Agriculture and Farm Equipment Market Size, Share, Trends, Industry Analysis Report: By Product (Tractors, Combine Harvesters, Forage Harvesters, Planting Equipment, Irrigation & Crop Processing Equipment, and Spraying Equipment), Application, Automation, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1080

- Base Year: 2024

- Historical Data: 2020-2023

Agriculture and Farm Equipment Market Overview:

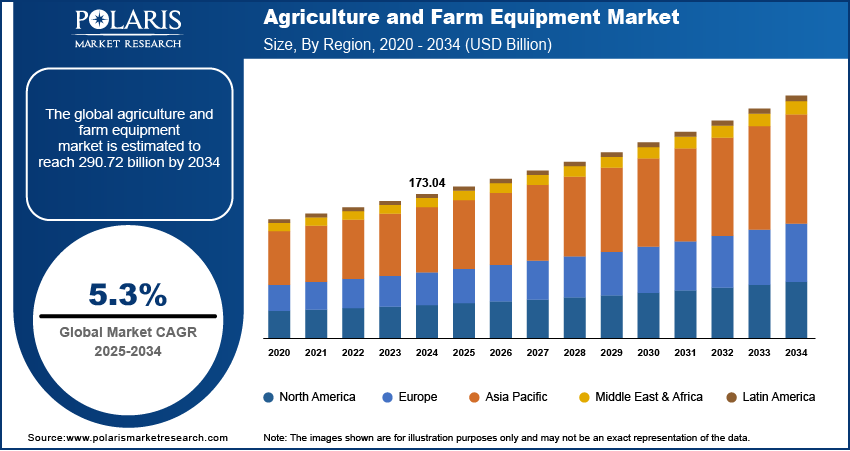

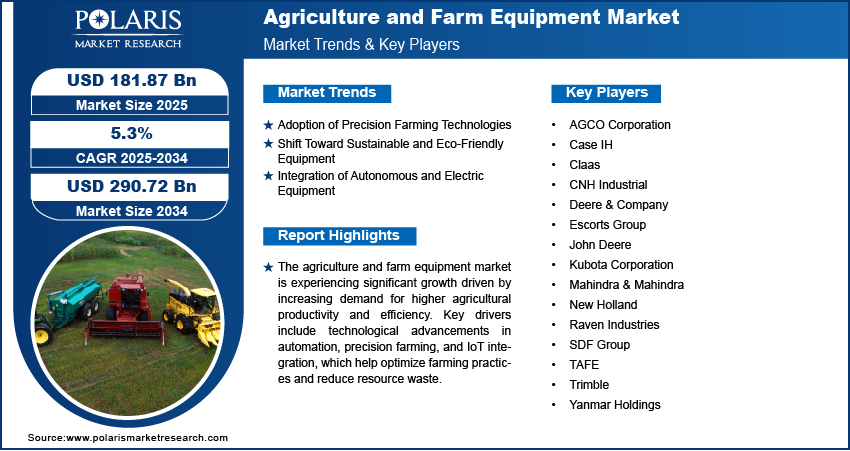

The agriculture and farm equipment market size was valued at USD 173.04 billion in 2024. The market is projected to grow from USD 181.87 billion in 2025 to USD 290.72 billion by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

The agriculture and farm equipment market includes a range of machinery and tools used in farming and agricultural operations, such as tractors, harvesters, plows, and irrigation systems. Factors such as technological advancements in automation, rising focus on precision farming, and the increasing requirement for food production due to the growing global population boost the market development. Trends such as the adoption of smart farming techniques, use of electric and autonomous vehicles, and the shift toward sustainable farming practices are contributing to the agriculture and farm equipment market growth. Additionally, government initiatives supporting agriculture modernization and the need for improved crop yields are expected to further propel the market demand.

To Understand More About this Research: Request a Free Sample Report

Agriculture and Farm Equipment Market Dynamics

Adoption of Precision Farming Technologies

Precision farming technologies are becoming increasingly popular in the agriculture sector as they allow farmers to optimize their crop yields through data-driven practices. This includes the use of GPS, sensors, and IoT-enabled devices to monitor soil conditions, weather patterns, and crop health. These technologies help in reducing resource waste, improving efficiency, and lowering operational costs. In addition, machine learning algorithms assist farmers in making real-time decisions. Hence, the rising adoption of precision farming technologies drives the agriculture and farm equipment market demand.

Shift Toward Sustainable and Eco-Friendly Equipment

Sustainability has become a key focus in the agriculture and farm equipment market, with increasing pressure on the industry to adopt eco-friendly practices. Manufacturers are developing equipment that reduces environmental impact, such as electric tractors, low-emission engines, and energy-efficient machinery. This trend is largely driven by both regulatory requirements and consumer demand for environmentally responsible farming. A report by the Environmental Protection Agency (EPA) highlights that in the US, agricultural equipment accounts for a significant portion of greenhouse gas emissions, prompting the need for cleaner technologies. The use of electric and hybrid equipment is gaining traction, with companies such as John Deere and Kubota making investments to develop and deploy more sustainable machines. Thus, the increasing shift toward sustainable and eco-friendly equipment is expected to boost the agriculture and farm equipment market growth during the forecast period.

Integration of Autonomous and Electric Equipment

Autonomous machinery, such as self-driving tractors and harvesters, help address concerns related to labor shortages and improve operational efficiency. Electric tractors and farm machinery, offering reduced operating costs and lower emissions, are also gaining attention as the agricultural sector increasingly looks for alternative energy sources. According to a study by the National Renewable Energy Laboratory (NREL), electric farm equipment could reduce fuel costs by up to 50%, which is appealing to farmers looking to cut operating expenses. The trend towards automation and electrification is expected to continue, with several major manufacturers working on prototypes and launching new models aimed at enhancing productivity and reducing environmental impact. Therefore, the integration of autonomous and electric equipment is projected to fuel the agriculture and farm equipment market development in the coming years.

Agriculture and Farm Equipment Market Segment Insights

Agriculture and Farm Equipment Market Outlook – Product-Based Insights

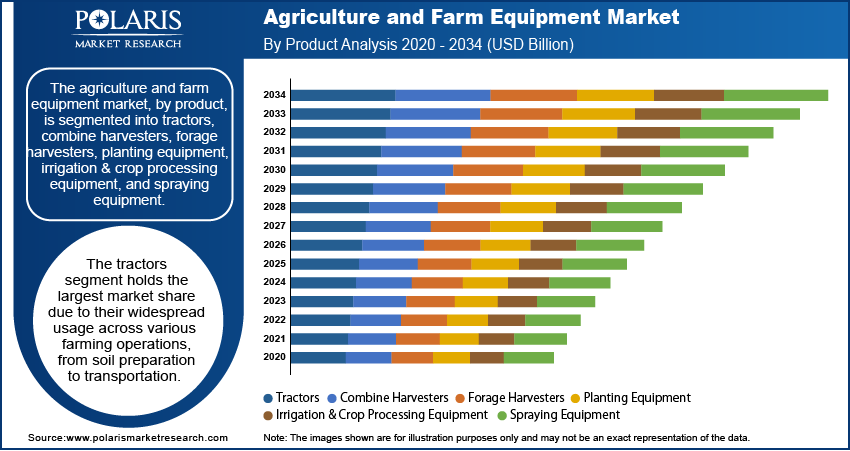

The agriculture and farm equipment market, by product, is segmented into tractors, combine harvesters, forage harvesters, planting equipment, irrigation & crop processing equipment, and spraying equipment. Each product plays a critical role in modern agricultural practices. The tractors segment holds the largest market share due to their widespread usage across various farming operations, from soil preparation to transportation. Tractors are essential for providing power to various other equipment, thus driving demand across different regions. Combine harvesters also represent a significant segment, with increasing adoption in large-scale farming operations that require efficient harvesting. The harvesters are witnessing consistent demand, especially in countries with large-scale cereal and grain farming. Demand for irrigation and crop processing equipment is growing rapidly, driven by the rising need for efficient water management solutions and post-harvest processing to meet the increasing food demand.

The planting equipment segment, which includes seeders and planters, is also gaining traction, largely due to the advancement in precision farming technologies and automation. The spraying equipment segment is experiencing robust growth, driven by increased use of crop protection products such as pesticides and fertilizers, particularly with the rise in integrated pest management practices. The tractors and combine harvesters segments lead the agriculture and farm equipment market share, whereas planting and irrigation equipment are registering the highest growth rates, driven by technological advancements and increasing focus on sustainability and yield optimization. This shift is reflective of the growing trend toward precision agriculture and sustainable farming practices, where efficiency and resource management are prioritized.

Agriculture and Farm Equipment Market Assessment – Application Insights

By application, the agriculture and farm equipment market is segmented into land development & seed bed preparation, sowing & planting, weed cultivation, plant protection, and others. The land development and seed bed preparation segment hold the largest share of the agriculture and farm equipment market revenue. This is primarily due to the extensive use of tractors, plows, harrows, and leveling equipment for soil preparation before planting. The demand for mechanized land preparation is driven by the need to improve soil structure, enhance water retention, and ensure uniform seed germination. Additionally, government subsidies and initiatives promoting farm mechanization in emerging economies contribute to the dominance of this segment. The adoption of advanced technologies, such as laser land leveling and automated tillage equipment, is also enhancing efficiency and productivity in this segment.

The sowing and planting segment is registering the highest growth, driven by the increasing adoption of precision planting technologies and automated seeding equipment. The integration of GPS-enabled seeders and variable-rate planting systems is improving crop yield by ensuring optimal seed distribution and depth. Additionally, rising concerns over seed wastage and the need for cost-efficient planting solutions are encouraging farmers to shift from traditional methods to advanced mechanized equipment. The growing demand for high-value crops and the expansion of large-scale commercial farming are also contributing to the accelerated growth of this segment.

Agriculture and Farm Equipment Market Regional Analysis

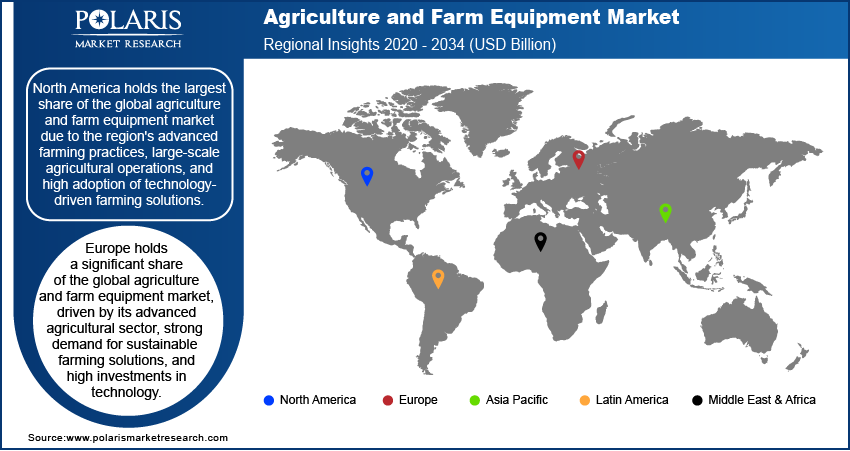

By region, the study provides agriculture and farm equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global market due to the region's advanced farming practices, large-scale agricultural operations, and high adoption of technology-driven farming solutions. The US, in particular, benefits from a well-established agricultural infrastructure, substantial investments in modern farming equipment, and government incentives for sustainable agriculture. Precision farming and automation technologies are widely adopted, contributing to the region's dominance. Europe also holds a significant share, driven by the demand for sustainable and eco-friendly farming practices, while the Asia Pacific market is registering the highest growth, propelled by the increasing agricultural output in countries such as China and India, which are focusing on mechanization to meet growing food demands. The markets in Latin America and the Middle East & Africa are experiencing moderate growth, driven by improvements in farming techniques and expanding agricultural sectors.

Europe holds a significant share of the global agriculture and farm equipment market, driven by its advanced agricultural sector, strong demand for sustainable farming solutions, and high investments in technology. The region is increasingly adopting precision farming and eco-friendly equipment due to strict environmental regulations and a push toward reducing carbon emissions. Key countries such as Germany, France, and the UK are prominent markets with a high level of mechanization in farming. The growing focus on organic farming and the shift toward more efficient irrigation and planting equipment are further supporting market growth. Additionally, the EU's agricultural policies and subsidies for sustainable practices continue to drive demand for modern equipment.

The Asia Pacific agriculture and farm equipment market is witnessing the highest growth, primarily due to the increasing mechanization of agriculture in emerging economies such as China, India, and Southeast Asian countries. The need for efficient farming techniques to meet the rising food demand, driven by a growing population, is pushing the adoption of advanced machinery. While traditionally labor-intensive, countries in the region are shifting toward automated and precision farming equipment to enhance productivity and reduce costs. Government initiatives aimed at improving agricultural output, alongside investments in irrigation and crop processing equipment, are accelerating the adoption of modern farming solutions. Additionally, the increasing focus on sustainability and water management is contributing to the Asia Pacific agriculture and farm equipment market expansion.

Agriculture and Farm Equipment Market – Key Market Players and Competitive Insights

A few key players in the agriculture and farm equipment market are John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, and Case IH. Other notable companies are Mahindra & Mahindra, Claas, Escorts Group, SDF Group, and Yanmar Holdings. Companies such as Trimble, Raven Industries, and Deere & Company focus on precision farming solutions, integrating GPS, sensors, and automation into agricultural equipment. Additionally, companies such as TAFE, New Holland, and Argo Tractors are expanding their product portfolios to include advanced machinery tailored to meet the diverse needs of the agricultural sector. Companies such as Kubota and CLAAS are also making significant strides in the electric and autonomous farming equipment space. Many of these companies have established themselves in the market with robust global distribution networks and innovation in product development.

The competitive landscape of the agriculture and farm equipment market is shaped by a mix of established players and emerging companies focusing on innovation and technological advancements. Companies such as John Deere and AGCO Corporation dominate the market with their extensive product offerings and consistent focus on technological integration, particularly in precision farming. These companies compete by enhancing their products with features that improve efficiency, sustainability, and ease of use, often integrating smart farming solutions. At the same time, companies such as Mahindra & Mahindra and Kubota are growing their market share by offering cost-effective solutions targeted at smaller and mid-scale farmers in developing economies.

Despite the strong competition, the agriculture and farm equipment market is witnessing new entrants and partnerships, with technology firms collaborating with traditional equipment manufacturers to push forward innovations such as autonomous machinery and electric-powered equipment. This is creating an increasingly fragmented market where companies need to balance cost, technology adoption, and sustainability. Players are investing in research and development to stay competitive, particularly in autonomous solutions and eco-friendly products. Moreover, regional factors play a role in competition, as companies adapt their offerings to meet the specific demands of different markets, such as those seen in North America, Europe, and Asia Pacific.

John Deere is a well-known company in the agriculture and farm equipment market, with a wide range of products that include tractors, combine harvesters, and precision farming tools. The company has a strong presence globally and is focused on providing equipment that improves productivity and efficiency for farmers. John Deere continues to innovate, particularly in the field of automation and smart farming, by integrating technology into its machines to assist farmers in making data-driven decisions.

AGCO Corporation, another major player in the market, offers a diverse range of agricultural equipment, including tractors, combine harvesters, and planting equipment. AGCO operates in several regions, including North America, Europe, and Asia, and is known for its focus on providing high-quality equipment and solutions tailored to the needs of modern agriculture. The company has recently been investing in technology to improve its product offerings, such as introducing the Fendt 1000 Vario tractor, which is designed for large-scale and precision farming.

List of Key Companies in Agriculture and Farm Equipment Market

- AGCO Corporation

- Case IH

- Claas

- CNH Industrial

- Deere & Company

- Escorts Group

- John Deere

- Kubota Corporation

- Mahindra & Mahindra

- New Holland

- Raven Industries

- SDF Group

- TAFE

- Trimble

- Yanmar Holdings

Agriculture and Farm Equipment Industry Developments

- In October 2024, John Deere announced the launch of its new autonomous tractor, which is designed to help farmers reduce labor costs and increase operational efficiency.

- In September 2024, AGCO acquired Trimble Inc., a company focused on advanced robotics, further expanding its capabilities in automation within the agriculture sector.

Agriculture and Farm Equipment Market Segmentation

By Product Outlook

- Tractors

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Irrigation & Crop Processing Equipment

- Spraying Equipment

By Application Outlook

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Others

By Automation Outlook

- Automatic

- Semi-automatic

- Manual

By End User Outlook

- Original Equipment Manufacturers (OEMs)

- Aftersales

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agriculture and Farm Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 173.04 billion |

|

Market Size Value in 2025 |

USD 181.87 billion |

|

Revenue Forecast by 2034 |

USD 290.72 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The agriculture and farm equipment market has been broadly segmented on the basis of products, application, automation, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The agriculture and farm equipment market growth and marketing strategies are centered around technological innovation, regional expansion, and product diversification. Companies are increasingly focusing on integrating precision farming solutions, automation, and sustainability features into their products to meet the evolving needs of modern agriculture. Strategic partnerships and acquisitions are also common, allowing players to enhance their technological capabilities and expand their market reach. Additionally, manufacturers are targeting emerging markets in Asia Pacific and Latin America, where the adoption of mechanized farming is increasing. Digital marketing, along with direct sales channels, is being used to effectively reach both large-scale commercial farmers and smaller, regional operations.

FAQ's

? The market size was valued at USD 173.04 billion in 2024 and is projected to grow to USD 290.72 billion by 2034.

? The market is projected to register a CAGR of 5.3% during the forecast period.

? North America had the largest share of the market in 2024.

? A few key players in the agriculture and farm equipment market include John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, and Case IH. Other notable companies are Mahindra & Mahindra, Claas, Escorts Group, SDF Group, and Yanmar Holdings.

? The tractors segment accounted for the largest share of the market in 2024.

? Agriculture and farm equipment refers to the machinery, tools, and devices used in farming and agricultural operations to increase productivity and efficiency. This equipment includes a wide range of products such as tractors, combine harvesters, plows, seeders, irrigation systems, crop processing machinery, and spraying equipment. These tools help in various tasks, including planting, harvesting, soil preparation, irrigation, and pest control. The use of agriculture and farm equipment allows farmers to optimize their operations, reduce labor costs, and improve crop yields, contributing to more efficient and sustainable farming practices.

? A few key agriculture and farm equipment market trends are described below: Adoption of Precision Farming: Increasing use of GPS, sensors, and data analytics to optimize farming practices and improve yields. Automation and Autonomous Equipment: Growing demand for self-driving tractors, harvesters, and drones to reduce labor costs and enhance operational efficiency. Sustainability and Eco-Friendly Solutions: Focus on developing energy-efficient and low-emission equipment, including electric tractors and machinery. Integration of IoT and Smart Technology: Enhanced connectivity in farm equipment for real-time monitoring, data collection, and decision-making.

? A new company entering the agriculture and farm equipment market should focus on innovation, particularly in precision farming technologies, automation, and sustainability. Emphasizing the development of smart, connected equipment that integrates IoT and data analytics can provide a competitive edge by offering efficiency and real-time decision-making capabilities. Additionally, the company could invest in creating energy-efficient and environmentally friendly solutions, such as electric or hybrid-powered machinery, to align with the growing demand for sustainable farming practices. Targeting emerging markets with cost-effective yet advanced equipment tailored to local needs can also help gain traction in regions experiencing rapid agricultural mechanization.

? Companies manufacturing, distributing, or purchasing agriculture and farm equipment and related products, and other consulting firms must buy the report.