Advanced Ceramics Market Size, Share, Trends, Industry Analysis Report: By Material, Product [Monolithic, Ceramic Coatings, and Ceramic Matrix Composites (CMCs)], Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1167

- Base Year: 2024

- Historical Data: 2020-2023

Advanced Ceramics Market Overview

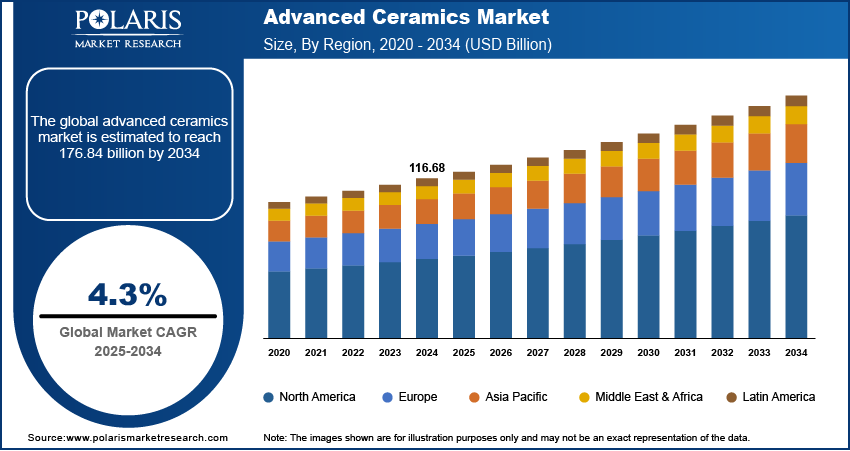

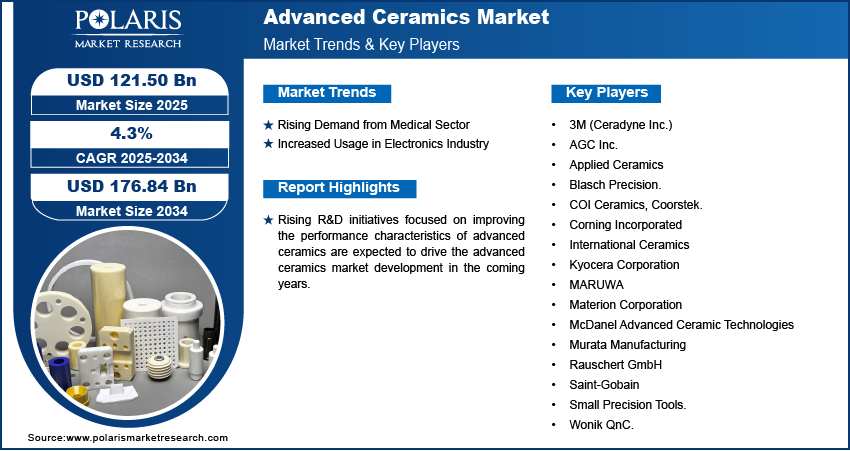

The global advanced ceramics market size was valued at USD 116.68 billion in 2024. The market is projected to grow from USD 121.50 billion in 2025 to USD 176.84 billion by 2034. It is projected to exhibit a CAGR of 4.3% from 2025 to 2034.

Advanced ceramics, also referred to as engineering ceramics and high-performance advanced ceramics, are products made from inorganic, high-purity compounds. Various technologies such as hydraulic pressing, isostatic pressing, tape, and compression casting are employed to improve the properties of advanced ceramics. These materials exhibit a wide range of properties, including heat, wear, and temperature resistance, as well as chemical resistance, food compatibility, and biocompatibility.

To Understand More About this Research: Request a Free Sample Report

Advanced ceramics outperform traditional ceramics in terms of corrosion resistance, vehicle maintenance, and armor. As a result, they are widely used across various industries, including aerospace, electric energy, automotive, electronics, and army and defense. The versatility and widespread applications of advanced ceramics drive the advanced ceramics market growth. In addition, rising environmental concerns driving the demand for sustainable and eco-friendly materials are supporting the market growth.

Rising research and development initiatives focused on improving the performance characteristics of advanced ceramics are one of the key market trends anticipated to drive their increased adoption. The rising use of advanced ceramics in nanotechnology is projected to provide several advanced ceramics market opportunities in the coming years.

Advanced Ceramics Market Dynamics

Rising Demand from Medical Sector

In the medical sector, advanced ceramics are used for surgical tools, medical devices, and diagnostic equipment. These ceramics are used in surgical knives and dental cleaning tools, as they are thermally and electrically insulating, hard, and wear-resistant. Also, the chemical stability and low friction of advanced ceramics means they find applications in orthopedic implants, heat pumps, and endoscopic equipment. The demand for advanced ceramics is rapidly increasing in medicine as they help reduce damage to equipment from exposure to mordant atmospheres or conflagration, impacting the advanced ceramics market development favorably.

Increased Usage in Electronics Industry

The electronics industry is one of the primary end users of advanced ceramics. They are used in the manufacturing of various electronic products such as tablets, laptops, and smartphones. Also, they find applications in the production of several electronics components such as sensors, capacitors, and insulators. Advanced ceramics offer high electrical conductivity and thermal stability and have low dielectric loss, making them ideal for use in electronic products and components. Thus, the increased usage of advanced ceramics in the electronics industry is propelling the advanced ceramics market revenue.

Advanced Ceramics Market Segment Insights

Advanced Ceramics Market Outlook Based on Material

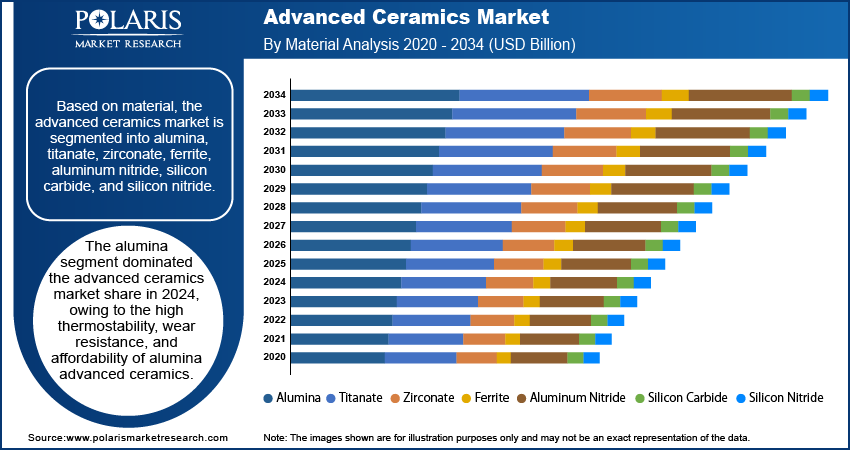

The advanced ceramics market, based on material, is segmented into alumina, titanate, zirconate, ferrite, aluminum nitride, silicon carbide, and silicon nitride. The alumina segment dominated the market with a revenue share of 36.9% in 2024. Alumina advanced ceramics are the most affordable material in the advanced ceramics market and offer excellent performance. Based on aluminum, they are used in demanding applications that require high thermostability and wear resistance. High-voltage separators, mechanical seals, semiconductor parts, and ballistic armor are among the key applications of these ceramics. Thus, the desirable characteristics and versatility of alumina advanced ceramics drive their dominance in the market.

Advanced Ceramics Market Evaluation Based on Product

The advanced ceramics market, based on product, is segmented into monolithic, ceramic coatings, and ceramic matrix composites (CMCs). The ceramic matrix composites (CMCs) segment is projected to register the fastest growth from 2025 to 2034. CMCs are made by combining ceramic materials with reinforcing materials. This combination enhances their properties, making CMCs lightweight, strong, and capable of withstanding thermal shock. The increasing focus on developing CMCs with a variety of benefits by leading market participants is expected to support the robust growth of the segment.

Advanced Ceramics Market Regional Analysis

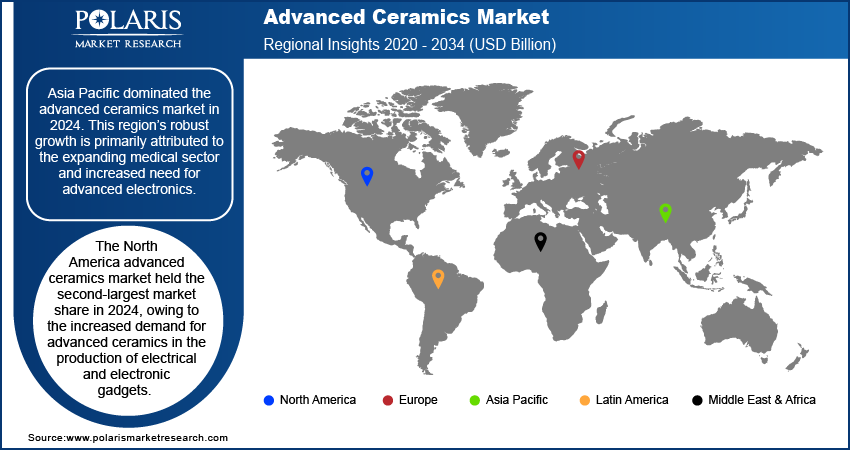

By region, the market report offers advanced ceramics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of 43.2% in 2024. This is primarily attributed to the expanding medical sector and the increasing need for advanced electronics in the region. Further, rapid technological advancements, increased research and development efforts, and the introduction of supportive government policies for advanced ceramics further support the regional market dominance.

The North America advanced ceramics market held the second-largest market share in 2024. The regional market growth is attributed to the increased demand for advanced ceramics in the production of electrical and electronic gadgets. Further, the rapidly growing medical and electric vehicle (EV) industries contribute to the regional market growth.

Advanced Ceramics Market – Key Players and Competitive Insights

The advanced ceramics market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce new ceramics to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly ceramics that comply with stringent government regulations. The advanced ceramics market research report offers a market assessment of all the major players, including 3M (Ceradyne Inc.), AGC Inc., Applied Ceramics, Blasch Precision., COI Ceramics, Coorstek., Corning Incorporated, International Ceramics, Kyocera Corporation, MARUWA, Materion Corporation, McDanel Advanced Ceramic Technologies, Murata Manufacturing, Rauschert GmbH, Saint-Gobain, Small Precision Tools., and Wonik QnC.

List of Key Players in Advanced Ceramics Market

- 3M (Ceradyne Inc.)

- AGC Inc.

- Applied Ceramics

- Blasch Precision.

- COI Ceramics

- Coorstek.

- Corning Incorporated

- International Ceramics

- Kyocera Corporation

- MARUWA

- Materion Corporation

- McDanel Advanced Ceramic Technologies

- Murata Manufacturing

- Rauschert GmbH

- Saint-Gobain

- Small Precision Tools

- Wonik QnC

Advanced Ceramics Industry Developments

In April 2023, Kyocera Corporation revealed the finalization of its agreement to acquire 37 acres of land for the establishment of a new smart facility in Isahaya City, Japan. According to Kyocera, the strategic move aligns with its goal of increasing the manufacturing capacity of fine ceramic components to meet rising demands.

In February 2023, MO SCI Corporation announced the completion of the acquisition of the 3M’s Advanced Materials business assets. The company stated that the acquisition involved the transfer of over 350 specialized pieces of equipment and all related intellectual property.

Advanced Ceramics Market Segmentation

By Material Outlook

- Alumina

- Titanate

- Zirconate

- Ferrite

- Aluminum Nitride

- Silicon Carbide

- Silicon Nitride

By Product Outlook

- Monolithic

- Ceramic Coatings

- Ceramic Matrix Composites (CMCs)

By Application Outlook

- Electric Equipment

- Catalyst Supports

- Electronic Devices

- Wear Parts

- Engine Parts

- Filters

- Bioceramic

- Others

By End-Use Industry Outlook

- Electric & Electronics

- Automotive

- Machinery

- Environmental

- Medical

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Advanced Ceramics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 116.68 billion |

|

Market Size Value in 2025 |

USD 121.50 billion |

|

Revenue Forecast by 2034 |

USD 176.84 billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 116.68 billion in 2024 and is projected to grow to USD 176.84 billion by 2034.

The market is projected to register a CAGR of 4.3% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are 3M (Ceradyne Inc.), AGC Inc., Applied Ceramics, Blasch Precision., COI Ceramics, Coorstek., Corning Incorporated, International Ceramics, Kyocera Corporation, MARUWA, Materion Corporation, McDanel Advanced Ceramic Technologies, Murata Manufacturing, Rauschert GmbH, Saint-Gobain, Small Precision Tools., and Wonik QnC.

The alumina segment accounted for the largest market share in 2024.

The ceramic matrix composites (CMCs) segment is anticipated to register the fastest growth during the forecast period.