5G Testing Equipment Market Size, Share, Trends, Industry Analysis Report: By Equipment, Revenue Source (New and Rental), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1720

- Base Year: 2024

- Historical Data: 2020-2023

5G Testing Equipment Market Overview

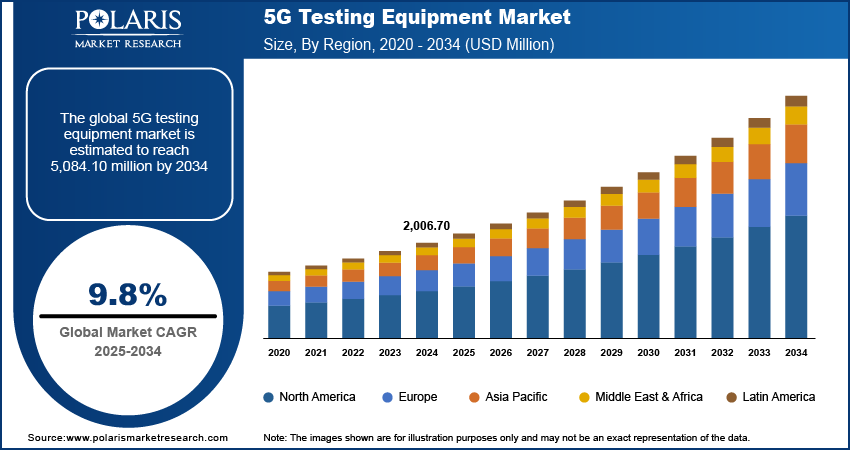

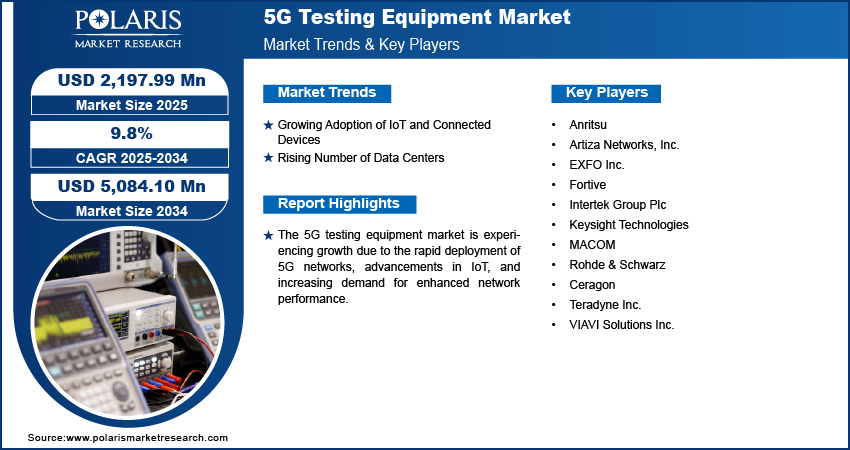

The global 5G testing equipment market size was valued at USD 2,006.70 million in 2024. The market is projected to grow from USD 2,197.99 million in 2025 to USD 5,084.10 million by 2034, exhibiting a CAGR of 9.8% from 2025 to 2034.

5G testing equipment refers to specialized tools and instruments used to assess the performance, coverage, and quality of 5G networks. The 5G testing equipment market growth is driven by the increasing adoption of 5G networks across various industries. These testing solutions are essential for ensuring the performance, speed, and reliability of 5G infrastructure. The demand for higher data speeds, low latency, and improved connectivity, which 5G promises, is pushing the market forward.

Advancements in technologies such as network slicing, beamforming, and massive MIMO are creating a need for specialized testing equipment. For instance, in June 2024, Rohde & Schwarz and VIAVI introduced joint network test solutions designed to support open radio commercialization. These solutions are ideally suited for radio equipment manufacturers seeking US Department of Commerce funding to deploy open networks in both the US and internationally.

To Understand More About this Research: Request a Free Sample Report

5G Testing Equipment Market Drivers Analysis

Growing Adoption of IoT and Connected Devices

The demand for high-speed, low-latency 5G networks has increased as industries integrate more IoT solutions, including smart sensors and connected devices which requires rigorous testing to ensure network reliability, performance, and scalability. 5G testing equipment is essential for verifying these complex IoT ecosystems, ensuring that devices can seamlessly communicate across advanced networks. For instance, in March 2023, Anritsu Corporation and Artiza Networks collaborated on an Open RAN test solution to support the deployment of multi-vendor networks. Additionally, the rise of applications such as electronic health records (EHR) systems, medical imaging systems in sectors such as healthcare, manufacturing, and automotive further accelerates the need for specialized testing solutions. Thus, the rising adoption of IoT and connected devices is a major driver of the 5G testing equipment market revenue.

Rising Number of Data Centers

The expansion of the 5G testing equipment market is influenced by the rising number of data centers being established globally. A substantial increase in data traffic is anticipated as the demand for data processing and storage intensifies, driven by the growth of cloud computing, artificial intelligence (AI), and Internet of Things (IoT) applications. This surge necessitates the construction of more data centers to effectively manage and process the vast amounts of data generated by 5G networks. For instance, in April 2021, T-Mobile expanded its data center in Prague by adding four new data halls, offering around 1,400 square meters of IT space to support the growing demand for digital services. These centers require robust testing to ensure optimal performance, low latency, and reliability in delivering services. 5G testing equipment is crucial for verifying the infrastructure and network capabilities that support high-density, high-speed data processing.

5G Testing Equipment Market Segment Analysis

5G Testing Equipment Market Assessment Based on Revenue Source

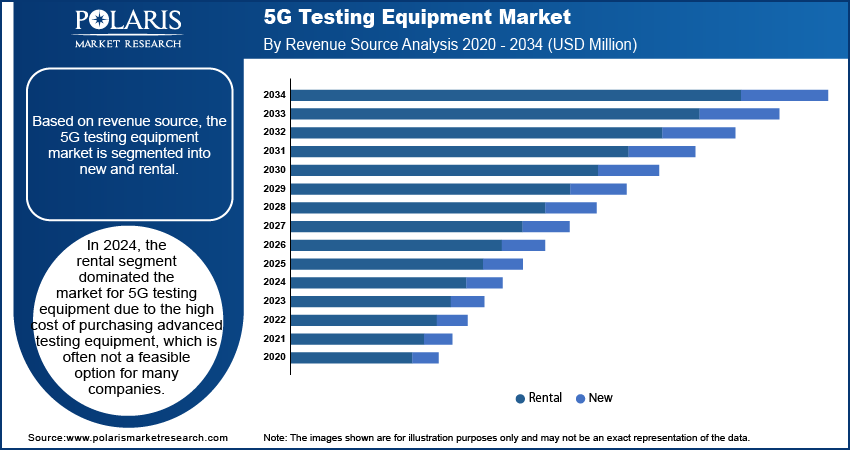

The global 5G testing equipment market assessment, based on revenue source, is segmented into new and rental. In 2024, the rental segment dominated the 5G testing equipment market due to the high cost of purchasing advanced testing equipment, which is often not a feasible option for many companies. Rental options allow businesses, particularly small and medium-sized enterprises (SMEs), to access advanced technology without heavy capital expenditure. This flexibility is crucial as companies can rent equipment based on specific project needs, ensuring they only pay for what they use. In addition, the rapid evolution of 5G technology and the frequent need for upgrades make rental solutions more attractive, as they provide access to the latest equipment without a long-term commitment.

5G Testing Equipment Market Evaluation Based on Equipment

The global 5G testing equipment market evaluation, based on equipment, is segmented into oscilloscopes signal and spectrum analyzers, vector signal generators, network analyzers, and others. The network analyzers segment is projected to witness the fastest growth from 2025 to 2034 due to the critical role of network analyzers in ensuring seamless communication in complex 5G networks. These devices are essential for analyzing signal integrity, identifying faults, and validating the performance of 5G components and systems. The increasing adoption of advanced technologies such as IoT, cloud computing, and edge computing demands robust testing of network infrastructure. Additionally, the shift toward Open RAN and multi-vendor network architectures amplifies the need for precise network analysis to maintain interoperability and performance. This growing complexity further drives the need for network analyzers in 5G development and deployment.

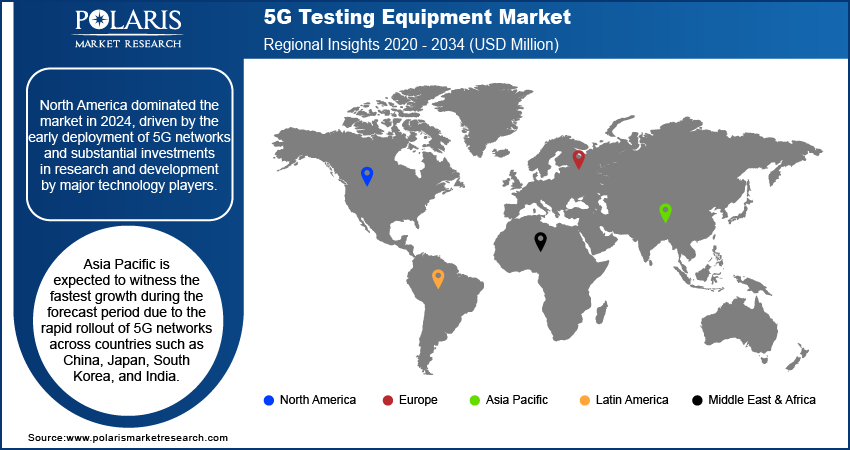

5G Testing Equipment Market Regional Analysis

By region, the study provides 5G testing equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market share in 2024 due to the early deployment of 5G networks and substantial investments in research and development by key technology players. For instance, in May 2024, Ericsson announced an additional USD 50 million investment in its USA 5G Smart Factory in Texas, following a USD 100 million investment made in 2020. This initiative aims to boost local production of 5G infrastructure, aligning with the Build America, Buy America Act (BABAA). The region is also home to major telecommunications and equipment manufacturers actively driving 5G advancements, including testing innovations. Morever, the growing adoption of IoT, smart devices, and edge computing in sectors such as healthcare, automotive, and manufacturing has accelerated the demand for advanced 5G testing solutions. Government initiatives supporting 5G deployment and the presence of a robust technology ecosystem have further contributed to the regional market demand.

The Asia Pacific is expected to witness the fastest 5G testing equipment market growth during the forecast period due to the rapid rollout of 5G networks in countries such as China, Japan, South Korea, and India. These nations are making significant investments in telecom infrastructure to support large-scale adoption of IoT, smart devices, and edge computing applications. The region is also characterized by a high concentration of electronics manufacturing and R&D activities, driving demand for advanced testing solutions. Additionally, government-led digital transformation initiatives and smart city projects are driving the demand for robust 5G testing equipment. For instance, a November 2024 report by India's Ministry of Communication highlights that 5G is projected to contribute INR 36.4 trillion (approximately $455 billion) to the Indian economy between 2023 and 2040, representing over 0.6% of the GDP by 2040.

5G Testing Equipment Market – Key Players and Competitive Insights

The competitive landscape of the 5G testing equipment market consists of global leaders and regional players aiming to capture market share through technological innovation, strategic partnerships, and regional expansions. Companies such as Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, and others leverage advanced R&D capabilities and comprehensive distribution networks to provide advanced testing solutions for 5G networks. Market trends highlight rising demand for solutions such as spectrum analyzers, network simulators, and advanced measurement tools to support 5G deployments and ensure seamless network performance. According to market forecasts, the market is expected to grow, driven by increasing 5G network rollouts, growing IoT adoption, and the need for efficient network optimization. Regional players focus on catering to localized requirements with cost-effective solutions, particularly in fast-growing regions such as Asia Pacific. Competitive strategies include mergers and acquisitions, collaborations with telecom operators, and the introduction of innovative testing solutions tailored for diverse applications such as autonomous vehicles, smart cities, and industrial automation. These advancements emphasize the role of technology, adaptability, and targeted investments in driving the 5G testing equipment market demand. A few of the key market players are Anritsu; Artiza Networks, Inc.; EXFO Inc.; Fortive; Intertek Group Plc; Keysight Technologies; MACOM; Rohde & Schwarz; Ceragon; Teradyne Inc.; and VIAVI Solutions Inc.

Anritsu Corporation, founded in 1895, is a leading Japanese multinational company specializing in telecommunications electronics equipment. Renowned for developing the world's first wireless telephone network, Anritsu has established itself as a key player in communication technology. Its commitment to innovation is highlighted by its extensive portfolio of testing and measurement (T&M) equipment, crucial for ensuring the reliability of communication networks. In recent years, Anritsu has concentrated on 5G testing solutions, recognizing the growing demand for robust mobile connectivity. It has introduced several pioneering technologies to support 5G deployment, including the world's first 5G chipset terminal verification tester compliant with 3GPP standards. Anritsu's 5G testing solutions encompass tools such as spectrum analyzers and network analyzers that assess critical parameters like signal integrity and latency. These capabilities are vital for both network operators and device manufacturers to optimize performance amidst increasing network complexity. Furthermore, Anritsu is dedicated to sustainability and innovation beyond telecommunications, actively addressing global social challenges through its advanced testing technologies.

Rohde & Schwarz is a global technology group headquartered in Munich, specializing in electronic test equipment, secure communications, and broadcasting solutions. A key focus area for Rohde & Schwarz is 5G testing equipment, which plays a crucial role in the development and deployment of next-generation wireless technologies. Their offerings include advanced signal generators, analyzers, and network testing solutions designed to support the entire lifecycle of 5G networks from design and development to production and maintenance. These tools enable engineers to ensure compliance with stringent performance standards and optimize network reliability. Rohde & Schwarz's commitment to research and development allows them to stay at the forefront of technological advancements, making them a trusted partner for industries seeking to harness the full potential of 5G and beyond. The company continues to drive innovation in a rapidly evolving digital landscape, emphasizing quality and customer service across its global operations with a workforce of approximately 14,400 employees worldwide.

List of Key Companies in 5G Testing Equipment Market

- Anritsu

- Artiza Networks, Inc.

- EXFO Inc.

- Fortive

- Intertek Group Plc

- Keysight Technologies

- MACOM

- Rohde & Schwarz

- Ceragon

- Teradyne Inc.

- VIAVI Solutions Inc.

5G Testing Equipment Industry Developments

In February 2023, Anritsu launched the Field Master MS2070A, a portable spectrum analyzer for RF testing up to 3 GHz in field, lab, and manufacturing settings. The company stated that the new analyzer offers high accuracy and advanced analysis features, including occupied bandwidth measurements and spectrograms, and is designed for rugged environments. Compact and versatile, it supports applications such as interference detection and transmitter testing.

In February 2023, Keysight Technologies launched the E7515R, a network emulation solution tailored for 5G RedCap and CIoT technologies such as industrial sensors and wearables. According to Keysight, the device supports testing workflows from design to deployment, focusing on reduced complexity and power consumption for devices aligned with 5G Release 17. It integrates RF, protocol, and performance testing, streamlining certification and development processes.

5G Testing Equipment Market Segmentation

By Equipment Outlook (Revenue – USD Million, 2020–2034)

- Oscilloscopes

- Signal and Spectrum Analyzers

- Vector Signal Generators

- Network Analyzers

- Others

By Revenue Source Outlook (Revenue – USD Million, 2020–2034)

- New

- Rental

By Application Outlook (Revenue – USD Million, 2020–2034)

- Lab Testing

- Performance Testing

- Wireless and RF Testing

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Testing Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,006.70 million |

|

Market Size Value in 2025 |

USD 2,197.99 million |

|

Revenue Forecast by 2034 |

USD 5,084.10 million |

|

CAGR |

9.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 2,006.70 million in 2024 and is projected to grow to USD 5,084.10 million by 2034.

The global market is projected to register a CAGR of 9.8% from 2025 to 2034.

North America dominated the market in 2024 due to the early deployment of 5G networks and substantial investments in research and development by key technology players.

A few of the key players in the market are Anritsu; Artiza Networks, Inc.; EXFO Inc.; Fortive; Intertek Group Plc; Keysight Technologies; MACOM; Rohde & Schwarz; Ceragon; Teradyne Inc.; and VIAVI Solutions Inc.

In 2024, the rental segment dominated the 5G testing equipment market.

The network analyzers segment is projected to register the fastest growth during the forecast period.