Advanced Glass Market Size, Share, Trends, Industry Analysis Report: By Product Type (Laminated Glass, Tempered Glass, Ceramic Glass, and Others), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1638

- Base Year: 2024

- Historical Data: 2020-2023

Advanced Glass Market Overview

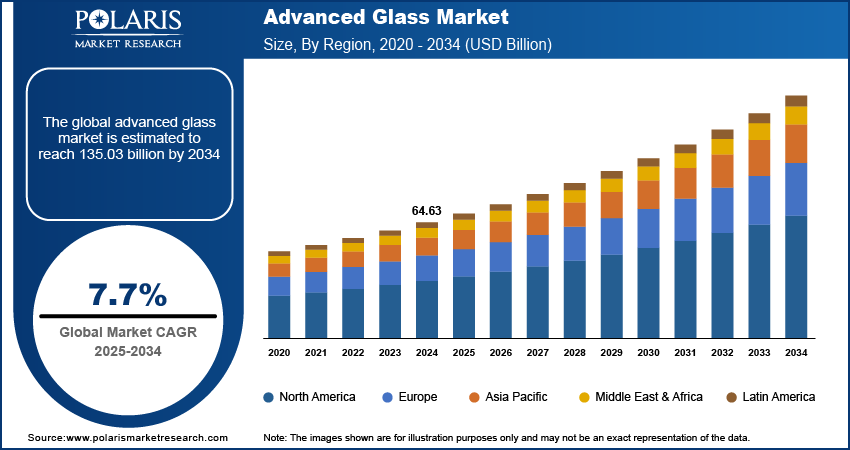

The global advanced glass market size was valued at USD 64.63 billion in 2024. The market is projected to grow from USD 69.50 billion in 2025 to USD 135.03 billion by 2034, exhibiting a CAGR of 7.7% during 2025–2034.

The global advanced glass market focuses on the production, distribution, and application of high-performance glass products. The products are designed to offer enhanced properties such as strength, durability, heat resistance, and energy efficiency. The market growth is driven by the increasing demand for energy-efficient building materials; innovations in automotive and electronics; and the growing use of advanced glass in construction, solar panels, and electronic displays. Key advanced glass market trends include the integration of smart glass technology, the development of eco-friendly glass solutions, and the expanding adoption of glass in the automotive sector for improved safety and aesthetics. Additionally, the rising focus on sustainability and environmental impact is shaping product development, with manufacturers emphasizing recycled materials and energy-efficient production processes.

To Understand More About this Research: Request a Free Sample Report

Advanced Glass Market Dynamics

Adoption of Smart Glass Technology

One of the most notable trends in the advanced glass market is the growing adoption of smart glasses, also known as electrochromic or switchable glass. Smart glass technology allows the glass to change its properties in response to external stimuli such as light or heat, offering benefits such as temperature regulation and privacy control. This trend is being driven by the increasing demand for energy-efficient buildings, where smart windows can reduce the need for air conditioning or heating by adjusting their tint based on sunlight exposure. In the automotive sector, smart glass is being integrated into car windows for improved comfort and privacy.

Shift Toward Sustainable and Advanced Glass

Sustainability has become a key focus in the development of advanced glass products as manufacturers seek to reduce their environmental impact. This includes the use of recycled materials in glass production and the development of energy-efficient glass solutions, such as low-emissivity (Low-E) coatings that enhance thermal insulation properties. As the construction industry pushes toward greener buildings, sustainable glass is gaining traction, particularly in energy-efficient windows that help reduce the carbon footprint of residential and commercial buildings. Thus, the rising shift toward sustainable and advanced glasses boosts the advanced glass market expansion.

Integration of Advanced Glass in Automotive Applications

The automotive industry is increasingly adopting advanced glass solutions for both functional and aesthetic purposes. This trend is characterized by the integration of lighter, stronger, and more durable glass materials into vehicle design, contributing to improved safety, fuel efficiency, and overall vehicle performance. For example, laminated and tempered glass is commonly used in automotive windshields for better strength and impact resistance. Moreover, automakers are exploring new applications for glass, such as larger panoramic roofs, which provide a more open and premium feel in vehicles. The use of advanced glass in electric vehicles (EVs) is particularly noteworthy, as it helps reduce vehicle weight and improve energy efficiency, which are critical for maximizing driving range. According to The International Transport Forum (ITF), advanced glass applications are expected to grow as the automotive sector shifts toward lighter and more energy-efficient vehicle designs.

Advanced Glass Market Segment Insights

Advanced Glass Market Outlook – by Product Type-Based Insights

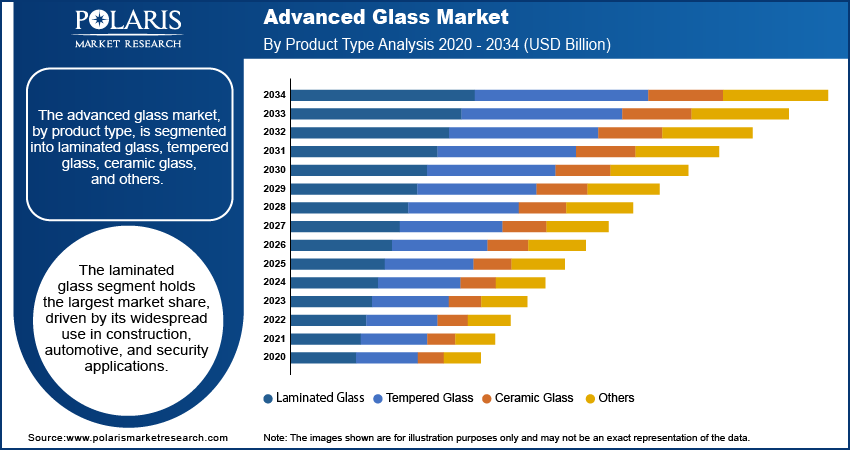

The advanced glass market, by product type, is segmented into laminated glass, tempered glass, ceramic glass, and others. The laminated glass segment holds the largest market share, driven by its widespread use in construction, automotive, and security applications. This product type is highly valued for its durability, safety features, and sound insulation properties. Laminated glass is commonly used in windows, facades, and automotive windshields, where its ability to hold together even when shattered makes it an essential choice for enhancing structural integrity and safety. The segment is also benefiting from increasing demand for energy-efficient and soundproofing solutions, particularly in urban development and high-rise buildings. As safety standards continue to rise globally, the demand for laminated glass is expected to remain robust.

The tempered glass segment is also experiencing significant growth due to its strength and resistance to thermal stress. This product is commonly used in automotive, architectural, and appliance applications. The segment is witnessing heightened adoption due to its role in enhancing safety and security features, with an increasing number of manufacturers incorporating tempered glass in products such as shower doors, furniture, and displays. Furthermore, the growth of the automotive sector, especially electric vehicles, is expected to drive demand for tempered glasses. Although other segments such as ceramic and specialty glass products have their niche applications, the tempered glass segment is poised to register one of the highest growth rates, particularly in sectors that prioritize safety and performance.

Advanced Glass Market Assessment – by Application-Based Insights

The advanced glass market, by application, is segmented into solar control, safety & security, optics & lighting, high performance, and others. The safety & security segment holds the largest share of the advanced glass market revenue, largely due to the increasing demand for products that enhance the safety of buildings, vehicles, and other infrastructure. Laminated and tempered glasses are used in windows, facades, automotive windshields, and doors to provide resistance to impacts, burglaries, and natural disasters. This segment benefits from rising concerns over safety standards and security regulations across industries, including construction, automotive, and public infrastructure. The growth of the safety and security application is particularly fueled by heightened security requirements in both residential and commercial construction, as well as growing awareness of the importance of safeguarding against natural hazards and accidents.

The solar control segment is registering the highest growth, driven by the increasing focus on energy efficiency and sustainable building practices. Advanced glass solutions with solar control properties help regulate indoor temperatures by reducing heat gain from the sun, which leads to lower energy consumption for cooling and heating. This is especially relevant in commercial and residential buildings aiming to meet green building standards and reduce carbon footprints. As the demand for energy-efficient buildings rises and consumers become more environmentally conscious, the market for solar control glass is expected to expand at a significant pace, with applications in windows, facades, and architectural glazing becoming increasingly common.

Advanced Glass Market Evaluation – by End User-Based Insights

The advanced glass market, by end user, is segmented into construction, infrastructure, automobiles, electronics, and others. The construction segment holds the largest market share, primarily driven by the extensive use of advanced glass solutions in residential, commercial, and institutional buildings. Glass products, such as energy-efficient windows, facades, and skylights, are in high demand as the construction industry increasingly focuses on sustainability and energy conservation. Additionally, advancements in smart glass technology and solar control glass are making their way into modern buildings to enhance comfort, reduce energy costs, and meet stringent environmental standards. The rapid urbanization and growth of green building trends globally are further reinforcing the dominance of the construction sector in the advanced glass market.

The automotive segment is registering the highest growth, fueled by the rising demand for advanced glass in vehicles, particularly in the automotive safety and performance sectors. The use of laminated and tempered glass in windshields, side windows, and sunroofs, along with the growing adoption of panoramic glass roofs and energy-efficient glass solutions in electric vehicles (EVs), is contributing to the growth of this segment. As the automotive industry continues to prioritize lightweight materials, improved vehicle aerodynamics, and enhanced safety features, the demand for advanced glass is expected to increase, particularly in electric and autonomous vehicle designs.

Advanced Glass Market Regional Insights

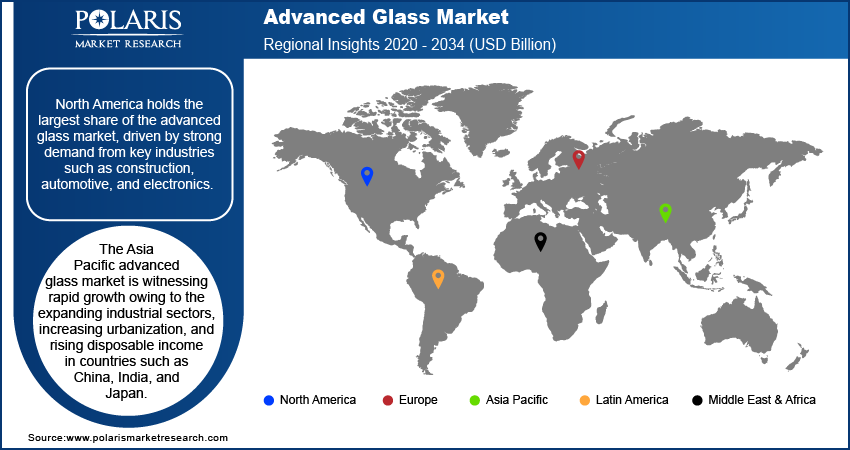

By region, the study provides advanced glass market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by strong demand from key industries such as construction, automotive, and electronics. The region benefits from significant investments in infrastructure development, including energy-efficient buildings and green construction projects, which are increasing the demand for advanced glass solutions such as smart glass and solar control glass. Additionally, the automotive sector in North America, particularly in the US, is seeing substantial growth in the adoption of advanced glass for safety and performance applications in traditional and electric vehicles. The presence of leading manufacturers and innovation-driven companies in the region further bolsters its dominant position in the global market. While other regions such as Europe and Asia Pacific also show strong growth, North America's focus on sustainability, safety, and advanced technologies ensures its leadership in the market.

Europe is a key region in the advanced glass market, driven by a strong emphasis on sustainability, energy efficiency, and advanced building technologies. The demand for eco-friendly and energy-efficient glass products, such as Low-E glass and solar control glass, is rising rapidly due to stringent environmental regulations and the region's commitment to reducing carbon emissions. The construction and automotive sectors in Europe are major consumers of advanced glass, with increasing adoption in green building projects and the growing use of smart glass in vehicles. Additionally, countries such as Germany, France, and the UK are leaders in innovation, with substantial investments in research and development for advanced glass technologies, particularly for architectural and automotive applications. The region’s robust automotive industry, especially the rise of electric vehicles (EVs), also boosts the demand for specialized glass products.

The Asia Pacific advanced glass market is witnessing rapid growth, driven by expanding industrial sectors, increasing urbanization, and rising disposable income in countries such as China, India, and Japan. The construction industry in this region is a key driver, with a surge in demand for energy-efficient glass products due to rising concerns about environmental sustainability and energy consumption. China, in particular, is a major market for advanced glass due to its extensive infrastructure development, including smart cities and eco-friendly building projects. The automotive sector in Asia Pacific is also growing, with an increasing focus on safety and performance features in vehicles, driving demand for high-quality laminated and tempered glasses. Moreover, the region's strong manufacturing capabilities and low-cost production offer a competitive advantage in meeting global demand for advanced glass solutions.

Advanced Glass Market – Key Players and Competitive Insights

Saint-Gobain, Guardian Industries, Corning Inc., AGC Inc., and NSG Group are a few key players in the advanced glass market. These companies are actively involved in the production of advanced glass products such as energy-efficient glass, laminated glass, and smart glass. Other significant players include Pilkington, Asahi Glass Co., PPG Industries, Schott AG, and Fuyao Glass, all of which have expanded their portfolios to include advanced glass solutions for construction, automotive, and electronics applications. Additionally, companies such as Eastman Chemical, O-I Glass, Trinseo, and Vetrotech (the Italian company) are increasingly focusing on innovations in glass technology, contributing to the market’s growth. Many of these companies are engaged in continuous research and development to enhance the properties of glass and meet the growing demand for sustainable and energy-efficient solutions.

The competitive landscape in the advanced glass market is shaped by constant innovation and technological advancements. Companies are investing heavily in research and development to create products with superior performance characteristics such as improved energy efficiency, safety features, and adaptability to various industrial applications. With sustainability becoming a key focus, many players are also incorporating eco-friendly materials and manufacturing processes to meet global environmental standards. Collaborations, mergers, and partnerships are common as companies seek to expand their product offerings and reach new markets. For instance, Corning Inc. has made significant strides in smart glass technologies, while Saint-Gobain focuses on sustainable building materials, enhancing its competitive positioning in the construction and automotive sectors.

In terms of market strategy, companies are diversifying their product portfolios to cater to specific applications across different sectors, including construction, automotive, and electronics. The automotive industry, with its increasing demand for high-performance glass, is a major area of focus as manufacturers develop advanced glass for better safety, comfort, and energy efficiency in vehicles. The construction industry is another key focus, where demand for smart glass and solar control glass is driving innovation. Furthermore, players are increasingly expanding their operations in emerging markets such as Asia Pacific and Latin America to take advantage of growing infrastructure and industrialization. With technological advancements and a focus on sustainability, these companies are positioning themselves to meet the current and future demands of the advanced glass market.

Saint-Gobain, a global company, produces construction and building materials, including advanced glass products. The company focuses on providing solutions that improve energy efficiency, safety, and sustainability in various sectors, such as construction, automotive, and industrial applications. It has a strong presence in Europe and North America, and it is actively involved in research and development to create innovative glass solutions.

Corning Inc. is known for its expertise in materials science and advanced glass technologies. Corning is particularly focused on innovations in glass for the electronics, automotive, and telecommunications industries. The company is widely recognized for its contributions to the development of Gorilla Glass, used in mobile devices, and other high-tech applications.

Key Companies in Advanced Glass Market

- Saint-Gobain

- Guardian Industries

- Corning Inc.

- AGC Inc.

- NSG Group

- Pilkington

- Asahi Glass Co.

- PPG Industries

- Schott AG

- Fuyao Glass

- Eastman Chemical

- O-I Glass

- Trinseo

- Vetrotech

- Xinyi Glass

Advanced Glass Industry Developments

- In September 2024, Saint-Gobain announced the opening of a new plant in Poland to produce high-performance glass for the automotive and construction sectors. This expansion is part of the company’s strategy to meet the growing demand for sustainable building materials in Eastern Europe.

- In March 2024, Corning launched a new line of environmentally friendly glass coatings designed to enhance durability while reducing the environmental impact of production. This move reflects the company’s ongoing commitment to sustainability and its efforts to meet the evolving needs of global markets.

Advanced Glass Market Segmentation

By Product Type Outlook

- Laminated Glass

- Tempered Glass

- Ceramic Glass

- Others

By Application Outlook

- Solar Control

- Safety & Security

- Optics & Lighting

- High Performance

- Others

By End User Outlook

- Construction

- Infrastructure

- Automobiles

- Electronics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Advanced Glass Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 64.63 billion |

|

Market Size Value in 2025 |

USD 69.50 billion |

|

Revenue Forecast by 2034 |

USD 135.03 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

? The global market size was valued at USD 64.63 billion in 2024 and is projected to grow to USD 135.03 billion by 2034.

The global market is projected to register a CAGR of 7.7% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Saint-Gobain, Guardian Industries, Corning Inc., AGC Inc., and NSG Group.

The laminated glass segment accounted for the largest share of the global market in 2024.

The safety & security segment led the global advanced glass market share in 2024.

Advanced glass refers to glass products that are engineered to offer superior performance, functionality, and durability compared to traditional glass. These types of glass are designed with specific properties to meet the demands of various industries, including construction, automotive, electronics, and energy. Advanced glass can include features such as enhanced strength, heat resistance, improved thermal insulation, soundproofing, and energy efficiency. It may also include smart glass, which can change its properties in response to external stimuli such as heat or light, and other specialized types such as solar control or security glass. These innovations enable advanced glass to be used in high-performance applications, contributing to more sustainable, energy-efficient, and safer environments.

A few key trends in the advanced glass market are described below: Smart Glass Technology: Increasing adoption of smart glass that adjusts its properties in response to light, heat, or electrical stimuli, enhancing energy efficiency and providing privacy control. Sustainability Focus: Growing demand for eco-friendly glass solutions, including the use of recycled materials and energy-efficient production processes to meet sustainability goals. Integration in Automotive Sector: Rising use of advanced glass in vehicles, such as laminated and tempered glass, for improved safety, fuel efficiency, and aesthetic appeal, especially in electric vehicles. Energy-Efficient Glass: Expansion of high-performance, energy-efficient glass products, such as Low-E and solar control glass, to reduce energy consumption in buildings and infrastructure.

For a new company entering the advanced glass market, focusing on innovation in smart glass technology and energy-efficient solutions could provide a competitive edge. Developing products that address the growing demand for sustainable and eco-friendly materials, such as recycled glass and energy-efficient coatings, would appeal to the environmentally conscious market. Additionally, targeting emerging industries such as electric vehicles and green construction could drive growth. Emphasizing customer-centric solutions and establishing strategic partnerships with key players in the construction and automotive sectors would help build market presence.

Companies manufacturing, distributing, or purchasing advanced glasses and related products, and other consulting firms must buy the report.