5G Smart Farming Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Services), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM5344

- Base Year: 2024

- Historical Data: 2020-2023

5G Smart Farming Market Overview

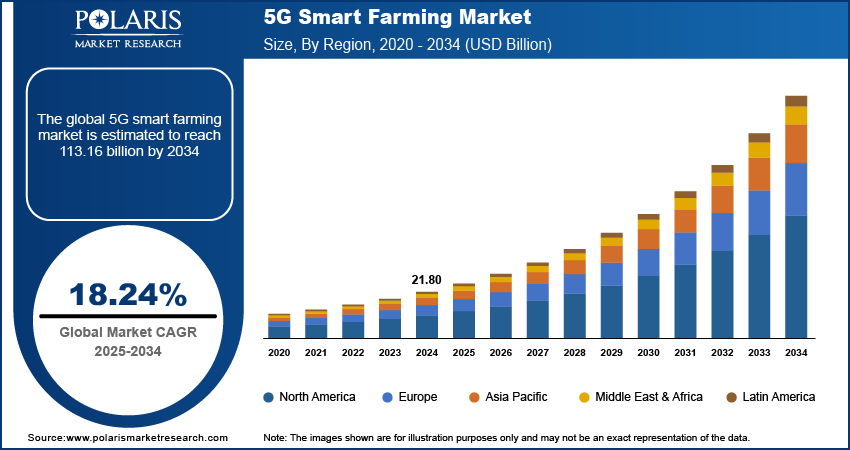

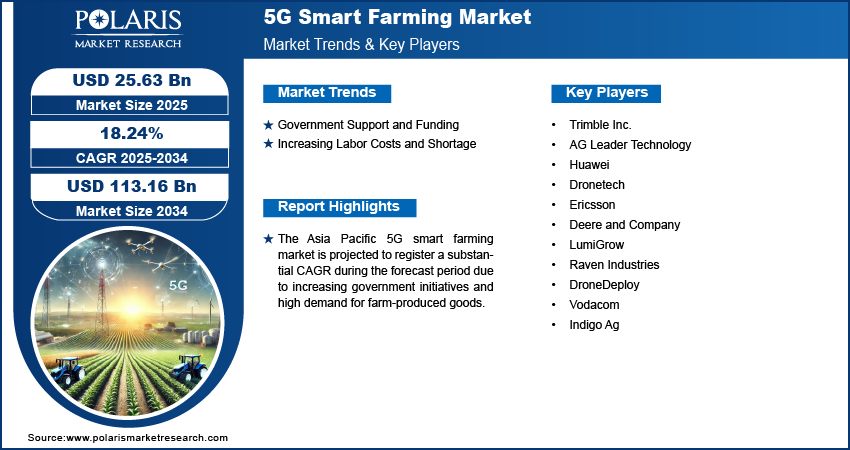

The global 5G smart farming market size was valued at USD 21.80 billion in 2024. The market is projected to grow from USD 25.63 billion in 2025 to USD 113.16 billion by 2034, exhibiting a CAGR of 18.24% during 2025–2034.

5G smart farming uses 5G integration in daily farming practices for autonomous decision-making in farms. The 5G smart farming market demand is primarily driven by technological advancements in the Internet of Things (IoT) and smart devices. 5G enables seamless connectivity for a wide range of IoT devices, improving the integration and performance of smart farming solutions such as soil sensors, weather stations, and livestock trackers. For instance, the National Institute of Agro-machinery Innovation and Creation (CHIAIC) in Luoyang launched a hydrogen fuel-cell electric tractor in June 2020. The new model, the ET504-H, sports a futuristic appearance and is equipped with 5G mobile communication technology. It features a self-driving mode and can be remotely controlled, showcasing the potential of integrating 5G with advanced farming machinery. The tractor represents a significant step forward in the use of smart technologies in agriculture, emphasizing how 5G connectivity can transform farming practices by enabling autonomous operation and enhanced control, ultimately contributing to more sustainable and efficient agricultural systems.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for precision farming is expended to fuel the 5G smart farming market growth during the forecast period. The demand for precision farming is driven by the need for more efficient agricultural practices that enhance yield while reducing resource consumption. Precision farming relies heavily on real-time data and advanced analytics to optimize crop management, which necessitates high-speed, low-latency communication network capabilities inherent to 5G technology. For instance, according to the US Department of Agriculture (USDA), precision agriculture can increase crop yields by up to 15% while reducing input costs by 10–15%, underscoring the critical role of accurate, timely data in modern farming. Furthermore, the global shift toward sustainable practices amplifies the need for such technologies to optimize resource use and minimize environmental impact. As governments and private entities invest in 5G infrastructure, the smart farming sector stands to benefit significantly from the enhanced capabilities and efficiencies offered by this next-generation network.

5G Smart Farming Market Drivers Analysis

Government Support and Funding

Many governments and agricultural organizations are investing in and supporting the development of 5G infrastructure and smart farming technologies. Initiatives, subsidies, and funding programs aimed at advancing agricultural innovation and digital infrastructure reduce financial barriers and encourage the adoption of smart technologies among farmers and agribusinesses. In Dec 2024, According to the Indian Ministry of Agriculture & Farmer Welfare, the agriculture department appointed 24 agribusiness incubators and five knowledge partners to promote innovation and agripreneurship. The department will provide financial support to the incubation center to develop the incubation ecosystem. These steps toward providing knowledge and supporting local farmers and agribusinesses with incentives are anticipated to increase the number of consumers operating in the sectors. Therefore, government support and increasing funding are expected to boost the 5G smart farming market development during the forecast years.

Increasing Labor Costs and Shortage

Increasing labor costs and labor shortages globally have accelerated the adoption of smart farming practices among local producers to meet the high demand for locally produced farming goods worldwide. According to the European Commission, the labor cost in the European Union has risen by 5.5% in the first quarter of 2024 compared to the same quarter in 2023. Additionally, labor costs in Romania have increased by 16% in 2024 first quarter compared to the same quarter in 2023. Such substantial increases in labor costs are pushing farmers to adopt more automated and technology-driven solutions to mitigate the impact on their operational expenses. Smart farming, enabled by advanced 5G connectivity, offers a solution by integrating IoT devices, drones, and data analytics to enhance operational efficiency and productivity. The adoption of 5G technology in agriculture is expected to accelerate, driven by the need to tackle labor market challenges and optimize farm management practices to meet increasing consumer demands. Thus, the rising labor costs and shortage drive the 5G smart farming market expansion.

5G Smart Farming Market Segment Insights

5G Smart Farming Market Outlook – by Component Insights

The 5G smart farming market segmentation, based on component, includes hardware, software, and services. The hardware segment is expected to register the highest CAGR in the global market during the forecast period. This growth is attributed to rising demand and technological advancement in sensors, drones, robotic systems, and smart tractors. Hardware is majorly used in daily farming practices. With advanced technologies to make hassle-free handling, the adoption of this hardware has increased, resulting in heightened demand from local farmers.

5G Smart Farming Market Assessment – by Application Insights

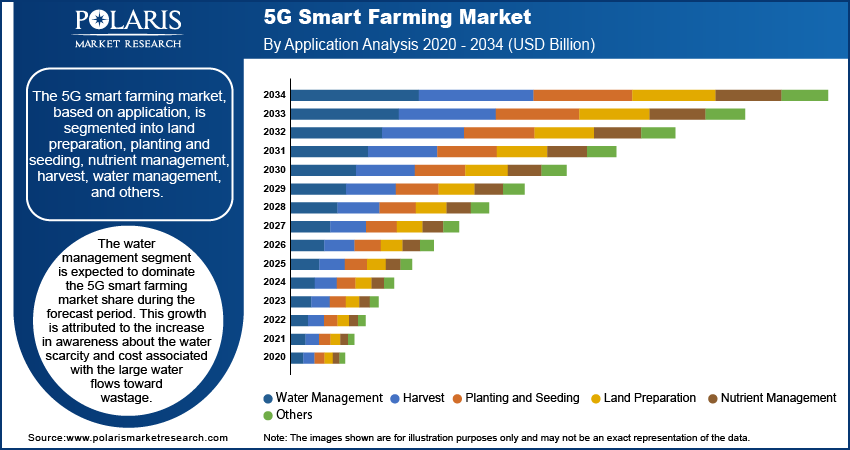

The 5G smart farming market, based on application, is segmented into land preparation, planting and seeding, nutrient management, harvest, water management, and others. The water management segment is expected to dominate the 5G smart farming market share during the forecast period. This growth is attributed to the increase in awareness about the water scarcity and cost associated with the large water flows toward wastage. Smart management of water is directly associated with lower cost consumption. This awareness has increased the implementation of smart farming practices for water management.

5G Smart Farming Market Regional Insights

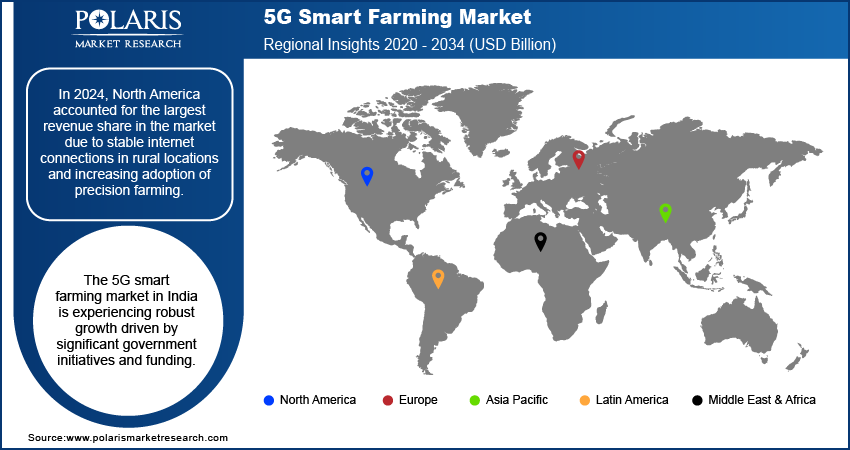

By region, the study provides the 5G smart farming market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the market due to stable internet connections in rural locations and increasing adoption of precision farming. According to the US Department of Agriculture (USDA), the adoption of precision agriculture technologies has been growing rapidly, with over 60% of US farmers using some form of digital agriculture tools as of 2023. This increase in adoption rate is expected to grow with more advanced technology and improved internet stability and connectivity. Governments in North America have taken several initiatives for better internet connectivity in major parts of the region. According to The Federal Communications Commission (FCC), USD 20 billion in funding is being allocated to enhance 5G network coverage across rural areas. This investment supports broader 5G adoption and facilitates the deployment of smart farming solutions, which are essential for addressing challenges such as labor shortages and resource management in agriculture. Thus, the aforementioned factors are expected to boost the 5G smart farming market growth in North America during the forecast period.

The Asia Pacific 5G smart farming market is projected to register a substantial CAGR during the forecast period due to increasing government initiatives and high demand for farm-produced goods due to the rapidly increasing population in major Asian countries. Governments in major countries have started investing in 5G technologies and digital initiatives for promoting smart farming methods. According to the Ministry of Agriculture and Rural Affairs of China, the government aims to integrate digital technologies into agriculture by deploying over 5G base stations in rural areas by 2024. This initiative is expected to enhance the efficiency of agricultural practices through real-time data analytics and automation. Additionally, Australia has started an initiative to automate farming procedures in the country to meet the high demand for farm products and deal with the shortage of labor in the region. According to The Australian Department of Agriculture, Water, and the Environment, the government has started an Agtech initiative to promote smart farming practices through funding. Similarly, governments in Asia Pacific have introduced various incentives for businesses and local farmers in the agriculture sector. Consequently, due to various government programs, the 5G smart farming market in the region is expected to record exponential growth during the forecast years.

The 5G smart farming market in India is experiencing robust growth driven by significant government initiatives and funding. The Indian government has committed substantial resources to advance agricultural technology. According to the Ministry of Agriculture and Farmers Welfare India, an allocation of USD 16.44 million (₹138.82 crores) was introduced for promoting Kisan drones. This funding covers the purchase of 317 drones for demonstration purposes across 79,070 hectares, alongside the provision of 461 drones to farmers at subsidized rates. Additionally, 1,595 drones have been supplied to Custom Hiring Centers (CHCs) to offer drone services to farmers on a rental basis. These measures are designed to enhance precision farming and improve crop management through advanced aerial monitoring and data collection. With such proactive support and investment in technology, India's 5G smart farming market is poised for accelerated growth during the forecast period.

5G Smart Farming Market – Key Players and Competitive Insights

The 5G smart farming market is continuously evolving, with many companies striving to innovate and stand out. Leading global corporations dominate the market by utilizing extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new applications, greater emphasis on sustainability, and the rising requirement for tailor-made single-use products in diverse industries. A few major players in the 5G smart farming market are Trimble Inc., AG Leader Technology, Huawei, Dronetech, Ericsson, Deere and Company, LumiGrow, Raven Industries, DroneDeploy, Vodacom, and Indigo Ag

Trimble Inc. is a global technology company that specializes in providing advanced solutions for various sectors, including agriculture, construction, geospatial, and transportation. Founded in 1978, Trimble is headquartered in Sunnyvale, California, USA. The company operates across multiple regions worldwide, including North America, Europe, Asia Pacific, and Latin America, serving a diverse clientele with its range of technological innovations. Trimble is a publicly traded company and does not have a parent company. The company offers comprehensive smart farming solutions designed to enhance productivity and operational efficiency. Recently, it has launched a suite of products incorporating 5G technology to support precision agriculture. These products include advanced GPS systems and data analytics tools that leverage 5G connectivity to provide real-time insights and improved automation capabilities for farmers.

Huawei Technologies Co., Ltd. is a global technology company headquartered in Shenzhen, China, and established in 1987. The company operates primarily in the telecommunications, information technology, and consumer electronics sectors. Huawei is a privately held company and does not have a parent company. It has a broad international presence, serving regions such as Asia Pacific, Europe, the Americas, Africa, and the Middle East. Huawei's diverse portfolio includes telecommunications equipment, network infrastructure, and smart devices. Recently, Huawei has expanded its offerings in the field of 5G smart farming. The company has launched advanced 5G solutions specifically designed for agriculture, such as its 5G IoT platform and smart sensors. These products aim to enhance agricultural productivity through real-time data transmission, precision monitoring, and automation. Huawei's 5G technology supports various smart farming applications, including crop management, livestock monitoring, and resource optimization, contributing to more efficient and sustainable agricultural practices.

List of Key Companies in 5G Smart Farming Market

- Trimble Inc.

- AG Leader Technology

- Huawei

- Dronetech

- Ericsson

- Deere and Company

- LumiGrow

- Raven Industries

- DroneDeploy

- Vodacom

- Indigo Ag

5G Smart Farming Industry Developments

Sept 2024: BoomGrow Productions Sdn Bhd and CelcomDigi Berhad's partnership was announced to transform Malaysia’s agricultural industry through 5G, AI, and XR technologies. CelcomDigi’s 5G connectivity, supported by ZTE, was integrated with BoomGrow's precision farming, enabling real-time monitoring and predictive analytics. The collaboration introduced 5G-enhanced farming, AI-driven data analytics, and XR-based agronomist training. This initiative aimed to boost crop yields and resource efficiency, with the centralized dashboard providing seamless management across BoomGrow's Machine Farms in Malaysia and the Philippines.

April 2024: C-DAC Pune's Smart Farm System was launched on its 37th Foundation Day. The system, developed indigenously, was designed to assist farmers in planning irrigation and fertilization based on environmental and soil conditions. By utilizing this technology, maximum yield was aimed to be achieved. The launch marked a significant step in advancing agricultural practices through innovative solutions, enhancing efficiency and productivity in farming operations

September 2023: Ericsson's 5G SA network was launched in collaboration with the US National Science Foundation’s PAWR program and Iowa State University's ARA team. The network, powered by Ericsson, was deployed to support precision agriculture and other research initiatives. Coverage extended across ISU's campus, local farms, and parts of Ames. The network featured mid-band and millimeter wave spectrum bands, delivering high throughput and ultra-low latency, and was designed to enhance rural broadband access and agricultural research.

5G Smart Farming Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Drones

- Robotic Systems

- Smart Tractors

- Software

- Services

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Land Preparation

- Planting and Seeding

- Nutrient Management

- Harvest

- Water Management

- Other

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Smart Farming Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.80 Billion |

|

Market Size Value in 2025 |

USD 25.63 Billion |

|

Revenue Forecast by 2034 |

USD 113.16 Billion |

|

CAGR |

18.24% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End-User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The 5G smart farming market size was valued at USD 21.80 billion in 2024 and is projected to grow to USD 113.16 billion by 2034.

The global market is projected to register a CAGR of 18.24% during the forecast period.

North America had the largest share of the global market in 2024.

A few key players in the market are Trimble Inc., AG Leader Technology, Huawei, Dronetech, Ericsson, Deere and Company, LumiGrow, Raven Industries, DroneDeploy, Vodacom, and Indigo Ag.

The water management segment is anticipated to experience substantial growth at a significant CAGR in the global market. This growth is attributed to an increase in awareness about the water scarcity and cost associated with the large water flows toward wastage.

The hardware segment accounted for the largest revenue share of the market in 2024 due to technological advancement in devices.