By offering its unique, science-based AI technology and the user-friendly Reactor platform, NobleAI aims to reach a broader customer base, helping them accelerate product development in an increasingly competitive market.

Report Segmentation

The AI in chemicals market is primarily segmented on the basis of component (hardware, software (by type, by technology, by deployment), business application, end user, and by region.

AI in Chemicals Market, By Component (2019-2032 (USD million)

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- By Type

- Dashboard & Analytics Tools

- Process Simulation Software

- Chemical Modeling Software

- Laboratory Management Software

- Virtual Screening Tools

- Chemical Property Prediction Tools

- By Technology

- ML

- Deep Learning

- Generative AI

- NLP

- Computer Vision

- Advanced Analytics

- By Deployment Mode

- Cloud

- On-Premises

- By Type

- Services

- Professional Services

- Consulting Services

- Deployment Services

- Support & Maintenance

- Managed Services

AI in Chemicals Market, By Business Application (2019-2032 (USD million)

- R&D

- Production

- Supply Chain Management

- Strategy Management

AI in Chemicals Market, By End User (2019-2032 (USD million)

- Basic Chemicals

- Advance Materials

- Active Ingredients

- Green & Biochemicals

- Paints & Coatings

- Adhesive & Sealants

- Water Treatment & Services

- Other End Users

AI in Chemicals Market, By Region Outlook (2019-2032 (USD million)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Coverage

The AI in chemicals market report emphasizes key regions across the world to provide better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, technology, deployment mode, application, end user, and their futuristic growth opportunities.

AI in Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 691.93 million |

|

Revenue forecast in 2032 |

USD 9,725.61 million |

|

CAGR |

39.1% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The AI in chemicals market size was valued at USD 499.95 million in 2023 and is projected to grow to USD 9725.61 million by 2032.

The global market is projected to grow at a CAGR of 39.1% during the forecast period.

North America held the largest share in the global market in the year 2023 due to the increased awareness of digitization and strong funding for research and development.

The key players in the market include AWS, C3.ai, Engie Impact, Zapata AI, Sumitomo Chemical Co., GE Vernova, Google, Hexagon, IBM, Iktos, Microsoft, NobleAI, NVIDIA, SAP, Nexocode, Sandbox, Deepmatter, Zapata AI, Chemical.Ai, TrendMiner, Xylem (US).

The basic chemicals category dominated the market in 2023 due to growing demand for products like petrochemicals, fertilizers, and polymers that form the foundation of numerous industries which makes their production highly crucial and large-scale.