Acidity Regulators Market Share, Size, Trends, Industry Analysis Report, By Product (Citric Acid, Phosphoric Acid, Acetic Acid, Maleic Acid, Lactic Acid); By Source; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3501

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

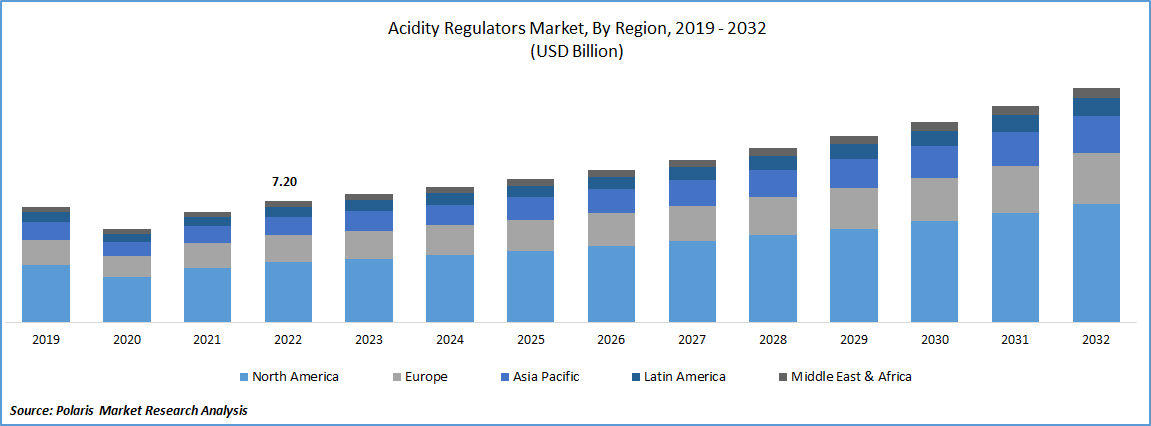

The global acidity regulators market was valued at USD 7.58 billion in 2023 and is expected to grow at a CAGR of 6.94% during the forecast period. The food processing industry is a major consumer of acidity regulators, as these additives play a critical role in improving the quality, flavor, and shelf life of food products. One of the main factors driving the expansion of the market for acidity regulators has been the rising need for food processing and preservation.

To Understand More About this Research: Request a Free Sample Report

Based on the combined study by the Associated Chambers of Commerce and Industry of India (ASSOCHAM) & Grant Thornton, India's food processing industry expected to draw USD 33 billion in investments, by 2024 and has the potential for significant investments in food processing technologies and processing equipment, given that the overall food production of the nation is expected to double, by 2024. As the demand for processed food continues to grow, the demand for acidity regulators is also increasing. In addition, the trend towards natural and organic food products has also led to the growth of the acidity regulators market.

Industry Dynamics

Growth Drivers

The food and beverage industry is expanding rapidly, particularly in emerging markets, which has led to an increase in demand for acidity regulators. The increasing consumption of processed foods and beverages in these markets is expected to drive the growth of the acidity regulators market. According to Stacey Haas, a partner at McKinsey & Company, CPG food and beverage enjoyed record growth overall, with industry revenues up 12% in 2020. This trend is projected to continue in the coming years and in turn demand for the acidity regulators market. The growing food and beverage industry is a major driver of the acidity regulators market. Acidity regulators play a crucial role in the food and beverage industry, as they are used to control the acidity and pH levels of food and beverage products. This helps to maintain the flavor, texture, and quality of the products, and extend their shelf life.

Report Segmentation

The market is primarily segmented based on product, source, application and region.

|

By Product |

By Source |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Citric Acid segment is expected to witness fastest growth during 2022

Citric Acid segment is projected to experience a faster growth rate in the study period. It is commonly used in carbonated soft drinks, fruit juices, jams and jellies, and other food products to enhance the flavor, act as a preservative, and regulate the acidity of the product. Consumers are increasingly demanding natural and clean label products, and citric acid is a natural ingredient that can be used to meet this demand. Citric acid is generally recognized as safe (GRAS) by the FDA, and it has a long history of use in food and beverage products. Citric acid has several health benefits, including its ability to enhance iron absorption, support the immune system, and improve digestion. These health benefits are driving the demand for citric acid in food and beverage products.

Natural segment projected to witness for the largest market share in the study period

Natural segment is projected to witness larger market share in the forecast period. Consumers are increasingly concerned about the safety and quality of the products they consume. They are looking for products that are made from natural ingredients and are free from synthetic chemicals. This trend is driving the demand for natural acidity regulators. Natural acidity regulators are often rich in vitamins, minerals, and antioxidants, which provide several health benefits.

These ingredients can improve digestion, boost the immune system, and reduce inflammation. This health-conscious trend is driving the demand for natural acidity regulators. These regulators are often considered clean label ingredients, meaning they are perceived to be safe and free from synthetic chemicals. This label claim appeals to consumers who are looking for transparent and trustworthy products. Natural acidity regulators are often environmentally friendly, as they are derived from renewable sources and are biodegradable. This feature appeals to consumers who are concerned about sustainability.

Beverages segment is expected to hold the significant revenue share in 2022

Beverage segment is projected to witness a larger revenue share for the market in coming years. The demand for beverages is increasing globally, driven by changing lifestyles and increasing disposable incomes. The increasing demand for beverages is driving the demand for acidity regulators. Acidity regulators are used in beverages to prevent spoilage and extend the shelf life of the product. This is important for manufacturers who need to ensure that their products remain fresh and safe for consumption.

Acidity regulators can enhance the flavor of beverages by providing a tart or sour taste. This is important for manufacturers who want to create unique and appealing flavor profiles for their products. Consumers are increasingly demanding natural and clean label products, and acidity regulators can be used to meet this demand. Natural acidity regulators, such as citric acid and malic acid, are commonly used in beverages to provide a tart taste and are perceived as safe and natural.

APAC projected to witness higher growth rate in the study period

APAC registered with the higher growth rate in the forecast timeframe. It has a large population with increasing disposable income. The growing population and disposable income are leading to increased demand for processed food and beverages, which is driving the demand for acidity regulators. The food processing industry in India is witnessing significant growth due to the increasing demand for packaged and processed food products, driven by the rising urbanization, changing lifestyles, and increasing disposable incomes of consumers. India's processed food business is predicted to increase at an amazing 14.6 percent. As the food industry continues to innovate and introduce new products, the demand for acidity regulators is likely to increase further.

North America garnered with the larger revenue share in 2022

North America is registered with the largest revenue share in the study period. The food and beverage industry in North America is well-developed, with a high demand for processed food and beverages. Acidity regulators are widely used in the industry to maintain the pH balance of food and beverages, and this is driving the demand for acidity regulators in the region. Consumers in North America are becoming increasingly health-conscious and are demanding natural and clean label products.

Natural acidity regulators, such as citric acid and malic acid, are commonly used in the food and beverage industry to provide a tart taste and are perceived as safe and natural. This trend is driving the demand for natural acidity regulators in North America. The growing health consciousness in the region is a key driver of the growth of the acidity regulators market, as consumers demand healthier and more natural food products.

Competitive Insight

Some of the major players operating in the global market include Bartek Ingredients, Cargill Incorporated, Celrich Products, Chemelco, Corbion F.B.C Industries, Foodchem, Jungbunzlauer Suisse, Fuerst Day Lawson, Archer Daniels Midland, American Tartaric Products, Merko, Tate & Lyle & Univar.

Recent Developments

- In February 2023, Corbion broadened its present cooperation with Azelis, a top worldwide innovation service provider in the specialty chemicals and food ingredients industries in order to distribute Corbion goods in Malaysia and Singapore.

- In April 2022, Bartek Ingredients announced the construction of the largest production factory for malic and food-grade fumaric acid in the world and is now under development.

Acidity Regulators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.01 billion |

|

Revenue forecast in 2032 |

USD 13.87 billion |

|

CAGR |

6.94% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Bartek Ingredients, Cargill Incorporated, Celrich Products, Chemelco, Corbion F.B.C Industries, Foodchem, Jungbunzlauer Suisse, Fuerst Day Lawson, Archer Daniels Midland, American Tartaric Products, Merko, Tate & Lyle & Univar. |

FAQ's

The acidity regulators market report covering key segments are product, source, application and region.

Acidity Regulators Market Size Worth $13.87 Billion By 2032.

The global acidity regulators market is expected to grow at a CAGR of 6.94% during the forecast period.

North America is leading the global market.

key driving factors in acidity regulators market are increasing consumption of processed foods and beverages.