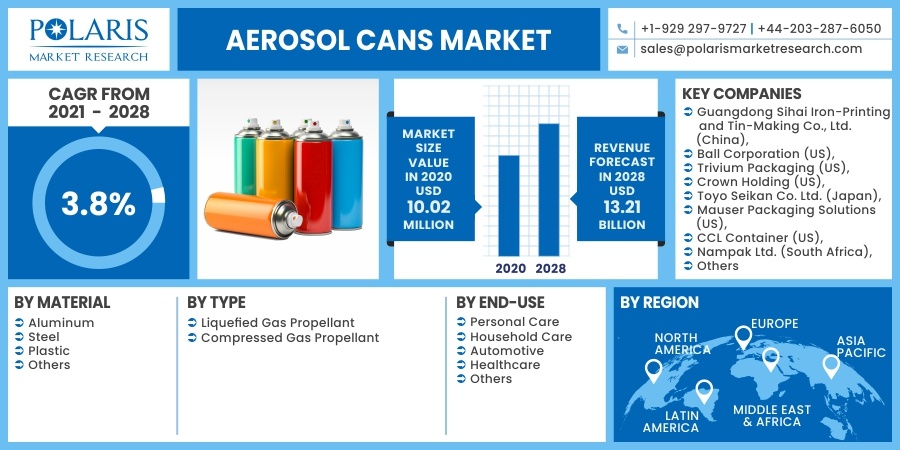

Aerosol Cans Market Share, Size, Trends, Industry Analysis Report, By Material (Aluminum, Steel, Plastic); By End-Use (Personal Care, Household Care, Automotive, Healthcare); By Type; Segment Forecast, 2021 - 2028

- Published Date:Jun-2021

- Pages: 118

- Format: PDF

- Report ID: PM1928

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

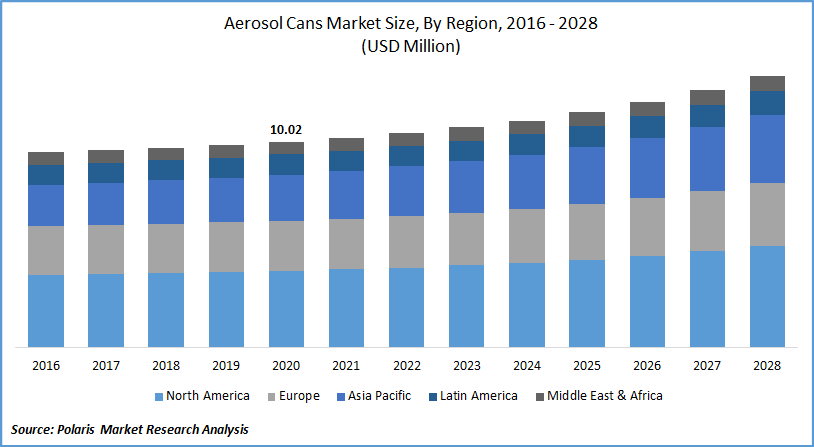

The global aerosol cans market was valued at USD 10.02 million in 2020 and is expected to grow at a CAGR of 3.8% during the forecast period. Change in the new retail format is the key factor contributing to the growth. High competition among the FMCG companies to capture the consumers with the limited shelf space has enforced the competitors into focusing on the improved packaging for the products which is expected to fuel the aerosol cans market growth over the coming years.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

A busy lifestyle among the youth population has created a demand for easy-to-carry and long-lasting packaged food alternatives. Several players are focusing on delivering the package food & beverages in aerosol cans as they are unbreakable, lightweight, and easy to hold and thus have significant growth opportunities over the forecast period.

Increasing disposable income, surge in demand for personal care products such as hair sprays, face and body creams, product differentiation and attractive presentations, and, significant change in the consumers' lifestyles are some of the crucial factors contributing to the industry development.

However, the aerosol cans market growth is anticipated to get hampered by the traditional alternatives as they are cost-efficient and easy to dispose of. The applications that do not need a spray can be easily replaced with flexible packages, thermoform, and tubes and thus impose a crucial challenge for industry development.

Know more about this report: request for sample pages

Aerosol Cans Market Report Scope

The market is primarily segmented on the basis of material, type, end-use industry, and geographic region.

|

By Material |

By type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Material

Aluminum aerosol cans dominated the industry in the year 2020 owing to its application in packaging. It is shatterproof, flexible, recyclable, impermeable, lightweight, and corrosion resistant. It aids in preserving the inner content for a longer time by preventing high volatile constituents from escaping.

Slim aluminum cans are gaining market popularity in the beverage sector than the food packaging considering the trend for the ready drink beverage segment. The nitrogen-infused widget process applied during the manufacturing of these cans aids in retaining the content quality for a longer period which is expected to boost the industry for aerosol aluminum cans in the coming years.

Aluminum aerosol cans are easily recyclable thus the demand for the product is increasing across the industries seeking for environmentally friendly products. Industries are using it to provide a better alternative for traditional packaging which is expected to drive the market in the forecast period. Aluminum aerosol cans are used for spraying pesticides and fertilizers as it protects the chemical from light and provides chemical resistance thus have market potential from agricultural industries.

Insight by Type

The industry for aerosol cans is bifurcated into liquified gas propellent and compressed gas propellent based on type. Liquified gas propellent had the largest market share in the year 2020, accounting for its application in perfumes, foams, insecticides, and deodorants. It can maintain constant pressure inside the can even after the product level drops as more propellant evaporated to sustain the pressure. It enables to maintain the pressures through the product life and thus have industry opportunities for aerosol cans in various sectors.

Compressed gas propellants have industry opportunities owing to their use in pharmaceutical applications such as drug delivery to the nasal passages, pulmonary airways, or the oral cavity. It required minimal cleanup after use and thus has gain popularity among the patients.

Insight by End-Use

The personal care segment led the industry in the year 2020, considering its use in face & body creams, perfumes, shaving foams, and deodorants. In the developing economies, the disposable income of the working population is increasing allowing them to spend more on personal care and beauty products which are further contributing to the growth of the aerosol can market.

The household care segment has significant growth opportunities in the coming years accounted for the growing demand for products such as bug spray, mosquito repellents, and furniture cleaners. Consumers are shifting towards easy-to-use anti-bug sprays which are expected to increase the demand for aerosol cans in the forecast period.

The healthcare segment of aerosol cans industry has promising future opportunities with the adoption of sterilized aerosol containers by several pharmaceutical industries. However, factors such as product interaction and growing concerns regarding transparency imposed crucial challenges for market growth.

The automotive segment is showing market growth owing to the implementation of aerosol cans in spray painting. Color coating enhanced the look of the car and protects the damage from corrosion. The paints used are water-based formula which needs to be applied with high pressure. Growing demand for the automotive sector across the globe is expected to act as a catalyst for market development for aerosol cans over the coming years.

Geographic Overview

North America dominated the market for aerosol cans in the year 2020, owing to the increasing disposable income among the population in the Canada and US. Consumers' inclination for easy-to-carry products is the key market growth driver. The presence of major market players has anticipated to aids the region is leading the market for aerosol cans over the coming years.

Asia Pacific is projected to register significant market growth in the forecast period accounted for the factors such as, industrialization in India and China, expansion of industries from local markets to the global consumer base, retail growth, changing lifestyle, and so on. The growth of the personal care industry in the region is expected to drive the market in the forecast period.

Middle East & Africa aerosol cans industry is anticipated to gain market traction considering the rising spending on personal care by most of the population. Countries such as Saudi Arabia and UAE contribute the most share to the personal care market due to growing income among the consumer base and the increasing young population.

Competitive Insight

Prominent players in the global aerosol market consist of Guangdong Sihai Iron-Printing and Tin-Making Co., Ltd. (China), Ball Corporation (US), Trivium Packaging (US), Crown Holding (US), Toyo Seikan Co. Ltd. (Japan), Mauser Packaging Solutions (US), CCL Container (US), Nampak Ltd. (South Africa), CPMC Holdings Ltd. (China), Colep (Portugal), etc.

Key players in the aerosol cans industry are focusing on mergers, acquisitions, partnerships, R&D, and product portfolio expansion to gain a competitive edge. In the July of 2020, Guangdong Sihai Iron and Tin-Making Co. Ltd completed the plant relocation which enables the organization to reduce the product delivery period by decrease loading time.

Trivium Packaging a company based in Argentina expanded the reuse and recycling of aluminum from used aerosol cans in Latin America. This initiative by the organization was focus on raising awareness about sustainability for the planet and the consumers. It’s been carried out through partnership with Creando Concienca a worker cooperative that used recycle waste to transform it into street furniture.