5G NTN Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Services), Platform, Application, Location, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5341

- Base Year: 2024

- Historical Data: 2020-2023

5G NTN Market Overview

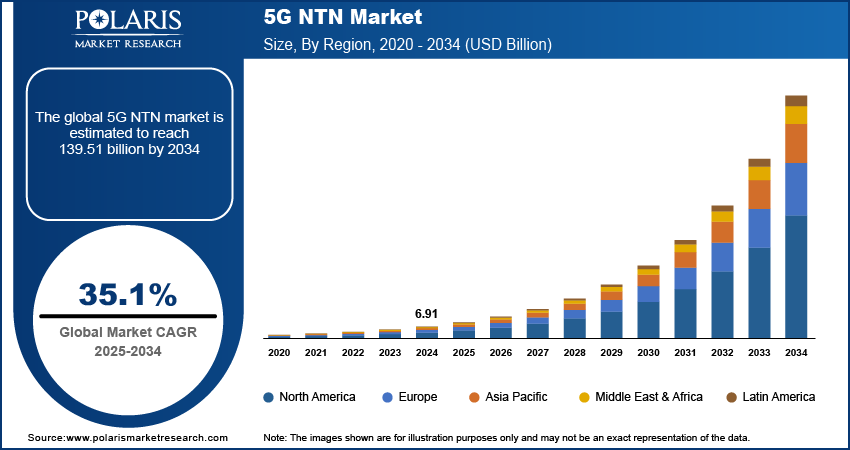

The global 5G NTN market size was valued at USD 6.91 billion in 2024. The market is projected to grow from USD 9.32 billion in 2025 to USD 139.51 billion by 2034, exhibiting a CAGR of 35.1% during 2025–2034.

5G NTN (5G Non-Terrestrial Networks) refers to the use of 5G technology in conjunction with non-terrestrial networks such as satellites, high-altitude platforms (HAPs), or drones. This approach aims to extend 5G connectivity beyond traditional terrestrial networks to cover remote areas, improve global coverage, and enhance network resilience.

The proliferation of 5G devices significantly propels the 5G non-terrestrial network market demand. As both consumers and businesses increasingly embrace 5G technology and transition to 5G-enabled devices, there is a growing demand for dependable, high-speed connectivity on the 5G NTN network. In February 2023, Samsung Electronics unveiled standardized 5G NTN modem technology designed to enable smartphone-satellite communication. The technology ensures interoperability and scalability across services provided by global telecom carriers, manufacturers of 5G mobile devices, and chip companies.

To Understand More About this Research: Request a Free Sample Report

The growing demand for data-intensive applications and services across various sectors drives the adoption of 5G NTN networks. The rising adoption of high-definition video streaming, online gaming, IoT, and cloud computing boosts the requirement for 5G NTN networks. These networks offer the high-speed, low-latency connectivity needed to support these applications effectively, boosting the 5G non-terrestrial network (NTN) market growth.

With the introduction of 5G and the anticipated arrival of 6G, there is a growing demand for NTN, presenting a significant opportunity for the 5G NTN industry. NTN technologies, utilizing satellites, drones, or balloons, extend connectivity to remote rural areas and challenging environments such as mountains, deserts, and oceans where ground infrastructure is limited or absent. This expansion helps bridge the digital divide by ensuring high-speed data services in underserved regions.

5G NTN Market Trends

Rising Demand for IoT Applications

The 5G NTN market expansion is being driven by the increasing demand for IoT (Internet of Things) applications. IoT devices require reliable, high-speed connectivity to transmit and receive data efficiently across various sectors, such as smart cities, industrial automation, healthcare, and transportation. 5G NTN technologies leverage advancements in satellite and HAP (High-Altitude Platform) technologies to deliver high-speed data transmission and reduced latency, which is critical for applications such as autonomous vehicles and remote operations.

Key players in the industry are leveraging advancements in non-terrestrial network technologies. Their efforts are instrumental in delivering global connectivity, high bandwidth, low latency, resilience, scalability, and integration capabilities. These are essential for meeting the diverse and expanding needs of IoT ecosystems worldwide, and their role is crucial in the future of the 5G NTN industry.

In March 2024, Omnispace and MTN announced a collaboration aimed at developing and deploying satellite IoT and 5G NTN services. The collaboration aims to investigate integrating MTN’s terrestrial mobile networks with Omnispace’s non-terrestrial (NTN) network, utilizing 3GPP standards, to support consumer mobile and enterprise IoT services.

In June 2023, Qualcomm launched new satellite IoT solutions designed to offer continuous asset tracking and remote monitoring capabilities. This includes the Qualcomm 212S Modem and the Qualcomm 9205S Modem, which demand standalone connectivity through non-terrestrial networks (NTN) or hybrid connectivity in combination with terrestrial networks. Such innovation is driving industries to adopt 5G NTN technologies to meet their connectivity needs effectively and increase the 5G non-terrestrial network market development.

Increasing Need for Global Connectivity in Rural Areas

The 5G NTN market is experiencing significant growth, driven by the rising need for global connectivity in rural areas due to high-altitude platforms, which offer a viable alternative by extending connectivity to underserved regions. This capability bridges the digital divide, ensuring that rural communities have access to reliable internet and communication services. Also, access to broadband internet is crucial for fostering economic growth and development in rural areas.

Rural areas often rely on agriculture and natural resource industries, which benefit significantly from IoT applications for monitoring, automation, and resource management. Leading companies expand broadband access to rural areas to achieve socio-economic development objectives. These initiatives play a crucial role in the deployment of 5G NTN solutions in rural regions.

In January 2023, Keysight and Qualcomm accelerated 5G NTN communication to support broadband in rural areas. These widespread 5G NTN deployments provide safety, critical health, and financial advantages to rural populations while enhancing economic requirements for industrial sectors such as energy, agriculture, health, and transportation.

In January 2024, John Deere and SpaceX revealed a strategic partnership to boost rural connectivity to farmers via satellite communications. Such innovative efforts of companies resulted in driving the growth in the 5G NTN market revenue.

5G NTN Market Segment Insights

5G NTN Market Outlook – by Location Insights

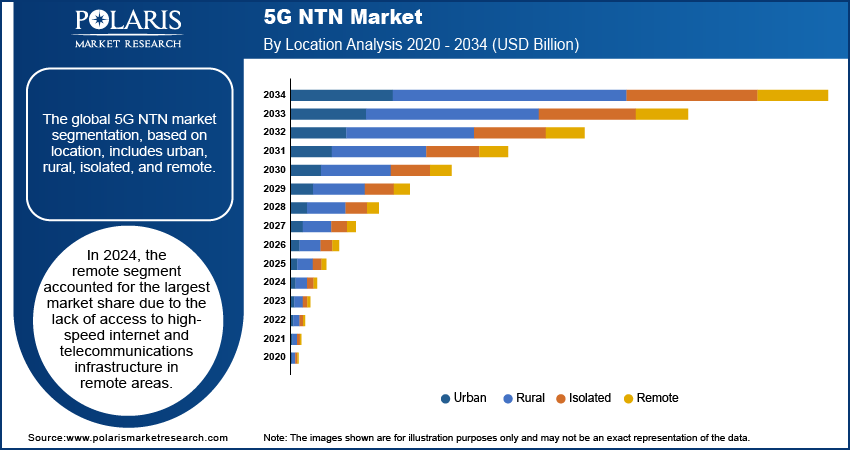

The global 5G 5G non-terrestrial network (NTN) market segmentation, based on location, includes urban, rural, isolated, and remote. In 2024, the remote segment accounted for the largest market share due to lack access to high-speed internet and telecommunications infrastructure. The increasing demand for broadband connectivity, driven by IoT applications, digital transformation initiatives, and the need for reliable communications in remote industries such as mining, agriculture, and oil & gas, has fueled the adoption of 5G NTN solutions.

Major players are at the forefront, implementing aggressive market expansion strategies to capture a major remote connectivity market. This includes offering to launch new solutions and leveraging existing infrastructure to accelerate the deployment and adoption of 5G NTN technologies in underserved areas, assuring the industry's progress.

In March 2024, Keysight and Capgemini validated a tailored 5G New Radio (NR) RAN solution for non-terrestrial networks, aligning with 3GPP Release 17 standards. These improvements significantly enhance radio access network functionalities, expanding 5G coverage into remote areas. This advancement is expected to spur demand in the 5G NTN market by facilitating innovative deployments and supporting applications such as Internet of Things (IoT) and connected vehicles, thereby driving industry growth.

5G NTN Market Assessment – by End User Insights

The global 5G NTN market segmentation, based on end user, includes maritime, aerospace & defense, government, mining, and others. The aerospace & defense segment is projected to register the highest CAGR during the forecast period. Military forces and defense organizations operate globally and in diverse terrains, including remote areas, oceans, and conflict zones. 5G NTN technologies offer extensive coverage capabilities, ensuring that military personnel and assets remain connected and communication channels remain operational across vast geographic regions.

Ongoing advancements in satellite technology, including higher throughput, improved signal processing, and enhanced encryption capabilities, contribute to the need for 5G NTN solutions for aerospace and defense applications. These advancements enable faster data transmission, improved network efficiency, and enhanced security features tailored to defense requirements.

In November 2023, Lockheed Martin, specializing in the aerospace & defense industry, achieved a significant milestone by preparing the first 5G.MIL payload for orbit. This milestone involved completing the final demonstration of the industry’s first completely Advanced 5G NTN Satellite Base Station as part of Lockheed Martin’s 5G.MIL Unified Network Solutions Program. This significant achievement increases the demand for 5 G NTN technologies in the aerospace and defense industry.

5G NTN Market Regional Insights

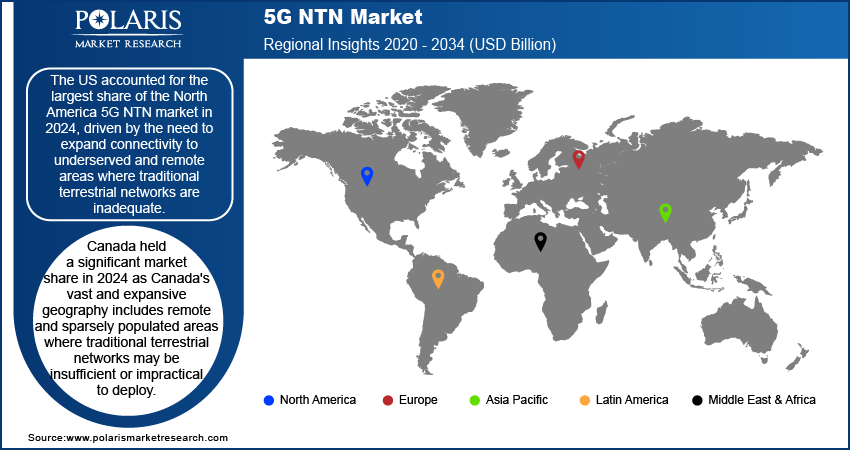

By region, the study provides the 5G NTN market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024. The presence of major market players such as EchoStar Corporation, Keysight Technologies, and VIAVI Solutions Inc strengthens the market landscape in North America. Also, key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the 5G NTN market expansion in the region.

The US accounted for the largest share of the North America 5G NTN market in 2024, driven by the need to expand connectivity to underserved and remote areas where traditional terrestrial networks are inadequate. Non-terrestrial networks, including satellite-based solutions, offer a means to extend high-speed internet access to rural communities, islands, and difficult-to-reach locations. The competitive landscape among telecom operators, satellite companies, and technology providers boosts innovation and drives investments in 5G NTN technologies.

In August 2023, VIAVI Solutions, headquartered in the US, launched network testing solutions for Non-Terrestrial Networks (NTN) and High-Altitude Platforms (HAPs) aimed at enhancing satellite communication capabilities for 5G and future 6G technologies.

The Canada 5G non-terrestrial network market held a significant share as Canada's vast and expansive geography includes remote and sparsely populated areas where traditional terrestrial networks may be insufficient or impractical to deploy. Ongoing advancements in satellite technology, including increased satellite capacity, improved throughput, and reduced latency, contribute to the attractiveness of 5G NTN solutions in Canada. Collaboration between international and domestic players further accelerates the deployment and adoption of these technologies to meet 5G NTN market demands.

In February 2023, OneWeb partnered with Galaxy Broadband Communications Inc., an Ontario-based satellite service provider catering to enterprise customers, in a USD 50 million multi-year agreement. This deal aims to deploy OneWeb's low Earth orbit (LEO) connectivity solutions across Canada, including the northern territory of Nunavut. Galaxy Broadband extends connectivity to over 75 locations throughout Canada, addressing diverse customer requirements and connecting between 30 to 800 users at each site. This significant investment in connectivity solutions is poised to boost the demand for 5G NTN technologies in Canada.

The Asia Pacific 5G NTN market is anticipated to record the highest CAGR during the forecast period due to diverse landscapes, including remote and island territories, where traditional terrestrial networks face limitations in coverage and capacity. Emerging economies in Asia Pacific, such as India, China, and Australia countries, are witnessing rapid technological adoption and infrastructure modernization. The deployment of 5G NTN networks supports economic growth, facilitates innovation in industries such as agriculture, healthcare, and education, and accelerates the adoption of 5G services among businesses and consumers.

In January 2024, Skylo Technologies partnered with Australia-based Anritsu Corporation. This collaboration enables OEMs and third-party test houses to conduct Skylo-defined testing of NTN devices using Anritsu's test platforms. It ensures that manufacturers of devices, modules, and chipsets can verify compatibility with Skylo's network, ensuring superior performance, reliability, and connectivity for customers.

China accounted for the largest share in 2023, driven by a large population concentrated in urban centers, growing need for enhanced connectivity to support IoT applications, smart city initiatives, and digital transformation efforts. On the other hand, the Japan 5G NTN market is expected to continue its significant growth during the forecast period due to technological innovation and management in satellite technology development. Such key players' initiatives and development of integrated network solutions tailored to meet 5G NTN market demands in the APAC region.

5G NTN Key Market Players & Competitive Insights

Leading market players are driving advancements in satellite technology, network infrastructure, and service offerings to meet the increasing demand for high-speed, reliable connectivity across diverse geographical locations. Companies are investing in the market development and deployment of robust network infrastructure. This includes satellite constellations, ground stations, and integrated network solutions that ensure broad coverage and reliable service delivery.

Strategic partnerships between telecom operators, satellite manufacturers, and technology providers are boosting collaboration and innovation in the 5G NTN market ecosystem. These partnerships enable the integration of satellite and terrestrial networks, expanding service offerings and enhancing 5G NTN industry competitiveness.

To differentiate in a competitive 5G NTN industry landscape, key players are focusing on offering customer-centric solutions tailored to various industry verticals. These solutions include IoT applications, smart city initiatives, industrial automation, and critical communications, which require reliable and low-latency connectivity.

A few major players in the 5G non-terrestrial network market are Counterpoint Technology; Druid Software; EchoStar Corporation; Ericsson; Gatehouse Satcom A/S; Keysight Technologies; MediaTek Inc; Nelco; Omnispace, LLC; Qualcomm Technologies Inc.; Radisys Corporation; Rohde & Schwarz; Sateliot; Skylo; SoftBank Group Corporation; Spirent Communications; Telesat; Thales Group; VIAVI Solutions Inc.; and ZTE Corporation.

Rohde & Schwarz is a manufacturer of test and measurement, secure communications, monitoring and network testing, and broadcasting equipment. With subsidiaries and representatives in over 70 countries, the company boosts an extensive sales and service network. It serves diverse industries, including aerospace and defense, automotive testing, broadcast and media, critical infrastructure, electronics testing, networks and cybersecurity, research and education, satellite testing, security, and wireless communications testing. In February 2024, Rohde & Schwarz and MediaTek collaborated to showcase a 5G Non-Terrestrial Network (NTN) New Radio (NR) connection based on the latest 3GPP Release 17 specifications.

Skylo Technologies, headquartered in Mountain View, CA, is a provider of Non-Terrestrial Network (NTN) services. Their service enables cellular modems and devices to connect directly over existing satellites. Skylo manages and serves connected devices through its commercial NTN vRAN, which includes a cloud-native base station and core built on 3GPP standards. It also offers a seamless connectivity solution that allows devices to roam between terrestrial and satellite networks anytime and anywhere. In June 2023, Skylo Technologies announced a collaboration with Qualcomm Technologies, Inc. to integrate Skylo's satellite connectivity solution with the Qualcomm Aware Platform, utilizing Qualcomm's new satellite-capable modems, the Qualcomm 212S Modem and Qualcomm 9205S Modem. This collaboration is set to provide enhanced connectivity options across various industries.

List of Key Companies in 5G NTN Market

- Counterpoint Technology

- Druid Software

- EchoStar Corporation

- Ericsson

- Gatehouse Satcom A/S

- Keysight Technologies

- MediaTek Inc

- Nelco

- Omnispace, LLC

- Qualcomm Technologies Inc.

- Radisys Corporation

- Rohde & Schwarz

- Sateliot

- Skylo

- SoftBank Group Corporation

- Spirent Communications

- Telesat

- Thales Group

- VIAVI Solutions Inc.

- ZTE Corporation

5G NTN Industry Developments

October 2023: Skylo Technologies announced a partnership with Samsung Electronics System LSI Business to introduce NTN support on Samsung’s flagship 5G chipsets, ensuring seamless interoperability between Skylo’s satellite network and cellular networks.

June 2023: SoftBank and the Government of Rwanda's Ministry of Education signed a partnership agreement to deploy educational technology services in Rwanda using NTN solutions.

March 2022: Nelco Limited and Omnispace announced a strategic partnership agreement that aims to enable and distribute 5G NTN direct-to-device satellite services. The initiative will significantly extend the reach of 5G connectivity via satellite across South Asia and India.

5G NTN Market Segmentation

By Component Outlook (USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Platform Outlook (USD Billion, 2020–2034)

- UAS Platform

- MEO Satellite

- LEO Satellite

- GEO Satellite

By Application Outlook (USD Billion, 2020–2034)

- eMBB (Enhanced Mobile Broadband)

- mMTC (Massive Machine-Type Communications)

- URLLC (Ultra Reliable and Low Latency Communications)

By Location Outlook (USD Billion, 2020–2034)

- Urban

- Rural

- Isolated

- Remote

By End User Outlook (USD Billion, 2020–2034)

- Maritime

- Aerospace & Defense

- Government

- Mining

- Others

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G NTN Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.91 billion |

|

Market Size Value in 2025 |

USD 9.32 billion |

|

Revenue Forecast by 2034 |

USD 139.51 billion |

|

CAGR |

35.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.91 billion in 2024 and is expected to reach USD 139.51 billion by 2034.

The global market is projected to register a CAGR of 35.1% during 2025–2034.

North America held the largest share in the global market in 2024

A few key players in the market are Counterpoint Technology; Druid Software; EchoStar Corporation; Ericsson; Gatehouse Satcom A/S; Keysight Technologies; MediaTek Inc; Nelco; Omnispace, LLC; Qualcomm Technologies Inc.; Radisys Corporation; Rohde & Schwarz; Sateliot; Skylo; SoftBank Group Corporation; Spirent Communications; Telesat; Thales Group; VIAVI Solutions Inc.; and ZTE Corporation.

In 2024, the remote segment accounted for the largest market share.

The aerospace & defense segment is projected to exhibit the highest CAGR during the forecast period.