Agricultural Tractors Market Size, Share, Trends, Industry Analysis Report: By Engine Power, Driveline Type (2WD and 4WD), Propulsion, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3288

- Base Year: 2024

- Historical Data: 2020-2023

Agricultural Tractors Market Overview

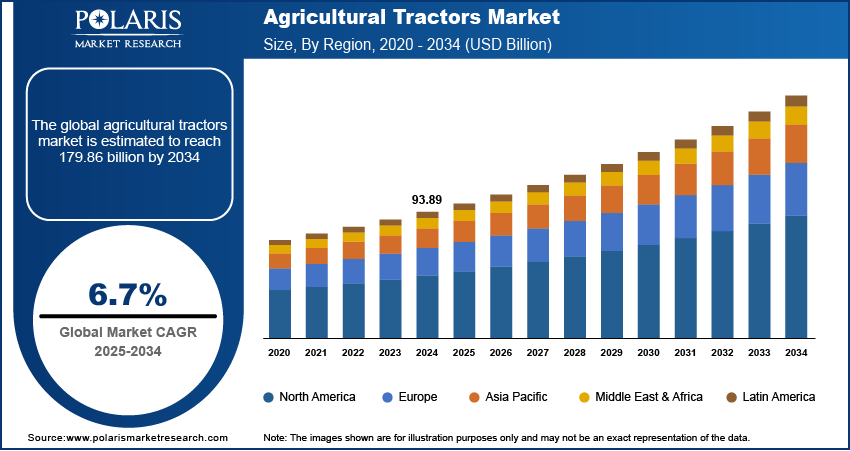

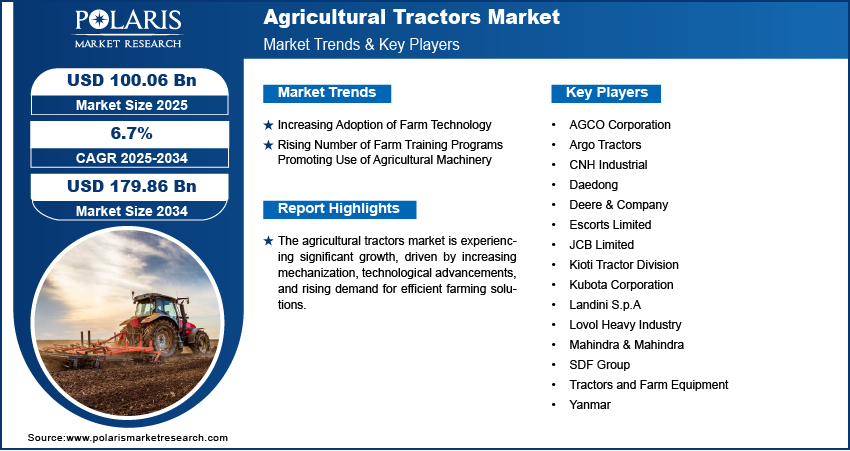

The global agricultural tractors market size was valued at USD 93.89 billion in 2024. The market is expected to grow from USD 100.06 billion in 2025 to USD 179.86 billion by 2034, at a CAGR of 6.7% from 2025 to 2034.

Agricultural tractors are essential mechanized vehicles designed to perform various farming tasks, such as plowing, tilling, and hauling equipment. The global agricultural tractors market is witnessing steady growth, driven by the increasing need to replace outdated agricultural machinery. The replacement of aging farm equipment is crucial as older machines often suffer from reduced efficiency, higher maintenance costs, and lower productivity. Farmers are increasingly investing in technologically advanced tractors such as autonomous tractors equipped with precision farming solutions and fuel-efficient engines to enhance operational efficiency and optimize resource utilization. For instance, in August 2023, Mahindra OJA launched seven revolutionary lightweight 4WD tractors in collaboration with Mitsubishi Mahindra Agriculture Machinery (Japan) to transform farming in India. This shift is particularly prominent in regions where outdated machinery continues to hinder agricultural productivity, prompting a shift toward modern, high-performance tractors.

To Understand More About this Research: Request a Free Sample Report

Government initiatives supporting farm mechanization are playing a key role in driving the agricultural tractor market expansion. Many governments worldwide are introducing subsidies, low-interest financing programs, and tax incentives to encourage farmers to adopt advanced agricultural tractors. A February 2024 report from the Indian Ministry of Agriculture and Farmers Welfare noted that the Agriculture Infrastructure Fund scheme will provide USD 11.56 billion in loans from banks and financial institutions. These loans will feature a 3% interest subsidy and credit guarantee coverage under CGTMSE for amounts up to USD 2.67 million. Each entity can benefit from the scheme for up to 25 projects across different LGD codes. As a result, the growing emphasis on mechanized farming, supported by policy interventions and financial support, is expected to drive the adoption of next-generation agricultural tractors, contributing to the overall transformation of the agricultural sector.

Agricultural Tractors Market Dynamics

Increasing Adoption of Farm Technology

Precision agriculture technologies, automation, and telematics integration are transforming traditional farming by enabling real-time monitoring, optimized resource allocation, and reduced operational costs. In August 2024, the Ministry of Agriculture and Farmers Welfare launched the Krishi Decision Support System, a digital geo-spatial platform for Indian agriculture. It provides easy access to essential data such as satellite images, weather updates, reservoir storage, groundwater levels, and soil health information, and the data is available anytime and anywhere. The rising demand for 5G smart farming solutions is driving the need for technologically advanced tractors that support data-driven decision-making. Additionally, farmers & manufacturers are increasingly investing in tractors equipped with GPS guidance, variable rate technology, and IoT sensor monitoring to enhance yield output and minimize wastage. The integration of intelligent systems is expected to accelerate agricultural tractors market development as agriculture becomes more technology-driven, fostering the transition toward more sustainable and efficient farming operations.

Rising Number of Farm Training Programs Promoting Use of Agricultural Machinery

Governments, agricultural institutions, and industry stakeholders are actively conducting training programs to educate farmers on the benefits of mechanized farming and the efficient utilization of modern tractors. A December 2024 report highlighted a 2-day training program on “Modern Mechanization for Sustainable Farm Efficiency,” organized by ICAR-National Academy of Agricultural Research Management. The program emphasized the importance of advanced farming technologies and the role of custom hiring centers (CHCs) in providing small farmers access to affordable equipment, reducing labor costs, and enhancing farm quality. These initiatives aim to bridge the knowledge gap, enabling farmers to adopt advanced equipment that enhances productivity and reduces labor dependency. Training programs often focus on operational efficiency, maintenance best practices, and safety protocols, ensuring that farmers can maximize the performance of agricultural tractors. The adoption of advanced tractors is expected to increase as awareness of mechanization continues to grow through structured training initiatives, further supporting the modernization of the agricultural sector.

Agricultural Tractors Market Segment Insights

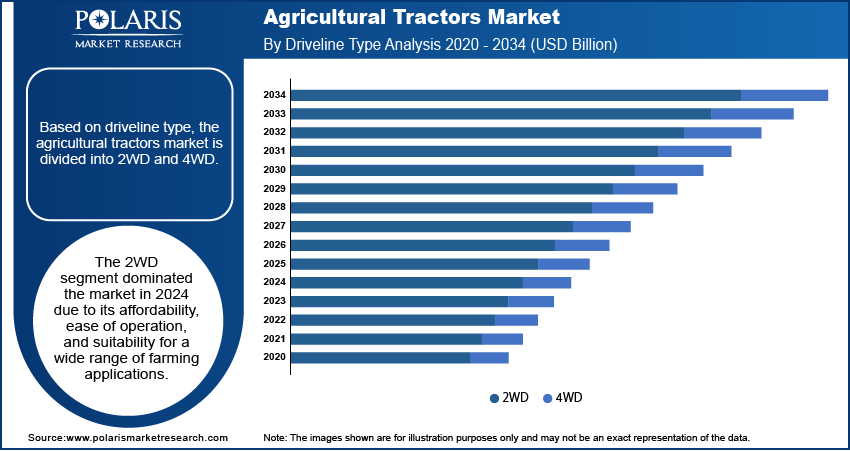

Agricultural Tractors Market Assessment by Driveline Type Outlook

The global agricultural tractors market assessment, based on driveline type, includes 2WD and 4WD. The 2WD segment dominated the market in 2024 due to its affordability, ease of operation, and suitability for a wide range of farming applications. These tractors are widely preferred by small and medium-scale farmers, particularly in regions with relatively flat terrains where high traction is not a primary requirement. Their lower initial investment and reduced maintenance costs make them a practical choice for cost-conscious farmers seeking efficient mechanization. Additionally, the availability of fuel-efficient models and the growing adoption of compact tractors for horticulture and row-crop farming have contributed to the segment's dominance. Thus, the demand for 2WD continues to drive agricultural tractors market expansion as small and medium-sized farms include a substantial portion of global agricultural land.

Agricultural Tractors Market Evaluation by Engine Power Outlook

The global agricultural tractors market evaluation, based on engine power, includes lesser than 40 HP, 40 HP to 99 HP, 100 HP to 150 HP, 151 HP to 200 HP, 201 HP to 270 HP, 271 HP to 350 HP, and greater than 350 HP. The 40 HP to 99 HP segment is expected to witness the fastest agricultural tractors market growth during the forecast period, primarily due to its versatility and broad application across diverse farming operations. These tractors offer a balanced combination of power and efficiency, making them ideal for a variety of tasks, such as plowing, tilling, and hauling. The increasing mechanization of small and mid-sized farms, coupled with the rising demand for multi-functional tractors, is propelling the growth of this segment. Additionally, advancements in tractor design, including enhanced fuel efficiency and integration with precision agriculture technologies, are boosting adoption.

Agricultural Tractors Market Regional Analysis

By region, the report provides the agricultural tractors market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the agricultural tractors market revenue in 2024, driven by the region's large agricultural sector, high rate of farm mechanization, and supportive government policies. Countries such as India, China, and Japan have witnessed a surge in tractor adoption due to increasing food demand, labor shortages, and rising investments in modern farming equipment. Additionally, favorable financing options, subsidies, and agricultural modernization initiatives have encouraged small and medium-scale farmers to invest in tractors. For instance, an August 2024 report by the International Atomic Energy Agency (IAEA) stated that farmers in six Asian countries increased rice yields using nuclear-derived climate-smart agricultural practices supported by the IAEA and the Food and Agriculture Organization of the United Nations (FAO). These practices helped optimize fertilizer and water use, resulting in yield increases of 1 to 2.5 tons per hectare. The program also reduced ammonia emissions by 36% while improving soil health and sustainability. The presence of leading tractor manufacturers and the availability of region-specific models serving different farming needs have further strengthened the demand for agricultural tractors in the region.

The North America agricultural tractors market is projected to witness the fastest growth during the forecast period, primarily due to the increasing adoption of precision farming techniques and advancements in agricultural machinery. Farmers in the region are investing in high-performance tractors equipped with GPS guidance, autonomous capabilities, and telematics to optimize farm productivity and reduce operational costs. Additionally, Government initiatives promoting sustainable agriculture, along with rising investments in farm infrastructure, are supporting tractor adoption. A February 2024 report by the United States Department of Agriculture (USDA) highlighted that the USDA and the Department of Energy (DOE) launched the RAISE initiative to help farmers adopt renewable technologies, particularly small-scale wind projects. The program aims to support 400 farmers in deploying wind technologies with USD 144 million from the Inflation Reduction Act and USD 4 million in DOE funding. It also provides technical assistance, research funding, and educational resources to help farmers save money and generate income through renewable energy. As a result, the region is set to experience accelerated growth as North American farmers increasingly embrace digital and mechanized solutions.

Agricultural Tractors Market – Key Players and Competitive Insights

The competitive landscape comprises global leaders and regional players seeking to capture agricultural tractors market share through innovation, strategic collaborations, and regional expansion. Established manufacturers such as Deere & Company, CNH Industrial, AGCO Corporation, and others leverage strong R&D capabilities and extensive distribution networks to deliver technologically advanced tractors equipped with precision farming solutions, automation, and fuel-efficient engines. Market trends indicate a rising demand for smart tractors integrated with GPS guidance, telematics, and autonomous functionalities, reflecting the shift toward data-driven and sustainable farming practices. The market is projected to witness significant growth, driven by increasing mechanization, labor shortages, and the need for enhanced farm productivity. Regional manufacturers focus on catering to localized needs by offering cost-effective and application-specific tractors, particularly in emerging markets such as the Asia Pacific, which is anticipated to grow at the fastest pace.

Competitive strategies in the market include mergers and acquisitions, strategic alliances with agritech firms, and the continuous introduction of innovative tractor models to meet evolving farmer requirements. Additionally, government support in the form of subsidies, financing schemes, and agricultural modernization initiatives strengthens market demand. These developments highlight the role of technological advancements, regional adaptability, and policy-driven incentives in shaping the agricultural tractors industry's competitive dynamics. A few key major players are AGCO Corporation, CNH Industrial, Deere & Company, Escorts Limited, Kubota Corporation, Mahindra & Mahindra, Yanmar, JCB Limited, Tractors and Farm Equipment, SDF Group, Argo Tractors, Kioti Tractor Division, Daedong, Lovol Heavy Industry, and Landini S.p.A.

Mahindra & Mahindra Ltd. is an Indian multinational company established in 1945 and headquartered in Mumbai, Maharashtra. Initially founded as a steel trading firm, it has evolved into the world's largest tractor manufacturer by volume, especially impacting the agricultural sector. Mahindra's agricultural division offers a wide range of tractors and implements under brands like Mahindra Tractors and Swaraj Tractors, catering to diverse farming needs. Their commitment to innovation is evident in their continuous development of advanced agricultural machinery that enhances productivity and efficiency for farmers. Beyond agriculture, Mahindra is also a leader in the automotive industry, recognized for its utility vehicles and commitment to sustainability through electric vehicle initiatives, solidifying its role as a key player in both sectors.

Deere & Company, widely known as John Deere, is an American corporation headquartered in Moline, Illinois, specializing in agricultural machinery and equipment. Founded in 1837, the Company has evolved into a global leader, producing a diverse range of products such as tractors, harvesters, and various farming implements. Its tractor lineup features several series, such as the D series and E series, serving different agricultural needs. John Deere's commitment to innovation is evident in its development of advanced technologies, such as autonomous tractors and precision agriculture solutions, which enhance productivity and sustainability for farmers worldwide. The Company's slogan, "Nothing Runs Like a Deere," reflects its reputation for reliability and performance.

List of Key Companies in Agricultural Tractors Market

- AGCO Corporation

- Argo Tractors

- CNH Industrial

- Daedong

- Deere & Company

- Escorts Limited

- JCB Limited

- Kioti Tractor Division

- Kubota Corporation

- Landini S.p.A

- Lovol Heavy Industry

- Mahindra & Mahindra

- SDF Group

- Tractors and Farm Equipment

- Yanmar

Agricultural Tractors Industry Developments

January 2025: John Deere unveiled its second-generation autonomous machines for agriculture, construction, and landscaping at CES 2025. The lineup features an autonomous tractor, orchard sprayer, dump truck, and commercial mower, designed to tackle labor shortages. The company stated that users can manage these machines remotely via the Operations Center Mobile app.

June 2024: Verizon Business and Monarch Tractor partnered to enhance sustainable farming with autonomous tractors that stay connected in remote areas.

Agricultural Tractors Market Segmentation

By Engine Power Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Lesser than 40 HP

- 40 HP to 99 HP

- 100 HP to 150 HP

- 151 HP to 200 HP

- 201 HP to 270 HP

- 271 HP to 350 HP

- Greater than 350 HP

By Driveline Type Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- 2WD

- 4WD

By Propulsion Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Electric

- ICE

By Regional Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agricultural Tractors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 93.89 billion |

|

Market Size Value in 2025 |

USD 100.06 billion |

|

Revenue Forecast by 2034 |

USD 179.86 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Thousand Units; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global agricultural tractors market size was valued at USD 93.89 billion in 2024 and is projected to grow to USD 179.86 billion by 2034

• The global market is projected to register a CAGR of 6.7% during the forecast period

• Asia Pacific dominated the agricultural tractors market revenue in 2024

• Some of the key players in the market are AGCO Corporation, CNH Industrial, Deere & Company, Escorts Limited, Kubota Corporation, Mahindra & Mahindra, Yanmar, JCB Limited, Tractors and Farm Equipment, SDF Group, Argo Tractors, Kioti Tractor Division, Daedong, Lovol Heavy Industry, and Landini S.p.A.

• The 2WD segment dominated the market in 2024.