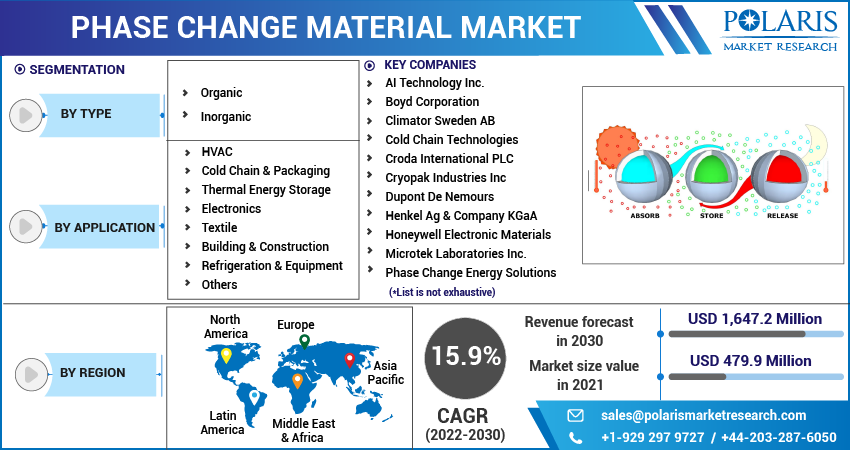

Phase Change Materials (PCM) Market Share, Size, Trends, Industry Analysis Report, By Product (Paraffin Wax, Salt Hydrates, Others); By Application (Organic, Inorganic, Eutectic); By Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 116

- Format: PDF

- Report ID: PM1171

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

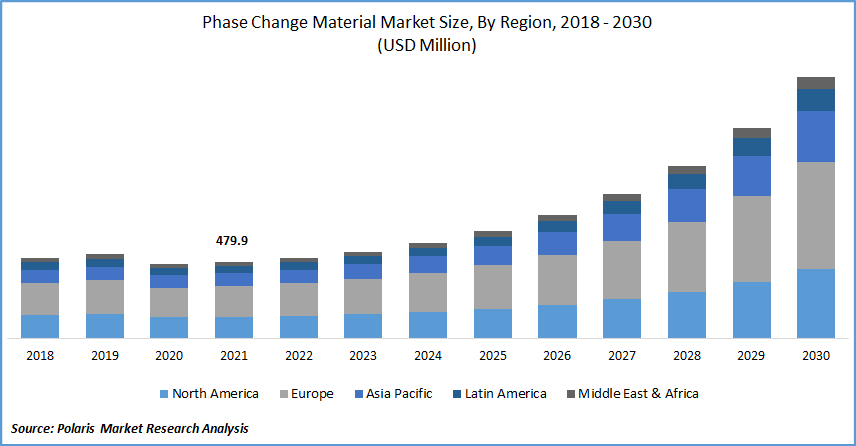

The global phase change material market was valued at USD 479.9 million in 2021 and is expected to grow at a CAGR of 15.9% during the forecast period. Factors such as the benefits of the industry for various applications and the rise in using these materials for controlling temperature boost industry growth during the forecast period.

Know more about this report: Request for sample pages

At a relatively consistent temperature, they show their physical nature to absorb, store and distribute significant heat. When a phase change material freezes, a substantial quantity of energy is released as latent heat, and when it melts, a large amount of heat is absorbed from the environment.

By liquefying and solidifying at specific temperatures, phase change materials absorb and release heat. The natural latent heat capability of phase change substances assists in the temperature preservation of a structure and protects it from external alterations. Ambient temperature fluctuations recharge phase change materials, making them fit for everyday use.

Further, the rising use of the phase change material market for temperature control will move the market forward. Their application in construction ensures room temperature management. The material phase, which releases and absorbs energy during the process, is shifted by changes in external temperatures over the day and night.

The demand for the heating and cooling equipment needed to maintain room temperature is reduced when temperature regulation is made with phase change material. However, the market has been hampered by the fluctuating costs of raw materials used to create such materials amid the COVID-19 pandemic. The lack of information about the benefits of employing the industry and its products is a serious issue for the phase change material market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising adoption of phase change material market in building and developing countries' rising construction industry. Between April 2020 and December 2020, India's FDI in the construction projects was USD 29.53 billion and USD 23.99 billion, according to with Department for Promotion of Industry and Internal Trade (DPIIT).

In addition, the Indian government has implemented several major policies and projects, including Smart Cities, Housing for All, and the 'Atal Mission for Urban Rejuvenation and Transformation' (AMRUT), all of which support India's construction industry's growth. In March 2021, for illustration, the Indian Parliament passed a bill to establish the National Bank for Financing Infrastructure and Development (NaBFID) to finance infrastructure projects across the country.

Moreover, PCMs are utilized in various housing infrastructure applications, including walls, floors, roofs, and others. The major applications in construction systems are wallboards or incorporating components into a concrete or mortar matrix. Combining building components with PCMs is an excellent approach to boost their thermal energy storage capacity. Wallboards, roofing, concrete, doors, and others are mixed to improve the structure's thermal efficiency.

Insulating concrete forms (ICFs) are used to create cast-in-place concrete walls with multiple insulation sheets. The inner side of the building envelope is the most typical technique for integrating PCMs in dwellings. As a result of the growing use of the product in building interiors, it is now possible to absorb and release heat in the space.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Type

Based on the type segment, the organic segment is expected to be the most significant revenue contributor. Organic phase change materials are naturally occurring petroleum bi-products that change phase at a specific temperature. In the future years, this is projected to boost segmental growth.

Also, hydrated salt solutions derived from manufactured natural water salts make up the inorganic section. Salts' chemical composition differs as a result. The proper phase-change temperature is obtained in the mixture. Special nucleating agents are added to the salt hydrate mixture to reduce salt separation and super-cooling.

Geographic Overview

Europe had the largest revenue share in the global market. The area is projected to dominate and retain an important place in the global market in the next years. The tremendous influence of stringent government rules, construction activities, and consumer expenditure are to blame. The market is projected to be driven by the expanding construction industry. In addition, the rising need for the product in cold chain & packaging and building & construction are likely to drive demand.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. China accounted for more than half of the Asia Pacific market. Building and construction, as well as cold chain packing, are key sectors in the country. India has many construction projects underway, which will propel the market forward. For instance, in China, the construction enterprises signed 50 trillion-yuan worth of contracts in 2018.

In addition, growing urbanization in emerging economies is likely to increase investment in critical infrastructure sectors, including power, building, and transportation. According to the World Bank, by 2025, 46 percent of Indians will be living in cities. In Brazil, urban regions are home to 89 percent of the country's population. Brazil's urban population is increasing at a rate of 1.1 percent per year.

Competitive Insight

Some of the major players operating in the global market include AI Technology Inc., Boyd Corporation, Climator Sweden AB, Cold Chain Technologies, Croda International PLC, Cryopak Industries Inc, Dupont De Nemours, Henkel Ag & Company KGaA, Honeywell Electronic Materials, Microtek Laboratories Inc., Phase Change Energy Solutions, Pluss Advanced Technologies, Puretemp LLC, Rubitherm Technologies GmbH, and Sasol Limited.

Phase Change Material Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 479.9 Million |

|

Revenue forecast in 2030 |

USD 1,647.2 Million |

|

CAGR |

15.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AI Technology Inc., Boyd Corporation, Climator Sweden AB, Cold Chain Technologies, Croda International PLC, Cryopak Industries Inc, Dupont De Nemours, Henkel Ag & Company KGaA, Honeywell Electronic Materials, Microtek Laboratories Inc., Phase Change Energy Solutions, Pluss Advanced Technologies, Puretemp LLC, Rubitherm Technologies GmbH, and Sasol Limited. |