Aerospace & Defense Coatings Market Size, Share, Trends, Industry Analysis Report

By Aircraft Type (Commercial & General Aviation, Military & Defense), By Application, By Resin, By Form, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 149

- Format: PDF

- Report ID: PM2072

- Base Year: 2024

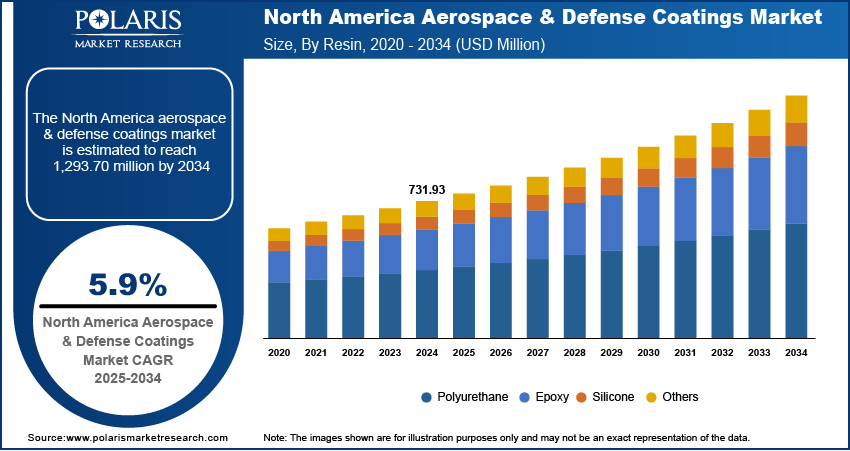

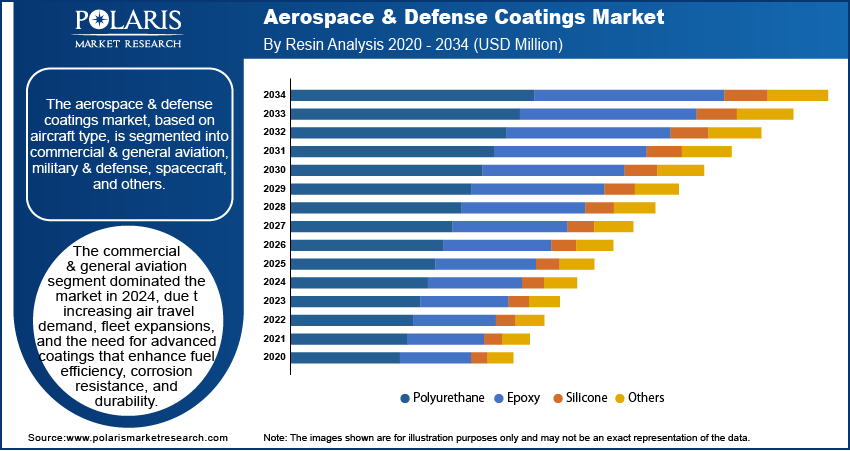

- Historical Data: 2020-2023

Market Overview

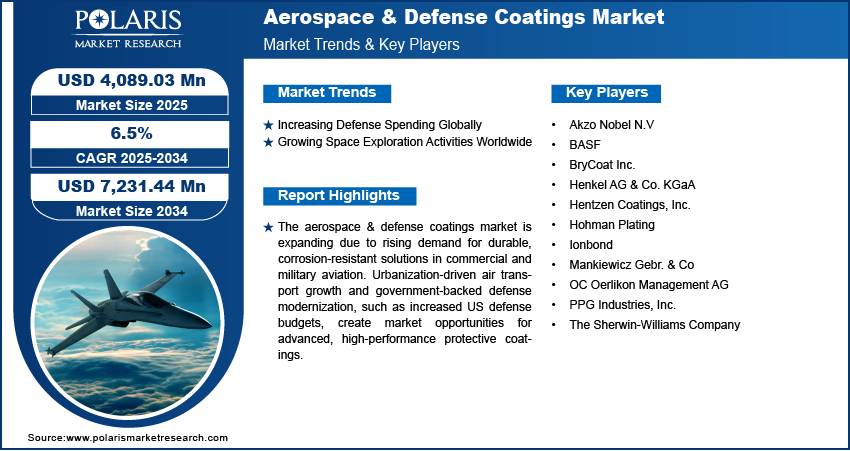

The global aerospace & defense coatings market size was valued at USD 3,854.30 million in 2024 and is expected to register a CAGR of 6.5% from 2025 to 2034. Rising demand for durable and efficient coatings drives industry expansion. Further, technological advancements in material composition are expected to fuel market growth during the forecast period.

Key Insights

- The commercial & general aviation segment dominated the market share in 2024. It is due to increasing air passenger traffic, fleet expansion, and rising demand for durable, fuel-efficient protective coatings.

- The polyurethane segment held the largest share in 2024. The dominance is driven by its superior durability, UV resistance, and widespread applications in interior and exterior aircraft surfaces.

- The engine segment is expected to experience the highest growth rate during the forecast period. The growth is attributed to the increasing demand for high-temperature-resistant coatings and improvements in fuel efficiency to enhance engine performance.

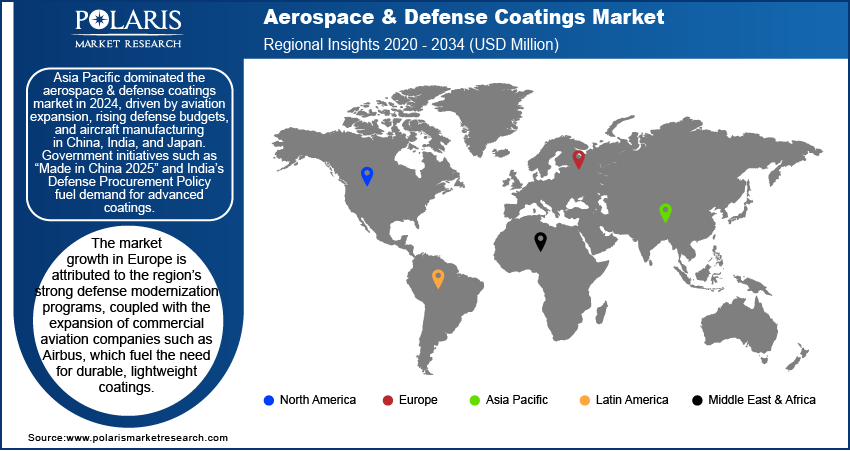

- Asia Pacific held the largest share of the global aerospace & defense coatings industry revenue in 2024. Rapid expansion of the aviation sector and increasing defense expenditures boost the regional industry growth.

Industry Dynamics

- Increasing investments in the defense sector across the world fuel the industry growth.

- Growing space exploration activities globally contribute to the market expansion.

- Regulatory initiatives and corporate R&D investments are expected to provide lucrative opportunities during the forecast period.

- Stringent regulatory compliance and certification requirements hinder the market demand.

Market Statistics

2024 Market Size: USD 3,854.30 million

2034 Projected Market Size: USD 7,231.44 million

CAGR (2025–2034): 6.5%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The aerospace & defense coatings market is growing due to increasing demand for advanced protective solutions in commercial and military platforms such as military drones, helicopters, and others. Market demand for these coatings has surged due to their ability to enhance durability, corrosion resistance, and thermal protection for aircraft, spacecraft, and defense equipment. A key driving factor contributing to market growth is the rising global urbanization, which has led to an increased reliance on air transport for both passenger and cargo services. For instance, data from the United Nations states that by 2050, 68% of the world population is projected to live in urban areas, driving airlines to expand fleets and invest in high-performance coatings to withstand extreme weather conditions. Moreover, government-backed defense modernization programs accelerate the market demand. The US Department of Defense has increased budget allocations for aerospace advancements, fostering aerospace & defense coatings market opportunity for innovative coating technologies that enhance aircraft longevity and operational efficiency.

Another important factor propelling aerospace & defense coatings market growth is the technological advancements in material composition, leading to the development of highly durable and efficient coatings. Epoxy-based aerospace coatings provide excellent adhesion and chemical resistance, making them the optimal choice for aircraft fuselages and military-grade vehicles. Additionally, the European Union's "Fit for 55" policy mandates a 55% reduction in CO₂ emissions by 2030, pushing the aerospace industry to adopt energy-efficient solutions, including advanced coatings that enhance fuel efficiency. The US military's focus on stealth technology has also led to increased adoption of radar-absorbing coatings, ensuring reduced detectability of aircraft. Therefore, such regulatory initiatives, along with corporate R&D investments, will drive growth opportunities in the aerospace & defense coatings market during the forecast period.

The increasing adoption of aerospace & defense coatings is attributed to their superior protective benefits, extending equipment lifespan while reducing maintenance costs. These coatings find key applications in commercial aviation, space exploration, space tourism, and defense sectors, where reliability under extreme conditions is important. A major aerospace & defense coatings industry trend influencing market expansion is the integration of nanotechnology in coatings, enabling enhanced thermal resistance, improved surface durability, and reduced weight. For instance, Boeing and Airbus have actively invested in nanostructured coatings to improve aircraft efficiency and minimize environmental impact. Thus, the market is expected to witness growth, driven by technological advancements, increasing demand for durability, and industry investments in fuel-efficient, high-performance protective solutions.

Market Dynamics

Increasing Defense Spending Globally

Governments across the globe are allocating larger budgets to strengthen their military capabilities, generating large orders for new aircraft, drones, and warships, all of which require specialized coatings for protection and performance enhancement. Rising defense budgets also drive increased naval fleet expansion and maintenance. Aircraft and drones present on aircraft carriers operate in highly corrosive marine environments, requiring specialized coatings to prevent rust, biofouling, and structural degradation. Anti-corrosion coatings extend the lifespan of naval assets, while anti-fouling coatings reduce drag and improve fuel efficiency.

As per the data published by the International Institute for Strategic Studies, global defense spending reached USD 2.46 trillion in 2024, up from USD 2.24 trillion in 2023. Moreover, governments and defense contractors are investing in developing next-generation coatings that enhance stealth, self-repairing properties, and resistance to electronic warfare. Nanocoatings, for instance, offer enhanced durability, lightweight protection, and self-cleaning capabilities, making them highly desirable for modern military applications. As defense budgets expand, funding for innovative coating technologies grows. Therefore, increasing defense spending globally is propelling the aerospace & defense coatings market growth.

Growing Space Exploration Activities Worldwide

Governments and private companies are investing in space missions such as lunar exploration and Mars colonization. These coatings are applied to protect spacecraft, satellites, and launch vehicles against extreme conditions in space. Coatings being employed for aerospace machinery ensure the durability, thermal stability, and functionality of spacecraft components exposed to intense radiation, temperature fluctuations, and micrometeoroid impacts. According to data published by the World Economic Forum, the global space economy is expected to reach USD 1.8 trillion by 2035. Increasing space exploration activities, benefiting from growing investments and technological advancements, will further drive rocket and launch vehicle production, accelerating coatings demand. Therefore, the growing space exploration activities globally are driving the aerospace & defense coatings market development.

Segment Analysis

Market Assessment by Aircraft Type

The aerospace & defense coatings market segmentation, based on aircraft type, includes commercial & general aviation, military & defense, spacecraft, and others. The commercial & general aviation segment dominated the aerospace & defense coatings market share in 2024 due to increasing air passenger traffic, fleet expansion, and rising demand for durable, fuel-efficient protective coatings. The commercial & general aviation segment is further divided into narrow-body aircraft, wide-body aircraft, and others.

The narrow-body aircraft segment dominates the commercial aviation segment due to their cost efficiency and adaptability, increasing the demand for lightweight, corrosion-resistant coatings that reduce operational costs and emissions. Advanced polymer-based coatings enhance aerodynamics and durability. Wide-body aircraft, essential for long-haul routes, require coatings that withstand extreme conditions such as UV exposure and temperature fluctuations. Growing eco-friendly formulations and thermal-resistant coatings for engine components aligned with global sustainability initiatives such as IATA’s carbon neutrality goals and ICAO’s CORSIA program are driving aerospace & defense coatings market demand and innovation. In 2023, Airbus partnered with AkzoNobel for coatings Xiamen aircraft A321neo fleet, which will reduce fuel consumption through improved surface smoothness. Therefore, the application of advanced coatings aligned with the European Union Aviation Safety Agency’s (EASA) sustainability mandates boosts market growth in the aviation industry.

Market Evaluation by Resin

The aerospace & defense coatings market segmentation, based on resin, includes polyurethane, epoxy, silicone, and others. The polyurethane segment dominated the market in 2024, driven by its superior durability, UV resistance, and widespread applications in interior and exterior aircraft surfaces for enhanced weather protection and aesthetics. Polyurethane resins are employed in aerospace coatings for their exceptional flexibility, abrasion resistance, and high-gloss finishes. They are widely used in both interior and exterior applications, offering protection against harsh weather, chemicals, and mechanical wear. A growing trend is the adoption of UV-resistant polyurethane coatings to combat solar degradation, particularly for aircraft operating in high-altitude or tropical environments. Therefore, the lightweight, low-maintenance coatings are driving demand as airlines are prioritizing fuel efficiency and sustainability. Programs such as the FAA’s Continuous Lower Energy, Emissions, and Noise (CLEEN) initiative further accelerate this adoption.

BASF offers polyurethane coatings such as the UNO Single Stage Polyurethane Coating, designed for helicopters and low-altitude aircraft. It meets American Architectural Manufacturers Association (AAMA) standards and can incorporate heat-reflective pigments for better temperature management.

Market Outlook by Application

In terms of application, the aerospace & defense coatings market is divided into exterior, interior, and engine. The engine segment is expected to experience the highest growth rate during the forecast period due to increasing demand for high-temperature-resistant coatings and improving fuel efficiency to enhance engine performance and longevity. Engine coatings are essential in the aerospace and defense sectors, providing critical protection to turbine blades, combustion chambers, and other components against extreme temperatures, corrosion, and erosion. These coatings enhance fuel efficiency by maintaining thermal stability and reducing friction, thereby improving overall engine performance. The increasing adoption of next-generation engines, such as Pratt & Whitney’s Geared Turbofan (GTF), has boosted the demand for advanced ceramic-based and thermal barrier coatings (TBCs) to withstand higher operating temperatures and stresses.

Regional Analysis

By region, the study provides the aerospace & defense coatings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share of the global aerospace & defense coatings market revenue in 2024, driven by rapid expansion in the aviation sector, increasing defense expenditures, and rising aircraft manufacturing activities in countries such as China, India, and Japan. A major driver boosting the market growth is the region’s booming aviation sector, with surging demand for both military and civilian aircraft, necessitating high-performance coatings for corrosion resistance and stealth capabilities. Products such as epoxy, polyurethane, and ceramic-based coatings are widely used in industrial applications, including aircraft fuselages and engine components. Additionally, governments are investing in indigenous defense manufacturing sector, further propelling the need for advanced coatings that enhance durability and operational efficiency. Moreover, policies and regulations, such as China’s "Made in China 2025" initiative and India’s Defense Procurement Policy, are encouraging local production and R&D in high-performance coatings.

The China aerospace & defense coatings market is experiencing increasing growth, propelled by the nation's expanding aerospace activities and defense modernization efforts. The government's substantial investments in indigenous aircraft development, such as the next-generation J-35 stealth jet, early warning aircraft KJ-600 program, necessitate the demand for advanced coatings to meet performance and stealth requirements.

A notable aerospace & defense coatings industry trend is the emphasis on technological innovation and sustainability. In March 2024, China introduced GB/T 43763-2024, a national standard for metallic coatings on special non-metallic materials used in aerospace applications, aiming to enhance coating performance and reliability. In November 2024, BASF's Chemetall showcased a comprehensive range of aerospace surface treatment solutions at Airshow China 2024, highlighting advancements in pre-treatment, coating, and maintenance technologies. These advancements highlight China's focus on enhancing its aerospace & defense coatings sector through innovation and compliance with international standards.

The Japan aerospace & defense coatings market is growing due to the nation's strong defense initiatives and technological advancements in aerospace manufacturing. A key driving factor is the Japanese government's substantial investment in defense installations. In December 2024, BAE Systems, Leonardo, and Japan Aircraft Industrial Enhancement Company (JAIEC) formed a joint venture to develop a next-generation fighter jet under the Global Combat Air Programme (GCAP), aiming for operational readiness by 2035.

The aerospace & defense coatings market in Europe plays an important role in the region’s aviation and defense industries. The aerospace & defense coatings provide advanced protective solutions for aircraft, military vehicles, and naval assets. Europe’s strong defense modernization programs, coupled with the expansion of commercial aviation companies such as Airbus, fuel the need for durable, lightweight coatings. Additionally, regulatory frameworks such as the EU's Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) are accelerating the shift toward eco-friendly products, such as low-VOC and water-based formulations, aligning with the EU’s sustainability goals while ensuring compliance with military durability standards.

Key Players & Competitive Analysis Report

Major companies operating in the aerospace & defense coatings market ecosystem significantly invest in research and development to expand their product offerings. Additionally, these market participants are engaging in various strategic activities to increase their global presence. A few key developments in the market are innovative technology advancements, international collaborations, increased investments, and mergers and acquisitions between private and public sectors.

The aerospace & defense coatings market is consolidated, with the presence of limited number of key global and regional market players. A few major players in the market include Akzo Nobel N.V; BASF; Henkel AG & Co. KGaA; Hentzen Coatings, Inc.; BryCoat Inc.; Hohman Plating; Ionbond; Mankiewicz Gebr. & Co; OC Oerlikon Management AG; PPG Industries, Inc.; and The Sherwin-Williams Company.

Akzo Nobel N.V. is a global provider of aerospace & defense coatings, offering high-performance protective solutions for aircraft, defense equipment, and space applications. The company's performance coatings business segment delivers advanced corrosion-resistant, thermal-resistant, and radar-absorbing coatings, enhancing durability and operational efficiency. The company serves commercial aviation, military, and space industries under brands such as AkzoNobel, Sikkens, and International. Moreover, with the growing focus on innovation and sustainability, Akzo Nobel continues to develop eco-friendly coatings, aligning with global aviation and defense standards to drive market growth.

BASF is a global chemical corporation with a strong presence in the aerospace & defense coatings market. The company’s Surface Technologies segment offers advanced coating solutions, including corrosion-resistant, thermal barrier, and radar-absorbing coatings for military and commercial aircraft. BASF's offerings, including polyurethane and epoxy-based coatings, help enhance the durability and fuel efficiency of the aircraft. BASF’s expertise in high-performance materials supports the aerospace industry’s demand for lightweight and weather-resistant coatings.

List of Key Companies

- Akzo Nobel N.V

- BASF

- BryCoat Inc.

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Hohman Plating

- Ionbond

- Mankiewicz Gebr. & Co

- OC Oerlikon Management AG

- PPG Industries, Inc.

- The Sherwin-Williams Company

Aerospace & Defense Coatings Industry Developments

June 2024: Oerlikon has established an Advanced Coating Technology Center in Westbury, NY, integrating thermal spray and PVD technologies to enhance aerospace and gas turbine industries with innovative, high-temperature coatings and sustainability solutions.

January 2023: Expansion Hentzen Coatings expanded in Kansas, leasing warehouse space in Salina to support Great Plains Manufacturing’s growth by locally storing liquid and powder coatings for industrial, defense, and aerospace applications.

Aerospace & Defense Coatings Market Segmentation

By Aircraft Type Outlook (Revenue, USD Million, 2020–2034)

- Commercial & General Aviation

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Others

- Military & Defense

- Spacecraft

- Others

By Resin Outlook (Revenue, USD Million, 2020–2034)

- Exterior

- Interior

- Engine

By Form Outlook (Revenue, USD Million, 2020–2034)

- Liquid

- Powder

By Application Outlook (Revenue, USD Million, 2020–2034)

- OEM

- Aftermarket

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,854.30 million |

|

Market Size Value in 2025 |

USD 4,089.03 million |

|

Revenue Forecast by 2034 |

USD 7,231.44 million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,854.30 million in 2024 and is projected to grow to USD 7,231.44 million by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are Akzo Nobel N.V; BASF; Henkel AG & Co. KGaA; Hentzen Coatings, Inc.; BryCoat Inc.; Hohman Plating; Ionbond; Mankiewicz Gebr. & Co; OC Oerlikon Management AG; PPG Industries, Inc.; and The Sherwin-Williams Company.

The commercial & general aviation segment dominated the market share in 2024.