5G Millimeter Wave Radio Frequency Chips Market Share, Size, Trends, Industry Analysis Report: By Type (CPU, GPU, FPGA, DSP, ASIC, and Others), By Application, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM5284

- Base Year: 2024

- Historical Data: 2020-2023

5G Millimeter Wave Radio Frequency Chips Market Overview

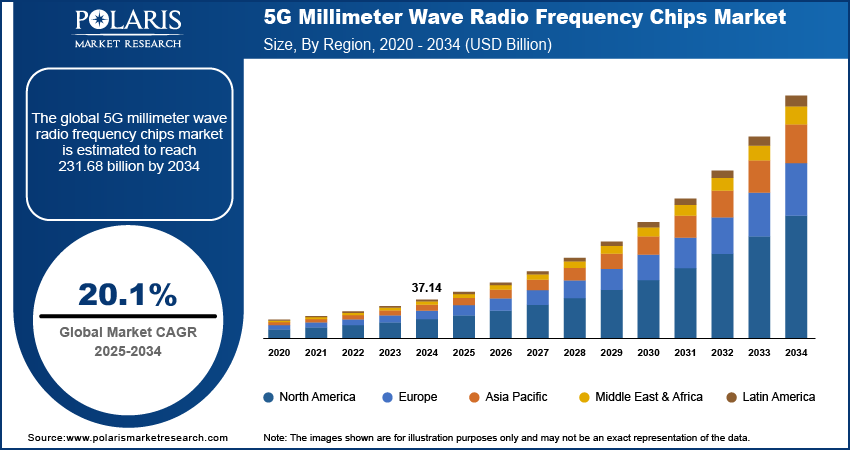

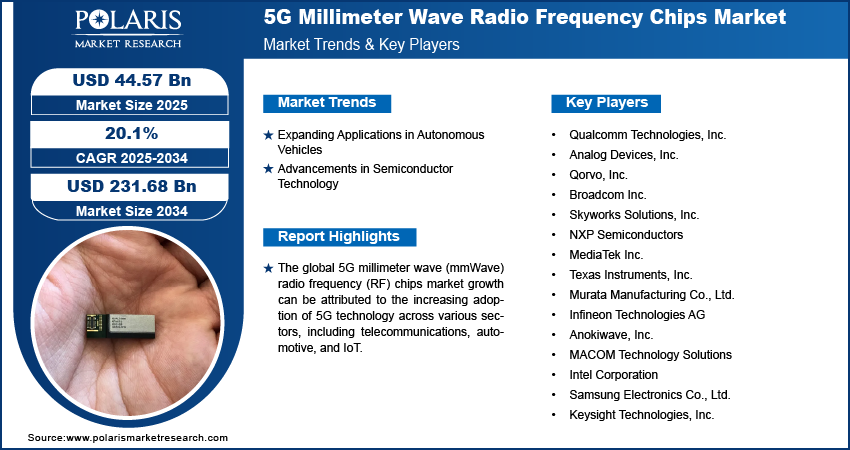

The global 5G millimeter wave radio frequency chips market size was valued at USD 37.14 billion in 2024. The market is projected to grow from USD 44.57 billion in 2025 to USD 231.68 billion by 2034, exhibiting a CAGR of 20.1% during 2025–2034.

The global 5G millimeter wave (mmWave) radio frequency (RF) chips market growth can be attributed to the increasing adoption of 5G technology across various sectors, including telecommunications, automotive, and IoT. In addition, the rising demand for high-speed, low-latency communication networks and the growing need for enhanced mobile broadband services boost the market growth. Upsurge in investments in 5G infrastructure, advancements in semiconductor technology, and the integration of mmWave RF chips in next-generation devices are expected to emerge key future trends in the market. Further, the push for network densification and the expansion of 5G coverage in urban areas propel the market growth.

To Understand More About this Research: Request a Free Sample Report

5G Millimeter Wave Radio Frequency Chips Market Trends

Increasing Integration in Consumer Electronics

There is a growing integration of 5G millimeter wave radio frequency chips into consumer electronics, particularly smartphones, tablets, and wearable devices. As 5G networks expand globally, consumers are demanding devices that can leverage the full potential of high-speed, low-latency connections. Manufacturers are responding by incorporating mmWave RF chips into their products, enabling faster data transfer rates and improved connectivity. This trend is expected to drive the growth of the 5G millimeter wave radio frequency chips market as more devices become 5G enabled, and consumers seek to take advantage of the enhanced performance offered by mmWave technology.

Expanding Applications in Autonomous Vehicles

The application of 5G mmWave RF chips is rising in the automotive industry, particularly in autonomous vehicles. The need for ultra-reliable, low-latency communication is critical for the safe operation of autonomous vehicles, which rely on real-time data transmission for navigation, obstacle detection, and decision-making. 5G mmWave technology offers the bandwidth and speed necessary to support these functions, making it a key enabler of autonomous driving. As the automotive industry continues to advance toward fully autonomous vehicles, the demand for mmWave RF chips is expected to rise during the forecast period.

Advancements in Semiconductor Technology

Advancements in semiconductor technology enable the development of smaller, more efficient, and cost-effective chips. Innovations in materials, design, and fabrication processes have led to the production of high-performance mmWave RF chips that can be integrated into a wide range of devices and applications. These advancements are improving the capabilities of 5G networks and reducing the cost of deployment, making 5G more accessible to consumers and businesses. As semiconductor technology continues to evolve, it will play a crucial role in the expansion and adoption of 5G mmWave RF chips across various industries in the coming years.

5G Millimeter Wave Radio Frequency Chips Market Segment Insights

5G Millimeter Wave Radio Frequency Chips Market – Type Insights

The 5G millimeter wave (mmWave) radio frequency (RF) chips market, by type, is segmented into CPU, GPU, FPGA, DSP, ASIC, and others. The ASIC segment dominates the market. Application-specific integrated circuits (ASICs) are specifically designed to handle the high-frequency signals and complex processing tasks required by 5G networks. Therefore, they are essential for optimizing performance in various applications, including telecommunications infrastructure and consumer electronics. Their ability to deliver high efficiency and performance tailored to specific tasks has positioned ASICs as the preferred choice for many 5G-related applications, driving their market dominance.

The FPGA segment is witnessing the highest growth rate in the market. Field-Programmable Gate Array (FPGAs) offers unparalleled flexibility and reprogrammability, allowing manufacturers to quickly adapt to evolving 5G standards and requirements. This adaptability is particularly valuable in the rapidly changing landscape of 5G technology, where new use cases and demands continuously emerge. As companies seek to future-proof their 5G deployments, the demand for FPGAs is expected to surge. Other segments such as CPU and GPU also play crucial roles, particularly in processing and graphics-intensive applications. However, they do not match the specialized advantages offered by ASICs and FPGAs in the 5G mmWave RF chips market.

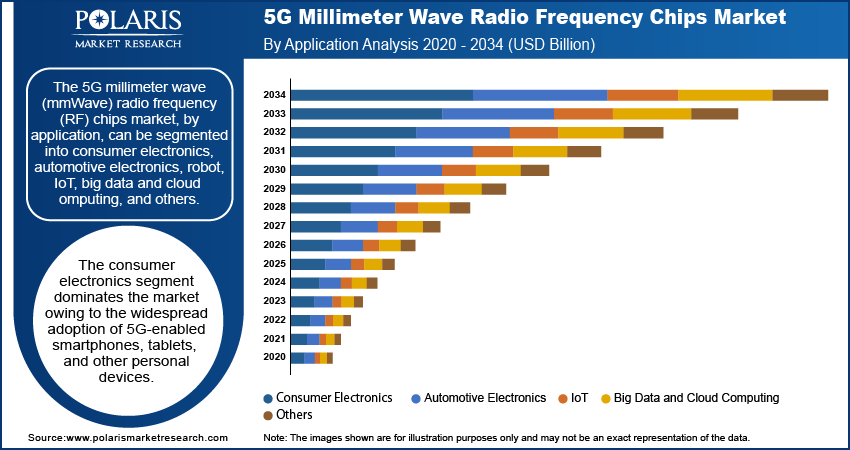

5G Millimeter Wave Radio Frequency Chips Market – Application Insights

The 5G millimeter wave (mmWave) radio frequency (RF) chips market, by application, can be segmented into consumer electronics, automotive electronics, robot, IoT, big data and cloud computing, and others. The consumer electronics segment dominates the market owing to the widespread adoption of 5G-enabled smartphones, tablets, and other personal devices. As consumers increasingly demand high-speed connectivity and enhanced mobile experiences, manufacturers are integrating mmWave RF chips into a broad range of devices, fueling significant growth of this segment. The proliferation of 5G networks worldwide is further boosting demand, solidifying consumer electronics as the leading application area.

The IoT segment is experiencing the highest growth rate in the market. The expansion of smart cities, industrial automation, and connected home devices is driving the need for reliable, high-speed communication, which 5G mmWave technology can provide. Internet of Things (IoT) applications require low-latency, high-capacity networks to support a vast number of connected devices, and mmWave RF chips are essential to meeting these demands. As IoT continues to evolve and expand across various industries, the demand for 5G mmWave RF chips in this segment is expected to surge, making it the fastest-growing application area in the market. Other segments such as automotive electronics and big data and cloud computing are also important, with the former benefiting from advancements in autonomous vehicles and the latter from the need for enhanced data processing and transmission capabilities.

5G Millimeter Wave Radio Frequency Chips Market Regional Insights

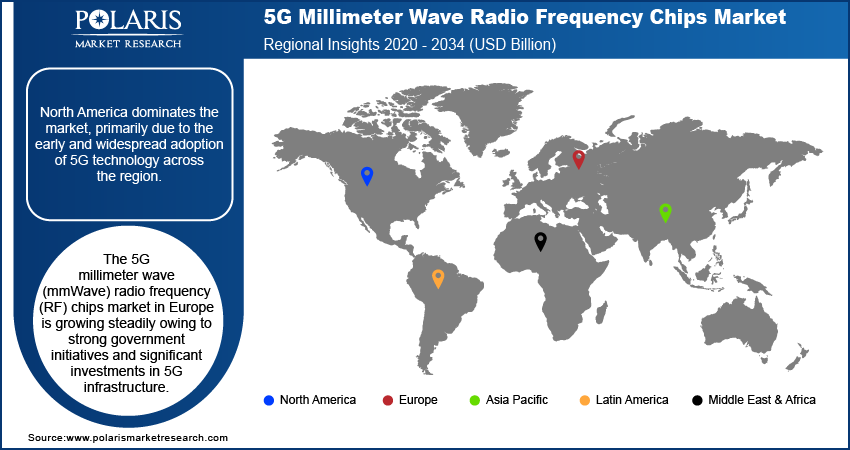

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market, primarily due to the early and widespread adoption of 5G technology across the region. The US, in particular, has seen significant investments in 5G infrastructure due to private sector initiatives and government support. This, coupled with the presence of leading technology companies and semiconductor manufacturers, has positioned North America as the leading region in the market. Additionally, the strong demand for advanced consumer electronics and the rapid development of smart cities and IoT applications contribute to the region's dominance. Asia Pacific, while also growing rapidly due to massive rollouts in countries such as China and South Korea, trails behind North America in terms of market share but is expected to catch up as 5G deployment accelerates.

The 5G millimeter wave RF chips market in Europe is growing steadily owing to strong government initiatives and significant investments in 5G infrastructure. The European Union has been proactive in setting up policies and frameworks to accelerate 5G deployment across member countries, with key markets such as Germany, the UK, and France leading the regional market share. The demand for mmWave RF chips is fueled by the region's rising focus on developing smart cities, enhancing industrial automation, and expanding IoT applications. Additionally, Europe's strong automotive industry, with its increasing emphasis on autonomous vehicles and connected cars, is contributing to the demand for advanced 5G mmWave RF chips. However, the region's progress is somewhat tempered by regulatory challenges and the need for substantial investment in infrastructure to cover diverse geographical landscapes.

The Asia Pacific 5G mmWave RF chips market is witnessing the fastest growth due to the rapid expansion of 5G networks in countries such as China, South Korea, and Japan. China, in particular, has been a significant driver of this growth, with its aggressive 5G rollout strategy backed by substantial government support and investments from leading telecom companies. The region's strong manufacturing base, coupled with its leadership in consumer electronics production, is further accelerating the demand for mmWave RF chips. South Korea and Japan are at the forefront of 5G adoption, with advanced technological infrastructures and early deployment of 5G services. The growing use of 5G in industrial automation, IoT, and smart city projects across Asia Pacific is expected to sustain this growth trajectory, positioning Asia Pacific as a key player in the global market.

5G Millimeter Wave Radio Frequency Chips Market – Key Players and Competitive Insights

Qualcomm Technologies, Inc.; Analog Devices, Inc.; Qorvo, Inc.; Broadcom Inc.; Skyworks Solutions, Inc.; NXP Semiconductors; MediaTek Inc.; Texas Instruments, Inc.; Murata Manufacturing Co., Ltd.; Infineon Technologies AG; Anokiwave, Inc.; MACOM Technology Solutions; Intel Corporation; Samsung Electronics Co., Ltd.; and Keysight Technologies, Inc are among the key players in the 5G millimeter wave (mmWave) radio frequency (RF) chips market. These companies are leading the charge in developing and manufacturing mmWave RF chips, capitalizing on the growing demand for 5G technology across various applications and regions.

The competitive landscape of the 5G mmWave RF chips market is characterized by intense competition, driven by continuous technological advancements and the need for high-performance, cost-effective solutions. Qualcomm, a global market player, has maintained its dominance through a robust portfolio of 5G chips and partnerships with major smartphone manufacturers. Broadcom and Skyworks Solutions are also key players, focusing on providing advanced RF components to meet the evolving needs of the 5G infrastructure market. Analog Devices and Qorvo are recognized for their innovative RF solutions, which cater to consumer electronics and automotive sectors, further enhancing their market position. The presence of semiconductor giants such as Intel and Samsung adds another layer of competition, as these companies leverage their extensive R&D capabilities and manufacturing scale to capture significant market share.

The 5G millimeter wave radio frequency chips market is witnessing a shift toward strategic partnerships, mergers, and acquisitions as companies seek to expand their capabilities and market presence. For instance, acquisitions by companies such as Skyworks and Qorvo have helped them enhance their product offerings and enter new markets. Additionally, the rise of Asian players, particularly in China and South Korea, is intensifying competition as these companies focus on producing cost-effective and high-quality mmWave RF chips to cater to the growing demand in Asia Pacific. Since the market continues to evolve, companies that can innovate and adapt to changing technological and market demands will likely emerge as leaders in the highly competitive 5G mmWave RF chips market.

Qualcomm Technologies, Inc. is a global player in the 5G millimeter wave (mmWave) radio frequency (RF) chips market, known for its extensive portfolio of 5G solutions. The company has been at the forefront of 5G innovation, providing advanced RF components that are integral to the performance of 5G-enabled devices, particularly smartphones. The company’s Snapdragon 5G Modem-RF systems are widely used across the industry, solidifying its position as a market leader.

Broadcom Inc. is another major player in the 5G mmWave RF chips market, recognized for its high-performance RF components that support the deployment of 5G networks across the world. RF solutions by the company are crucial for infrastructure applications, including base stations and network equipment, making the company a key supplier in the telecommunications industry.

Key Companies in 5G Millimeter Wave Radio Frequency Chips Market

- Qualcomm Technologies, Inc.

- Analog Devices, Inc.

- Qorvo, Inc.

- Broadcom Inc.

- Skyworks Solutions, Inc.

- NXP Semiconductors

- MediaTek Inc.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Infineon Technologies AG

- Anokiwave, Inc.

- MACOM Technology Solutions

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Keysight Technologies, Inc.

5G Millimeter Wave Radio Frequency Chips Industry Developments

- In July 2023, Qualcomm announced a strategic partnership with Apple to supply 5G modems for upcoming iPhones, extending their collaboration through 2026. This move reinforces Qualcomm's dominance in the 5G chip market, ensuring its continued relevance in the evolving 5G ecosystem.

- In March 2024, Broadcom announced the release of its new generation of 5G mmWave RF chips designed for enhanced network efficiency and coverage. This innovation highlights Broadcom’s commitment to advancing 5G technology and strengthening its competitive position in the market.

5G Millimeter Wave Radio Frequency Chips Market Segmentation

5G Millimeter Wave Radio Frequency Chips Market – Type Outlook

- CPU

- GPU

- FPGA

- DSP

- ASIC

- Others

5G Millimeter Wave Radio Frequency Chips Market – Application Outlook

- Consumer Electronics

- Automotive Electronics

- Robot

- IoT

- Big Data and Cloud Computing

- Others

5G Millimeter Wave Radio Frequency Chips Market – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Millimeter Wave Radio Frequency Chips Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 37.14 billion |

|

Market size value in 2025 |

USD 44.57 billion |

|

Revenue forecast in 2034 |

USD 231.68 billion |

|

CAGR |

20.1% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The 5G millimeter wave radio frequency chips market has been broadly segmented on the basis of type and application. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the 5G millimeter wave (mmWave) radio frequency (RF) chips market focuses on strategic partnerships, mergers, and acquisitions to expand technological capabilities and market reach. Companies are investing heavily in research and development to innovate and enhance the performance of mmWave RF chips, catering to the evolving demands of 5G infrastructure and consumer electronics. Additionally, manufacturers are targeting emerging markets, particularly in Asia Pacific, to capitalize on the rapid adoption of 5G technology. Marketing efforts are geared toward showcasing the critical role of mmWave RF chips in enabling high-speed, low-latency 5G networks, positioning these solutions as essential for the future of global connectivity.

FAQ's

The global 5G millimeter wave radio frequency chips market size was valued at USD 37.14 billion in 2024 and is projected to grow to USD 231.68 billion by 2034.

The global market is projected to register a CAGR of 20.1% during 2025–2034.

North America held the largest share of the global market in 2024.

Key players in the 5G millimeter wave RF chips market are Qualcomm Technologies, Inc.; Analog Devices, Inc.; Qorvo, Inc.; Broadcom Inc.; Skyworks Solutions, Inc.; NXP Semiconductors; MediaTek Inc.; Texas Instruments, Inc.; Murata Manufacturing Co., Ltd.; Infineon Technologies AG; Anokiwave, Inc.; MACOM Technology Solutions; Intel Corporation; Samsung Electronics Co., Ltd.; and Keysight Technologies, Inc

The ASIC segment dominated the market in 2024.

The consumer electronics segment accounted for the largest market share in 2024.

5G millimeter wave (mmWave) radio frequency (RF) chips are specialized semiconductor components designed to operate within the millimeter wave spectrum, typically between 24 GHz and 100 GHz. The chips play a crucial role in the 5G network infrastructure by enabling high-speed data transmission, low latency, and increased network capacity. They are used in various applications, including base stations, antennas, and consumer devices such as smartphones and tablets, to support the advanced capabilities of 5G technology.

A few key trends observed in this market are described below: Increased Integration in Consumer Electronics: Growing adoption of 5G-enabled smartphones, tablets, and wearables incorporating mmWave RF chips to support high-speed connectivity and enhanced performance. Expansion in Autonomous Vehicles: Rising use of mmWave RF chips in automotive applications for real-time communication and advanced driver-assistance systems (ADAS) in autonomous vehicles. Advancements in Semiconductor Technology: Ongoing innovation in chip design and materials to improve performance, efficiency, and cost-effectiveness of mmWave RF chips. Growth in IoT Applications: Increasing demand for mmWave technology to support the vast number of connected devices and applications in smart cities, industrial automation, and home automation.

For a new company entering the 5G millimeter wave (mmWave) radio frequency (RF) chips market, focusing on innovation and differentiation is crucial. Prioritizing advancements in chip design to enhance performance, efficiency, and cost-effectiveness can provide a competitive edge. Developing solutions tailored to emerging applications, such as autonomous vehicles and smart cities, could also capture growing market segments. Building strategic partnerships with telecom providers and technology firms can facilitate market entry and expansion. Additionally, investing in R&D to stay ahead of technological trends and addressing specific regional demands, particularly in rapidly expanding markets such as Asia Pacific, can strengthen the market positioning of a company.

Companies offering 5G millimeter wave radio frequency chips and related products, semiconductor companies, and other consulting firms must buy the report.