Aerospace & Defense PCB Market Share, Size, Trends, Industry Analysis Report

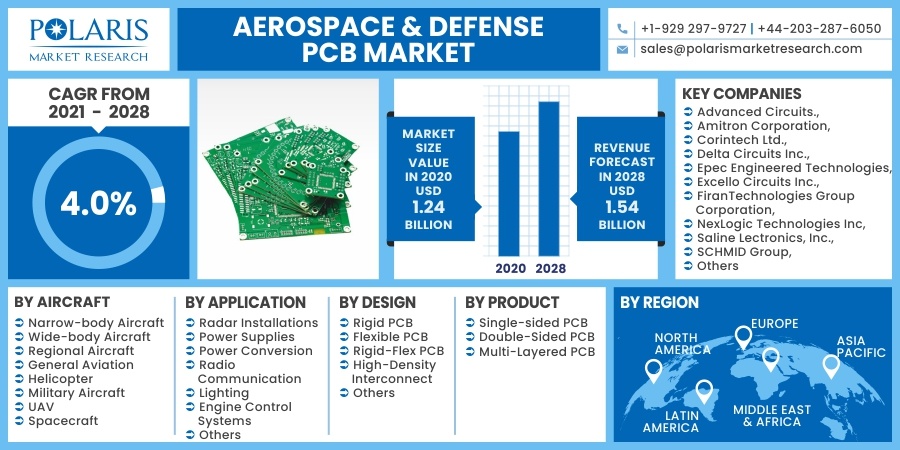

By Product (Single-Sided PCB, Double-Sided PCB, Multi-Layered PCB); By Aircraft; By Application; By Design; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 124

- Format: PDF

- Report ID: PM2082

- Base Year: 2020

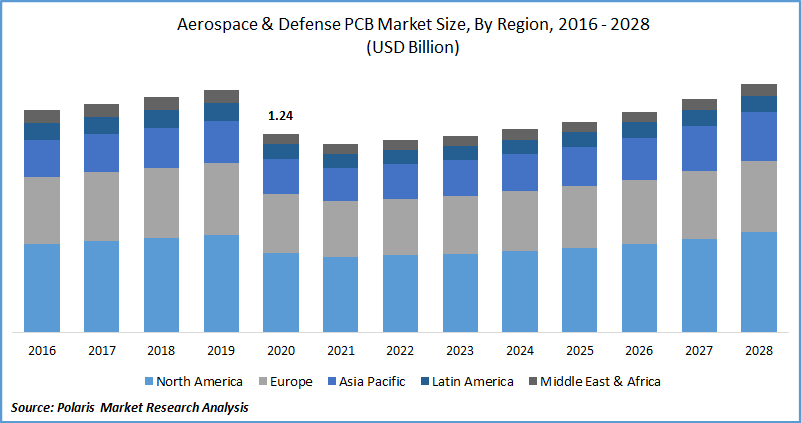

- Historical Data: 2016 - 2019

Report Outlook

The global aerospace & defense PCB market was valued at USD 1.24 billion in 2020 and is expected to grow at a CAGR of 4.0% during the forecast period. A gradual shift from pneumatic to electrical systems in the aerospace industry, increasing in-flight entertainment in modern aircraft programs, expected recovery in air traffic and aircraft deliveries and production, and continuous advancement in technologies are key factors driving the demand for PCB (Printed Circuit Boards) in the global aerospace & defense industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 pandemic brought severe repercussions to the aerospace industry. Airlines suffered a severe financial crisis in 2020 due to travel restrictions across the globe and halt of cross border flights. As per Forbes magazine (June 2021 article), international flights saw the worst ever downfall of 68% vs. domestic flights, which witnessed about a 40% decline in 2020 over 2019 aerospace & defense market.

Furthermore, strong fundamentals of the aircraft defense industry, such as thousands of backlog orders of commercial aircraft at the court of both the industry giants Airbus and Boeing, ensure a resilient future of the industry and niche markets such as electronic components and PCB. Additionally, upcoming aircraft programs such as B777x, C919, and Irkut MC-21 are likely to substantiate new aerospace & defense market opportunities in the foreseen future.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing commercial and regional aircraft deliveries with an expected increase in air passenger and air cargo traffic is directly driving the aerospace & defense market demand across the globe. Additionally, the trend of more aircraft electric aircraft leading to a gradual shift from traditional mechanical and pneumatic systems to modern electrical systems is fueling the demand for PCB in the global aerospace & defense PCB market.

For instance, the next leading European tier player Thales Group has replaced traditional pneumatic and hydraulic circuits with light and compact electrical circuits in the next-generation aircraft platform of Boeing B787, thereby creating more room for electronic components, including PCB in the global aerospace & defense market.

Furthermore, there is a trend towards more electric aircraft, which proliferates lesser emissions and offers significant fuel savings. This leads to increasing penetration of various electronic components on board in a plane, thereby fueling the demand for PCB subsequently. Advancement in technologies such as the development of compact electronic components with enhanced power and efficiency is also anticipated to fuel the aerospace & defense PCB market in the coming years.

Report Segmentation

The market is segmented in the most comprehensive way based on aircraft, application, design, product, and region.

|

By Aircraft |

By Application |

By Design |

By Product |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft

Commercial aircraft (including both narrow-body and wide-body aircraft) hold the lead in the global aerospace & defense PCB market, with narrow-body aircraft being the sweet spot of the industry. Quick recovery in narrow-body aircraft production of both Airbus and Boeing and market entry of upcoming short-haul aircraft such as C919 and MC-21 are likely to boost the demand of the aerospace & defense market in the segment during the forecast period.

Military aircraft and spacecraft have been relatively untouched by the impact of COVID-19 pandemic and are experiencing good growth across the regions. Healthy defense contracts boosting the military aircraft orders and deliveries and robust growth in space launch with thousands of orders in the pipeline to substantiate the aerospace & defense market demand in the near term.

Insight by Application

Among application types, radar installation segment is estimated to depict the fastest growth in the global aerospace & defense market during the forecast period. Increasing airborne surveillance and guidance activities, increasing complexity; and functioning in flight control operations, and growing penetration of electronics in avionics are key driving factors of the segment’s market for aerospace & defense in the foreseen future.

Engine control systems also offer substantial aircraft defense systems market opportunities in the coming years. Modern aero engines are more equipped with electrical systems than traditional pneumatic or hydraulic systems. For instance, the thrust reverser on Airbus A350XWB and A380 is electric instead of hydraulic, which used to be on older generation aircraft.

Insight by Design

Flexible PCB are gaining traction over the other design types in the global aerospace & defense market during the forecast period. Growing requirements of design freedom in modern aerospace electronics, increasing demand for lightweight electronics, and advancement in versatility of flexible PCB in various application areas such as head-up displays and modular electronics.

Additionally, there is a strong need for better airflow and heat dissipation in modern electronics of the aerospace industry, thereby pushing the need for advancement in PCB. Flexible PCB are the choice of products for complex electronics onboard aircraft electrical systems.

Geographic Overview

North America is estimated to remain the largest region of the global aerospace & defense market during the forecast period. Modern aircraft platforms in the region such as Boeing B787 and B737 Max, Airbus A220, and Bombardier Global Express have incorporated more electrical components, leading to increasing demand of PCB in the region.

Asia Pacific is projected to exhibit the fastest growth in the global aerospace & defense market during the forecast period. China, Japan, and India are the key countries having a significant share in the aircraft defense systems market. A shift of manufacturing bases from developed western economies to developing Asian economies like China and India is one of the key growth drivers for the region.

For instance, both leading aircraft industry giants Airbus and Boeing have opened assembly plants of their best-selling aircraft program A320 and B737, in China. Air passenger traffic in the region is also having long-road for saturation, representing robust growth opportunities for the aerospace & defense market in the coming years.

Competitive Landscape

Leading aerospace & defense PCB manufacturers are well diversified into various other product business which mitigates the risks of losses. Development of new products with advanced technologies such as high reliability at extreme environments, customization in design to achieve high-value proposition, and execution of M&A to gain competitive edge in the aerospace & defense market.

Some of the key players competing in the global aerospace & defense market are Advanced Circuits., Amitron Corporation, Corintech Ltd., Delta Circuits Inc., Epec Engineered Technologies, Excello Circuits Inc., FiranTechnologies Group Corporation, NexLogic Technologies Inc, Saline Lectronics, Inc., SCHMID Group, SMTC Technologies Inc., Technotronix.us, and TTM Technologies Inc.

Aerospace & Defense PCB Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 1.24 billion |

|

Revenue forecast in 2028 |

USD 1.54 billion |

|

CAGR |

4.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft, By Application, By Design, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Circuits., Amitron Corporation, Corintech Ltd., Delta Circuits Inc., Epec Engineered Technologies, Excello Circuits Inc., FiranTechnologies Group Corporation, NexLogic Technologies Inc, Saline Lectronics, Inc., SCHMID Group, SMTC Technologies Inc., Technotronix.us, and TTM Technologies Inc. |