Agmatine Market Share, Size, Trends, Industry Analysis Report, By Form (Powder and Capsules); By Flavor: By Sales Channel; By Region; Segment Forecast, 2024 – 2032

- Published Date:Dec-2023

- Pages: 115

- Format: PDF

- Report ID: PM4146

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

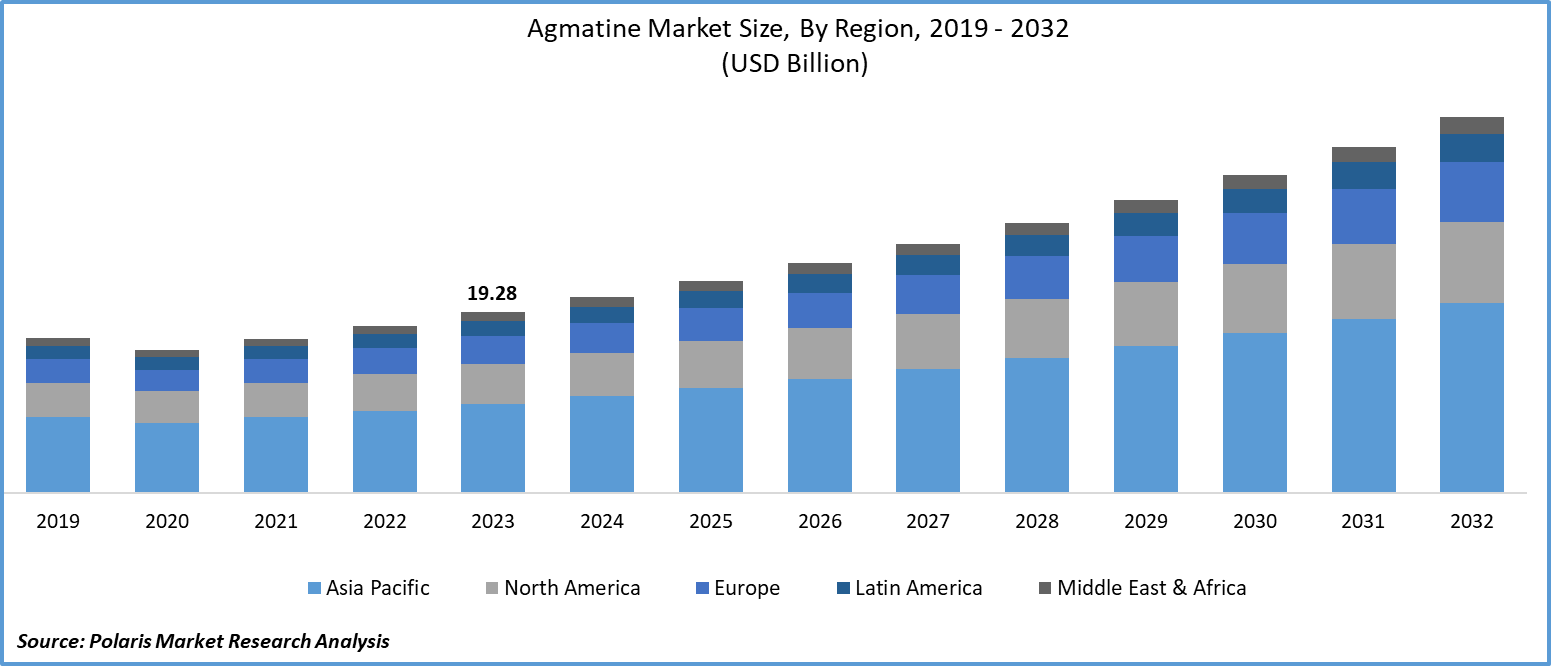

The global agmatine market was valued at USD 19.28 billion in 2023 and is expected to grow at a CAGR of 8.5% during the forecast period.

The continuous surge in the need and demand for healthy dietary supplements due to their ability to reduce body weight and improve muscles and growing product use in different clinical trials in the medical field because it contain properties like anti-inflammatory, antioxidant, and neuroprotective among others, are the primary factors driving the demand and growth of the market. In addition, the growing adoption of sustainable sourcing of agmatine raw materials that includes eco-friendly cultivation practices and prioritizing ethical and environmental-conscious production methods coupled with the growing investments on R&D activities to develop new agmatine products, are further likely to boost market growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in April 2023, Bucked Up, a leading sports nutrition and lifestyle brand, announced the launch of a first-of-its-kind pre-workout product called Pixie Pump. The newly developed product includes agmatine, nitrosigine, Vitamin B6, Vitamin B12, and Himalayan rock salt, and is free from caffeine.

Moreover, the rising number of innovations in product quality control and better compliance with regulatory standards to ensure that agmatine products meet safety and efficacy requirements along with the growing number of companies exploring new innovative ways to offer agmatine supplements tailored to individual specific needs and requirements, are further projected to contribute significantly to the market growth in the coming years.

However, the lack of comprehensive scientific data and a significant number of complex regulations and regulatory standards for agmatine use in different industries like pharmaceutical and nutraceuticals, are key factors acting as major restraints of the market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the agmatine market. The rapid spread of the deadly pandemic resulted in huge disruptions in global supply chains and production or processing facilities, as a result of lockdowns and restrictions on trade activities imposed by government and regulatory agencies. However, the pandemic also heightened consumer interest in products supporting immune health like agmatine which are known for their potential immune-boosting effects.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

- Growing consumer interest in dietary supplements and nutraceuticals driving the market growth

The rapid increase in consumer demand and preferences for dietary supplements and nutraceuticals, that significantly incorporate agmatine due to its potential benefits in improving cognitive function, mood enhancement, and overall well-being along with the surging product utilization in the agriculture as a plant growth regulator and stress reliever, that might help crop yields as well as protect plants from several environmental stressors, are key factors fostering the global agmatine market growth.

- Product potential in managing several chronic conditions boosting its use and pushing the market forward

In recent years, the product has shown significant promise in preclinical studies because of its potential in managing different types of chronic conditions like neuropathic pain, diabetes, and neurodegenerative diseases. Thus, with the growing incidences of chronic diseases around the world, the need and demand for agmatine also increases at a rapid pace.

- For instance, according to the World Health Organization, chronic diseases are the major cause of death globally with around 41 million deaths each year equivalent to 74% of total deaths globally, and around 17 million out of these deaths take place before age 70.

Report Segmentation

The market is primarily segmented based on form, flavor, sales channel, and region.

|

By Form |

By Flavor |

By Sales Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Form Analysis

- Powder segment accounted for the largest market share in 2022

The powder segment accounted for the largest market share in terms of revenue. This growth is attributable to a drastic increase in demand for sports supplements because of its capabilities to improve muscle pump and recovery and the ability of powder-based segments to easily incorporate into various types of dietary supplement formulations like pre-workout blends and nootropics.

Beside this, some consumers around the world prefer powdered supplements over capsules or tablets, as they can be easily or conveniently customized in terms of dosage, mixed into beverages, offer quicker absorption, and can be absorbed more rapidly by the body as compared to solid forms, thereby propelling the segment market growth.

By Flavor Analysis

- Flavor segment held a significant market share in 2022

The flavor segment held a substantial market share in terms of revenue in 2022, which is majorly driven by higher consumer preferences for flavored product supplements, as adding flavors into the product can mask their bitterness and make the product more appealing to a broader audience. Apart from this, several leading companies in the market are focusing on highlighting the functional benefits of flavored agmatine products such as cognitive enhancement and improved workout performance, also driving the market growth.

The unflavored segment is also expected to exhibit significant growth over the next coming years, on account of increasing consumer awareness about health & wellness and growth in the number of research & development activities focused on exploring new potentials and applications of unflavored product types.

By Sales Channel Analysis

- Online channels segment is projected to witness the highest growth

The online channels segment is projected to grow at the highest growth rate over the course of study period, which is largely attributed to the easy availability of dietary supplements and products incorporated agmatine on various online shopping platforms and growing consumer inclination towards these channels due to their beneficial features including wider product selection, higher convenience, easier accessibility from all over the world, and home delivery among others. Moreover, the overall trend towards e-commerce has been steadily rising over the years, as a result of increased mobile penetration, faster internet access, and a shift in consumer behavior toward online shopping platforms.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market. This growth is highly attributable to the presence of favorable regulatory standards and changes in regulations related to dietary supplements and nutritional ingredients promoting their use and consumption coupled with the increasing focus on exploring the product’s potential in neuroprotective and mood enhancement properties.

The Asia Pacific region is anticipated to emerge as the fastest growing region with a healthy CAGR over the forecast period, owing to increasing product use in various pharmaceutical applications and rising consumer disposable income and rate of urbanization in countries like India and China, leading to higher spending of health and wellness products and focus on maintaining health and overall well-being.

Key Market Players & Competitive Insights

The agmatine market is highly competitive due to the rising product demand from various industries that force companies to bring out new and innovative products with improved or enhanced capabilities and cater to specific industry needs. Also, the leading companies in the market are focusing on the expansion of their global reach, thereby adopting business expansion strategies including partnerships, collaborations, acquisitions, and mergers.

Some of the major players operating in the global market include:

- Ajinomoto Health & Nutrition North America Inc.

- BulkSupplement.Com

- Douglas Laboratories

- Dymatize Nutrition

- Glanbia Nutritionals

- Hard Rhino

- Jarrow Formulas

- Metabolic Maintenance

- NOW Foods Inc.

- Nutrabio Inc.

- PrimaForce

- Purus Labs

- Spectrum Chemical Manufacturing Corporation

- Swanson Health

Recent Developments

- In January 2022, Dr. Riggs Rhelief, introduced its new revolutionary functional herbal beverage powder, which offers significant pain relief within just a few minutes and is also quickly absorbed into the bloodstream. The newly launched beverage contains the amino acid arginine, which is metabolized into agmatine and ornithine, resulting in less nerve pain.

- In May 2021, Unbound Supplements, announced the launch of its six new potent products, which include UNLOAD, UNBENT, UNLOCK, BYLD, SAUCE, and SLYN, and all are used for different purposes and applications. The SLYN supplement consists high dose of banaba extract, pump-inducing agmatine sulfate, and cinnamon for insulin support.

Agmatine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 20.88 billion |

|

Revenue Forecast in 2032 |

USD 40.09 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Form, By Flavor, By Sales Channel, Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region,s and segmentation. |

FAQ's

The agmatine market report covering key segments are from, flavor, sales channel, and region.

Agmatine Market Size Worth $40.09 Billion By 2032

The global agmatine market is expected to grow at a CAGR of 8.5% during the forecast period.

North America is leading the global market

key driving factors in agmatine market are Growing consumer interest in dietary supplement and nutraceuticals driving the market growth