Active Calcium Silicate Market Share, Size, Trends, Industry Analysis Report, By Form (Blocks, Powder, Boards); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM1160

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

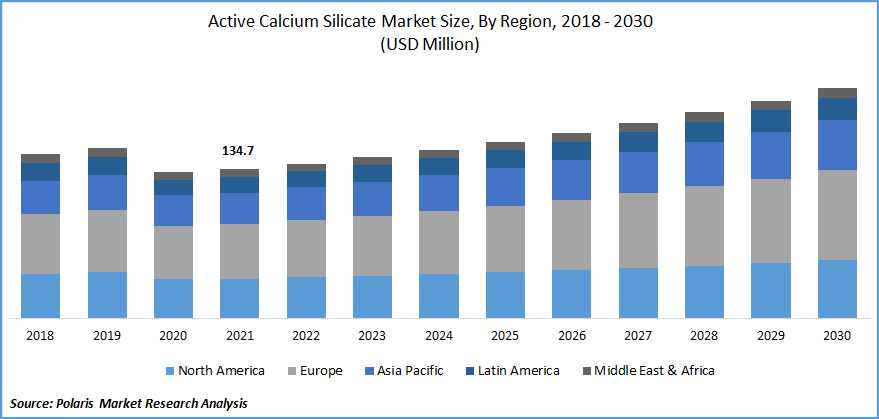

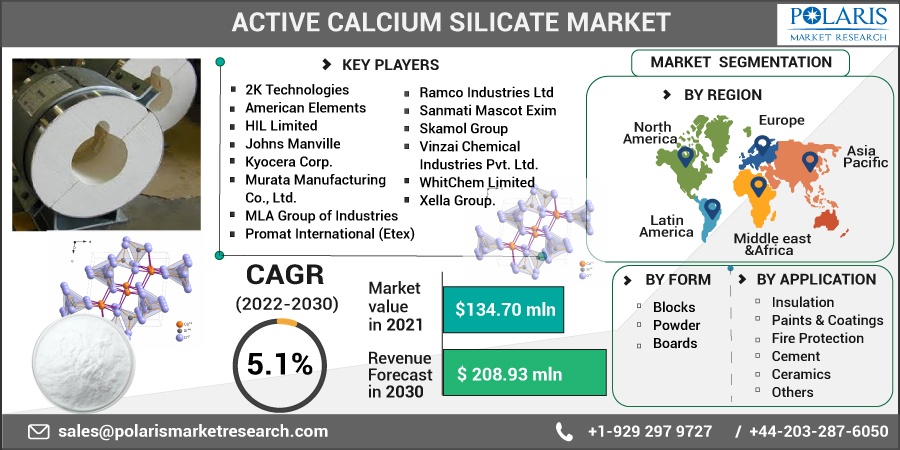

The global active calcium silicate market was valued at USD 134.7 million in 2021 and is expected to grow at a CAGR of 5.1% during the forecast period. The availability of good cement, fire protection, and insulators have increased due to the robust expansion in the development of new residential and commercial buildings due to the growing population, which will drive the active calcium silicate market growth.

Know more about this report: Request for sample pages

Limestone, sodium silicate, and hydrochloric acid make active calcium silicate, which would be a polysilicate compound. It is considered a safer alternative to asbestos in suitable insulating applications. Active calcium silicate is used to make grade pipework and industrial equipment. It has distinct properties, such as great mechanical strength and superior water absorption. It also has excellent thermal and mechanical properties and low thermal conductivity, making it perfect for industrialization insulation.

It's defined as the sale of boards, blocks, and powder, and it's used during the construction, oil and gas, and automotive industries for technological applications. Also, the compound can substitute for other building materials such as asbestos and metals because of its light density and resilience to water damage. These materials are lighter than fiber cement board, have good sound absorption, and can withstand high temperatures, making them perfect for roofing and floor tile applications.

However, regulatory authorities like OSHA and ACGIH have imposed stringent rules on the exposure of active calcium silicate to human health, which may stifle market growth. Excessive exposure to the product might cause itching, soreness, redness in the eyes, and scratchiness in the throat, all of which can hinder market expansion throughout the anticipated timeframe. However, the market size will grow as demand for solutions that offer higher dimensional stability in humid conditions grows.

Industry Dynamics

Growth Drivers

Increasing government laws relevant to fire safety standards during infrastructure building due to rising safety concerns should increase market size. The Ministry of Home Affairs has been going to assist state governments in expanding their firefighting abilities by organizing a soft loan from the General Insurance Corporation through the Ministry of Finance (Insurance Division) for acquiring capital firefighting equipment and renovating fire station buildings.

A loan of Rs. 406.47 crore was approved for establishing the State Fire Services from 1980 to 2005. The National Disaster Management Authority (NDMA) requested Rs. 7000 crore from the 13th Finance Commission to overhaul the country's fire and emergency services. There is an urgent need to re-structure "Fire and Emergency Services" in urban and rural areas. The Commission proposed that a portion of the monies given to urban local governments be used to redesign Fire Services in their jurisdictions.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on form, application, and region.

|

By Form |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insulation is expected to witness the fastest growth

This is due to increased demand for excellent insulation materials from diverse industries, including petrochemical and glass. These materials are appropriate for pipe insulation applications because they have exceptional strength and durability and inhibit corrosion on the exterior surfaces of pipe and equipment. The market revenue should be boosted further by the rising demand for high-temperature structural integrity materials and contribute to energy conservation throughout the production process.

Fire Protection segment accounted for the second-largest market share in 2021

Due to the increased demand for high-performance fire protection components from heavy industries that work with high-temperature furnaces, the fire protection segment is the second largest. Because of their non-combustible nature, compactness, and economic feasibility, these materials provide a safe and long-lasting fire-resistant solution to various sectors. These materials can survive intense heat for more extended periods and can be used to replace traditional building materials, which are essential market drivers.

Over the projection period, the paints and coatings application segment is expected to increase significantly. It's mostly used as a binder in the paint and coatings business and has weather-resistant properties. The paints and coatings application industry has benefited from growing industrialization and an increase in residential construction projects.

Powder segment is expected to hold the significant revenue share

This is growing owing to its benefits across various verticals. Active calcium silicate is an inorganic compound in two forms: CaSiO3 and Ca2SiO4. It's a fine white or off-white powder with a lower molecular density and high mechanical water absorption. It is often used in food products as an anti-caking agent.

Anti-caking agents are additives to the food powders that prevent caking and aggregation while also improving flowability. Water absorption is the mechanism of active calcium silicate. It is said to absorb 2.5 times its weight in water to draw moisture away from the host material. Calcium silicate has a high affinity for water. It traps and holds water within. It can also retain moisture during desorption, which is the process of releasing one material from another.

The demand in North America is expected to witness significant growth

North America's active calcium silicate demand is due to the region's growing paints & coatings sector. The increasing demand for paints and coatings in the automotive, home furnishings, and construction industries is expected to drive up demand in the region for active calcium silicate. Rising consumer expenditure on high-end decorative interiors due to rising living standards has increased product demand. The demand for eco-friendly paints to improve visual appeal, texture, and shelf life will drive regional expansion.

Asia Pacific's active calcium silicate market is expected to witness a high CAGR in the global market. This is becoming more prevalent due to increased government backing for constructing new residential buildings due to population expansion. For instance, China has previously established a set of fire safety regulations, ranging from policy-based fire suppression and reduction legislation to specific criteria for fire safety buildings and monitoring systems.

The Code for Fire Protection Design of Buildings (GB50016-2014), which dictates the proposed techniques with the "Code of Fire Protection Design of Tall Buildings" to promote consistency and compliance with the other proper procedures, is the updated fire safety law. Regulations like these help to increase the uptake of the active calcium silicate.

Further, increased construction activity has increased demand for high-quality bricks, cement, and insulation materials to increase building lifetime, which is expected to support market growth for active calcium silicate. The Indian real estate market is expected to exceed USD 1 trillion by 2030, according to the Indian Brand Equity Foundation (IBEF), and contribute roughly 13% of the country's GDP by 2025. Regional growth will be induced by increased demand for energy-efficient buildings and rising urbanization.

Competitive Insight

Some of the major players operating in the global active calcium silicate market include 2K Technologies, American Elements, HIL Limited, Johns Manville, Kyocera Corp., Murata Manufacturing., MLA Group, Promat International, Ramco Industries, Suzhou CMT Engineering, Sanmati Mascot, Skamol Group, Vinzai Chemical, WhitChem Limited, Weifang Hongyuan, and Xella Group.

Recent Developments

In May 2022, Ramco Industries opened a new manufacturing unit In Arakkonam. The company claims to have a capacity of 11.5 million sq. mtrs. for the "Calcium Silicate Board and Tiles Range," sold in more than 15 countries. With this new facility, they will be able to trade in more than 40 nations across the globe.

In March 2021, the Firefly H1000 was Tenmat's newest high-temperature board. It's made of a high-strength calcium silicate-based substance that's meant to withstand even higher temperatures than Tenmat's other universe engineering boards.

Active Calcium Silicate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 134.70 million |

|

Revenue forecast in 2030 |

USD 208.93 million |

|

CAGR |

5.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

2K Technologies, American Elements, HIL Limited, Johns Manville, Kyocera Corp., Murata Manufacturing Co., Ltd., MLA Group of Industries, Promat International (Etex), Ramco Industries Limited, Suzhou CMT Engineering Company Limited, Sanmati Mascot Exim, Skamol Group, Vinzai Chemical Industries Pvt. Ltd., WhitChem Limited, Weifang Hongyuan Chemical Co., Ltd., and Xella Group. |