Aerospace Composites Market Size, Share, Trends, Industry Analysis Report

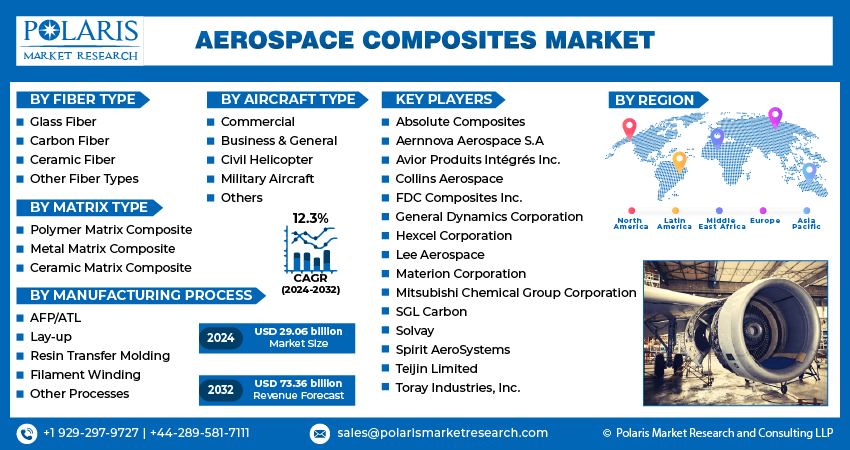

– By Fiber Type (Glass Fiber, Carbon Fiber, Ceramic Fiber, and Other Fiber Types), By Matrix Type, By Manufacturing Process, By Aircraft Type, and By Region; Segment Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 119

- Format: PDF

- Report ID: PM5056

- Base Year: 2023

- Historical Data: 2019-2022

Aerospace Composites Market Outlook

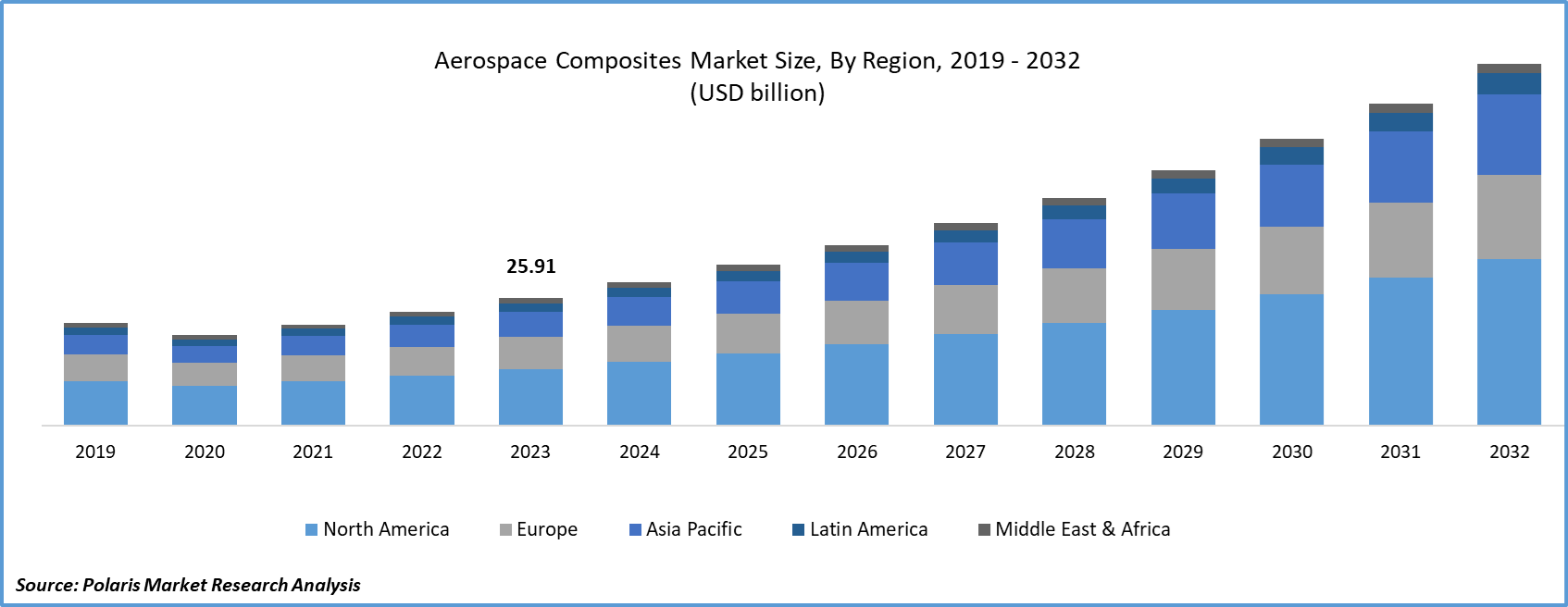

The aerospace composites market size was valued at USD 25.91 billion in 2023. The market is anticipated to grow from USD 29.06 billion in 2024 to USD 73.36 billion by 2032, exhibiting a CAGR of 12.3% during 2024–2032.

Market Overview

The expansion of global infrastructure projects, particularly in airport development to accommodate the rising air passenger traffic, is driving significant demand for new aircraft production. This surge in aircraft manufacturing, necessitated by the growing need for enhanced capacity and modernized fleets, is a critical factor propelling the aerospace composites market growth. The versatile nature of composites, driven by their potential to mold or modify into multiple patterns and their ability to withstand extreme weather conditions, is anticipated to create new opportunities in the market during the forecast period. Moreover, increasing investments in research, development, and manufacturing infrastructure by both government and private organizations are expected to drive substantial market expansion in the coming years, which is further accelerating growth in the aerospace composites sector. For instance, in November 2023, Pentagon announced its plan to invest USD 3.7 million in Qarbon Aerospace, a producer of aerospace composites in Texas, to enhance the development of lightweight thermoplastic composites for US defense aircraft applications.

To Understand More About this Research:Request a Free Sample Report

Increased government spending on military aircraft, drones, and unmanned aerial vehicles (UAVs) is significantly boosting demand for aerospace composites due to the material's distinct advantages in defense applications. Modern defense strategies increasingly prioritize technological superiority, and aerospace composites play a crucial role in enhancing the capabilities of military aircraft and UAVs, thus propelling the growth of the aerospace composites market.

Growth Drivers

Rising Focus on Reducing Environmental Pollution

The rising number of firms stepping forward to reduce carbon footprint and growing government policies to promote environmental sustainability drive the aerospace composites market growth. For instance, according to Our World Data, in 2024, the aviation industry is accountable for 2.6% of global carbon dioxide emissions and 4% of global warming. This factor stimulates the development and adoption of lightweight and sustainable aerospace composites. The rising concerns of passengers about environmental pollution motivate aerospace agencies to prefer eco-friendly aircraft designs to gain a competitive edge.

In October 2023, GKN announced the expansion of its aero-engine agreement with GE Aerospace. The agreement consists of new technology insertion, complex engines, and sustainable product innovations, which aim to limit global emissions.

Increasing Demand for Air Travel

The growing air travel demand is driving the development of new aircraft models, including fuel-efficient and environmentally friendly designs that rely heavily on composite materials. This trend is particularly evident in the production of next-generation commercial aircraft such as the Boeing 787 and Airbus A350, which incorporate a significant percentage of composite materials to achieve optimal performance. Furthermore, the robust growth in demand and capacity underscores the aviation industry's recovery and highlights the need for continued investment in fleet expansion and optimization. For instance, according to the International Air Transport Association (IATA), in January 2024, total demand, measured in revenue passenger kilometers, rose by 16.6%, while capacity, measured in available seat kilometers, increased by 14.1%, leading to a load factor of 79.9%, indicating efficient operations and high seat utilization. Thus, the growing need for aircraft is driving substantial demand for manufacturing tools and equipment, including composites, which is further fueling the market growth.

Restraining Factors

High Costs of Materials and Low Availability of Skilled Professionals

The higher cost of raw materials to produce composites and the low awareness and presence of skilled or experienced professionals adversely impact the aerospace composites market. The challenges associated with the repair of composites also hinder their adoption.

Aerospace Composites Market Report Segmentation

The aerospace composites market is primarily segmented on the basis of fiber type, matrix type, manufacturing process, aircraft type, and region.

|

By Fiber Type |

By Matrix Type |

By Manufacturing Process |

By Aircraft Type |

By Region |

|

|

|

|

|

By Fiber Analysis

The Carbon Fiber Segment is Expected to Witness the Highest Growth Rate During the Forecast Period

The carbon fiber segment is projected to register the highest CAGR during the forecast period owing to its higher use in the manufacturing of wings, tail sections, and fuselages of private, commercial, and other aircraft. The propensity to last for a longer duration, the ability to resist corrosion, and the potential to produce composites in compact sizes are anticipated to propel their adoption in the coming years.

By Matrix Type Analysis

The Polymer Matrix Segment Accounted for the Largest Market Share in 2023

The polymer matrix segment held the largest aerospace composites market share in 2023. The growing number of aircraft manufacturing firms focusing on developing sustainable, energy-efficient, and longer-shelf-life aircraft boosts the demand for polymer matrix. The increasing number of research studies exploring the benefits associated with matrix-type aircraft composites promotes the market growth.

By Aircraft Type Analysis

The Commercial Segment Held a Significant Market Revenue Share in 2023

The commercial segment held a significant revenue share of the aerospace composites market, due to the continuous rise in the production of commercial aircraft with the growing economic activities across the world and increasing demand for tourism. As per Boeing, in 2023, there will be demand for 42,600 new commercial jets in the next 20 years. Thus the rising economic activities and tourism is driving the commercial segment significantly.

Aerospace Composites Market Regional Insights

North America Held Largest Share of Global Market in 2023

North America held the dominant share of the aerospace composites market owing to the presence of a higher-income population. The rising use of aircraft, coupled with the growing demand for air travel, is leading to higher greenhouse gas emissions. For instance, according to the Environmental Protection Agency, commercial and large business aircraft contribute 10% of the national transportation greenhouse gas emissions in the US.

Asia Pacific is expected to be the fastest growing region with the highest CAGR during the forecast period in the aerospace composites market, owing to the presence of more populous nations, particularly China and India, creating huge traffic problems. Furthermore, the rising disposable income among the population propels the demand for low-time-consuming transportation. For instance, according to the Boeing 2024 estimates, India is expected to contribute 8% annual air traffic growth due to the growing middle-class population in the economy. This fuels the demand for aerospace composites over the forecast period.

Key Market Players and Competitive Insights

Strategic Partnerships to Drive Competition

The aerospace composites market is partially consolidated, driven by a growing number of companies focusing on global expansion through acquisitions, collaborations, and partnerships. In May 2023, GracoRoberts completed the acquisition of Pacific Coast Composites, aiming to promote its product offering and short lead times in the aerospace industry. The increasing demand for aerospace composites due to the growing aviation industry will drive innovations in the marketplace.

Major Players in Global Aerospace Composites Market

- Absolute Composites

- Aernnova Aerospace S.A

- Avior Produits Intégrés Inc.

- Collins Aerospace

- FDC Composites Inc.

- General Dynamics Corporation

- Hexcel Corporation

- Lee Aerospace

- Materion Corporation

- Mitsubishi Chemical Group Corporation

- SGL Carbon

- Solvay

- Spirit AeroSystems

- Teijin Limited

- Toray Industries, Inc.

Recent Developments in Industry

- In April 2024, Boeing acquired Aerospace Composites Malaysia Sdn from Hexcel Corporation. With this, it has expanded its brand coverage in Southeast Asia.

- In May 2023, GKN Aerospace established a new technology center in the Netherlands for USD 86.4 million. This is to establish a favorable environment for aerospace composite research and speed up the development of sustainable aviation technologies.

Report Coverage

The aerospace composites market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, fiber type, matrix type, manufacturing process, aircraft type, and their futuristic growth opportunities.

Aerospace Composites Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 29.06 billion |

|

Revenue forecast in 2032 |

USD 73.36 billion |

|

CAGR |

12.3% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aerospace composites market size was valued at USD 25.91 billion in 2023 and is projected to grow to USD 73.36 billion by 2032.

The global market is projected to grow at a CAGR of 12.3% during the forecast period.

North America had the largest share in the global market due to its presence of a higher-income population.

The key players in the market Absolute Composites, Aernnova Aerospace, Avior Produits Intégrés, Collins Aerospace, FDC Composites, and General Dynamics.

The polymer matrix category dominated the market in 2023 due to the growing number of aircraft manufacturing firms focusing on developing sustainable, energy-efficient, and longer-shelf-life aircraft.

The carbon fiber category had the fastest share due to its higher use in the manufacturing of wings.