Africa Rope Market Size, Share, Trends, Industry Analysis Report: By Product (Synthetic, Steel Wire, Cotton, and Other Products), End Use, and Country (South Africa, Nigeria, Kenya, Morocco, Mauritius, Algeria, and Rest of Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 58

- Format: PDF

- Report ID: PM5146

- Base Year: 2023

- Historical Data: 2019-2022

Africa Rope Market Overview

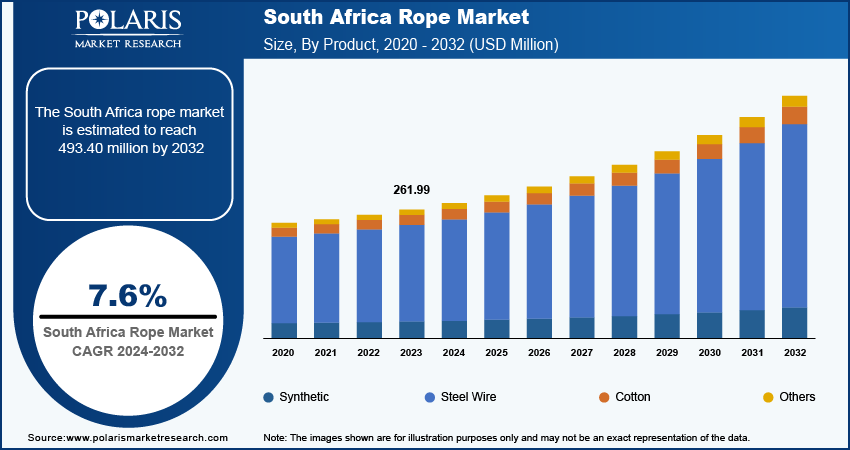

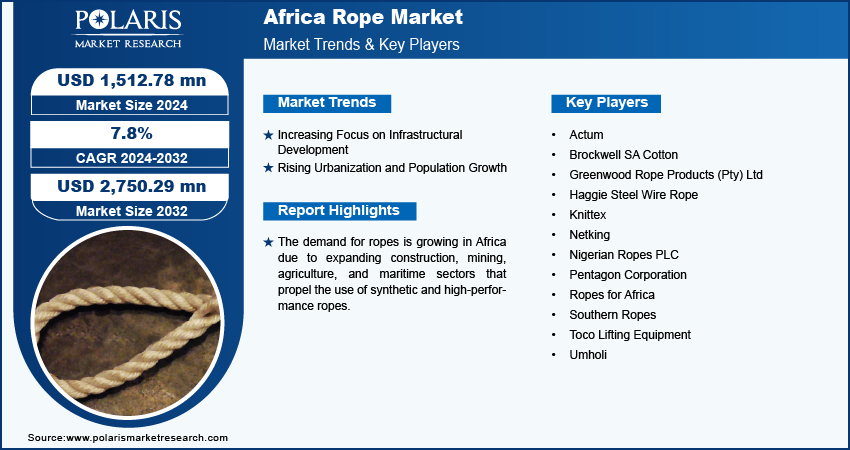

The Africa rope market size was valued at USD 1,438.69 million in 2023. The market is projected to grow from USD 1,512.78 million in 2024 to USD 2,750.29 million by 2032, exhibiting a CAGR of 7.8% during 2024–2032.

Ropes are flexible, durable cords made of materials such as steel, synthetic fibers, and natural fibers. They are increasingly used for lifting, pulling, and securing heavy loads across various industries, including construction, mining, and maritime. The expanding maritime industry, covering fishing, shipping, and port operations, is driving the demand for ropes. Additionally, infrastructure development and mining activities in resource-rich nations fuel the Africa rope market growth.

For Specific Research Requirements: Request a Free Sample Report

Governments are investing heavily in infrastructure projects, leading to heightened demand for high-strength, durable ropes essential for construction, transportation, and energy sectors. Furthermore, the growing mining sector in resource-rich nations such as South Africa and Nigeria is a major contributor to this demand, particularly for steel wire and other robust rope materials. The rising focus on safety and efficiency in these sectors also amplifies the need for reliable ropes. Thus, the combination of infrastructural investments and mining activities is propelling the Africa ropes market growth.

The growing investments in renewable energy projects, particularly in wind and solar farms, drive demand for specialized ropes in Africa. These projects require durable, high-performance ropes for installation, maintenance, and operational tasks. Additionally, increasing awareness of the benefits of advanced ropes, such as their enhanced strength, durability, and safety, is boosting their demand across various industries. Technological advancements in rope manufacturing, including innovative materials and production techniques, are expected to open new avenues for market growth during the forecast period. African manufacturers have the opportunity to introduce high-performance rope solutions that meet rigorous industry standards, with a stronger focus on safety and efficiency in sectors such as construction, mining, and energy, which would drive the Africa rope market growth in the future.

Africa Rope Market Drivers and Trends

Increasing Focus on Infrastructural Development

Infrastructural development focuses on developing ambitious projects aimed at transforming the region’s economy. Over the past decade, African governments have prioritized infrastructure development to accommodate a rapidly urbanizing population. Major initiatives, including road and railway construction projects, require durable materials such as ropes for various applications, including lifting heavy loads and ensuring safety.

A prime example is Kenya's Standard Gauge Railway (SGR), which connects the port city of Mombasa to the capital, Nairobi, and extends to the Ugandan border. This monumental project has significantly increased the demand for high-strength ropes used throughout construction, from bridge building to securing railway lines. The need for ropes extends beyond construction to maintenance and expansion, contributing to the ongoing growth of the African ropes market.

Rising urbanization intensifies the demand for infrastructure development, particularly in countries such as South Africa and Nigeria, where rapid population shifts toward cities are leading to the construction of high-rise buildings and commercial centers. These developments rely heavily on ropes for scaffolding, material handling, and safety measures. The versatility of ropes makes them indispensable in urban construction, solidifying their essential role in ongoing projects.

The expansion of the energy sector, driven by Africa's abundant natural resources, contributes to the growth of the ropes market. Projects in oil, gas, and renewable energy require specialized ropes designed to withstand extreme conditions, such as those found in offshore drilling operations. With increasing international investments, particularly through initiatives such as China’s Belt and Road Initiative, the African ropes market is well-positioned for significant growth, underscoring its integral role in the continent’s infrastructure and economic development.

Rising Urbanization and Population Growth

Increasing urbanization and population growth significantly influence the construction, industrial, and agricultural sectors. Cities such as Lagos and Nairobi are witnessing rapid expansion as Africa’s urban population is projected to double in the coming years, necessitating extensive construction activities. This urban growth requires high-strength ropes for various applications, including scaffolding, lifting materials, and ensuring worker safety in residential and commercial developments. Additionally, the demand for infrastructure such as roads, bridges, and utilities fuels the need for durable ropes, supporting the continent's modernization efforts.

The increasing population, which is expected to reach 2.5 billion by 2050, drives the demand for agricultural products, requiring ropes for efficient farming practices. Urbanization also expands informal settlements, creating opportunities for affordable, durable rope solutions in community development projects. As these demographic shifts continue, the Africa ropes market is poised for significant growth, reflecting the diverse applications and critical roles that ropes play in an evolving economic landscape.

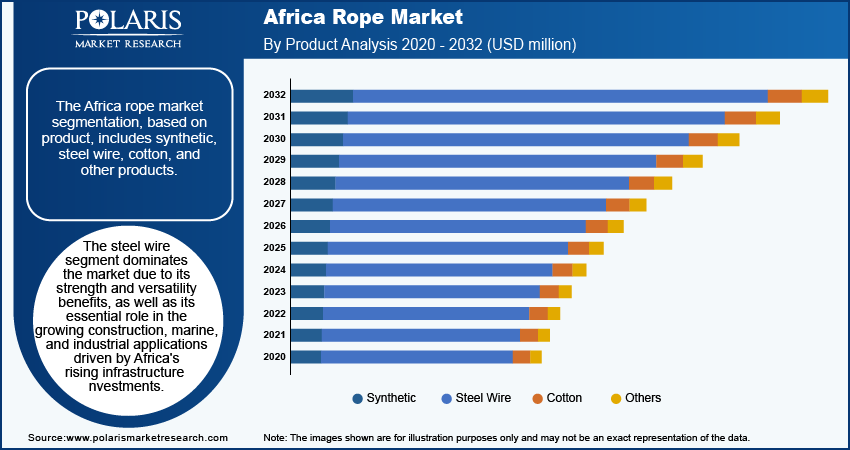

Africa Rope Market Segment Insights

Africa Rope Market Breakdown By Product Insights

The Africa rope market segmentation, based on product, includes synthetic, steel wire, cotton, and other products. In 2023, the steel wire segment dominated the market, accounting for around 76% of market revenue share due to its strength and versatility. Steel wire ropes are manufactured by twisting stainless steel and high-carbon steel wires, creating a robust structure that ensures optimal performance and durability. This high strength-to-weight ratio makes them ideal for demanding applications, particularly in the marine and fishing industries, where reliability is crucial.

The need for durable materials in the construction and industrial sectors grows as Africa’s economy expands. Steel wire ropes are essential in various applications, including lifting and rigging, which further enhances their market demand. With increasing investments in infrastructure and industrial projects across the region, the steel wires segment is poised for significant growth, solidifying its critical role in supporting Africa's infrastructure development.

Africa Rope Market Breakdown By End Use Insights

The Africa rope market, based on end use, is segmented into industrial, commercial, and residential. The commercial segment is expected to register at a CAGR of 8.0% during the forecast period due to its wide range of applications across various sectors. Ropes play a crucial role in activities such as camping, rock climbing, agriculture, and adventure sports, catering to an increasing demand for outdoor recreational experiences. Additionally, their utility in logistics and as fall protection measures increases their importance in commercial settings, reflecting a growing awareness of safety and efficiency.

More people and businesses are investing in high-quality ropes made of materials such as nylon, polyester, hemp, and polypropylene as urbanization speeds up and disposable incomes increase. These materials are chosen for their specific properties suited to various environments, further driving the demand for ropes. Consequently, the commercial segment is becoming a key driver of the growth of the African ropes market, positioning it as an essential component of the region's economic development.

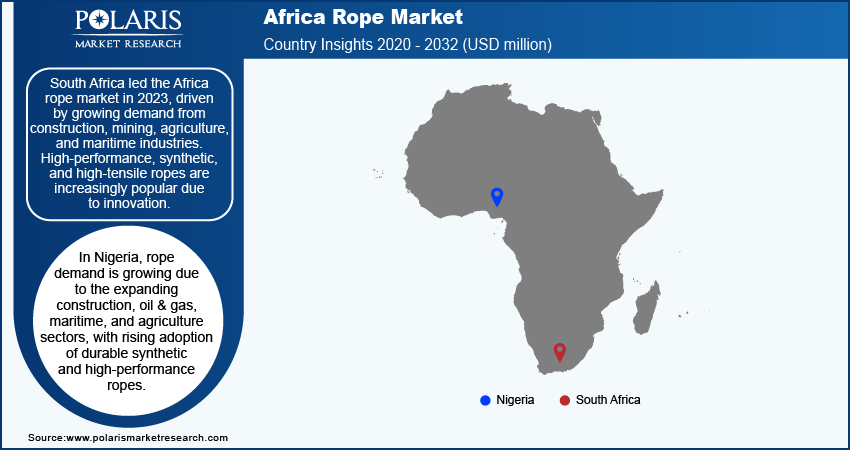

Africa Rope Market Breakdown By Country Insights

By country, the study provides market insights into South Africa, Nigeria, Kenya, Morocco, Mauritius, Algeria, and RoAfrica. South Africa held a prominent share of the Africa rope market in 2023. The demand for rope in South Africa is steadily growing, driven by key industries such as construction, mining, agriculture, and marine. The need for durable, high-performance ropes increases as infrastructure development and mining activities expand. The agricultural sector also contributes to this growth as ropes are increasingly used for crop handling and livestock management. Additionally, the maritime industry requires ropes for mooring, towing, and fishing operations. Innovations in rope materials, such as synthetic and high-tensile ropes, are also attracting consumers in the country.

In Nigeria, the demand for ropes is expected to grow steadily during the forecast period, driven by the expansion of key sectors such as construction, oil & gas, maritime, and agriculture. The construction industry requires high-strength ropes for lifting and rigging operations as infrastructure projects and urban development increase. In the oil & gas sector, ropes are essential for drilling and offshore operations. The maritime industry, with Nigeria's extensive coastline, also fuels the demand for ropes in shipping, fishing, and mooring. In the agricultural sector, ropes are increasingly used for crop handling and animal husbandry, further contributing to the market growth. Additionally, the increasing adoption of synthetic and high-performance ropes due to their durability and strength is expected to boost market growth during 2024–2032.

Africa Rope Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Africa rope market grow even more. Market participants are also undertaking a variety of strategic activities to expand their Africa footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and growing market, market players must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Africa rope market to benefit clients. In recent years, the market has offered a few technological advancements. A few major players in the Africa rope market are Ropes for Africa, Southern Ropes, Haggie Steel Wire Rope, Pentagon Corporation, Actum, Greenwood Rope Products (Pty) Ltd, Toco Lifting Equipment, Nigerian Ropes PLC, Netking, Umholi, Knittex, and Brockwell SA Cotton.

Ropes for Africa specializes in supplying ropes and related products for industries such as construction, sports, marine, and entertainment. Their diverse portfolio includes synthetic and natural ropes, nets, and accessories for commercial and personal use, meeting industry needs.

Southern Ropes manufactures high-quality synthetic ropes for various industries, including marine, mining, and construction. They offer innovative products such as UHMwPE, Vectran, and Technora, with a global presence across Europe, Americas, and countries such as the UK and Australia.

List of Key Companies in Africa Rope Market

- Actum

- Brockwell SA Cotton

- Greenwood Rope Products (Pty) Ltd

- Haggie Steel Wire Rope

- Knittex

- Netking

- Nigerian Ropes PLC

- Pentagon Corporation

- Ropes for Africa

- Southern Ropes

- Toco Lifting Equipment

- Umholi

Africa Rope Market Segmentation

By Product Outlook

- Synthetic

- Steel Wire

- Cotton

- Others

By End Use Outlook

- Industrial

- Commercial

- Residential

By Country Outlook

- South Africa

- Nigeria

- Kenya

- Morocco

- Mauritius

- Algeria

- Rest of Africa

Africa Rope Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,438.69 Million |

|

Market Size Value in 2024 |

USD 1,512.78 Million |

|

Revenue Forecast by 2032 |

USD 2,750.29 Million |

|

CAGR |

7.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2020–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Africa rope market size was valued at USD 1,438.69 million in 2023 and is projected to grow to USD 2,750.29 million by 2032.

The Africa market is expected to register a CAGR of 7.8% during 2024–2032.

South Africa held a prominent share of the market in 2023

A few key players in the market are Ropes for Africa, Southern Ropes, Haggie Steel Wire Rope, Pentagon Corporation, Actum, Greenwood Rope Products (Pty) Ltd, Toco Lifting Equipment, Nigerian Ropes PLC, Netking, Umholi, Knittex, and Brockwell SA Cotton.

The steel wire segment dominated the market in 2023.

The industrial segment accounted for the largest share of the market in 2023.