Activated Alumina Market Size, Share, Trends, Industry Analysis Report: By Form (Beaded and Powdered), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1158

- Base Year: 2024

- Historical Data: 2020-2023

Activated Alumina Market Overview

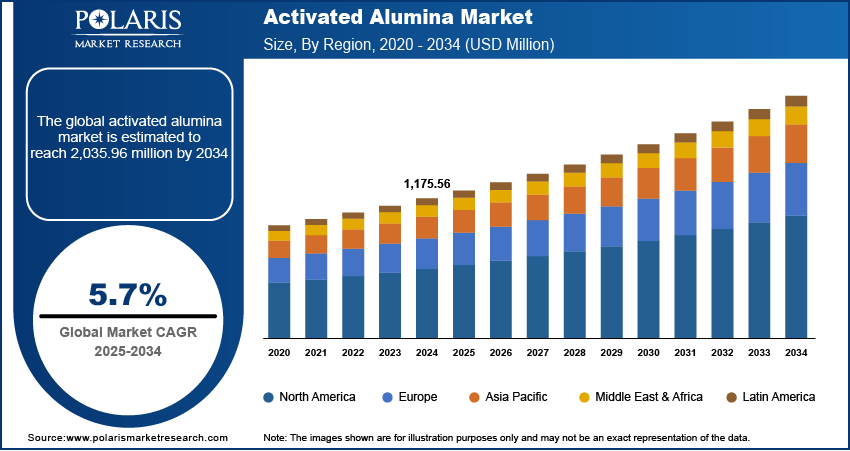

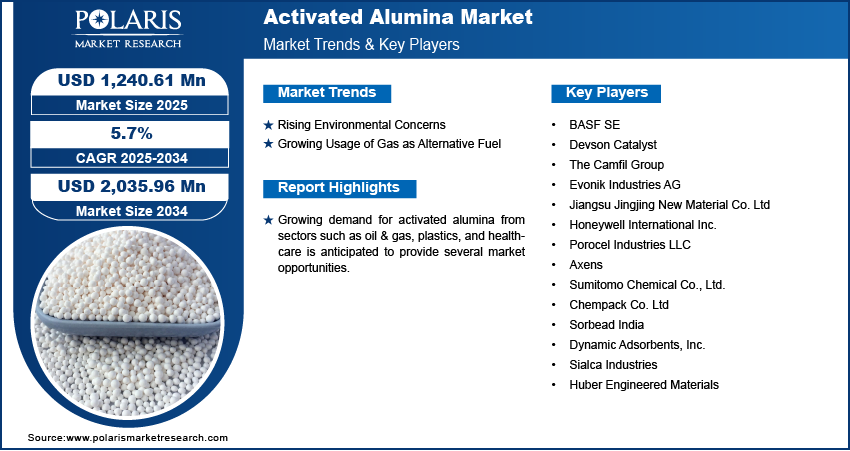

The global activated alumina market size was valued at USD 1,175.56 million in 2024. The market is projected to grow from USD 1,240.61 million in 2025 to USD 2,035.96 million by 2034. It is projected to exhibit a CAGR of 5.7% from 2025 to 2034.

Activated alumina is a porous, solid form of aluminum oxide, known for its properties such as low abrasion, reduced pressure drops, resistance to liquid water, thermal shock resistance, and high adsorption capacity. It is commonly used as a catalyst carrier, desiccant, and fluoride adsorbent. Activated alumina plays a key role in the purification of gases and liquids, drying organic liquids, and drying steam-cracked liquids. In addition, it is utilized in water purification, hydrogen generation, and gas drying in air separation plants.

The activated alumina market growth is driven by the increasing need to provide clean water to communities worldwide. Economic growth, rising industrialization, and declining water reserves in many countries have heightened the demand for water treatment solutions. In addition, rapid population growth has created a greater need for enhanced water treatment facilities.

Technological advancements and government initiatives to ensure a steady supply of clean water are further supporting the activated alumina market demand. The increasing usage of activated alumina in the chemical industry as an adsorbent, catalyst, and source of filtration is expected to boost activated alumina market expansion in the coming years. Growing demand from other sectors, such as oil & gas, plastics, and healthcare, is also anticipated to provide lucrative market opportunities during the forecast period.

Activated Alumina Market Dynamics

Rising Environmental Concerns

Activated alumina is known for its ability to adsorb fluorine and other contaminants from water sources, which has resulted in its increased adoption in water treatment applications. With governments and environmental authorities enforcing stringent rules on water quality, the need for activated alumina in water treatment is anticipated to remain strong. Thus, rising concerns about water pollution caused by fluorine have had a significant impact on the activated alumina market demand.

Growing Usage of Gas as Alternative Fuel

The consumption of gases such as liquid petroleum gas (LNG), compressed natural gas (CNG), and others has increased significantly over the past few years. These gases need to be free of moisture and contaminants to avoid blockages in the fuel system and corrosion within the storage tank due to the formation of hydrates. The passing of these gases through activated alumina removes moisture and impurities such as hydrogen sulfide and carbon dioxide. Thus, the increasing consumption of CNG, LNG, and other gases is having a favorable impact on the activated alumina market revenue.

Activated Alumina Market Segment Insights

Activated Alumina Market Outlook Based on Application

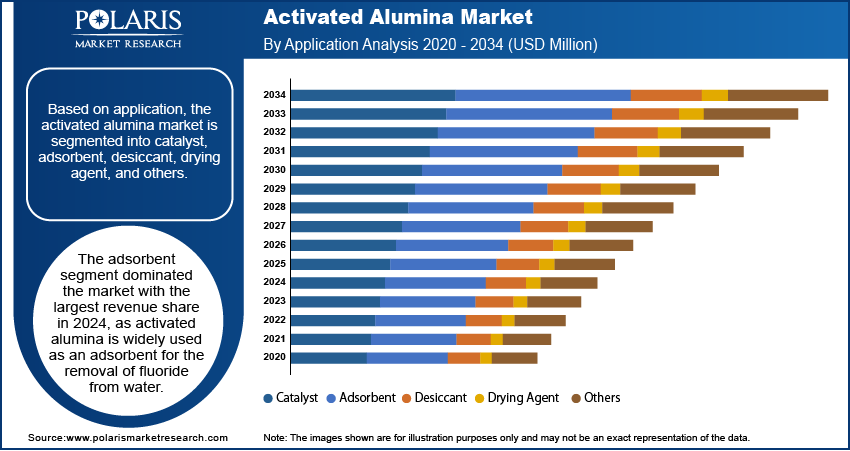

The activated alumina market, based on application, is segmented into catalyst, adsorbent, desiccant, drying agent, and others. The adsorbent segment dominated the market with the largest share of 36.1% in 2024. Activated alumina is widely used as an adsorbent for the removal of fluoride from water. It is also utilized in various end-use industries for the separation of components. In addition to fluoride, contaminants such as sulfur, arsenic, and lead are removed through adsorption. Factors such as growing industrialization, rising adoption of advanced technologies, and the introduction of safety regulations are driving the activated alumina market growth for this segment.

Activated Alumina Market Evaluation Based on End-Use Industry

The activated alumina market, based on end-use industry, is segmented into healthcare, water treatment, chemical, oil & gas, and others. The water treatment segment is projected to register the highest CAGR of 5.9% from 2025 to 2034. Water treatment applications use activated alumina for the effective removal of fluoride and other contaminations from water. The increasing demand for clean water and the introduction of stringent safety regulations regarding effluent treatment are among the primary factors anticipated to drive the growth of the segment.

Activated Alumina Market Regional Analysis

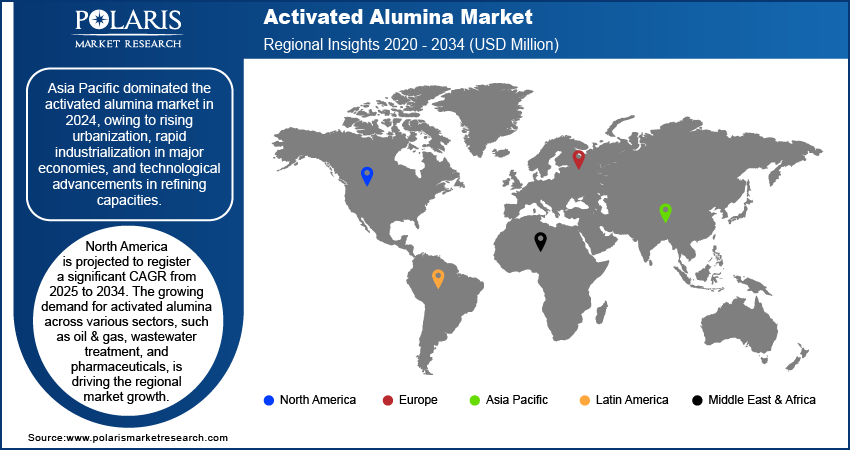

By region, the market report offers activated alumina market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of 43.2% in 2024. The rapid industrialization in major economies such as India, China, and Japan is the primary factor driving the robust demand for activated alumina in Asia Pacific. Technological advancements in refining capacities, rising urbanization, and expansion activities by major market participants are other factors propelling regional market dominance.

The North America activated alumina market is projected to register a significant CAGR of 5.1% from 2025 to 2034. The rising demand for activated alumina across various sectors, such as oil & gas, wastewater treatment, and pharmaceuticals, is boosting the regional market growth. The presence of stringent regulations for wastewater treatment further augments the market development in the region.

Activated Alumina Market – Key Players and Competitive Insights

The activated alumina market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce advanced solutions to cater to diverse consumer needs.

Several leading market participants are prioritizing the development of sustainable and eco-friendly activated alumina that complies with stringent government regulations. A few of the key market players are BASF SE; Devson Catalyst; The Camfil Group; Evonik Industries AG; Jiangsu Jingjing New Material Co. Ltd; Honeywell International Inc.; Porocel Industries LLC; Axens; Sumitomo Chemical Co., Ltd.; Chempack Co. Ltd; Sorbead India; Dynamic Adsorbents, Inc.; Sialca Industries; and Huber Engineered Materials.

List of Key Players in Activated Alumina Market

- BASF SE

- Devson Catalyst

- The Camfil Group

- Evonik Industries AG

- Jiangsu Jingjing New Material Co. Ltd

- Honeywell International Inc.

- Porocel Industries LLC

- Axens

- Sumitomo Chemical Co., Ltd.

- Chempack Co. Ltd

- Sorbead India

- Dynamic Adsorbents, Inc.

- Sialca Industries

- Huber Engineered Materials

Activated Alumina Industry Developments

In February 2024, BASF SE, under its Chemetall brand, announced the opening of a new global aluminum competence center in Giussano, Italy. The company stated that the new facility will strengthen its position in surface treatment solutions for aluminum substrates.

In October 2022, BASF SE collaborated with Shell plc to evaluate and implement BASF’s Sorbead Adsorption Technology as an alternative to traditional activated alumina. According to BASF, the strategic move highlights a major shift in the activated alumina market as manufacturers look for more efficient ways to treat gases.

Activated Alumina Market Segmentation

- Beaded

- Powdered

By Application Outlook

- Catalyst

- Adsorbent

- Desiccant

- Drying Agent

- Others

By End-Use Industry Outlook

- Healthcare

- Water Treatment

- Chemical

- Oil & Gas

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Activated Alumina Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,175.56 million |

|

Market Size Value in 2025 |

USD 1,240.61 million |

|

Revenue Forecast by 2034 |

USD 2,035.96 million |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 1,175.56 million in 2024 and is projected to grow to USD 2,035.96 million by 2034.

The market is projected to register a CAGR of 5.7% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are BASF SE; Devson Catalyst; The Camfil Group; Evonik Industries AG; Jiangsu Jingjing New Material Co. Ltd; Honeywell International Inc.; Porocel Industries LLC; Axens; Sumitomo Chemical Co., Ltd.; Chempack Co. Ltd; Sorbead India; Dynamic Adsorbents, Inc.; Sialca Industries; and Huber Engineered Materials.

The adsorbent segment accounted for the largest market share in 2024.

The water treatment segment is anticipated to register the highest CAGR during the forecast period.