Access Control System Market Size, Share, Trends, Industry Analysis Report: By Offering, Type [Discretionary Access Control (DAC), Mandatory Access Control (MAC), and Role-Based Access Control (RBAC)], End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1760

- Base Year: 2024

- Historical Data: 2020-2023

Access Control System Market Overview

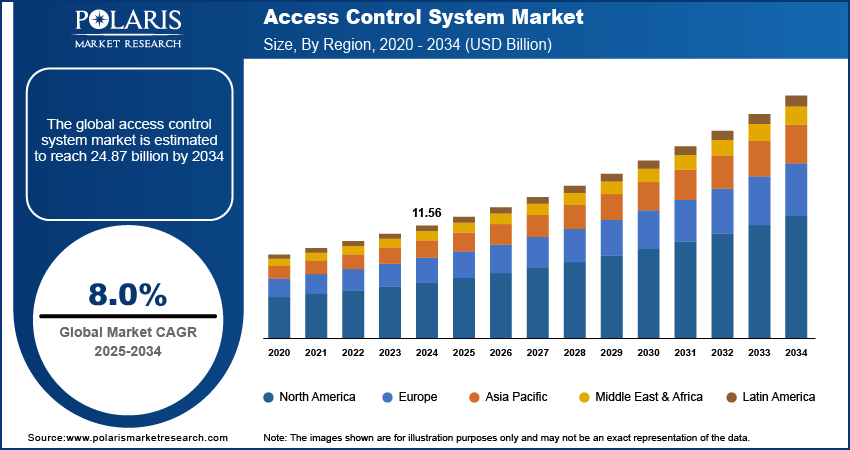

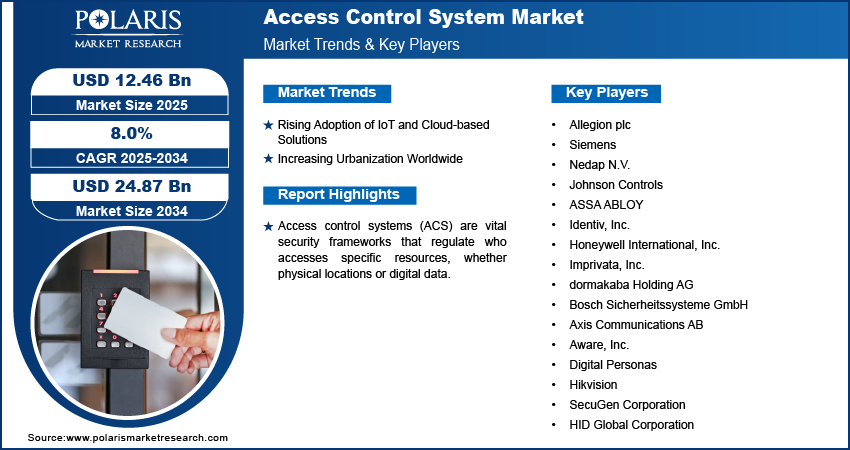

Access control system market size was valued at USD 11.56 billion in 2024. The market is projected to grow from USD 12.46 billion in 2025 to USD 24.87 billion by 2034, exhibiting a CAGR of 8.0% during the forecast period.

Access control systems (ACS) are vital security frameworks that regulate who access specific resources, whether physical locations or digital data. These systems ensure that only authorized individuals enter secure areas or utilize sensitive information, thereby protecting assets and maintaining privacy.

The rising investment in smart city projects worldwide is driving the global access control system market. On August 28, 2024, the Government of India approved 12 new industrial smart city projects with a total project cost of ₹28,602 crores (USD 3,432.24 million). Smart cities aim to enhance safety, optimize resource use, and improve the quality of life through integrated technologies. Access control systems, including biometric scanners, RFID-based solutions, and mobile app-controlled devices, play a vital role in achieving these goals by safeguarding critical facilities, managing traffic flow, and ensuring secure entry to residential, commercial, and public spaces. Therefore, as the investment in smart city projects increases, the demand for access control system spurs.

To Understand More About this Research: Request a Free Sample Report

The access control system market growth is driven by the increasing popularity of smart homes. Smart homes are designed to integrate various connected devices, enabling remote control and automation of home functions such as lighting, temperature, and security. Access control systems, including smart locks, biometric authentication, and video doorbells, are central to this ecosystem, providing enhanced security and seamless entry management. These systems offer features such as remote access via smartphones, real-time monitoring, and integration with voice assistants, which appeal to the growing tech-savvy consumer base. Thus, as smart home adoption rises globally, the demand for innovative and interconnected access control solutions continues to grow.

Access Control System Market Dynamics

Rising Adoption of IoT and Cloud-based Solutions

The adoption of IoT and cloud-based solutions is projected to propel the global access control system market demand. IoT integration needs access control devices to communicate seamlessly with other smart systems, enhancing functionalities such as real-time monitoring, remote management, and automated responses. Additionally, the shift towards hybrid work models and increased reliance on remote operations have developed the need for adaptable, cloud-connected access solutions, driving their adoption across residential, commercial, and industrial sectors.

Increasing Urbanization Worldwide

The rising urbanization worldwide is fueling the global access control system market. As per data published by the United Nations, over half of the world lives in urban areas. Urbanization leads to an increase in residential complexes, commercial establishments, and public infrastructure, all of which require advanced systems to regulate access and ensure safety. Access control systems, including card-based entry, biometric systems, and mobile-based solutions, are critical for managing high foot traffic and safeguarding sensitive areas in these environments. Hence, as urbanization worldwide rises, the demand for access control systems automatically spurs.

Access Control System Market Segment Analysis

Access Control System Market Assessment by Type

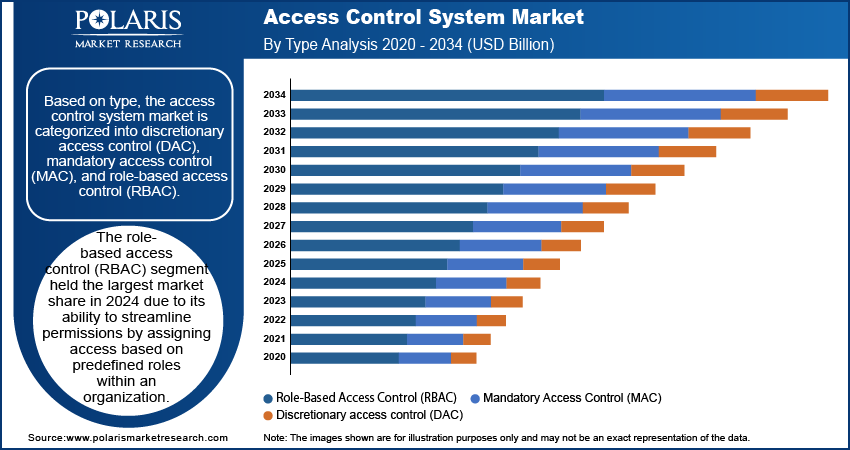

Based on type, the access control system market is categorized into discretionary access control (DAC), mandatory access control (MAC), and role-based access control (RBAC). The role-based access control (RBAC) segment held the largest market share in 2024 due to its ability to streamline permissions by assigning access based on predefined roles within an organization. This approach eliminates the need for individual user permissions, simplifying management and enhancing operational efficiency. Enterprises across sectors such as healthcare, IT, and finance favor RBAC due to its adaptability and alignment with regulatory compliance requirements such as GDPR and HIPAA. The rising prevalence of remote work and cloud-based applications has further boosted the demand for RBAC systems, which ensure secure and scalable management of user access while minimizing risks of unauthorized entry.

The mandatory access control (MAC) segment is also expected to grow at a rapid pace during the forecast period, owing to the increasing frequency of cyberattacks and stringent data protection laws. MAC enforces stricter security policies by assigning access permissions directly to individuals or groups based on clearance levels and the sensitivity of data. This heightened control makes it ideal for industries such as defense, government, and critical infrastructure, where data confidentiality and security are important. Furthermore, advancements in technologies such as biometric authentication and artificial intelligence have enhanced MAC's effectiveness, making it a crucial solution for organizations prioritizing uncompromising security.

Access Control System Market Evaluation by End User

In terms of end user, the access control system market is divided into businesses & enterprises, financial institutions, hospitality & entertainment, retail & customer-facing, government & public services, residential, education & research, healthcare & life sciences, energy & utility infrastructure, and transportation & logistics. The businesses & enterprises segment dominated the access control system market share in 2024 due to the increasing need for security measures in corporate offices, coworking spaces, and IT hubs to protect sensitive data and intellectual property. Organizations across industries have been adopting advanced solutions, including biometric authentication and multi-factor verification, to address the challenges of managing large, dynamic workforces. The surge in remote work and hybrid models has further amplified the demand for systems that ensure seamless and secure access for employees, contractors, and visitors. Additionally, regulatory mandates requiring businesses to safeguard critical data and maintain audit trails have driven investment in access control technologies personalized to corporate environments.

Access Control System Market Regional Insights

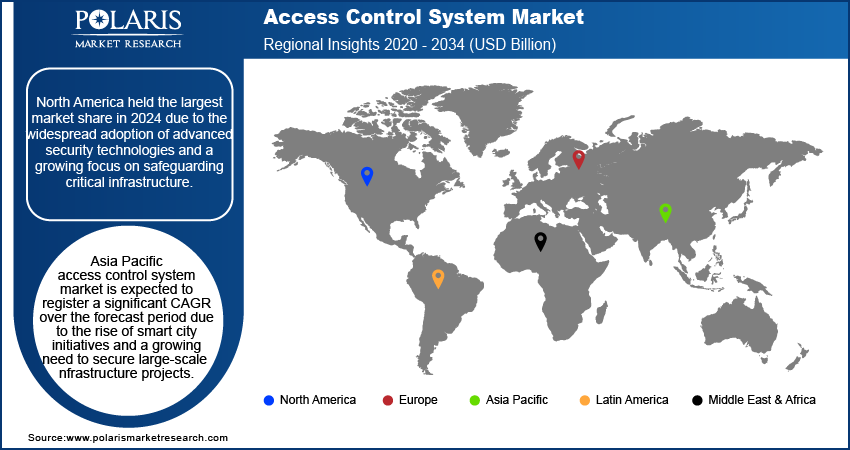

By region, the study provides the access control system market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the widespread adoption of advanced security technologies and a growing focus on safeguarding critical infrastructure. The US dominated the region, accounting for the highest market share. The US leadership is attributed to the presence of key technology providers, significant investments in smart building solutions, and a heightened emphasis on cybersecurity due to increasing incidents of data breaches. Industries such as healthcare, financial services, and IT have prioritized security systems that integrate with IoT devices and cloud platforms, further fueling market growth. Government initiatives to enhance public safety and stringent regulatory frameworks, such as CISA guidelines, have also boosted adoption rates of access control systems in North America.

Asia Pacific access control system market is expected to register a significant CAGR over the forecast period due to the rise of smart city initiatives and a growing need to secure large-scale infrastructure projects. Significant investments in surveillance systems, coupled with advancements in artificial intelligence and biometric technologies in China, have positioned the country as a regional leader. The proliferation of e-commerce, rapid industrialization, and increasing awareness of data privacy have further encouraged businesses and governments across Asia Pacific to adopt access control systems. Additionally, supportive policies and funding for smart infrastructure development have accelerated the adoption of these systems in emerging markets within the region.

Access Control System Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the access control system industry grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The access control system market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Allegion plc; Siemens; Nedap N.V.; Johnson Controls; ASSA ABLOY; Identiv, Inc.; Honeywell International, Inc.; Imprivata, Inc.; dormakaba Holding AG; Bosch Sicherheitssysteme GmbH; Axis Communications AB; Aware, Inc.; Digital Personas; Hikvision; SecuGen Corporation; and HID Global Corporation.

Allegion plc is a prominent global provider of security and access solutions, specializing in a comprehensive range of products that enhance safety and security across various environments. Headquartered in Dublin, Ireland, Allegion operates in over 120 countries and has an extensive portfolio that includes mechanical locks, electronic locks, biometric access control systems, door controls, exit devices, and workforce productivity solutions. These products are designed to serve diverse markets, including healthcare, education, government, hospitality, and residential sectors. In April 2024, Allegion unveiled new interoperable electronic access control technologies and software at ISC West 2024.

Aware, Inc. is a major provider of biometric software solutions that enhance security and streamline access control systems across various industries. With over thirty years of experience serving governments and enterprises worldwide, Aware has established itself as a trusted partner in biometric technology. The company specializes in integrating advanced biometric modalities, such as facial and voice recognition, into access control systems, thereby ensuring robust identity verification and authentication. This integration allows organizations to manage physical and digital access seamlessly while maintaining compliance with security regulations.

Key Companies in Access Control System Market

- Allegion plc

- Siemens

- Nedap N.V.

- Johnson Controls

- ASSA ABLOY

- Identiv, Inc.

- Honeywell International, Inc.

- Imprivata, Inc.

- dormakaba Holding AG

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Aware, Inc.

- Digital Personas

- Hikvision

- SecuGen Corporation

- HID Global Corporation

Access Control System Market Developments

February 2024: Allegion, a provider of security products and solutions, announced a strategic integration with Genea, a major cloud-based access control security platform provider, to revolutionize access control security.

February 2024: Hikvision, a China-based company that manufactures and sells a range of products and solutions for security, smart home, industrial automation, and automotive electronics, has unveiled its second-generation professional access control products.

March 2023: Vertiv, a global provider of critical digital infrastructure and continuity solutions, announced the launch of the Vertiv Intelligent Fingerprint Rack Access Control System (iFACS) to physically secure the racks housing mission critical equipment, assets, and enterprise data.

Access Control System Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020 - 2034)

- Hardware

- Card-based Readers

- Biometric Readers

- Multi-technology Readers

- Electronic Locks

- Controllers

- Others

- Software

- Visitor Management System

- Others

- Services

- Installation & Integration Services

- Support & Maintenance Services

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Discretionary access control (DAC)

- Mandatory Access Control (MAC)

- Role-Based Access Control (RBAC)

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Businesses & Enterprises

- Financial Institutions

- Hospitality & Entertainment

- Retail & Customer-Facing

- Government & Public Services

- Residential

- Education & Research

- Healthcare & Life Sciences

- Energy & Utility Infrastructure

- Transportation & Logistics

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Access Control System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.56 billion |

|

Market Size Value in 2025 |

USD 12.46 billion |

|

Revenue Forecast in 2034 |

USD 24.87 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global access control system market size was valued at USD 11.56 billion in 2024 and is projected to grow to USD 24.87 billion by 2034.

The global market is projected to grow at a CAGR of 8.0% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Allegion plc; Siemens; Nedap N.V.; Johnson Controls; ASSA ABLOY; Identiv, Inc.; Honeywell International, Inc.; Imprivata, Inc.; dormakaba Holding AG; Bosch Sicherheitssysteme GmbH; Axis Communications AB; Aware, Inc.; Digital Personas; Hikvision; SecuGen Corporation; and HID Global Corporation.

The role-based access control (RBAC) segment is projected for significant growth in the global market.

The business & enterprises segment dominated the access control system market in 2024.