Acetone Market Size, Share, Trends, Industry Analysis Report: By Grade (Specialty Grade Acetone, Technical Grade Acetone), By End-User, By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 125

- Format: PDF

- Report ID: PM1665

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

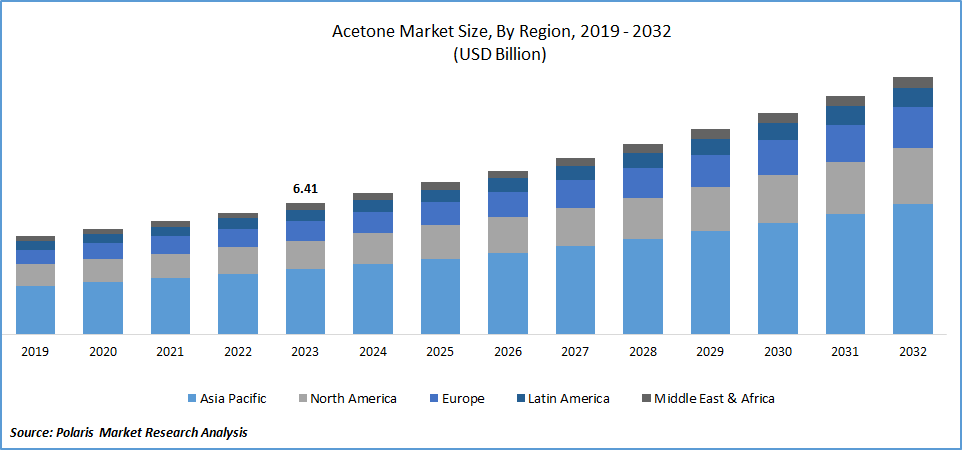

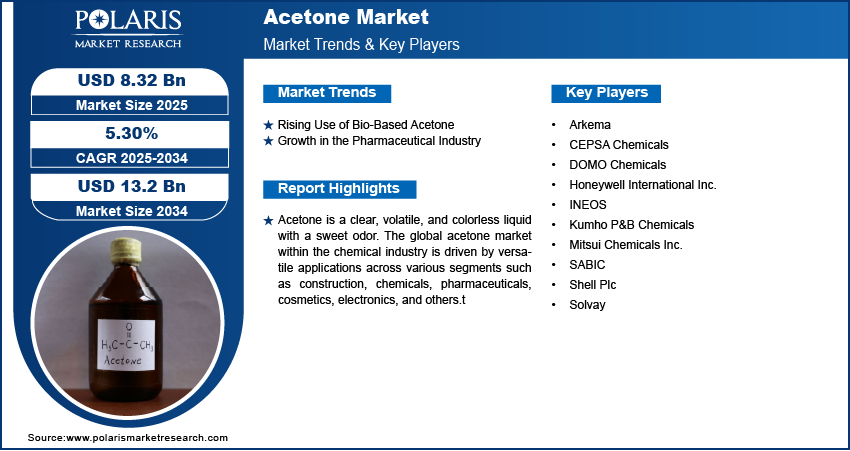

Global acetone market size was valued at USD 6.41 billion in 2023. The industry is projected to grow from USD 6.90 billion in 2024 to USD 12.60 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.8% during the forecast period.

Acetone is a clear, volatile, and colorless liquid with a sweet odor. The global acetone market within the chemical industry is driven by versatile applications across various segments such as construction, chemicals, pharmaceuticals, cosmetics, electronics, and others.

The acetone market is currently growing steadily due to increased demand from the construction industry for acetone-based products such as polycarbonates. These products are essential in construction materials, specifically for thermal insulation panels and glazing.

The paints and coatings industry are also experiencing growth. Acetone derivatives are widely used as solvents or components for resin compositions in this industry. They are known for their ability to dissolve pigments and resins, which improves paint application and performance, thus boosting the acetone market.

To Understand More About this Research:Request a Free Sample Report

There is a growing demand for products derived from acetone in infrastructure, automotive manufacturing, agrochemicals, and pharmaceuticals due to the increasing need for petrochemical feedstock. This interdependent relationship requires consistent levels of production and consumption. Consequently, significant industry leaders are making investments to expand their acetone manufacturing capacities.

For instance, in October 2023, Haldia Petrochemicals Ltd. (HPL) invested $360 million in constructing a new phenol/acetone plant at its facility in West Bengal, India. The plant will be functional in the first quarter of the year 2026 and capable of producing 300,000 tons of phenol and 185,000 tons of acetone per year to meet the rising demand for acetone from the petrochemicals sector.

Acetone Market Trends

Rising Use of Bio-Based Acetone is Driving the Market Growth

The market growth rate for acetone is being driven by the increasing use of bio-based acetone sourced from renewable biological sources such as biomass, industrial waste streams, or agricultural residues. Bio-based acetone offers a sustainable option with a lower environmental impact. It is obtained through methods like fermentation, bioconversion of biomass feedstock, or enzymatic conversion.

Bio-based acetone is used in various industrial operations including solvent manufacturing, chemical synthesis, and as a raw material for producing different chemicals. The growing demand for sustainable and eco-friendly acetone has prompted key players to introduce bio-based acetone for use in diverse sectors.

For instance, in October 2020, VertecBio launched ELSOL AR, a bio-based acetone solution applicable to manufacturing, pharmaceutical, or industrial/environmental cleaning requirements.

Growth in the Pharmaceutical Industry is Driving the Market

The acetone market is experiencing significant growth due to its reliability and versatility as a solvent for extracting active ingredients from natural sources in pharmaceutical manufacturing processes. Acetone is widely used in pharmaceutical formulations as a solvent for active pharmaceutical ingredients, excipients, and in the production of pharmaceutical intermediates.

The demand for acetone is expected to increase as the pharmaceutical industry expands rapidly, driven by advancements in drug development and increasing healthcare needs. For instance, according to Invest India, the Indian pharmaceutical industry was valued at USD 50 billion in 2023. It is projected to reach USD 65 billion by 2024 and USD 130 billion by 2030.

This growth in the pharmaceutical sector is contributing to the increasing revenue of the acetone market. Acetone's ability to dissolve a wide range of substances in the synthesis and purification of pharmaceutical compounds, as well as its use in synthesizing pharmaceutical compounds, is driving this trend.

Acetone Market Segment Insights

Acetone Grade Insights:

The global acetone market segmentation, based on grade, includes specialty grade acetone and technical grade acetone. In 2023, the technical grade acetone segment dominated the market owing to its affordability and wide applications in the construction industry. Technical-grade acetone is used in lacquers, construction adhesives, floor polishing, adhesive cement, and concrete admixtures. Moreover, the surge in construction activities and growing construction projects are expected to drive the demand for technical-grade acetone.

For instance, according to Invest India, in 2019, the Indian construction sector experienced seven merger and acquisition transactions totaling $1,461 million, and the highway construction/widening sector witnessed a surge of 9.8% as compared to the previous year.

Acetone Application Insights

The global acetone market segmentation, based on application, includes bisphenol A, methyl methacrylate, solvents, methyl isobutyl ketone, and others. The solvents category dominated the market in 2023, mainly attributed to the acetone’s solvency power, volatility, and ability to dissolve a wide range of substances in various industries, such as paints, coatings, adhesives, and pharmaceuticals.

Further, the growth in the construction and automotive sectors contributes significantly to acetone demand, driven by its effectiveness in formulations and cleaning processes. Moreover, the expanding electronics industry, where acetone is utilized for circuit board production, further propels market growth. Environmental regulations promoting the use of eco-friendly solvents also impact market dynamics, pushing manufacturers towards sustainable alternatives. As industries continue to innovate and expand globally, the demand for acetone and other solvents is expected to remain robust, driven by evolving applications and regulatory landscapes.

Global Acetone Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Acetone Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The acetone market in North America accounted for a significant market share, owing to the usage of acetone as a solvent in various sectors, including cosmetics, automobiles, personal care, and others.

Moreover, the North American region has a robust industrial base, especially in sectors such as chemicals, pharmaceuticals, and manufacturing which are significant consumers of acetone. This industrial strength creates a demand for acetone for direct use and as a precursor in the production of other chemicals.

For instance, in 2021, Matrix Chemical, LLC, a distributor of acetone and solvents in North America, achieved sales of USD 200 million. The company supplied acetone and other solvents to clients across the United States and Canada applicable in various sectors such as personal care, adhesives, and the paint and coatings sector.

The acetone market in Europe is predicted to experience the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2032. This growth is attributed to advancements in chemical manufacturing technology, which enable large-scale refinement and commercial production of acetone. There is an increasing demand for sustainable and eco-friendly technologies that can minimize pollution and carbon dioxide emissions, thereby aligning with Europe's climate-neutral policy by 2050.

For instance, in November 2023, PYROCO2, a biotech company, collaborated with eight other key players to encompass a technology that utilizes carbon capture and utilization technology to convert industrial CO2 into acetone in a Norway plant, offering climate-positive solutions for European chemical production. This demonstrates the economic viability and scalability of carbon capture and utilization in producing climate-positive acetone, driving market growth.

Global Acetone Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Furthermore, the Asia-Pacific acetone market dominated the acetone market over the forecast period due to the growing demand for the product across different end-user sectors like pharmaceuticals, personal care & cosmetics, and automotive in several countries, such as China, India, and Japan.

Acetone market in China held the largest market share in 2023 as it is a primary consumer of acetone. It is projected to boost acetone consumption further due to the expanding construction, paints, and electronics industries.

For instance, in 2021, according to the National Bureau of Statistics reported that the construction output in China reached a value of around CNY 29.31 trillion. Further, key players are investing in expanding the paints and coatings industry in China. For instance, in May 2021, PPG Industries Inc. invested a total of USD 13 million to establish eight new powder coating production lines to increase the production capacity by more than 8,000 metric tons annually by enhancing the paints and coatings division in China, thus driving the demand for acetone.

Acetone Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the acetone market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the acetone industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global acetone industry to benefit clients and increase the market sector. In recent years, the acetone industry has offered some technological advancements. Major players in the acetone market, including Arkema, CEPSA Chemicals, DOMO Chemicals, Honeywell International Inc., INEOS, Kumho P&B Chemicals, Mitsui Chemicals Inc., SABIC, Shell Plc and Solvay.

Honeywell International Inc. is a multinational company headquartered in North America. The company offers the product in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). In March 2021, Honeywell revealed that Lotte GS Chemical Corp. has opted for Honeywell Phenol 3G, Evonik MSHP, and UOP Q-Max technologies to manufacture acetone and phenol of about 565,000 metric tons per year at its petrochemical facility in South Korea.

Mitsui Chemicals Inc. is a chemical manufacturer headquartered in Tokyo, Japan. The company operates in various business sectors, including basic and green materials, life and health care, ICT, mobility, and other industries. Its product portfolio includes petrochemicals, basic chemicals, polyurethane raw materials, performance compounds, elastomers, polypropylene compounds, and other materials. The company has a global presence with operations in various countries, including Singapore, Taiwan, Germany, India, Malaysia, Thailand, South Korea, Mexico, and the US. In November 2023, A joint venture between China's Sinopec and Japan's Mitsui Chemicals recommenced operations at the phenol and acetone plant in Shanghai, ensuring the reliability of chemical production facilities and efficiency.

Key Companies in the Acetone Market Include

- Arkema

- CEPSA Chemicals

- DOMO Chemicals

- Honeywell International Inc.

- INEOS

- Kumho P&B Chemicals

- Mitsui Chemicals Inc.

- SABIC

- Shell Plc

- Solvay

Acetone Industry Developments

- March 2024: Mitsui Chemicals is scheduled to resume operations at its Phenol/Acetone Unit located in Japan, by mid-June 2024, with an annual production capacity of 190,000 tons of phenol and 114,000 tons of acetone to enhance supply levels and cater to market requirements.

- April 2023: INEOS Phenol acquired the chemical segment of Mitsui Phenols Singapore Ltd. This acquisition enabled INEOS to enhance its support for customers worldwide while also fostering the growth of new markets and partnerships in Asia.

- July 2022: LG Chem declared its plan to export 1,200 tons of acetone and 4,000 tons of phenol, one of the largest shipments in South Korea to be certified with ISCC PLUS.

Acetone Market Segmentation

Acetone Grade Outlook

- Specialty Grade Acetone

- Technical Grade Acetone

Acetone End-User Outlook

- Construction

- Automotive

- Cosmetics and Personal Care

- Paints and Coatings

- Pharmaceutical

- Agriculture

- Others

Acetone Application Outlook

- Bisphenol A

- Methyl Methacrylate

- Solvents

- Methyl Isobutyl Ketone

- Others

Acetone Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Acetone Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.41 billion |

|

Market size value in 2024 |

USD 6.90 billion |

|

Revenue Forecast in 2032 |

USD 12.60 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global acetone market size was valued at USD 6.41 billion in 2023 and is projected to be valued at USD 12.60 billion in 2032

The global market is projected to grow at a CAGR of 7.8% during the forecast period, 2024-2032.

Asia-Pacific held the largest share of the global market

The key players in the market are Arkema, CEPSA Chemicals, DOMO Chemicals, Honeywell International Inc., INEOS, Kumho P&B Chemicals, Mitsui Chemicals Inc., SABIC, Shell Plc and Solvay.

The technical grade acetone category dominated the market in 2023.

The solvents category held the largest share in the global market.