Agricultural Lighting Market Share, Size, Trends, Industry Analysis Report, By Offering (Hardware, Software, and Services); By Light Source; By Wattage; By Installation Type; By Sales Channel; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3655

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

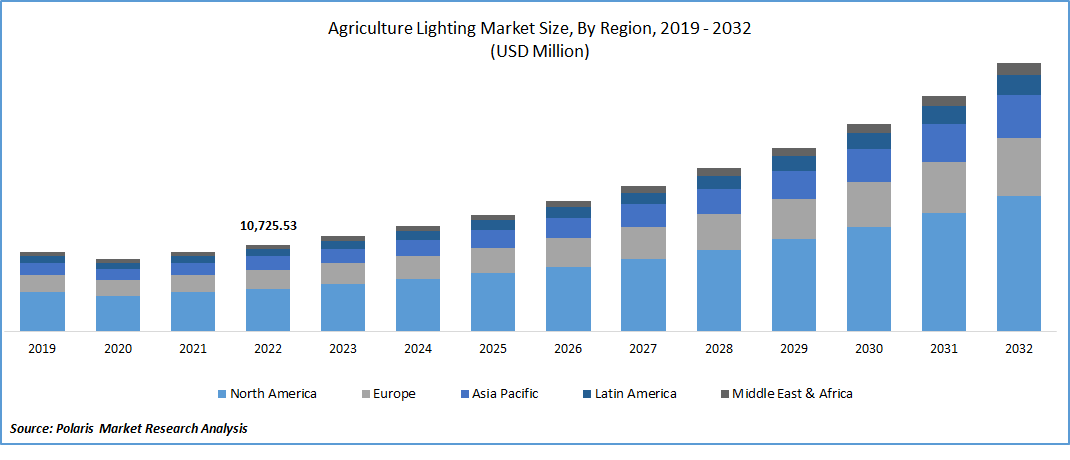

The global agricultural lighting market was valued at USD 11800.22 million in 2023 and is expected to grow at a CAGR of 12.40% during the forecast period.

Integrating agricultural lighting with other advanced technologies, such as the Internet of Things (IoT), sensors, and automation systems, enhances the efficiency and effectiveness of lighting solutions in agriculture. Apart from this, successful applications and product launches are only a few of the most recent achievements showing how enthusiastically the lighting community is moving forward. For example, in April 2022, with Delphy Improvement Centre, Fluence by OSRAM investigated the effects of LED lighting on strawberry production in greenhouses.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic disrupted global supply chains, including producing and distributing agricultural lighting products. However, the pandemic also highlighted the vulnerabilities of traditional agricultural supply chains and the importance of local food production. As a result, there has been an increased focus on indoor farming practices such as vertical farming, hydroponics, and greenhouse cultivation. This further improved the demand for agricultural lighting. Also, the need for social distancing and minimizing human contact in agricultural operations accelerated the adoption of automation and technology. Farmers turned to smart lighting systems and advanced control solutions to remotely monitor and manage lighting parameters. This trend drove the demand for software offerings, IoT integration, and intelligent lighting systems in the agricultural lighting market.

Growth Drivers

Increasing demand for indoor farming drives the market

Improved demand for indoor farming is supporting the market to achieve noteworthy revenue globally. With the growing global population and shrinking agricultural land, there is a rising need for indoor farming practices such as vertical farming, greenhouse cultivation, and plant factories. For instance, indoor farms produce 10–15 times more than outdoor farms. Additionally, indoor farming offers faster growth and more harvest cycles; for instance, indoor lettuce growers flip their crops 4 times as often as outdoor growers do in a given year. Agricultural lighting is crucial in providing artificial light to supplement natural sunlight and optimize plant growth, resulting in higher yields and year-round production. This factor is influencing the development of the global market.

Light-emitting diode (LED) technology has witnessed significant advancements in recent years, making it more energy-efficient, long-lasting, and cost-effective. LEDs are highly suitable for agricultural lighting because they emit specific light wavelengths that promote plant growth and development. To leverage the benefits of the market, many players are participating in the development of LED. For example, Bustanica & Philips LED worked together to develop a special lighting recipe. Each year, the business generated around 1 Mn of leafy greens. This allows it to manage the production of leafy greens. Philips LED has given the best light efficacy for the Bustanica vertical farming facility with the few LEDs needed to provide the best outcomes. This is significantly flourishing the growth in the market worldwide.

Report Segmentation

The market is primarily segmented based on offering, light source, wattage, installation type, sales channel, and region.

|

By Offering |

By Light Source |

By Wattage |

By Installation Type |

By Sales Channel |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering

Software offering is projected to grow with fastest CAGR during forecast period

Software offering is expected to grow with the highest growth rate during the forecast period as software applications in agricultural lighting provide tools and algorithms for optimizing energy management and efficiency. Smart lighting systems integrate hardware components with software applications to enable advanced functionalities and control. These software offerings allow farmers to remotely monitor and manage their lighting systems, adjust light settings, create customized lighting schedules, and gather data on crop growth and performance. The demand for smart lighting solutions is rising as farmers seek greater control, automation, and data-driven decision-making in their agricultural operations. This type of offering in agricultural lighting enables farmers to collect and analyze data related to lighting conditions, crop growth, and environmental parameters.

By Light Source

LED light segment held largest market share in the global market in 2022

The LED lighting segment is quickly becoming more popular and is expected to generate the largest global revenue share in 2022. Compared to traditional lighting technologies, LED lighting solutions are highly energy-efficient and have a significantly longer lifespan. For instance, LED fixtures can last up to 50,000 to 100,000 hours, depending on the specific product and its use. The popularity of this segment is due to its design flexibility, heat management, optimal light spectrum, and other impressive features.

LED technology has also seen significant advancements, improving performance and reducing costs. For example, the U.S. Department of Agriculture (USDA) found that energy expenditures are the third-largest expense for most growers in today's agriculture and horticulture industries, with greenhouse lighting being a significant contributor. However, ongoing research and development in LED technology continue to improve its efficiency, light output, and spectral control, making it even more dominant in the agricultural lighting market.

By Wattage

Below 50W segment held largest share in the global market in 2022

In the fiscal year 2022, the below 50W segment dominated the market. This is because the segment typically consists of energy-efficient lighting solutions, such as LED (Light-Emitting Diode) fixtures and bulbs. LED technology offers high energy efficiency, converting a significant portion of energy into usable light while minimizing energy wastage as heat. Additionally, lighting solutions in the below 50-wattage segment are often more affordable in terms of initial investment and long-term operational costs. The segment offers versatile lighting options suitable for a variety of agricultural applications. They are adaptable to different crop types, growth stages, and lighting requirements. Additionally, these lighting solutions' compact size and lower wattage allow for easy installation and flexibility in positioning within agricultural spaces.

By Installation Type

Retrofit installation type is anticipated to expand with fastest CAGR in the projected years

During the forecast period, retrofit installation type is expected to grow with the fastest CAGR in the global market as it offers a practical and cost-effective solution for farmers with existing lighting infrastructure. It is often a more affordable option compared to complete lighting system replacements. It provides flexibility and adaptability to changing lighting requirements. However, retrofitting allows farmers to modify or upgrade their lighting systems per their needs. They can introduce new technologies, adjust light intensity or spectrum, and incorporate smart controls without requiring extensive infrastructure changes. Further, retrofit installation involves upgrading or modifying existing lighting systems to integrate new technologies or features. Many agricultural facilities, such as greenhouses and indoor farms, already have lighting infrastructure.

By Sales Channel

Retail/ wholesale segment dominated the global market in 2022

The retail/ wholesale segment is dominating the market with a significant share in the global market in the fiscal year 2022. This channel type often has an extensive distribution network, allowing agricultural lighting manufacturers and suppliers to reach a large customer base. These channels enable the availability of agricultural lighting products in various regions, making it convenient for farmers to access and purchase the necessary lighting solutions. Moreover, indoor farming, such as vertical farming, greenhouses, and plant factories, relies heavily on artificial lighting to provide the required light spectrum and intensity for optimal plant growth. As the demand for indoor farming continues to grow, the retail/wholesale segment plays a crucial role in supplying the required agricultural lighting solutions to farmers and agricultural businesses.

Regional Insights

Europe accounted the largest share in the global market in 2022

In the fiscal year 2022, Europe accounted for the largest global market share as the region has robust capital investment capabilities. The surge in government funding in European countries to boom farming productivity is one of the prominent aspects helping the market account for the highest share globally. For example, in February 2023, as per the Department for Environment and Food & Rural Affairs, throughout the year, farmers will have access to more than £168 million in grants to encourage innovation, increase food production, enhance animal health and welfare, and safeguard the environment. This helps the market to improve its revenue.

Asia Pacific is one of the fastest-growing regions and is expected to grow with a significant CAGR during the assessment years. The agriculture industry in this region has witnessed buoyant growth in the past few years. The increasing agriculture industry with emerging technologies is playing a vital role in expanding the market in the Asia Pacific region.

Key Market Players & Competitive Insights

The Agricultural Lighting market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Signify

- OSRAM

- Gavita

- Valoya

- California Lightworks

- Helliospectra AB

- LumiGrow Inc.

- Hortilux Schréder

- Eye Hortilux

- Signify Holding

- ams-OSRAM GmbH

- Gavita International B.V.

- Valoya

- California LightWorks

- DeLaval

- CBM Lighting

- Heliospectra AB

- Hortilux Schréder

Recent Developments

- In January 2023, co-operation on a wirelessly charged light sensor for controlled-environment agriculture & vertical farming was announced by the Energous Corporation and OSRAM.

Agricultural Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13,033.35 million |

|

Revenue forecast in 2032 |

USD 33,158.07 million |

|

CAGR |

12.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Light Source, By Application, By Offering, By Installation Type, By Wattage Type, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Key companies in the market are,Signify,OSRAM,Gavita,Valoya,California Lightworks.

The global agricultural lighting market is expected to grow at a CAGR of 12.2% during the forecast period.

Key segments covered are offering, light source, wattage, installation type, sales channel, and region.

Key driving factors in agricultural lighting market are Increasing demand for indoor farming drives the market.

The global agricultural lighting market size is expected to reach USD 33,158.07 million by 2032