5G System Integration Market Size, Share, Trends, Industry Analysis Report: By Service (Consulting, Infrastructure Integration, and Application Integration), Application, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM1708

- Base Year: 2024

- Historical Data: 2020-2023

5G System Integration Market Overview

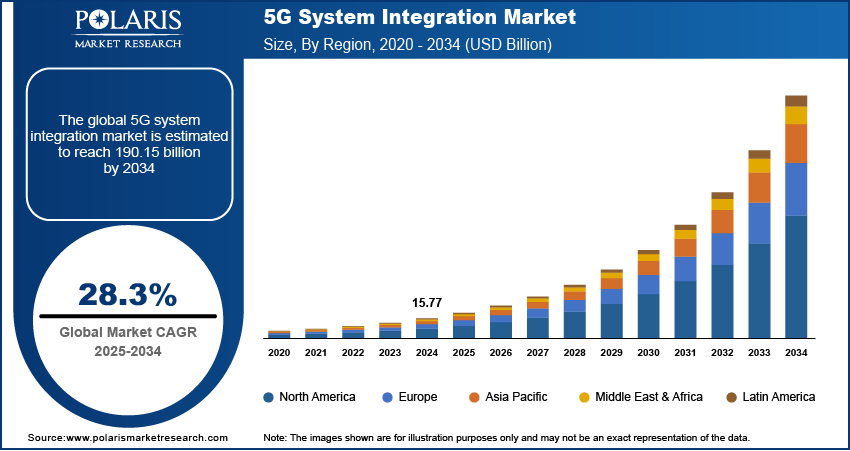

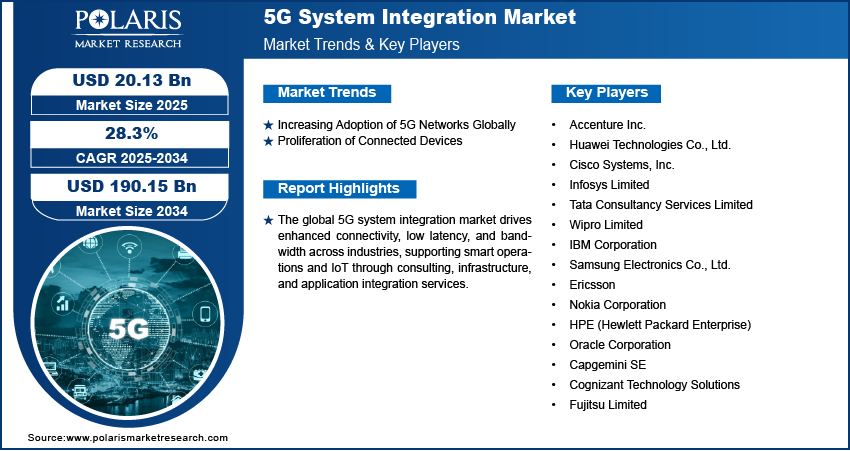

5G system integration market size was valued at USD 15.77 billion in 2024. The 5G system integration industry is projected to grow from USD 20.13 billion in 2025 to USD 190.15 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 28.3% during the forecast period.

The global 5G system integration market focuses on the seamless incorporation of 5G technology into existing and new infrastructures across various industries. This integration enables enhanced connectivity, ultra-low latency, and increased bandwidth, facilitating advancements in sectors such as manufacturing, healthcare, and transportation. Industries are transitioning to smart operations and the Internet of Things (IoT), due to which the demand for efficient 5G system integration services are growing. For instance, according to the Association of Advancing Automation, in 2023, 31,159 robots were purchased by manufacturers operating in North America. This market encompasses services such as consulting, infrastructure integration, and application integration, all aimed at ensuring that 5G networks are effectively deployed and optimized to meet specific organizational needs.

To Understand More About this Research: Request a Free Sample Report

5G System Integration Market Dynamics

Growing Connected Devices

The increasing adoption of 5G networks globally and the proliferation of connected devices necessitate advanced network capabilities. For instance, according to the IoT Analytics, in 2023, the number of connected IoT device raised by 13% compared to 2022, showcasing the growth of the connected devices. This growth in connected devices is driving the demand for the 5G integration systems, thereby driving the demand for the 5G systems integration market demand.

Increasing Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is driving the adoption of 5G system integration technology, as emerging technologies like autonomous vehicles, smart cities, and the Internet of Things (IoT) require rapid, reliable, and seamless data transmission. Autonomous vehicles rely on real-time communication to exchange critical data with other vehicles and infrastructure to ensure safety and efficiency. Similarly, smart cities depend on fast and efficient networks to manage everything from traffic systems to energy grids. The demand for 5G infrastructure capable of supporting high-capacity, low-latency connections is rising as these technologies evolve, thereby driving the growth of the 5G system integration market revenue.

5G System Integration Market Segment Analysis

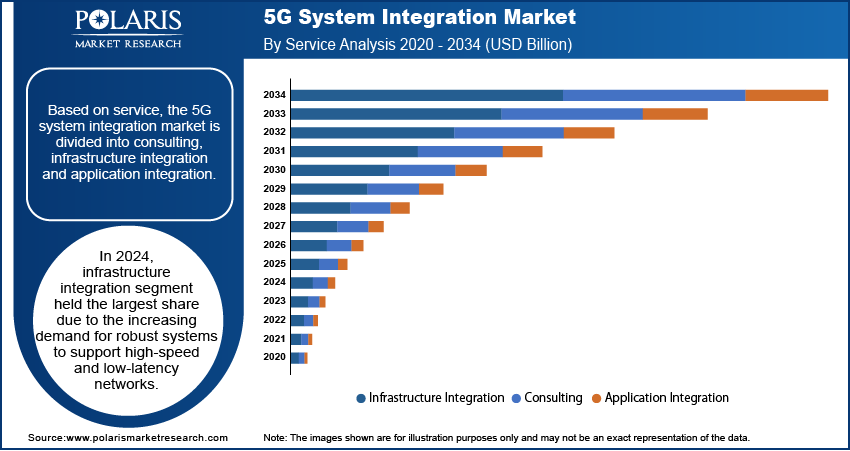

5G System Integration Market Assessment by Service Outlook

The 5G system integration market assessment based on service includes consulting, infrastructure integration, application integration. The infrastructure integration segment is held the largest share due to the growing demand for strong and reliable systems that can support the high-speed, low-latency requirements of 5G networks. The demand to build and integrate infrastructure that handles vast amounts of data and ensures smooth communication is rising as more industries and cities are adopting 5G. Infrastructure integration ensures that all components of the network, such as antennas, base stations, and data centers, work seamlessly together, which is essential for enabling the full potential of 5G technology, thereby driving the segmental growth in the global 5G system integration market report.

5G System Integration Market Evaluation by Application Outlook

The 5G system integration market evaluation based on application includes industrial sensors, robotics, smart cities, autonomous vehicles, connected healthcare and gaming. The autonomous vehicles segment is expected to experience significant growth due to increasing investments in connected transportation systems and the vital role of 5G in enabling real-time communication. Autonomous vehicles rely on fast and reliable data exchanges with other vehicles, traffic systems, and infrastructure to operate safely and efficiently. 5G’s low latency and high-speed capabilities make it ideal for these applications, allowing vehicles to communicate instantly and make quick decisions. The demand for 5G integration in autonomous vehicles is rising as more investments are made in smart transportation technologies, thereby driving the segmental growth in the global 5G systems integration market report.

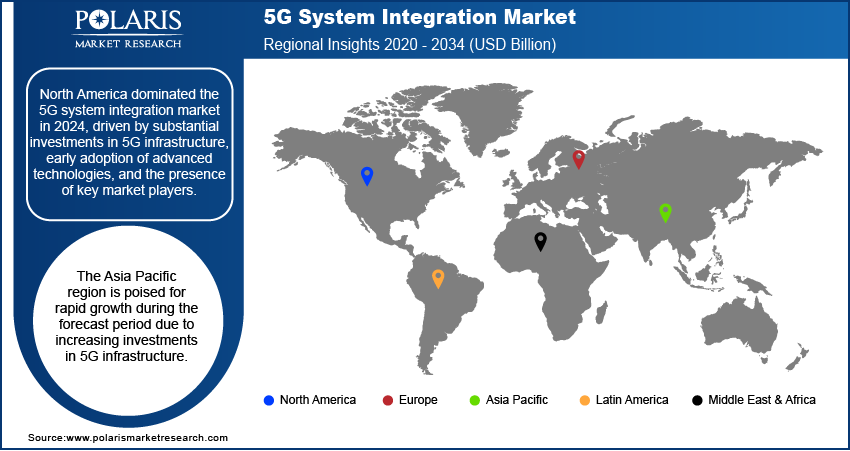

5G System Integration Market Share by Region

By region, the study provides the 5G system integration market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the 5G system integration market in 2024, driven by substantial investments in 5G infrastructure, early adoption of advanced technologies, and the presence of key market players. The United States, in particular, leads due to its robust technological ecosystem and significant government support for 5G services deployment. For instance, according to the United States Federal Communication Commission, In October 2020, the Commission launched the 5G Fund for Rural America, allocating up to USD 9 billion from the universal service fund to facilitate the deployment of advanced 5G mobile wireless infrastructure in rural regions. This initiative aims to enhance connectivity and bridge the digital divide by incentivizing carriers to invest in next-generation wireless services where traditional service has been insufficient. This, in turn, is driving the 5G system integration market expansion in North America.

The Asia Pacific region is expected to record significant growth during the forecast period fueled by increasing investments in 5G infrastructure, a burgeoning consumer base, and supportive government initiatives promoting digital transformation. Countries like China are at the forefront of this growth, with aggressive 5G rollout plans and substantial investments in technology. According to the Mobile Economy China 2024 Report, it is projected that by the end of 2024, over 50% of mobile connections in China will be 5G-enabled. This shift underscores the rapid adoption of advanced mobile technologies within the region, signaling a significant transition in network infrastructure and user experience, thereby driving the 5G system integration market statistics in Asia Pacific.

5G System Integration Key Market Players & Competitive Analysis Report

The major players dominate the 5G system integration market stats through strategic initiatives, technological innovation, and extensive industry experience. Collectively, they offer comprehensive solutions that cater to diverse industry needs, leveraging their global presence and expertise to secure significant market shares. Individually, companies like Huawei Technologies Co., Ltd. have made substantial investments in 5G research and development, leading to advanced integration solutions that set industry standards. Similarly, Ericsson has established a strong foothold by forming strategic partnerships and delivering end-to-end 5G integration services. Accenture Inc. utilizes its consulting prowess to guide enterprises through complex 5G transformations, while Cisco Systems, Inc. focuses on integrating 5G with existing network infrastructures, ensuring seamless connectivity. These companies' ability to adapt to market demands, coupled with their commitment to innovation, enables them to maintain a competitive edge and drive the overall growth of the 5G system integration market.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software, infrastructure services, and the hardware segment and IT services, which hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. However, as of 2022, the IBM Watson Healthcare business was purchased by Merative. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. IBM's 5G and edge computing solutions, powered by Red Hat OpenShift, enable businesses to process data closer to its source. This improves data control, accelerates insights, and ensures continuous operations across industries.

Huawei is an international organization in information and communications technology (ICT) infrastructure and smart devices. The company's solutions cater to a user base of over three billion individuals worldwide, with a presence in over 170 countries and regions. Huawei's core business spans a wide range of products and services, including mobile network equipment, enterprise networking solutions, consumer devices, and cloud computing. The company's consumer business includes a diverse portfolio of smartphones, tablets, and wearables. Additionally, Huawei has developed its operating system, HarmonyOS, which has been deployed on over 220 million Huawei devices and has a growing ecosystem of over 2.2 million developers. In the enterprise and cloud computing space, Huawei offers a wide range of solutions, including cloud services, enterprise intelligence, and industry-specific applications. The company has established partnerships with over 2,000 cloud service providers and has deployed its cloud services in more than 170 countries and regions. Huawei's 5G System Integration offers cloud-native architecture, network slicing, and CUPS for flexible, scalable networks. It supports diverse services (eMBB, uRLLC, mMTC), enhancing efficiency and innovation across industries.

Key Companies in the 5G System Integration Market

- Accenture Inc.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Infosys Limited

- Tata Consultancy Services Limited

- Wipro Limited

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Ericsson

- Nokia Corporation

- HPE (Hewlett Packard Enterprise)

- Oracle Corporation

- Capgemini SE

- Cognizant Technology Solutions

- Fujitsu Limited

5G System Integration Market Developments

December 2024: Ericsson entered into a multi-billion-dollar agreement with India's Bharti Airtel to enhance 4G and 5G services, providing centralized radio access network (RAN) and Open RAN-ready solutions.

October 2024: NEC Corporation, a leader in the integration of IT and network technologies, joined forces with Cisco to deliver a new private 5G network solution to their customers.

June 2023: Nokia's on-demand network slicing was introduced, enhancing customer experience through improved service delivery and resource allocation in mobile networks.

October 2021: Stellantis, TIM Brazil, and Accenture collaborated to implement a private 5G network pilot project at the Stellantis plant, located in the Automotive Centre of Goiana in northeastern Brazil. Private 5G network pilot project combines 5G, cloud, artificial intelligence, and IoT to enhance quality, compliance, and efficiency at automotive plant.

March 2020: Fujitsu Launched Japan's first commercial private 5G Network at its Shin-Kawasaki Technology Square office, thereby strengthening its market position.

5G System Integration Market Segmentation

By Service Outlook (Revenue, USD Billion, 2020 - 2034)

- Consulting

- Infrastructure Integration

- Application Integration

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Industrial Sensors

- Robotics

- Smart Cities

- Autonomous Vehicles

- Connected Healthcare

- Gaming

By Industry Vertical Outlook (Revenue, USD Billion, 2020 - 2034)

- IT & Telecom

- Manufacturing

- Healthcare

- Media & Entertainment

- Energy & Utilities

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G System Integration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.77 billion |

|

Market Size Value in 2025 |

USD 20.13 billion |

|

Revenue Forecast in 2034 |

USD 190.15 billion |

|

CAGR |

28.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global 5G system integration market size was valued at USD 15.77 billion in 2024 and is projected to grow to USD 190.15 billion by 2034.

The global market is projected to grow at a CAGR of 28.3% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Accenture Inc.; Huawei Technologies Co., Ltd.; Cisco Systems, Inc.; Infosys Limited; Tata Consultancy Services Limited; Wipro Limited; IBM Corporation; Samsung Electronics Co., Ltd.; Ericsson; Nokia Corporation; HPE (Hewlett Packard Enterprise); Oracle Corporation; Capgemini SE; Cognizant Technology Solutions; and Fujitsu Limited.

The infrastructure integration segment held the largest share in 2024 due to the increasing demand for robust systems to support high-speed and low-latency networks.