Acrylonitrile Butadiene Styrene Market Size, Share, Trends, Industry Analysis Report: By Product Type (Transparent, Opaque, and Colored), End-User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1154

- Base Year: 2024

- Historical Data: 2020-2023

Acrylonitrile Butadiene Styrene Market Overview

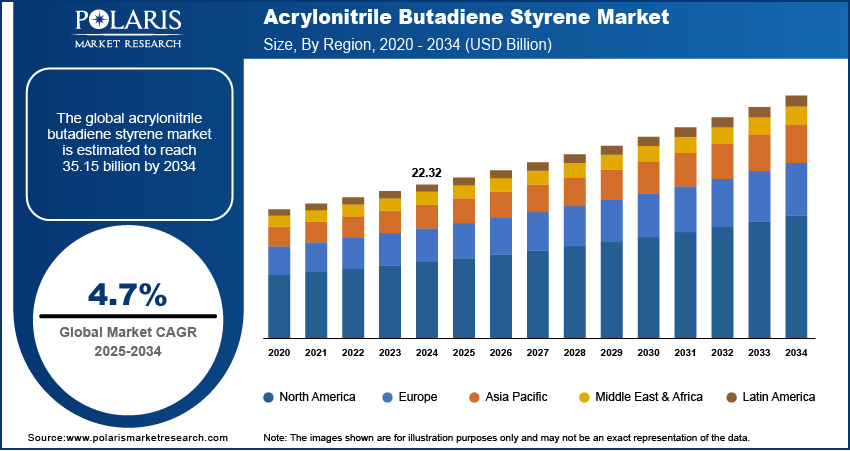

The acrylonitrile butadiene styrene market size was valued at USD 22.32 billion in 2024. The market is projected to grow from USD 23.33 billion in 2025 to USD 35.15 billion by 2034, at a CAGR of 4.7% from 2025 to 2034.

Acrylonitrile butadiene styrene (ABS) is a commercially important amorphous thermoplastic polymer with high strength, durability, and impact resistance. It consists of three monomers that are acrylonitrile, butadiene, and styrene. Each monomer adds a distinct property to the finished product. Acrylonitrile provides thermal and chemical stability; butadiene gives toughness and strength to it; and styrene adds a glossy finishing touch to the final product. ABS has a wide range of applications across various industries such as automotive, construction, industrial, consumer goods, and electronics. It is used in a number of products such as electrical equipment enclosures; protective headgear; phone and computer components; medical supplies; kitchen appliances; power tool housing and cases; and automotive parts, including body parts, wheel covers, and trunk tubs.

To Understand More About this Research: Request a Free Sample Report

Absorbent butadiene styrene (ABS) is a significant amorphous copolymer. By altering the ratio of its monomer units, its properties can be adjusted. Good chemical resistance, aging resistance, hardness, gloss, and rigidity are all provided by acrylonitrile. It is increasingly being used in 3D printing and injection molded plastic production due to its low melting temperature, high machinability, cost-effectiveness, and ductility.

The growing automotive industry accelerates the acrylonitrile butadiene styrene market growth. Furthermore, due to its exceptional mechanical strength, resistance, and lightweight nature, ABS is utilized in vacuum construction, and pipes and fittings. ABS's exceptional durability and resistance to corrosion make it a popular material for waste collector products. These factors are expected to boost the acrylonitrile butadiene styrene market expansion during the forecast period. ABS plastics are being used to provide greater stability to medical devices and products, including masks, gloves, head and shoe covers, and gowns, to meet the needs of the expanding healthcare sector.

Acrylonitrile Butadiene Styrene Market Dynamics

Increasing Demand from End-Use Industry

The absorbent butadiene styrene market is significantly driven by the increasing demand from end-use sectors such as automotive, electrical, and electronics. ABS is widely utilized in the automobile industry for its lightweight, impact resistance, and dimensional stability in parts, including dashboards, lights, interior trim, and bumpers. ABS is preferred in the electrical and electronics sector for making casings, coverings, and structural elements as it offers crucial qualities, including impact resistance, electrical insulation, and ease of customization, which propels the absorbent butadiene styrene market expansion.

Growing Interest in Lightweight Automobiles

The growing consumer desire for lightweight cars has spurred innovation in the automotive sector. The demand for efficient cars has increased as a result of the world's population growth rate. These materials, such as acrylonitrile butadiene rubber market and other thermoplastic polymers, can be found in dashboards, exterior panels, bumpers, and other parts of an automobile. Owing to its many advantageous qualities, ABS is the perfect material to employ in automotive lightweight material. Thus, the growing interest in lightweight automobiles is fueling the acrylonitrile butadiene styrene market development.

Acrylonitrile Butadiene Styrene Market Segment Insights

Acrylonitrile Butadiene Styrene Market Outlook by Product Type

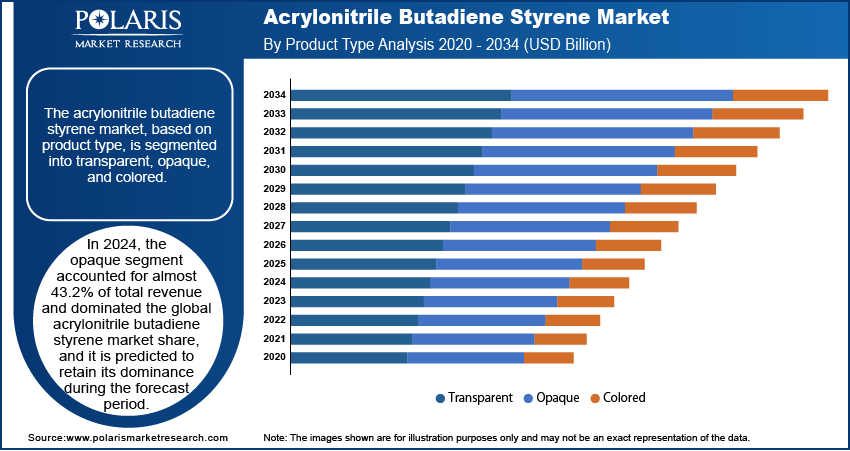

Based on product type, the acrylonitrile butadiene styrene rubber market is segmented as transparent, opaque, and color. In 2024, the opaque segment accounted for almost 43.2% of total revenue share and dominated the global acrylonitrile butadiene styrene market. Its qualities make it useful for a variety of applications such as computer components, automobile parts, baggage cases, and airplane uses. Good chemical resistance, age resistance, hardness, gloss, and rigidity are a few of the physical attributes that provide opaque ABS its many applications in the automobile sector. Owing to its exceptional mechanical strength and low weight, acrylonitrile butadiene styrene is also utilized in vacuum construction and pipes and fittings.

Acrylonitrile Butadiene Styrene Market Assessment by End-User

Acrylonitrile Butadiene Styrene market segmentation based on end-use is made into construction, consumer goods, automotive, electrical & electronics, appliances, and others. In 2024, the appliances segment held a dominant position in the market, accounting for over 28.4% of the total revenue share. The need for acrylonitrile butadiene styrene in the appliances industry is anticipated to increase due to the growing demand for home appliances such as washing machines, dryers, and microwave ovens, as well as rising consumer expenditure on appliances. Furthermore, the automotive sector is expected to need ABS as a result of the increase in automobile production. In the coming years, the expanding economy, rapid urbanization, rising desire for electric vehicles, and technological improvements are expected to boost the demand for appliances, which would drive market growth.

Acrylonitrile Butadiene Styrene Market Regional Insights

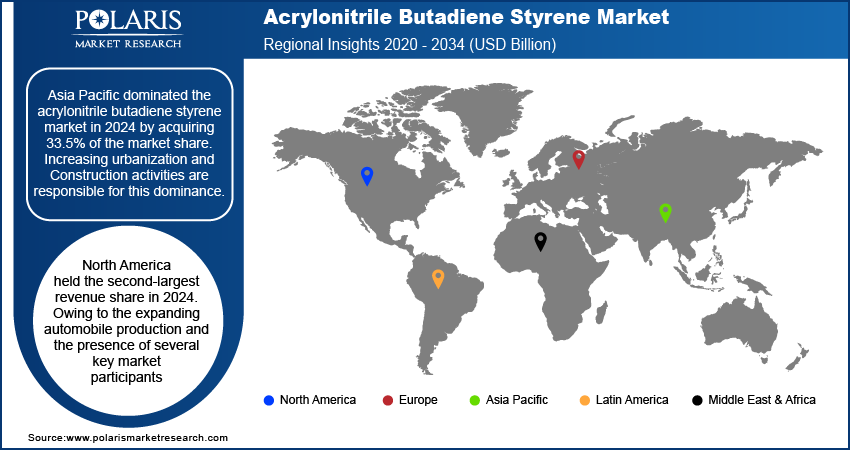

The study offers regional insight into the acrylonitrile butadiene styrene market in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

In 2024, Asia Pacific dominated the acrylonitrile butadiene styrene market and contributed over 33.5% of total revenue share. The expansion of the construction industry due to rising cash flow and increasing government investments in major infrastructure projects is the cause of the dominance based on both volume and revenue. The increase in auto manufacturing across Asia Pacific is expected to boost the market growth during the forecast period.

Due to rising car manufacturing in the region, North America held the second-largest revenue share in 2024. Due to rising car production and the presence of many key market players, the region's automotive sector is predicted to grow significantly. In the coming years, the automotive industry is expected to witness an increase in car production and exports. Leading automakers such as Honda, Nissan, and Mazda have set up their manufacturing plants in the region's center region to produce a wide range of car models in enormous quantities. All these factors propel the regional acrylonitrile butadiene styrene market expansion.

Acrylonitrile Butadiene Styrene Market – Key Players and Competitive Insights

According to the acrylonitrile butadiene styrene market insights, it is anticipated that most multinational corporations will expand their polymer offerings to Asia Pacific, Central & South America, and the Middle East & Africa. Along with a few small and medium regional businesses, the market has been defined by the presence of major players.

Chi Mei Corporation; LyondellBasell Industries Holdings BV; The 3M Company; Ravago Americas LLC; Covestro AG; Kumho Petrochemical Co., Ltd.; Teijin Limited; Trinseo; DuPont de Nemours, Inc.; Ineos Group Ltd.; Formosa Chemicals & Fibre Corp; LG Chem Ltd.; SABIC; and BASF SE are among the key leaders in the acrylonitrile butadiene styrene market.

List of Key Players in Acrylonitrile Butadiene Styrene Market

- Chi Mei Corporation

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- The 3M Company

- Ravago Americas LLC

- Covestro AG

- Kumho Petrochemical Co., Ltd.

- Teijin Limited

- Trinseo

- DuPont de Nemours, Inc.

- Ineos Group Ltd.

- Formosa Chemicals & Fibre Corp.

- LG Chem Ltd.

- SABIC

- BASF SE

Acrylonitrile Butadiene Styrene Industry Developments

In June 2024, Trinseo unveiled the newest recycled acrylonitrile butadiene styrene and styrene-acrylonitrile resins. Up to 60% of the styrene in these resins is chemically recycled, which might result in an 18% reduction in carbon emissions.

In April 2024, BASF and Youyi Group signed a contract to deepen their strategic collaboration and to meet the growing demand for adhesive materials in China. The agreement focuses on the supply of butyl acrylate and 2-ethylhexyl acrylate from BAF's Zhanjiang plant.

Acrylonitrile Butadiene Styrene Market Segmentation

By Product Type Outlook

- Transparent

- Opaque

- Colored

By End-User Outlook

- Construction

- Consumer Goods

- Automotive

- Electrical and Electronics

- Appliances

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Acrylonitrile Butadiene Styrene Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.32 billion |

|

Market Size Value in 2025 |

USD 23.33 billion |

|

Revenue Forecast by 2034 |

USD 35.15 billion |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The acrylonitrile butadiene styrene market size is expected to reach USD 35.15 billion by 2034 from USD 23.33 billion in 2025.

The market is expected to register a CAGR of 4.7% during the forecast period.

In 2024, Asia Pacific dominated the market with over 33.5% of total revenue share.

Kumho Petrochemical Co., Ltd.; Teijin Limited; Trinseo; DuPont de Nemours, Inc.; Ineos Group Ltd.; LyondellBasell Industries Holdings BV; Mitsui Chemicals, Inc.; The 3M Company; Ravago Americas LLC; and Covestro AG are among the key players influencing the market.

In 2024, the opaque segment generated over 43.2% of total revenue and dominated the worldwide acrylonitrile butadiene styrene market share in 2024.

In 2024, the appliances segment held a dominant position in the market, accounting for over 28.4% of total revenue.