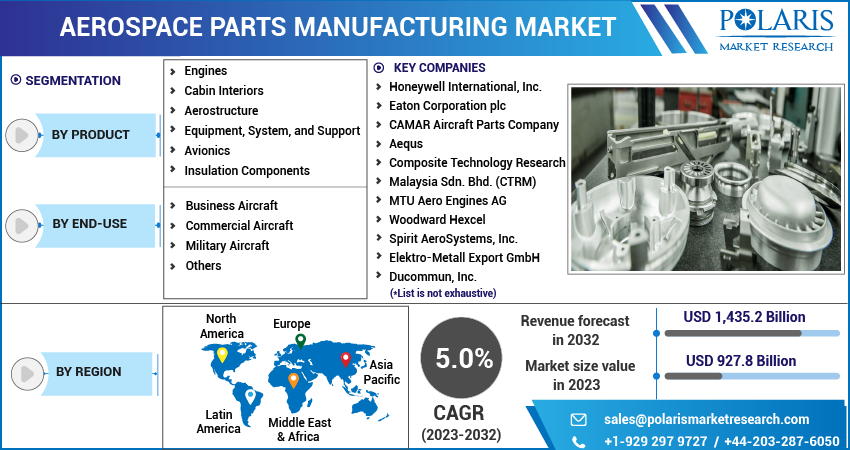

Aerospace Parts Manufacturing Market Size, Share, Trends, Industry Analysis Report: By Product (Aerostructure; Cabin Interiors; Engines; Equipment, System, & Support; Avionics; and Insulation Components), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 140

- Format: PDF

- Report ID: PM2353

- Base Year: 2024

- Historical Data: 2020-2023

Aerospace Parts Manufacturing Market Overview

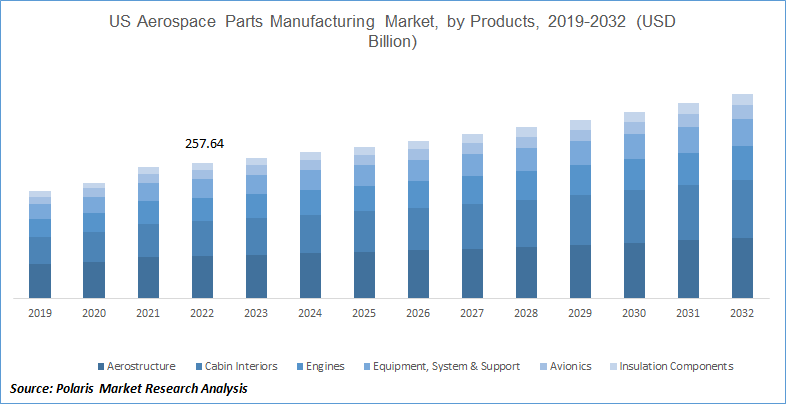

The global aerospace parts manufacturing market size was valued at USD 969.62 billion in 2024. The market is projected to grow from USD 1,014.40 billion in 2025 to USD 1,600.98 billion by 2034, exhibiting a CAGR of 5.2% during 2025–2034.

The aerospace parts manufacturing industry plays a crucial role in supporting both commercial and defense aviation sectors. It involves the production of critical components such as engines, airframes, landing gear, avionics, and control systems that ensure the safety, performance, and efficiency of aircraft. This sector supports aircraft production and also provides aftermarket parts for maintenance, repair, and overhaul (MRO), making it essential for sustained aviation operations.

To Understand More About this Research:Request a Free Sample Report

The global demand for aerospace parts is growing significantly due to increased air travel. According to the International Air Transport Association (IATA), global air passenger demand in 2024 rose by 10.4% compared to 2023, surpassing pre-pandemic levels. This sharp recovery in international and domestic air traffic, especially the strong year-end finish in December, emphasizes the aerospace parts manufacturing market opportunity. Aircraft manufacturers are increasing production to meet the rising demand, resulting in a greater demand for reliable and high-quality parts.

The rising global air passenger traffic directly correlates with the growing requirement for newer, more fuel-efficient aircraft, which, in turn, accelerates the aerospace parts manufacturing market demand. Airlines are modernizing fleets and expanding operations, triggering a wave of orders for parts manufacturers. Additionally, high load factors and increased operational hours place further emphasis on the demand for durable and technologically advanced components

Aerospace Parts Manufacturing Market Dynamics

Increasing Spending on Military Drones/UAVs

The increasing spending on military drones/UAVs is significantly driving aerospace parts manufacturing market expansion. Military drones, now central to modern warfare, require advanced components such as lightweight airframes, precision control systems, and efficient propulsion units. The rising demand for intelligence, surveillance, and reconnaissance (ISR) capabilities is pushing defense agencies to invest heavily in UAV technology. According to the Teal Group, global R&D and procurement spending on military drones is expected to grow from USD 11.1 billion in 2020 to USD 14.3 billion by 2029.

The US leads this trend by increasing its R&D spending from USD 2.2 billion in 2020 to a projected USD 2.7 billion by 2029. Fuel cell-powered drones, offering extended flight time and reduced noise, are becoming preferred choices. For instance, LIG Nex1 was selected for South Korea’s USD 39.3 billion hydrogen-powered cargo drone project. This shift toward technologically advanced UAVs is fueling the aerospace parts manufacturing market demand, particularly for innovative and lightweight components.

Rising Focus on Reducing Aircraft Weight and Increasing Government Initiatives

The increasing focus on reducing total aircraft weight using lightweight parts is a key driver of aerospace parts manufacturing market development. Lightweight components enhance fuel efficiency, lower emissions, and reduce maintenance costs, making them essential for modern aircraft design. The use of advanced composites in fuselage manufacturing minimizes fatigue in high-tension areas, reducing the need for frequent repairs and lowering overall operational costs.

Government initiatives aimed at expanding space exploration programs are creating strong demand for aerospace components. Satellites, rockets, and related space systems require high-performance, lightweight parts for efficiency and durability. Additionally, the growing use of drones and UAVs for military and surveillance applications is contributing to the aerospace parts manufacturing market growth despite potential restraints from fluctuating military budgets.

Aerospace Parts Manufacturing Market Segment Analysis

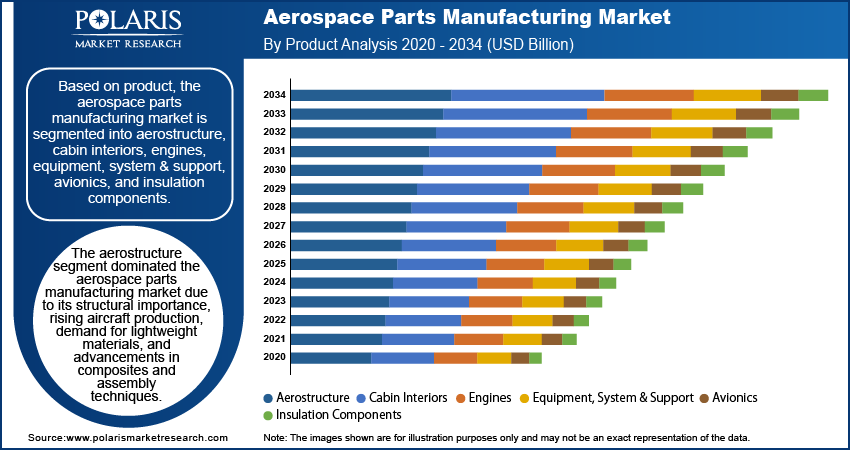

Aerospace Parts Manufacturing Market Assessment by Product

The global aerospace parts manufacturing market segmentation, based on product, includes aerostructure; cabin interiors; engines; equipment, system, & support; avionics; and insulation components. The aerostructure segment accounted for ~32% of the aerospace parts manufacturing market share due to its critical role in aircraft construction. Aerostructures include key components such as fuselage, wings, and empennage, which form the structural backbone of an aircraft. The increased demand for lightweight and durable materials in these areas drives significant investment in design and manufacturing innovations. The growing aircraft production across commercial and defense sectors further amplifies demand for these essential structures.

Technological advancements in composite materials and modular assembly techniques are helping manufacturers meet performance and efficiency standards. The increased production of next-generation aircraft and rising demand for fuel-efficient designs continue to reinforce the dominance of the aerostructure segment within the overall market.

Aerospace Parts Manufacturing Market Evaluation by End Use

The global aerospace parts manufacturing market segmentation, based on end use, includes business aircraft, commercial aircraft, military aircraft, and others. The commercial aircraft segment is expected to register the highest CAGR of 6.3% during the forecast period due to the rising demand for air travel, especially in emerging economies. The increasing globalization, tourism, and business travel are driving airlines to expand and modernize their fleets. Airlines are focusing on fuel-efficient, next-generation aircraft to reduce operational costs and environmental impact. Governments and the private sector are heavily investing in aviation infrastructure to support growing passenger traffic. Technological advancements and improved safety features are also boosting aircraft replacement cycles. These factors collectively contribute to the rapid growth and strong outlook of the commercial aircraft segment.

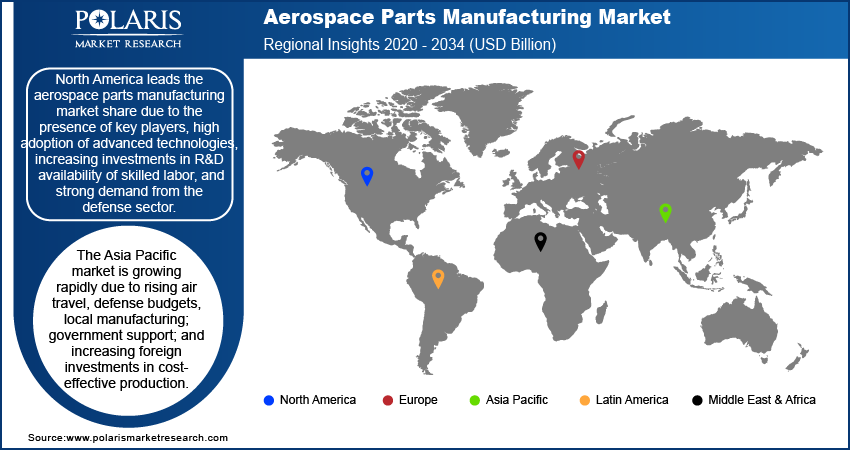

Aerospace Parts Manufacturing Market Regional Analysis

By region, the study provides aerospace parts manufacturing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global aerospace parts manufacturing market revenue share due to the presence of key industry players, robust technological advancements, and significant investments in research and development. The region is home to major aerospace manufacturers and suppliers, including Boeing, Lockheed Martin, and General Electric, that drive the market growth. The demand for both commercial and defense aircraft, coupled with high government spending on defense contracts, contributes to North America's leadership. Moreover, favorable regulatory frameworks, a skilled workforce, and the adoption of innovative manufacturing processes further strengthen the market demand in the region.

The Asia Pacific aerospace parts manufacturing market is experiencing substantial growth due to rapid industrialization, increasing air travel demand, and expanding commercial aviation fleets. Countries such as China, India, and Japan are heavily investing in aerospace infrastructure and local production capabilities. Government initiatives supporting domestic manufacturing and strategic partnerships with global aerospace companies are driving regional market development. The rising defense budgets and the emergence of low-cost carriers are boosting demand for new aircraft and replacement parts. Skilled labor availability and cost-effective manufacturing further attract foreign investments, making Asia Pacific a key hub for market development in the coming years.

Aerospace Parts Manufacturing Market – Key Players and Competitive Analysis Report

The competitive landscape of the aerospace parts manufacturing market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. A few key market players such as GE Aviation; Honeywell International, Inc.; IHI Corp.; Kawasaki Heavy Industries Ltd.; Mitsubishi Heavy Industries, Ltd.; Rolls Royce plc; Raytheon Technologies Corp.; Ducommun Inc.; Eaton Corporation plc; and Thales Group leverage their strong engineering capabilities and global manufacturing footprints to develop high-performance aerospace components. These companies focus on competitive intelligence and strategy to optimize production processes, improve fuel efficiency, and ensure compliance with stringent regulatory standards. Competitive trends indicate a growing emphasis on lightweight materials and digital integration in part manufacturing. Smaller firms, meanwhile, are enhancing their competitive positioning by offering niche, cost-effective solutions tailored to specific customer needs. Industry-wide, strategies such as joint ventures, supply chain diversification, and aftermarket service expansion are shaping the competitive dynamics.

Honeywell International Inc. is a global company in aerospace, industrial automation, and smart building technologies. Its Industry 4.0 solutions, including Honeywell Forge, integrate IoT, AI, and sustainability can enhance operational efficiency, safety, and energy management across industries. In July 2022, Honeywell partnered with Archer Aviation to supply flight control actuation and thermal management systems, enhancing Archer’s 12 tilt 6 design and in-cabin passenger experience.

Thales Group delivers advanced electronic systems, software, and services across aerospace, defense, and digital security. Its offerings include avionics, satellites, cybersecurity, radar, and biometric solutions, serving commercial, government, and military sectors through its aerospace, defense, and digital identity business segments. In May 2022, Thales collaborated with Dassault Aviation through the signature of a maintenance agreement signed on April 1, 2022, for electrical systems on Falcon 900 and Falcon 2000 Series Fleets.

List of Key Companies in Aerospace Parts Manufacturing Market

- Ducommun Inc.

- Eaton Corporation plc

- GE Aviation

- Honeywell International, Inc.

- IHI Corp.

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Raytheon Technologies Corp.

- Rolls Royce plc

- Thales Group

Aerospace Parts Manufacturing Industry Development

In November 2022, GE Aerospace and Tata Advanced Systems Ltd extended their manufacturing agreement under which the latter will continue to produce and supply several commercial aircraft engine components to GE’s global engine manufacturing factories.

In November 2022, Kawasaki Heavy Industries Ltd., SAP Japan Co., Ltd., and Skillnote Corporation collaborated on the development of platform services supporting digital transformation (DX) in the manufacturing industry, with a focus on the manufacturing of aircraft, railways, ships, and large machinery. The companies will combine their experience and know-how in DX, system construction, and engineering to create manufacturing platform services that strengthen the supply chain.

Aerospace Parts Manufacturing Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Aerostructure

- Cabin Interiors

- Engines

- Equipment, System, & Support

- Avionics

- Insulation Components

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Business Aircraft

- Commercial Aircraft

- Military Aircraft

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Parts Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 969.62 Billion |

|

Market Size Value in 2025 |

USD 1,014.40 Billion |

|

Revenue Forecast by 2034 |

USD 1,600.98 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aerospace parts manufacturing market size was valued at USD 969.62 billion in 2024 and is projected to grow to USD 1,600.98 billion by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market are GE Aviation; Honeywell International, Inc.; IHI Corp.; Kawasaki Heavy Industries Ltd.; Mitsubishi Heavy Industries, Ltd.; Rolls Royce plc; Raytheon Technologies Corp.; Ducommun Inc.; Eaton Corporation plc; and Thales Group.

The aerostructure segment led the market share in 2024.

The commercial aircraft segment is anticipated to register the highest growth rate during the forecast period.