Agriculture Analytics Market Size, Share, Trends, Industry Analysis Report

: By Offering (Solutions and Services), Agriculture Type, Farm Size, Technology, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1651

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

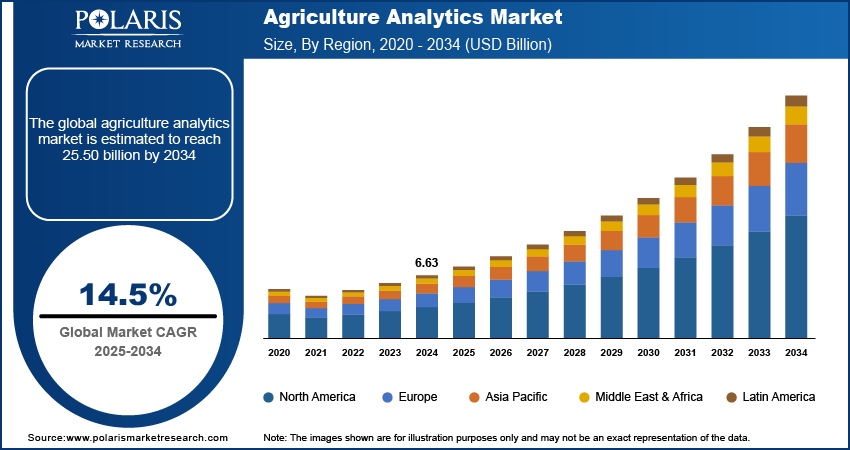

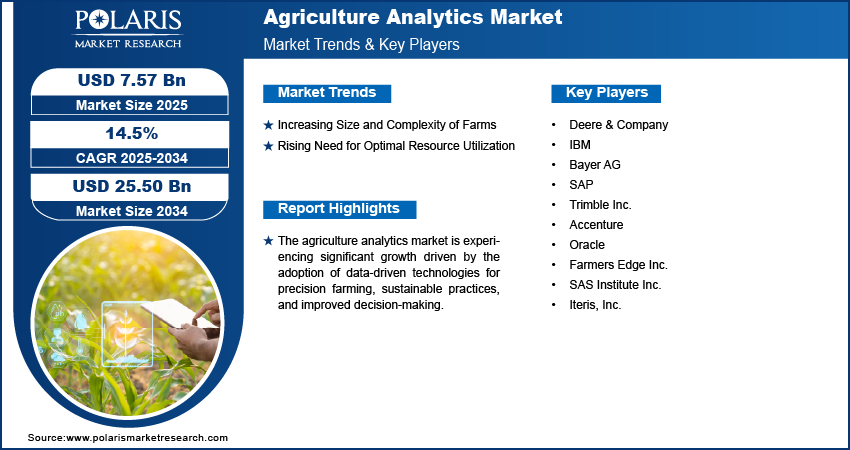

The agriculture analytics market size was valued at USD 6.63 billion in 2024 and is projected to grow at a CAGR of 14.5% during the forecast period. The market growth is primarily fueled by technological advancements and the growing need for sustainable farming solutions.

Key Insights

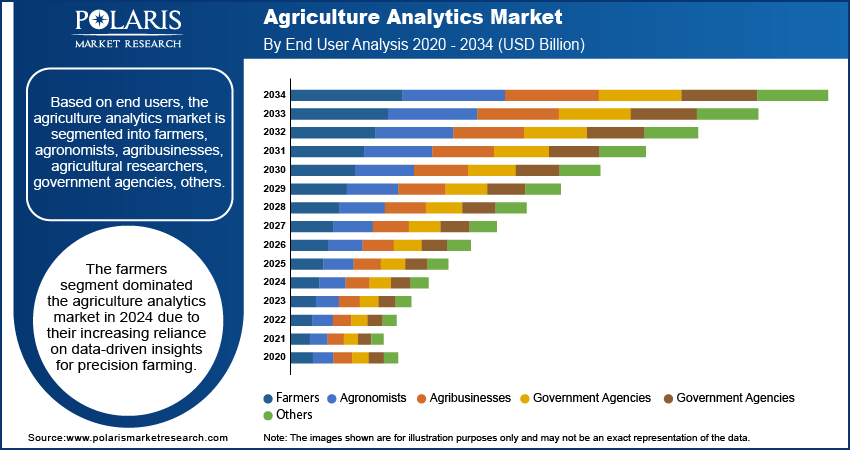

- The farmers segment led the market in 2024. The segment’s dominance is primarily attributed to the growing reliance of farmers on data-driven insights for precision farming.

- The remote sensing and satellite imagery segment is projected to register the fastest growth during the projection period, owing to its ability to provide large-scale, precise, and real-time data.

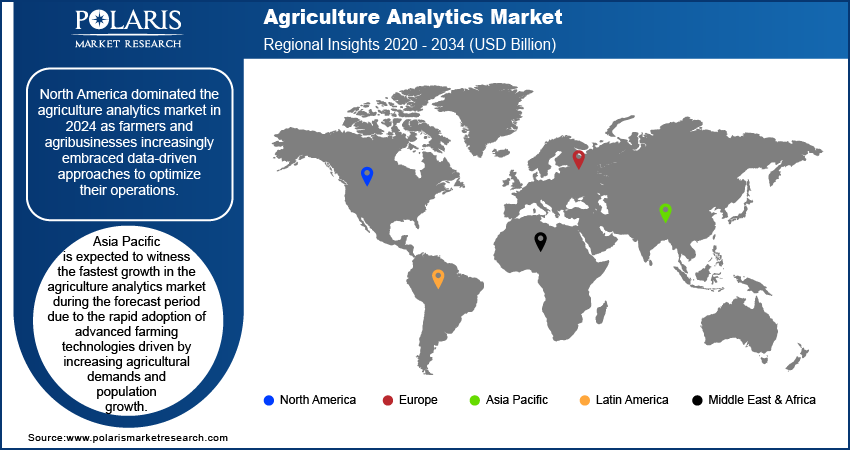

- North America led the global market in 2024. This is primarily because farmers and agribusinesses in North America are increasingly embracing data-driven approaches for optimizing their operations.

- Asia Pacific is anticipated to witness the fastest growth during the forecast period. The increased adoption of advanced farming technologies, fueled by population growth and rising agricultural demands, contributes to the regional market growth.

Industry Insights

- The growing size and complexity of farms have created a greater need for advanced solutions for managing large-scale operations. This, in turn, is fueling market growth.

- The rising emphasis on optimizing resource allocation in agriculture, fueled by increased global population and the pressures of climate change, is driving market expansion.

- The rising need for sustainable farming practices is anticipated to provide several opportunities in the coming years.

- High costs associated with data collection and analysis may present challenges to market development.

Market Statistics

2024 Market Size: USD 6.63 billion

2034 Projected Market Size: USD 25.50 billion

CAGR (2025-2034): 14.5%

North America: Largest Market in 2024

AI Impact on Agriculture Analytics Market

- AI analyzes satellite imagery, sensor data, and weather patterns to deliver precise, real-time insights for crop management.

- Machine learning models predict yield outcomes and detect early signs of disease or pest infestations, enabling timely interventions.

- AI-driven analytics optimize irrigation, fertilizer use, and resource allocation, reducing costs and improving sustainability.

- Integration of AI supports market forecasting, helping farmers and agribusinesses make better pricing and distribution decisions.

To Understand More About this Research: Request a Free Sample Report

Agriculture analytics refers to the application of data analytics and advanced technologies such as Artificial Intelligence, machine learning, and IoT to optimize farming operations, improve crop yields, and manage resources efficiently. It helps stakeholders make data-driven decisions to address challenges such as climate change, pest control, and sustainable farming practices.

The agriculture analytics market demand is expanding due to advancements in technology and the increasing need for sustainable farming solutions. It integrates AI, IoT, machine learning, and big data analytics to provide actionable insights for optimizing crop yields, water usage, and insect pest control. The rising adoption of precision farming and smart agricultural practices is driving market expansion. The key applications include monitoring soil health, weather forecasting, and enhancing supply chain efficiency. Additionally, growing investments in agri-tech startups and supportive government policies worldwide are further fostering market growth.

For instance, a report published in July 2024 by the Ministry of Agriculture & Farmers Welfare highlighted that the government launched a USD 90 billion agri fund for startups & rural enterprises (AgriSURE) to support agripreneurs and agri-startups. The fund will provide equity and debt investments for high-risk agricultural activities, focusing on farm value chains, farmer's producer organizations (FPOs), rural infrastructure, and technological innovations. The launch also included the AgriSURE Greenathon 2024, a hackathon tackling challenges such as high-tech costs and agri-waste. This dynamic market is anticipated to see robust growth, particularly in regions with large-scale agricultural activities and increasing digital transformation in farming practices.

Market Dynamics

Increasing Size and Complexity of Farms

The increasing size and complexity of farms are driving the market as they create a need for more advanced solutions to manage large-scale operations. Farmers face challenges related to resource optimization, crop monitoring, and yield prediction as farms expand. Agriculture analytics tools help in efficiently managing vast amounts of data, enabling better decision making through real-time insights. These technologies support precision farming, which enhances productivity, reduces waste, and improves profitability.

For instance, in July 2024, Cropin Technology launched Sage, a real-time agri-intelligence solution powered by Google Gemini. Sage provides data on agriculture, crops, irrigation, climate, and soil using a grid-based map. It leverages AI, climate data, and crop models to forecast yields and optimize production. The platform assists businesses and governments in improving food production and supply chains, initially focusing on 13 key crops covering 80% of global food demand. Additionally, the growing complexity also drives the demand for refined data analytics, further boosting the agriculture analytics market growth.

Rising Need for Optimal Resource Utilization

The rising need for optimal resource utilization in agriculture is driven by the increasing demand for food due to global population growth, limited arable land, and the pressures of climate change. Efficient use of resources such as water, liquid fertilizers, and labor is crucial for enhancing crop yields while minimizing waste and environmental impact. Advanced technologies like agriculture analytics, Internet of Things (IoT) sensors, and precision farming tools enable real-time data collection, allowing farmers to make informed decisions about resource allocation. This improves productivity, reduces operational costs, and promotes sustainability. The need for optimal resource use is further emphasized by the growing focus on reducing the carbon footprint and maintaining soil health, contributing to sustainable agricultural practices.

Furthermore, one of the another major drivers of the agriculture analytics market is the growing need for data driven decision making in farming. Farmers are leveraging advanced technologies such as IoT, satellite imagery, and AI to optimize crop yields and reduce costs with the increasing adoption of precision agriculture. For instance, in May 2022, FarmQA collaborated with Planet Labs PBC to integrate near-daily satellite imagery into its platform. This partnership enabled growers and consultants to track crop health, identify issues, and optimize farming practices, fostering precision agriculture. The satellite imagery is accessible offline through FarmQA’s mobile and web applications, facilitating targeted field analysis and improved crop management. Additionally, the availability of real-time data allows for more accurate forecasting and risk management, enhancing productivity and sustainability. The rising demand for food security, along with government initiatives supporting digital transformation in agriculture, further accelerates market growth. As a result, agriculture analytics is becoming an essential tool for improving farm efficiency and profitability.

Segment Analysis

Market Assessment by End Users Outlook

The global agriculture analytics market segmentation, based on end users, includes farmers, agronomists, agribusinesses, agricultural researchers, government agencies, and others (insurance assessors, drone services, consumers, and consumer organizations). The farmers segment dominated the market in 2024 due to their increasing reliance on data-driven insights for precision farming. Farmers adopted advanced tools to monitor crop health, optimize resource usage, and improve yield quality in response to rising food demand and the need to address environmental concerns. The affordability and accessibility of analytics solutions, combined with government subsidies and initiatives promoting digital transformation in agriculture, further drove adoption among farmers. Additionally, real-time data from IoT devices, satellite imagery, and weather forecasts enabled better decision-making, reducing risks and enhancing productivity. These factors collectively positioned farmers as the largest end user group in the market.

Market Evaluation by Technology Outlook

The global agriculture analytics market segmentation, based on technology, includes remote sensing and satellite imagery, geographic information system, robotics and automation, big data and cloud computing, visualization and reporting, blockchain technology, and others (mobile applications, internet of things (IoT), and machine learning and AI). The remote sensing and satellite imagery segment is expected to witness the fastest growth in the market due to its ability to provide precise, large-scale, and real-time data. This technology enables farmers to monitor crop health, soil conditions, and weather patterns efficiently, driving better decision-making. Advances in satellite technology, such as higher resolution imagery and improved data processing capabilities, further fuel adoption. Additionally, the integration of remote sensing with AI and machine learning improves predictive analytics, supporting sustainable agricultural practices. The rising focus on maximizing yield and minimizing resource wastage also contributes to the rapid agriculture analytics market growth.

Market Share Regional Insights

By region, the study provides agriculture analytics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 as farmers and agribusinesses increasingly embraced data-driven approaches to optimize their operations. Advanced analytics tools enabled precise monitoring of crop performance, soil health, and weather conditions, leading to improved decision-making and resource efficiency. The region’s strong digital infrastructure and the availability of advanced technologies, such as AI and IoT, further supported this growth. Additionally, the focus on sustainable farming practices and government incentives promoting precision agriculture contributed to widespread adoption. For instance, a report published by the US Department of Agriculture highlighted that in September 2022, Secretary Vilsack announced an investment of up to $2.8 billion in 70 projects under the Partnerships for Climate-Smart Commodities funding initiative. In December 2022, an additional $325 million was allocated to 71 more projects to support farmers, ranchers, and private forest landowners. These factors collectively positioned North America as the leader in the agriculture analytics market.

The agriculture analytics market in Asia Pacific is expected to witness the fastest growth during the forecast period due to the rapid adoption of advanced farming technologies driven by increasing agricultural demands and population growth. Governments across the region are investing in smart agriculture to enhance productivity and address challenges such as climate change and resource scarcity. Additionally, the rise in digital agriculture solutions, along with growing awareness of data-driven farming, has led to higher adoption rates. For instance, in June 2024, Indian Farmers Fertiliser Cooperative Limited (IFFCO) selected Oracle Cloud Infrastructure (OCI) to host its mobile application, IFFCO Kisan Uday. The app, designed as a cloud-native solution, enables farmers to book, view, and manage drone-based sprayings of IFFCO Nano Fertilizers. The presence of emerging economies and increasing agricultural mechanization further contributes to the region's strong growth prospects.

Key Players and Competitive Analysis Report

The competitive landscape of the agriculture analytics industry comprises global leaders and regional players aiming to gain market share through technological innovation, strategic alliances, and regional expansion. Major players such as Deere & Company, IBM, Bayer AG, and SAP leverage strong R&D capabilities and advanced analytics platforms to provide solutions for precision farming, crop health monitoring, and resource optimization. Trends in the market highlight the adoption of AI, machine learning, and IoT to drive actionable insights for farmers, addressing issues such as yield improvement and climate resilience. The market is projected to grow significantly, driven by increasing global food demand, sustainability initiatives, and advancements in digital agriculture. Regional companies, particularly in emerging markets such as Asia Pacific, capitalize on localized needs with cost-effective solutions, contributing to the region's highest CAGR. Strategies such as partnerships with ag-tech startups, mergers, and new product launches underscore the role of innovation, adaptability, and regional investments in shaping the agriculture analytics industry. A few key major players are Deere & Company; IBM; Bayer AG; SAP; Trimble Inc.; Accenture; Oracle; Farmers Edge Inc.; SAS Institute Inc.; and Iteris, Inc.

Oracle Corporation provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, as well as manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing, are few of the cloud software programs included in the company's Oracle software as a service. It also provides licensed cloud-based business infrastructure solutions, middleware (which contains tools for development and other purposes), and enterprise databases such as Oracle and Java. Also, company provides Generative AI is powered by state-of-the-art LLMs from Cohere, ensuring unparalleled data security, trusted performance, and versatile deployment options for text generation. Oracle's four main business divisions - cloud, license, hardware, and services - provide its database management systems and cloud-engineering services and solutions. In addition, the company also offers cloud-based industrial solutions for numerous industries, support services for Oracle licenses, and licenses for Oracle application software. The company provides its services to various industries such as automotive, communications, consumer goods, construction and engineering, energy and water, government and education, food and beverage, financial services, health, high technology, life sciences, hospitality, media and entertainment, industrial manufacturing, oil and gas, retail, public safety, wholesale distribution, travel and transportation, professional services among others.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software which generates 29% of its revenue. Infrastructure services hold 37%, the hardware segment has 8%, and IT services hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. For instance, the company is responsible for 50% of all wireless and 90% of all credit card transactions. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. However, as of 2022, the IBM Watson Healthcare business was purchased by Merative. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes.

List Of Key Companies

- Deere & Company

- IBM

- Bayer AG

- SAP

- Trimble Inc.

- Accenture

- Oracle

- Farmers Edge Inc.

- SAS Institute Inc.

- Iteris, Inc.

Agriculture Analytics Industry Development

May 2025: John Deere announced the acquisition of remote imagery solutions provider Sentera. The company stated that the acquisition will advance its existing technology offerings and provide farmers with a more comprehensive set of tools.

November 2024: Farmers Edge introduced Managed Technology Services. According to Farmers Edge, the services include technology consulting, custom development, outsourcing, and data licensing. With the services, the company aims to solve digital challenges faced by large-scale agribusinesses and crop insurers.

March 2024: Bayer launched a pilot for a GenAI system that assists farmers and supports agronomists in their daily tasks. The system is trained using Bayer's proprietary agronomic data, which includes insights from years of trials, internal findings, and expertise accumulated by Bayer agronomists globally. This initiative integrates advanced language model capabilities with agricultural data to enhance decision-making and operational efficiency.

May 2024: EarthDaily Agro, a subsidiary of EarthDaily Analytics, partnered with Norwegian ag-tech startup DigiFarm. This collaboration integrates EarthDaily Agro's expertise in Earth observation analytics with DigiFarm's AI-based solution for accurately defining property boundaries, enhancing agricultural data precision, and operational applications.

Agriculture Analytics Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

By Agriculture Type Outlook (Revenue, USD Billion, 2020–2034)

- Precision Farming

- Livestock Farming

- Aquaculture Farming

- Vertical Farming

- Others (Organic and Conventional farming)

By Farm Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Farms

- Small and Medium-Sized Farms

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Remote Sensing and Satellite Imagery

- Geographic Information System

- Robotics and Automation

- Big Data and Cloud Computing

- Visualization and Reporting

- Blockchain Technology

- Others (Mobile Applications, Internet of Things (IoT), and Machine Learning and AI)

By End Users Outlook (Revenue, USD Billion, 2020–2034)

- Farmers

- Agronomists

- Agribusinesses

- Agricultural Researchers

- Government Agencies

- Others (Insurance Assessors, Drone Services, Consumers, and Consumer Organizations)

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agriculture Analytics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.63 billion |

|

Market Size Value in 2025 |

USD 7.57 billion |

|

Revenue Forecast by 2034 |

USD 25.50 billion |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global agriculture analytics market size was valued at USD 6.63 billion in 2024 and is projected to grow to USD 25.50 billion by 2034.

The global market is projected to register a CAGR of 14.5% during the forecast period.

North America dominated the agriculture analytics market in 2024 as farmers and agribusinesses increasingly embraced data-driven approaches to optimize their operations.

A few key players in the market are Deere & Company; IBM; Bayer AG; SAP; Trimble Inc.; Accenture; Oracle; Farmers Edge Inc.; SAS Institute Inc.; Iteris, Inc.

The farmers segment dominated the agriculture analytics market in 2024.

The remote sensing and satellite imagery segment is expected to witness the fastest growth in the agriculture analytics market.