5G Infrastructure Market Size, Share, Trends, Industry Analysis Report: By Communication Infrastructure (Small Cell and Macro Cell), Core Network Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM1700

- Base Year: 2024

- Historical Data: 2020-2023

5G Infrastructure Market Overview

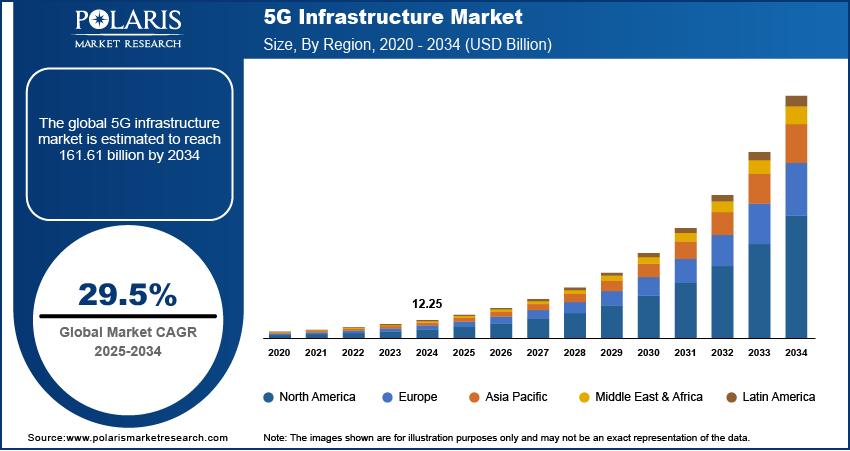

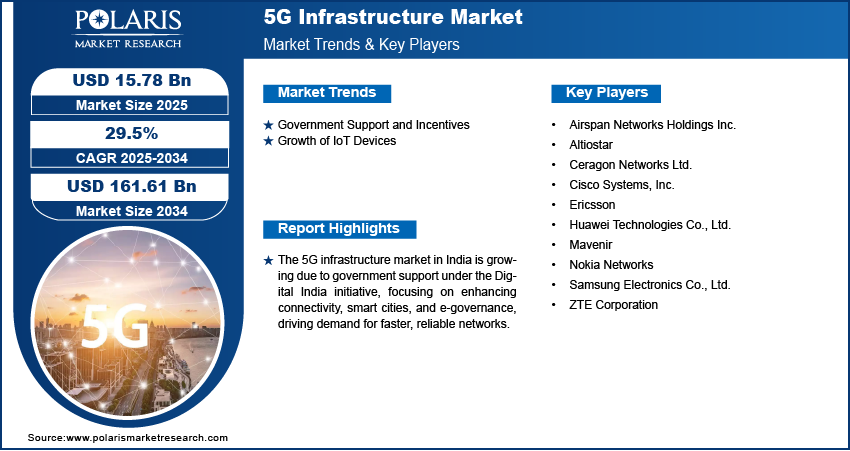

The 5G infrastructure market size was valued at USD 12.25 billion in 2024. The industry is projected to grow from USD 15.78 billion in 2025 to USD 161.61 billion by 2034, exhibiting a CAGR of 29.5% during the forecast period.

5G infrastructure refers to the hardware, software, and network systems required to support and deploy 5G wireless networks, including base stations, antennas, and backhaul systems. It enables faster data transfer, lower latency, and greater network capacity, facilitating advanced services such as IoT, autonomous vehicles, and high-definition streaming.

To Understand More About this Research: Request a Free Sample Report

Technology advancements have led to an increased reliance on fast and reliable internet by both people and businesses. The growing demand for high-speed connectivity is especially evident with the rise of activities such as streaming, gaming, and real-time communication. Industries such as healthcare, education, and finance are also depending on faster data transfer to improve performance and efficiency. 5G networks, offering significantly faster speeds and lower latency than 4G, provide a solution to meet these demands. Telecom operators are responding by investing heavily in 5G infrastructure to accommodate this surge in demand for seamless and fast internet connections, thereby driving the 5G infrastructure market growth.

The growing collaboration between 5G infrastructure providers and IT infrastructure companies is driving the market. These partnerships enabled companies to offer comprehensive solutions, including LTE, 5G private wireless services, and Industry 4.0 solutions to global clients. For instance, in February 2023, Kyndryl and Nokia expanded their global partnership to deliver advanced LTE and 5G private wireless services, Industry 4.0 solutions, and edge computing for enterprises. These collaborations help businesses across various sectors, such as manufacturing, healthcare, and logistics, to implement advanced technologies that rely on fast, reliable connectivity. The increasing demand for such integrated solutions is fueling the 5G infrastructure market expansion.

5G Infrastructure Market Dynamics

Government Support and Incentives

Governments worldwide are actively supporting the expansion of 5G networks through regulatory assistance, spectrum allocation, and financial incentives to encourage adoption. These efforts align with national strategies aimed at improving digital infrastructure, which is driving the demand for the 5G infrastructure. For instance, according to the Indian Ministry of Communication, the government of India has sanctioned USD 11.63 million to focus on 5G applications across various sectors, including education, healthcare, and urban management. Key sectors such as manufacturing, healthcare, and transportation are expected to benefit significantly from the enhanced capabilities of 5G. Such strong governmental support drives large investments into 5G infrastructure, accelerating its deployment and instilling greater confidence among investors in the market's prospects. This, in turn, is significantly driving the 5G infrastructure market demand.

Growth of IoT Devices

The growing number of connected devices is driving the 5G infrastructure market growth. The Internet of Things (IoT) encompasses everything from smart home appliances to industrial machines, and its device count is rapidly expanding, due to which the demand for the 5G infrastructure is growing. For instance, according to IoT Analytics, by the close of 2023, the number of connected Internet of Things (IoT) devices reached approximately 16.6 billion, reflecting significant advancements in device interconnectivity and the proliferation of smart technologies across various sectors. 5G’s capability to handle vast quantities of data from millions of devices in real-time makes it an ideal solution for supporting the growing IoT ecosystem. Increased adoption of IoT solutions by businesses and consumers heightens the demand for strong 5G infrastructure to manage this connectivity, thereby driving the market growth.

5G Infrastructure Market Segment Analysis

5G Infrastructure Market Assessment by Communication Infrastructure

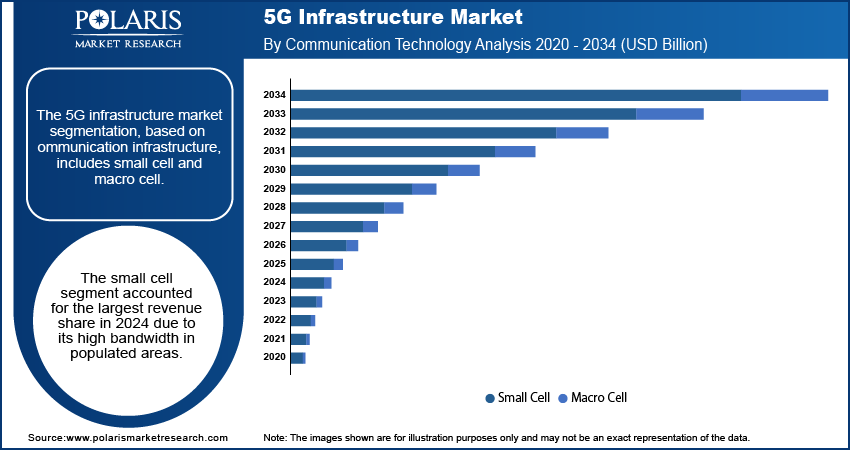

The 5G infrastructure market segmentation, based on communication infrastructure, includes small cell and macro cell. The small cell segment accounted for the largest 5G infrastructure market revenue share in 2024. Small cells are crucial components of 5G infrastructure, providing high bandwidth 5G coverage in highly populated urban areas such as downtown areas, shopping malls, stadiums, train stations, and other locations requiring extensive data capacity and coverage. These small cell base stations are designed to blend into the existing environment while taking up as little physical space as possible. Consequently, the use of small-cell infrastructure allows for seamless network evolution while utilizing the capabilities of the high-frequency 5G radio spectrum, driving small cell segmental growth in the global market report.

5G Infrastructure Market Evaluation by End Use

The 5G infrastructure market segmentation, based on end use, includes commercial, residential, government, and industrial. The commercial segment is expected to grow significantly during the forecast period, owing primarily to increased demand for greater data bandwidth across corporate enterprises. Various applications, such as virtual meetings, cloud computing, and the integration of IoT-based smart workplaces, contribute to the increased demand. The efficacy of these applications is dependent on consistent and reliable connectivity, which is essential in facilitating efficient communication and data exchange. Consequently, businesses are actively seeking advanced connectivity solutions to meet their growing bandwidth requirements and ensure smooth operational processes, thereby driving the commercial segment growth in the market.

5G Infrastructure Market Regional Insights

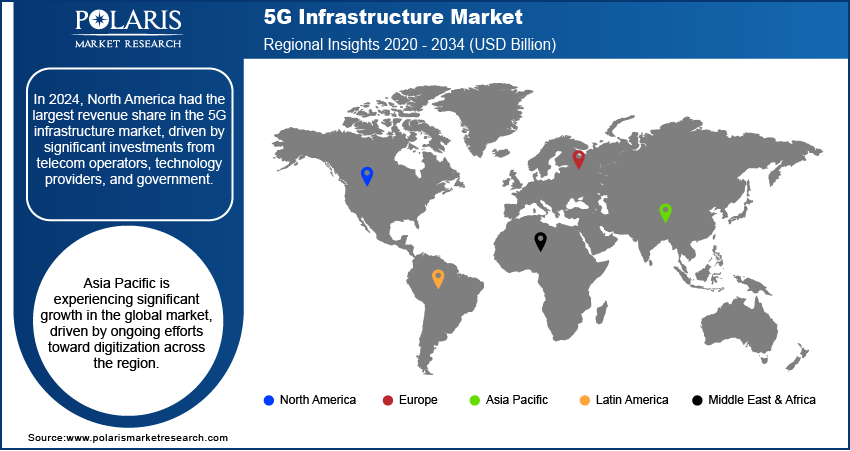

By region, the study provides the 5G infrastructure market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America had the largest revenue share, driven by significant investments from telecom operators, technology providers, and governments. The US and Canada are leading the charge in 5G deployments, with major telecom companies such as Verizon, AT&T, and T-Mobile rolling out 5G networks across urban and rural areas. Additionally, governments are supporting the initiative through policies and funding aimed at expanding broadband access. The region’s strong technological foundation, high demand for advanced connectivity in sectors including healthcare, manufacturing, and entertainment, and growing Internet of Things (IoT) applications further fuel the growth of the 5G infrastructure market growth in North America.

Asia Pacific is experiencing significant growth in the global 5G infrastructure market, driven by ongoing efforts toward digitization across the region. Countries such as China, South Korea, and Japan are leading the way, heavily investing in 5G networks to support digital transformation in industries such as manufacturing, healthcare, and entertainment. Governments in the region are prioritizing the development of smart cities, IoT technology applications, and automation, which rely on high-speed connectivity. Additionally, the increasing adoption of digital services, e-commerce, and mobile technologies across emerging markets is further accelerating the demand for robust 5G infrastructure, thereby driving the market growth.

The market is expected to grow significantly in India, fueled by increased government investment in digitization. The Indian government is actively supporting the rollout of 5G networks as part of its Digital India initiative, aiming to boost connectivity and drive economic growth. The focus on upgrading digital infrastructure, including smart cities and e-governance services, is driving the demand for faster and more reliable network infrastructure, driving the growth of the 5G infrastructure market in India.

5G Infrastructure Market Key Players & Competitive Analysis Report

The 5G infrastructure industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the 5G infrastructure market include Airspan Networks Holdings Inc.; Altiostar; Ceragon Networks Ltd.; Cisco Systems, Inc.; Ericsson; Huawei Technologies Co., Ltd.; Mavenir; Nokia Networks; Samsung Electronics Co., Ltd.; and ZTE Corporation.

Huawei Technologies Co., Ltd. is a global technology company headquartered in Shenzhen, China, and established in 1987. The company operates primarily in the telecommunications, information technology, and consumer electronics sectors. Huawei is a privately held company and does not have a parent company. It has a broad international presence, serving regions including Asia Pacific, Europe, the Americas, Africa, and the Middle East. Huawei's diverse portfolio includes telecommunications equipment, network infrastructure, and smart devices. Recently, Huawei has expanded its offerings in the field of 5G smart farming. The company has launched advanced 5G solutions specifically designed for agriculture, such as its 5G IoT platform and smart sensors. These products aim to enhance agricultural productivity through real-time data transmission, precision monitoring, and automation. Huawei's 5G technology supports various smart farming applications, including crop management, livestock monitoring, and resource optimization, contributing to more efficient and sustainable agricultural practices.

Samsung Electronics Co., Ltd. is a South Korean multinational electronics company and a flagship subsidiary of the Samsung Group, headquartered in Suwon. Established in 1969, the company operates in the manufacturing of consumer electronics, semiconductors, and telecommunications equipment. Samsung's diverse product portfolio includes smartphones, televisions, home appliances, and various electronic components such as memory chips and displays. In 2012, Samsung was ranked as the highest Asian company in Interbrand's list of best global brands. Samsung operates on a global scale, with a presence in numerous countries across all continents. Samsung Electronics Co., Ltd. provides advanced 5G infrastructure solutions, including network equipment, small cells 5G network, virtualized RAN, and core technologies, enabling high-speed, low-latency connectivity for carriers and enterprises worldwide.

Key Companies in 5G Infrastructure Market

- Airspan Networks Holdings Inc.

- Altiostar

- Ceragon Networks Ltd.

- Cisco Systems, Inc.

- Ericsson

- Huawei Technologies Co., Ltd.

- Mavenir

- Nokia Networks

- Samsung Electronics Co., Ltd.

- ZTE Corporation

5G Infrastructure Market Developments

January 2025: Vodafone Idea's 5G launch was announced for March 2025, targeting 75 cities. Affordable plans, AI-driven networks, and ₹30,000 crore in upgrades were included in the ambitious rollout strategy.

February 2023: Cisco and NTT Ltd., an IT infrastructure and services provider, partnered to foster the widespread adoption of Private 5G in key industries such as public services, automotive, retail, healthcare, logistics, and automotive. NTT and Cisco intend to collaborate on co-innovation, introducing cutting-edge technology and managed services

February 2023: NEC Corporation and ADVA partnered to develop time synchronization solutions for Telkom Indonesia. The partnership aims to equip the operator's transport network for the efficient nationwide delivery of time-sensitive 5G services. Enabling new service monetization opportunities is critical for mobile operators seeking to establish a strong presence in the 5G era, particularly in the field of ultra-low latency applications.

April 2022: Ericsson and Valmont Industries, Inc. completed the acquisition of ConcealFab, a provider of 5G and small cell infrastructure. Ericsson's strategic move is intended to accelerate the advancement of 5G infrastructure in the United States.

5G Infrastructure Market Segmentation

By Communication Infrastructure Outlook (Revenue USD Billion, 2020–2034)

- Small Cell

- Macro Cell

By Core Network Technology Outlook (Revenue USD Billion, 2020–2034)

- Software Defined Networking

- Network Function Virtualization

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Commercial

- Residential

- Government

- Industrial

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Infrastructure Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.25 billion |

|

Market Size Value in 2025 |

USD 15.78 billion |

|

Revenue Forecast in 2034 |

USD 161.61 billion |

|

CAGR |

29.5% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The 5G infrastructure market size was valued at USD 12.25 billion in 2024 and is projected to grow to USD 161.61 billion by 2034.

The global market is projected to register a CAGR of 29.5% during the forecast period, 2025-2034.

The 5G infrastructure market report covering key segments are communication Infrastructure, core network technology, end-use, and region.

The key players in the market are Airspan Networks Holdings Inc.; Altiostar; Ceragon Networks Ltd.; Cisco Systems, Inc.; Ericsson; Huawei Technologies Co., Ltd.; Mavenir; Nokia Networks; Samsung Electronics Co., Ltd.; and ZTE Corporation.

The small cell segment accounted for the largest revenue share in 2024 due to its high bandwidth in populated areas.

The commercial segment is expected to grow significantly during the forecast period, owing primarily to increased demand for greater data bandwidth across corporate enterprises.