Acrylic Acid Market Size, Share, Trends, Industry Analysis Report: By Derivative (Acrylate Esters, Glacial Acrylic Acid, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1157

- Base Year: 2024

- Historical Data: 2020-2023

Acrylic Acid Market Overview

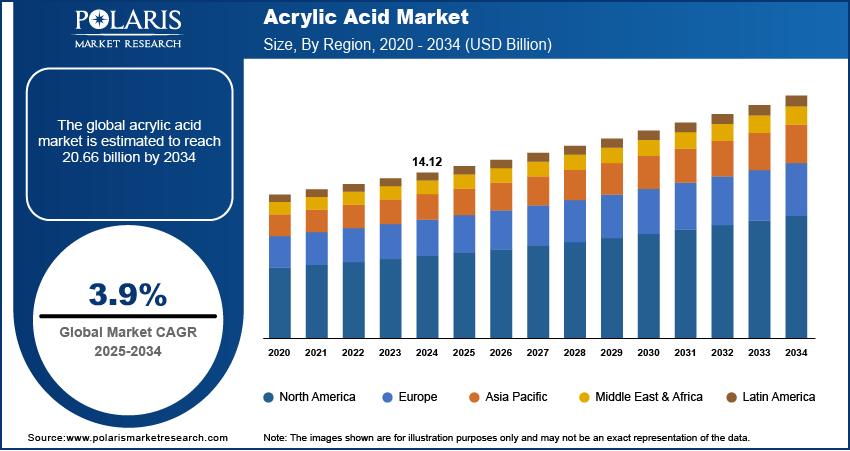

Acrylic acid market size was valued at USD 14.12 billion in 2024. The market is projected to grow from USD 14.65 billion in 2025 to USD 20.66 billion by 2034, exhibiting a CAGR of 3.9% during the forecast period.

Acrylic acid is an essential organic compound recognized as the simplest unsaturated carboxylic acid. This compound appears as a colorless liquid with a pungent odor and is highly compatible with water, alcohol, ethers, and chloroform. The compound is crucial in producing polymers used in diverse applications such as coatings, adhesives, and plastics.

The increasing infrastructure development worldwide is propelling the global acrylic acid market growth. Acrylic acid is a key ingredient in manufacturing adhesives, sealants, and coatings, which are widely used in infrastructure development, such as building and construction projects. Products derived from acrylic acid, such as superabsorbent polymers and emulsions, enhance the performance and longevity of construction materials, making them essential for infrastructure development. Therefore, as infrastructure projects such as roads, bridges, commercial buildings, and residential complexes continue to expand, the demand for durable, weather-resistant, and flexible chemicals, including acrylic acid, is increasing.

To Understand More About this Research: Request a Free Sample Report

The acrylic acid market demand is driven by rising industrialization in emerging nations. Acrylic acid is a critical component in the production of polymers, adhesives, coatings, and sealants, which are essential in the construction, automotive, packaging, consumer goods, and textiles industries that are rapidly expanding in emerging countries. Thus, as industries in emerging economies expand, they require more acrylic acid-based products for applications such as paint formulations, water treatment solutions, and hygiene products such as diapers and sanitary pads.

Acrylic Acid Market Dynamics

Growing Population Worldwide

The growing population worldwide is projected to propel the global acrylic acid market expansion. As per a report published by the According to the United Nations, the world's population will grow by about 2 billion people in the next 30 years, rising from 8 billion to 9.7 billion by 2050. Acrylic acid is a key chemical in manufacturing superabsorbent polymers used in diapers, sanitary products, and adult incontinence products, all of which see high demand as the population expands. Additionally, a larger population drives the need for housing, healthcare facilities, and other infrastructure, increasing the use of acrylic acid in construction materials such as adhesives, sealants, and coatings.

Innovations in Production Technologies

The innovations in production technologies are estimated to fuel the global acrylic acid market revenue. Advances in manufacturing processes, such as bio-based acrylic acid production or energy-efficient catalytic methods, reduce production costs and environmental impact, making acrylic acid more attractive to industries and consumers. These innovations enable the development of higher-quality and more sustainable derivatives, expanding its use in sectors such as personal care, construction, and textiles. Improved production techniques also allow for customized formulations, meeting the specific demands of emerging markets and specialized applications such as water treatments and others.

Acrylic Acid Market Segment Analysis

Acrylic Acid Market Assessment by Derivative

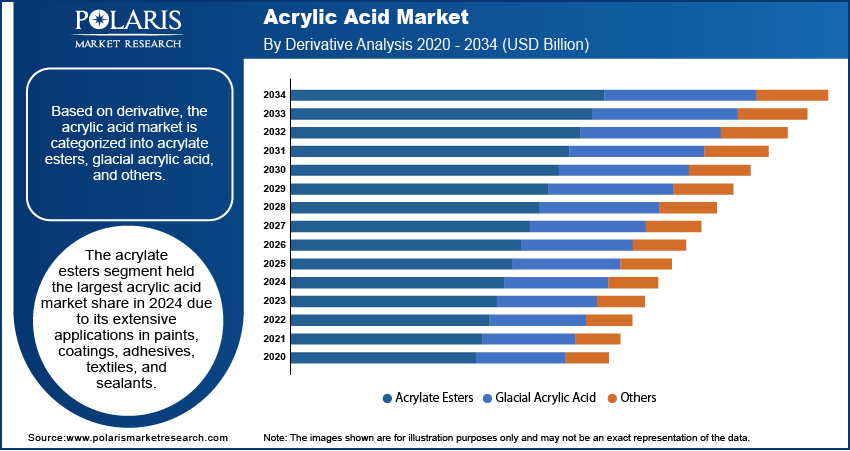

Based on derivative, the acrylic acid market is categorized into acrylate esters, glacial acrylic acid, and others. The acrylate esters segment held the largest acrylic acid market share in 2024 due to its extensive applications in paints, coatings, adhesives, textiles, and sealants. Industries increasingly relied on this derivative due to its excellent adhesion properties, durability, and versatility in both industrial and consumer products. The construction sector significantly contributed to this dominance as acrylate esters are vital in high-performance paints and coatings that provide weather resistance and enhanced aesthetics. Rapid industrialization in emerging economies and the expansion of urban infrastructure further boosted the segment’s leadership position by increasing the consumption of materials derived from these esters.

The glacial acrylic acid segment is also expected to grow at a robust pace in the coming years owing to its critical role as a raw material for superabsorbent polymers, which are widely used in hygiene products such as diapers and sanitary pads. The growing awareness of personal hygiene, coupled with the rising global population, has fueled demand for this derivative, particularly in developing regions. Additionally, the water treatment industry increasingly utilizes glacial acrylic acid to produce dispersants and scale inhibitors, reflecting a broader focus on sustainable water management. Innovations in production technology and the adoption of bio-based alternatives have also enhanced the appeal of this derivative, further driving its adoption.

Acrylic Acid Market Evaluation by Application

In terms of application, the acrylic acid market is divided into surfactants & surface coatings, organic chemicals, adhesives and sealants, textiles, water treatment, personal care products, and others. The personal care products segment dominated the market share in 2024 due to the increasing demand for hygiene products such as diapers and sanitary pads, which rely on superabsorbent polymers derived from acrylic acid. A rising global population, coupled with growing awareness of personal hygiene, significantly contributed to the expansion of the segment. Urbanization and improved living standards in emerging economies further amplified the demand for high-performance hygiene products, driving demand for acrylic acid. Additionally, the beauty and skincare industry incorporated advanced formulations in creams, lotions, and gels, enhancing the segment's appeal.

Acrylic Acid Market Outlook by Region

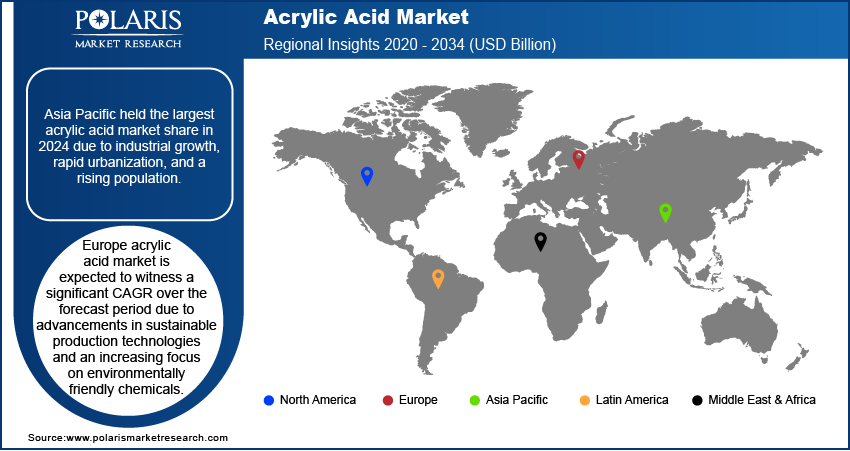

By region, the study provides the acrylic acid market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific held the largest acrylic acid market share in 2024 due to industrial growth, rapid urbanization, and a rising population. Countries such as China and India led this dominance due to their expanding construction, automotive, and personal care industries. China, in particular, emerged as the dominant country within the region, fueled by its massive manufacturing base and significant investments in infrastructure development. Additionally, favorable government policies promoting industrialization and an increasing focus on hygiene products in the region further supported market growth.

Europe acrylic acid market is expected to witness a significant CAGR over the forecast period due to advancements in sustainable production technologies and an increasing focus on environmentally friendly chemicals. Stringent environmental regulations have encouraged the adoption of bio-based and low-emission products, driving demand in sectors such as water treatment, coatings, and adhesives. Countries including Germany and France, with their strong industrial base and focus on innovation, are expected to play a significant role in this growth. The rising demand for high-quality hygiene products and construction materials, coupled with a shift toward green building practices, has further fueled the market expansion.

Acrylic Acid Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the acrylic acid industry grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The acrylic acid market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Shanghai Huayi Acrylic Acid Co., Ltd; NIPPON SHOKUBAI CO., LTD.; Dow; Sinopec; Formosa Plastics Corporation; Sasol; Wanhua; Vigon International, LLC.; SMC; BASF; Arkema; and LG Chem.

Sasol is a prominent integrated energy and chemical company headquartered in Sandton, South Africa, and established in 1950. The company operates in 33 countries and employs over 30,000 people, leveraging advanced technologies to develop and commercialize a wide range of products that cater to various industries. Acrylic acid is one of the many products produced by Sasol, reflecting the company's commitment to diversifying its chemical portfolio. Sasol's operations are structured into two upstream business units, three regional operating hubs, and four customer-facing strategic business units, which collectively enhance its ability to respond to market demands and stakeholder expectations.

BASF, headquartered in Ludwigshafen, is the world's largest chemical producer and a leading player in the global chemicals market. Founded in 1865 as Badische Anilin- und Soda-Fabrik, BASF has a rich history that includes significant contributions to the development of chemical processes, such as the Haber-Bosch process for ammonia synthesis. Over the years, BASF has expanded its operations across more than 80 countries, operating six integrated production sites and approximately 390 other facilities worldwide. The company serves a diverse array of industries, including agriculture, automotive, construction, and consumer goods, through its extensive portfolio of products that span chemicals, plastics, performance products, and agricultural solutions.

Key Companies in Acrylic Acid Market

- Shanghai Huayi Acrylic Acid Co., Ltd

- NIPPON SHOKUBAI CO., LTD.

- Dow

- Sinopec

- Formosa Plastics Corporation

- Sasol

- Wanhua

- Vigon International, LLC.

- SMC

- BASF

- Arkema

- LG Chem

Acrylic Acid Market Developments

October 2023: Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced the acquisition of ester-grade acrylic acid technology, and light and heavy acrylates process technology from Air Liquide Engineering & Construction. This acquisition helped Lummus to expand its portfolio for propylene production and derivative products.

May 2023: NIPPON SHOKUBAI CO., LTD., a chemical company that produces and sells chemicals, catalysts, and resins to manufacturing companies, inaugurated a new acrylic acid plant in Indonesia with a total investment of USD 200 million.

Acrylic Acid Market Segmentation

By Derivative Outlook (Volume, Kiloton, Revenue, USD Billion, 2020 - 2034)

- Acrylate Esters

- Glacial Acrylic Acid

- Others

By Application Outlook (Volume, Kiloton, Revenue, USD Billion, 2020 - 2034)

- Surfactants & Surface Coatings

- Organic Chemicals

- Adhesives and Sealants

- Textiles

- Water Treatment

- Personal Care Products

- Others

By Regional Outlook (Volume, Kiloton, Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Acrylic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.12 billion |

|

Market Size Value in 2025 |

USD 14.65 billion |

|

Revenue Forecast in 2034 |

USD 20.66 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume in Kiloton, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global acrylic acid market size was valued at USD 14.12 billion in 2024 and is projected to grow to USD 20.66 billion by 2034.

• The global market is projected to register a CAGR of 3.9% during the forecast period.

• Asia Pacific had the largest share of the global market in 2024.

• Some of the key players in the market are Shanghai Huayi Acrylic Acid Co., Ltd; NIPPON SHOKUBAI CO., LTD.; Dow; Sinopec; Formosa Plastics Corporation; Sasol; Wanhua; Vigon International, LLC.; SMC; BASF; Arkema; and LG Chem.

• The glacial acrylic acid segment is projected for significant growth in the global market.

• The personal care product segment dominated the acrylic acid market in 2024.