5G IoT Market Size, Share, Trends, Industry Analysis Report: By Component, Network Type (5G Standalone and 5G Non-Standalone), Organization Size, Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1714

- Base Year: 2024

- Historical Data: 2020-2023

5G IoT Market Overview

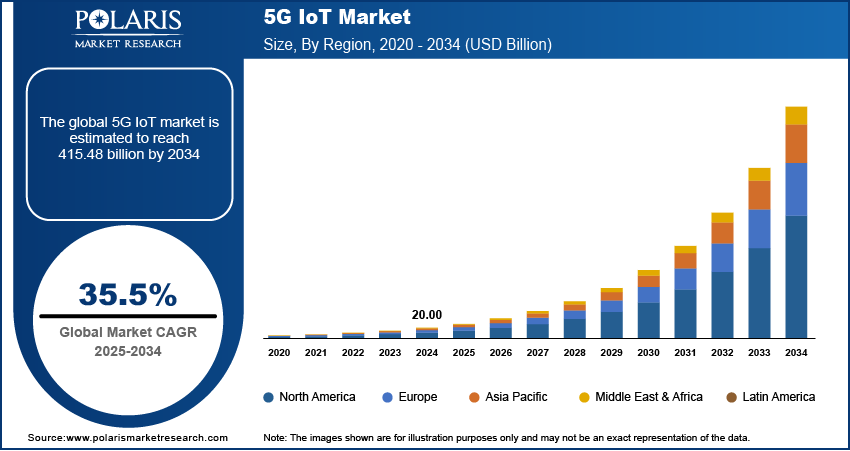

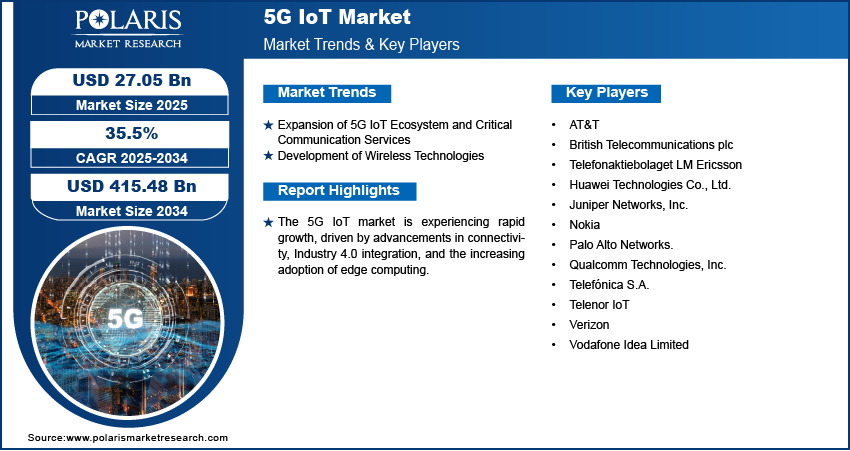

The global 5G IoT market size was valued at USD 20.00 billion in 2024. The market is projected to grow from USD 27.05 billion in 2025 to USD 415.48 billion by 2034, exhibiting a CAGR of 35.5% from 2025 to 2034.

5G IoT refers to the integration of the Internet of Things (IoT) with 5G technology, enabling ultra-fast, low-latency communication between connected devices. This combination enhances IoT applications across various sectors, including smart cities, healthcare, and industrial automation, by offering improved connectivity, scalability, and real-time data processing.

To Understand More About this Research: Request a Free Sample Report

The 5G IoT market is experiencing rapid growth, driven by the widespread adoption of 5G networks that offer faster speeds, lower latency, and greater connectivity. This technology enables seamless communication between a vast array of IoT devices, including sensors, wearables, smart cities, and industrial automation. By integrating 5G with IoT, industries are expected to benefit from real-time data processing, improved operational efficiency, and advanced applications in healthcare, manufacturing, and transportation.

Government initiatives and the growing demand for smart solutions are fueling the 5G IoT market expansion. For instance, in November 2024, the Indian government launched several initiatives to boost 5G deployment, including the BharatRAN project for indigenous telecom infrastructure and funding for 5G test beds and labs. Spectrum price cuts and policy reforms aimed at streamlining network expansion have further encouraged investments and innovations. These efforts are positioning 5G IoT as a key enabler of digital transformation across sectors.

5G IoT Market Dynamics

Expansion of 5G IoT Ecosystem and Critical Communication Services

The 5G IoT ecosystem and critical communication services enable seamless connectivity between a vast number of devices, facilitating real-time data transmission with minimal latency. The high-speed, low-latency nature of 5G allows for the development of critical applications across industries such as healthcare, automotive, and manufacturing, where instant communication and reliability are crucial. For instance, OQ Technology's MACSAT mission, launched in March 2023, aims to demonstrate 5G IoT services via a small satellite in Low Earth Orbit. The mission will test 5G IoT algorithms and qualify NB-IoT chips for satellite use. This satellite, part of OQ Technology's constellation, will process 5G devices using satellite frequencies aligned with terrestrial networks. Such advancements in satellite-enabled 5G connectivity enhance operational efficiency, support automation, and enable advanced technologies such as autonomous vehicles and smart cities. Thus, the expansion of the 5G IoT ecosystem and critical communication services drives the 5G IoT market development.

Development of Wireless Technologies

The development of wireless technologies, particularly 5G, enables faster data transmission and lower latency, which is crucial for real-time IoT applications. For instance, in February 2024, ZTE Corporation showcased its plans and innovations for the 5G-Advanced (5G-A) era at the ‘5G-Advanced Innovation and New Product Release Conference.’ The company introduced 10 new 5G-A products, ready for commercial use, marking a significant step towards the widespread adoption of 5G-A technology. The evolution of wireless systems is facilitating the simultaneous connection of a larger number of devices, thereby expanding IoT capabilities across industries such as healthcare, transportation, and manufacturing. With 5G's enhanced bandwidth, IoT devices can transmit vast amounts of data quickly, supporting advanced applications like autonomous vehicles and smart cities. Additionally, the ability to support diverse IoT use cases through wireless networks is driving the global expansion of 5G networks. Thus, the development of wireless technologies is boosting the 5G IoT market revenue.

5G IoT Market Segment Analysis

5G IoT Market Assessment Based on End User

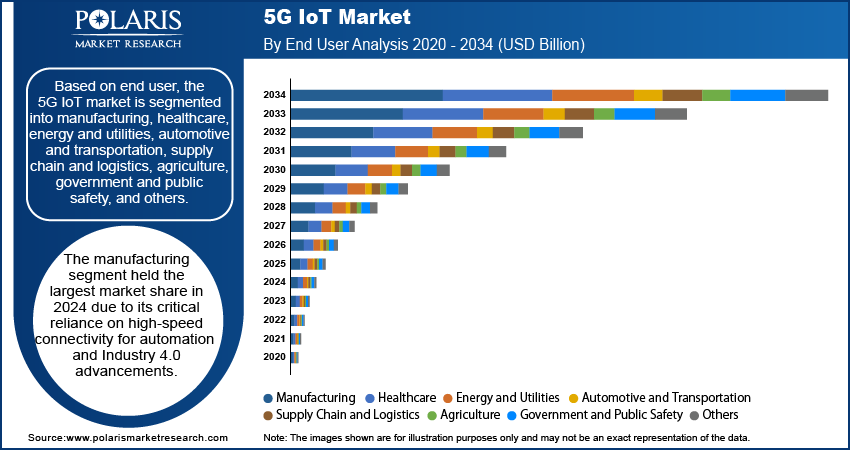

The global 5G IoT market, based on end user, is segmented into manufacturing, healthcare, energy and utilities, automotive and transportation, supply chain and logistics, agriculture, government and public safety, and others. The manufacturing segment held the largest share of the 5G IoT market in 2024 due to its critical reliance on high-speed connectivity for automation and Industry 4.0 advancements. 5G IoT enables seamless integration of robotics, real-time monitoring, and predictive maintenance, significantly improving efficiency and reducing downtime in manufacturing processes. Additionally, the adoption of 5G-powered smart factories allows for enhanced data analytics and AI applications, optimizing supply chain management and production workflows. The increasing demand for customized products and the need for efficient, agile production lines further drive the adoption of 5G IoT in manufacturing, solidifying its leading position in the market.

5G IoT Market Evaluation Based on Type

The global 5G IoT market, based on type, is segmented into short-range IoT devices and wide-range IoT devices. The wide-range IoT devices segment is expected to register the highest CAGR from 2025 to 2034 due to the ability of wide-range IoT devices to support long-distance communication and large-scale IoT deployments. These devices leverage technologies such as 5G, Low Power Wide Area Network (LPWAN), and satellite IoT to ensure reliable connectivity across vast geographical areas, making them ideal for applications in agriculture, logistics, energy, and utilities. Their role in enabling smart cities, autonomous transportation systems, and remote monitoring of infrastructure contributes to their rising adoption. Furthermore, advancements in 5G networks and the integration of wide-range IoT devices with non-terrestrial networks (NTN) drive their expansion in regions with limited terrestrial network coverage.

5G IoT Market Regional Analysis

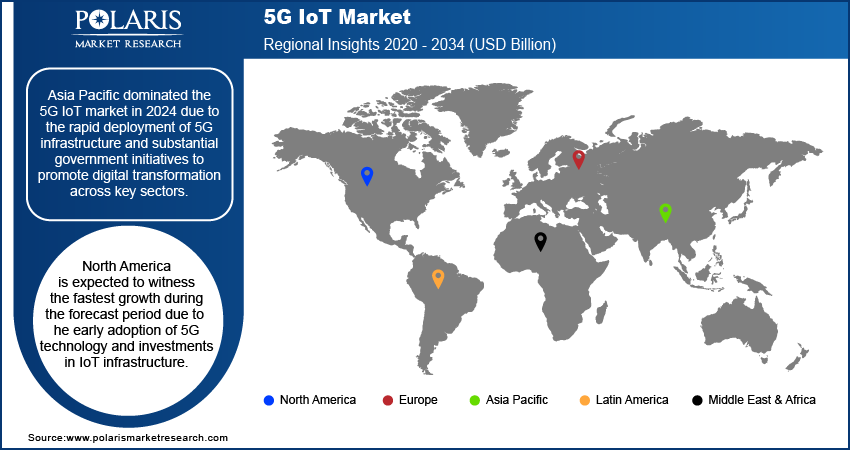

By region, the study provides 5G IoT market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024 due to the rapid deployment of 5G infrastructure and substantial government initiatives to promote digital transformation across key sectors. Countries such as China, Japan, and South Korea have been leading in 5G rollouts, supported by investments from telecom operators and technology firms. The region's strong manufacturing base, adoption of smart city projects, and increasing demand for IoT applications in agriculture, logistics, and healthcare further fuel market growth. Additionally, robust collaborations between public and private entities in 5G-enabled innovations contribute to Asia Pacific's leadership in the global market. For instance, in October 2024, Ericsson and MobiFone collaborated to establish a 5G Innovation Hub in Vietnam, which aims to foster advanced 5G use cases and drive technological innovation in the region.

The North America 5G IoT market is expected to witness the fastest growth during the forecast period due to the early adoption of 5G technology and investments in IoT infrastructure. The region benefits from robust technological advancements, the strong presence of key market players, and the widespread deployment of 5G networks. Industries such as healthcare, automotive, and manufacturing are rapidly adopting 5G IoT solutions to enable advanced applications such as autonomous vehicles, remote surgeries, and smart factories. Additionally, government initiatives and funding to accelerate 5G implementation is driving the 5G IoT market revenue. For instance, The Federal Communications Commission established the 5G Fund in October 2020 to expand 5G mobile broadband to underserved rural areas through a reverse auction mechanism. Key implementation issues were revisited in a Further Notice of Proposed Rulemaking in September 2023, and rules for the Phase I auction were adopted in August 2024. These initiatives aim to promote equitable 5G access and continue to drive market growth in North America.

5G IoT Market – Key Players and Competitive Insights

The competitive landscape of the 5G IoT market is characterized by global leaders and regional players aiming to gain market share through technological advancements, strategic partnerships, and geographic expansion. Key players such as Ericsson, Nokia, Huawei Technologies, and Qualcomm Technologies lead the market with advanced solutions in areas such as IoT connectivity, edge computing, and AI-driven network management. The market reflects a surge in demand for 5G-enabled IoT applications, including smart cities, industrial automation, and connected vehicles, driven by the unparalleled speed, low latency, and scalability offered by 5G networks. Regional players focus on addressing localized requirements by offering tailored solutions, particularly in emerging markets like Asia Pacific, which is projected to exhibit the fastest growth due to substantial investments in digital infrastructure and government-backed initiatives. Competitive strategies in the 5G IoT market include mergers and acquisitions, collaborations with IoT platform providers, and the development of sector-specific use cases, such as healthcare IoT and smart agriculture. The industry's growth highlights the significance of innovation, adaptability to regional demands, and a focus on sustainability in driving the adoption of 5G IoT technologies. A few key major players are AT&T; British Telecommunications plc; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; Nokia; Palo Alto Networks; Qualcomm Technologies, Inc.; Telefónica S.A.; Telenor IoT; Verizon; and Vodafone Idea Limited.

Huawei is an international organization specializing in information and communications technology (ICT) infrastructure and smart devices. The company's solutions cater to a user base of over three billion individuals worldwide, with a presence in over 170 countries and regions. Huawei's core business spans a wide range of products and services, including mobile network equipment, enterprise networking solutions, consumer devices, and cloud computing. Huawei offers a range of 5G IoT solutions, including devices, connectivity modules, and platforms that enable industries like manufacturing, transportation, and smart cities to harness the power of 5G for enhanced connectivity and automation. Additionally, Huawei has developed its operating system, HarmonyOS, which has been deployed on over 220 million Huawei devices and has a growing ecosystem of over 2.2 million developers. In the enterprise and cloud computing space, Huawei offers a wide range of solutions, including cloud services, enterprise intelligence, and industry-specific applications. The company has established partnerships with over 2,000 cloud service providers and has deployed its cloud services in more than 170 countries and regions.

Qualcomm Technologies, headquartered in San Diego, California, has been into wireless technology since its establishment in 1985. Initially focused on CDMA technology, it now offers solutions in 5G, IoT, and other advanced communication technologies. Qualcomm operates on a fabless manufacturing model, emphasizing research and development while outsourcing production. Its innovations, including the Snapdragon system-on-chip and Gobi modems, have shaped mobile communications and supported advancements in AI, machine learning, and edge computing. Qualcomm remains at the forefront of wireless technology, driving progress in connectivity and digital transformation with over USD 16 billion invested in R&D. The advent of 5G has amplified Qualcomm's role in improving data speeds, reducing latency, and expanding IoT applications across industries such as automotive, healthcare, and smart cities. The company's technologies enable seamless device connectivity and support the vision of an interconnected "Internet of Everything." Strategic partnerships and a licensing program with over 190 companies worldwide further extend Qualcomm's influence, fostering innovation and growth within the wireless ecosystem. Its commitment to developing advanced solutions continues to shape the future of communication and connected systems.

List of Key Companies in 5G IoT Market

- AT&T

- British Telecommunications plc

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Nokia

- Palo Alto Networks.

- Qualcomm Technologies, Inc.

- Telefónica S.A.

- Telenor IoT

- Verizon

- Vodafone Idea Limited

5G IoT Industry Developments

In May 2024, Sateliot announced plans to launch four satellites from its 5G-IoT constellation aboard SpaceX’s Transporter-11 mission in July. The satellites, set to deploy from a Falcon 9 rocket at Vandenberg Space Force Base in California, will mark the commercial phase of Sateliot's Low-Earth orbit 5G IoT network designed for global coverage. The company has secured USD 210 million USD in recurring revenue contracts from over 400 clients in 50 countries worldwide.

In July 2024, Telefónica Tech partnered with Nokia to promote private 5G networks for businesses, offering over 100 solutions in cloud, Edge Computing, and industrial systems. Telefónica Tech stated that the initiative aims to support industries such as manufacturing, logistics, and healthcare in automating processes, reducing costs, and enhancing efficiency with real-time data and low-latency communications.

In October 2024, Ericsson introduced seven 5G Advanced software products focused on enhancing network programmability, performance, and energy efficiency for communication service providers (CSPs). According to Ericsson, key features of these products include AI-powered automation, mission-critical services, energy management, and enhanced device battery performance. These products, compatible with Open RAN and Cloud RAN, aim to optimize networks for diverse applications and improve service-level agreement compliance.

5G IoT Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Platform

- Connectivity

- Services

By Network Type Outlook (Revenue – USD Billion, 2020–2034)

- 5G Standalone

- 5G Non-Standalone

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Sized Enterprises

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Short-Range IoT Devices

- Wide-Range IoT Devices

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Healthcare

- Energy and Utilities

- Automotive and Transportation

- Supply Chain and Logistics

- Agriculture

- Government and Public Safety

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G IoT Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.00 billion |

|

Market Size Value in 2025 |

USD 27.05 billion |

|

Revenue Forecast by 2034 |

USD 415.48 billion |

|

CAGR |

35.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 20.00 billion in 2024 and is projected to grow to USD 415.48 billion by 2034

The global market is projected to register a CAGR of 35.5% from 2025 to 2034.

Asia Pacific dominated the market in 2024 due to the rapid deployment of 5G infrastructure and substantial government initiatives to promote digital transformation across key sectors.

A few key players in the market are AT&T; British Telecommunications plc; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; Nokia; Palo Alto Networks; Qualcomm Technologies, Inc.; Telefónica S.A.; Telenor IoT; Verizon; and Vodafone Idea Limited.

The manufacturing segment held the largest market share in 2024 due to its critical reliance on high-speed connectivity for automation and Industry 4.0 advancements

The wide-range IoT devices segment is expected to register the highest CAGR during the forecast period.