Aerosol Market Size, Share, Trends, Industry Analysis Report: By Type (Standard Type and Bag-In-Valve Type), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1173

- Base Year: 2024

- Historical Data: 2020-2023

Aerosol Market Overview

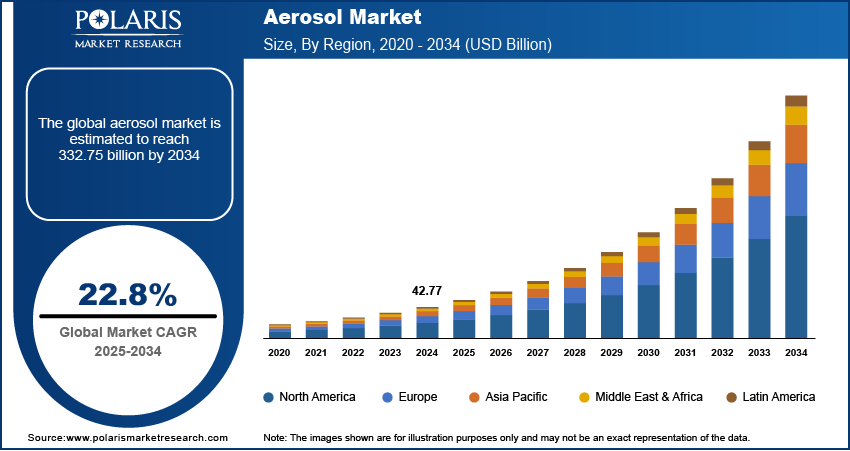

The global aerosol market size was valued at USD 42.77 billion in 2024. The market is projected to grow from USD 52.34 billion in 2025 to USD 332.75 billion by 2034, at a CAGR of 22.8% from 2025 to 2034.

Aerosols are tiny particles, either solid or liquid, suspended in the atmosphere. They can significantly impact climate, weather, health, and ecology. Aerosols are used in a variety of products, such as deodorants, hair sprays, dry shampoos, insecticides, air fresheners, cleaning products, lubricants, and medical sprays.

The growing disposable income and increasing awareness of personal cleanliness and appearance are a few of the key factors driving the aerosol market growth. Aerosols are now used across a wide range of industries, including automotive, paint and varnish, industrial, medicinal, veterinary, and food sectors. The rising use of aerosol propellants in products like styling mousses, hair sprays, deodorants, and antiperspirants further contributes to the market expansion.

To Understand More About this Research:Request a Free Sample Report

Rapid urbanization and infrastructure developments in emerging nations are expected to drive the demand for aerosol paints and coatings, as well as home goods like disinfectants. The growing need for pesticides in the agricultural sector is expected to provide various aerosol market opportunities during the forecast period.

Aerosol Market Dynamics

Rising Applications in Automotive Industry

Aerosols are used in various applications within the automobile industry, including cleaners, lubricants, and ignition sealants. For instance, cleaning aerosols are used to clean car brakes, carburetors, fuel-injection air intakes, battery terminals, electric motors, and electronics. Ongoing research and innovation in the automotive industry, along with growing concerns about environmental pollution, have led to the emergence of new markets for hybrid, fuel-cell, and electric vehicles (EVs). In addition, governments worldwide are promoting the production of cars with lower emissions, boosting automobile manufacturing. As a result, the demand for aerosol automotive products is expected to rise, supporting the continued expansion of the aerosol market.

Increasing Demand for Pharmaceuticals and Personal Care Packaging

A growing number of consumer packaged goods (CPG) companies are adopting aerosol-based sustainable packaging to promote product recycling and reusability. The airtight nature of aerosol packaging minimizes the risk of leaks, spills, and breakage, offering several economical and durable advantages to CPG companies. Additionally, the pharmaceutical industry is increasingly using aerosol-based treatments for obstructive airway illnesses such as tuberculosis and chronic obstructive pulmonary disease (COPD). Aerosols are also commonly used in dental procedures, including air tooth polishing and dental drills. Thus, the rising demand for pharmaceuticals and personal care packaging is propelling the aerosol market revenue.

Aerosol Market Segment Insights

Aerosol Market Assessment by Material Insights

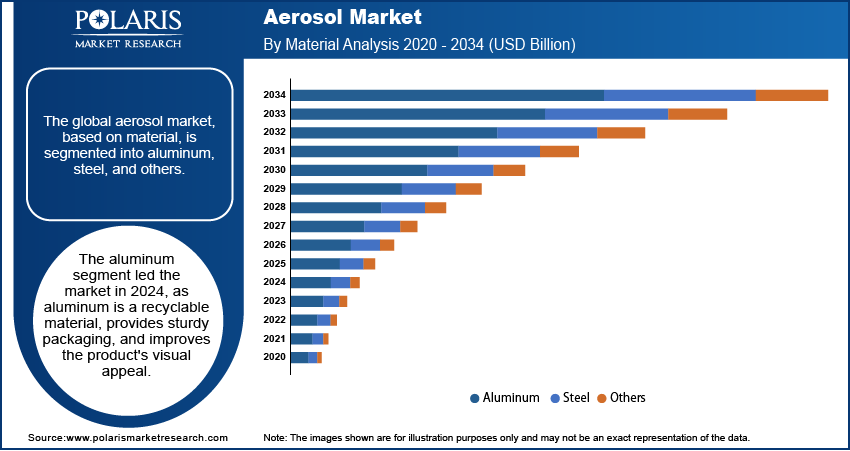

The global aerosol market, based on material, is segmented as aluminum, steel, and others. The aluminum segment led the market with the highest revenue share of 63.2% in 2024 and is anticipated to grow at a significant rate during the forecast period. Aluminum is an environmentally friendly material that can be recycled several times. Additionally, it provides durable packaging and greatly enhances a product's visual appeal. These factors have been key drivers of the segment's leading position in the market.

The plastic material segment has witnessed increased demand in recent years due to the low weight, low cost, and high recyclability of PET plastic. However, stringent regulations on plastic packaging, particularly in Europe, are expected to hinder the segment’s growth in the coming years.

Aerosol Market Outlook by Type Insights

Based on type, the aerosol market is bifurcated into standard type and bag-in-valve type. The standard type segment commanded the market in 2024 and is expected to retain its dominance over the forecast period. This segment includes both metering and continuous-type valves. Continuous valves are used when a continuous spray is needed. Metered valves are used in pharmaceutical and air freshening applications as they can effectively distribute metered doses. The high utilization of these valves in food products, electronics products, and home care products contributes to the segment’s dominant market position.

In a bag-in-valve aerosol, the product is mainly released by the propellant when the bag is compressed after pressing the spray button. The bag inside the valve ensures nearly 99.5% dispersion of the product; it is usually made from four-layer laminates, minimizing oxidation risk, and the product is securely sealed with the bag. These advantages are attracting several producers to the bag in the valve aerosol market.

Aerosol Market Regional Analysis

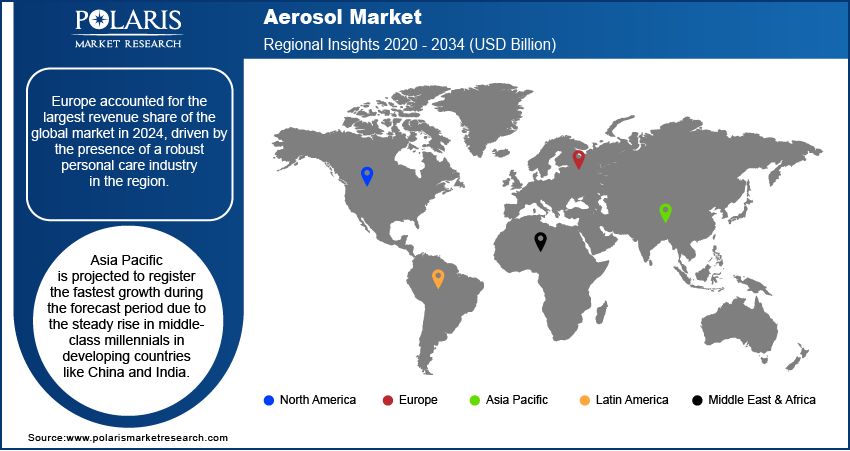

By region, the report the aerosol market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the global market with a 36.2% revenue share in 2024, as the region is a leading producer of aerosol. Its robust market share is also attributable to the presence of a robust personal care sector. Other factors, such as rising consumer spending, rapid growth in the fragrance industry, and high cosmetic consumption, contribute to the region’s leading market population.

The Asia Pacific aerosol market is projected to witness the fastest growth during the forecast period, driven by the steady increase in the middle-class millennial population in emerging nations like China and India. Millennials in this region tend to have high disposable income and a strong connection to the digital world. As a result, this demographic is highly informed and a major consumer of personal care products, including shaving foam, hair mousse, perfumes & deodorants, and hair spray.

Aerosol Market – Key Players and Competitive Insights

The aerosol market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce new products to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly aerosols that comply with stringent government regulations. The aerosol market research report offers a market assessment of all the major players, including Beiersdorf AG, Arkema Group, Akzo Nobel N.V., Emirates Gas LLC, Colep UK Ltd, Grillo-Werke AG, Starco Brands, SC Johnson & Son Inc., Honeywell International Inc., Procter & Gamble, Crabtree & Evelyn, Royal Dutch Shell p.l.c., Lindal Group, Reckitt Benckiser Group Plc., and Unilever LLC.

List of Aerosol Market Key Players

- Akzo Nobel N.V.

- Arkema Group

- Beiersdorf AG

- Colep UK Ltd

- Crabtree & Evelyn

- Emirates Gas LLC

- Grillo-Werke AG

- Honeywell International Inc.

- Lindal Group

- Procter & Gamble

- Reckitt Benckiser Group Plc.

- Royal Dutch Shell p.l.c.

- SC Johnson & Son Inc

- Starco Brands

- Unilever LLC

Aerosols Industry Developments

In October 2024, Silgan Holdings declared the acquisition of Weener Plastics, a Dutch company that offers advanced solutions for plastic packaging for dispensing and containing applications. Silgan stated that the acquisition aspires to integrate the experiences of both businesses and product portfolios to cater to the changing consumer demands globally.

In January 2024, Medspray and Resyca signed an exclusive license and collaboration agreement with Recipharm, a contract development and manufacturing organization (CDMO). According to Resyca, the partnership aims to create nasal soft mist delivery systems for both single and combination medications.

Aerosol Market Segmentation

By Type Outlook

- Standard Type

- Bag-In-Valve Type

By Material Outlook

- Aluminum

- Steel

- Others

By Application Outlook

- Household

- Plant Protection

- Furniture & Wax Polishes

- Surface Care

- Insecticides

- Air Fresheners

- Disinfectants

- Others

- Food

- Whipped Cream

- Sprayable Flavors

- Oils

- Edible Mousse

- Medical

- Topical Application

- Inhaler

- Personal Care

- Hair Mousse

- Shaving Mousse/Foam

- Deodorants

- Hair Spray

- Suncare

- Others

- Automotive & Industrial

- Lubricants

- Cleaners

- Spray Oils

- Greases

- Paints

- Consumer

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerosol Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.77 billion |

|

Market Size Value in 2025 |

USD 52.34 billion |

|

Revenue Forecast by 2034 |

USD 332.75 billion |

|

CAGR |

22.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 42.77 billion in 2024 and is projected to grow to USD 332.75 billion in 2034.

The market is projected to register a CAGR of 22.8% during the forecast period.

Europe accounted for the largest market share in 2024.

Beiersdorf AG, Akzo Nobel N.V., Arkema Group, Colep UK Ltd, Emirates Gas LLC, Grillo-Werke AG, Starco Brands, Honeywell International Inc., SC Johnson & Son Inc, Procter & Gamble, Crabtree & Evelyn, Lindal Group, Royal Dutch Shell p.l.c., Reckitt Benckiser Group Plc., and Unilever LLC are a few of the key markey players

The standard type segment led the market in 2024.

The aluminum segment held the largest market share in 2024.